Kal ke forex trades ka tajziya aur British pound ke liye trading tips:

Dopehar mein, 1.2341 par test hua aur yeh MACD indicator ke saath coincident tha, jo zero line se downward movement start kar raha tha. Yeh ek mazboot entry point confirm karta tha pound bechne ke liye, jis ne pair ko 30 pips se zyada neeche bheja. Forex market ab bhi challenges pesh kar raha hai, jahan aksar investors side line par rehtay hain aur developments ka intezar karte hain.

Technical indicators yeh suggest karte hain ke pound apne uptrend ko continue kar sakta hai, lekin market sentiment par fundamentals ka zyada asar hai. Sabse bara reason yeh hai ke Bank of England ki monetary policy mein mumkin adjustment ka intezar hai. Agar interest rates mein tabdeeliyan hoti hain, toh yeh pound ki demand par zyada asar dal sakti hain aur market uncertainty barh sakti hai.

Saath hi, Europe mein geopolitical instability aur economic concerns investor sentiment par asar dalte hain. Tareekhi taur par, yeh factors ziada volatility ka sabab banay hain, jis ki wajah se traders ehtiyat se kaam lete hain, aur yeh riskier assets, jaise ke British pound, ke outlook ko negative karte hain.

Is mahal mein, pound kharidne ka jazba kam ho sakta hai, kyun ke market participants apne profits ko secure karna pasand karenge. Agar UK mein interest rates cut hoti hain, toh yeh pound bechne ka naya daur shuru kar sakti hai, jo market dynamics ko badal dega aur shayad trend correction la sakta hai.

Yeh concerns zyadah tar agle hafte ke liye hain. Aaj traders CBI ke industrial orders data ka intezar kar rahe hain. Yeh data business conditions aur economic activity ka indicator hota hai. Agar numbers umeed se kam hue, toh yeh traders ke liye concern ban sakta hai aur pound bechne ka sabab ban sakta hai.

Key focus: Scenario no. 1 aur Scenario no. 2 par hoga.

Buy Signal:

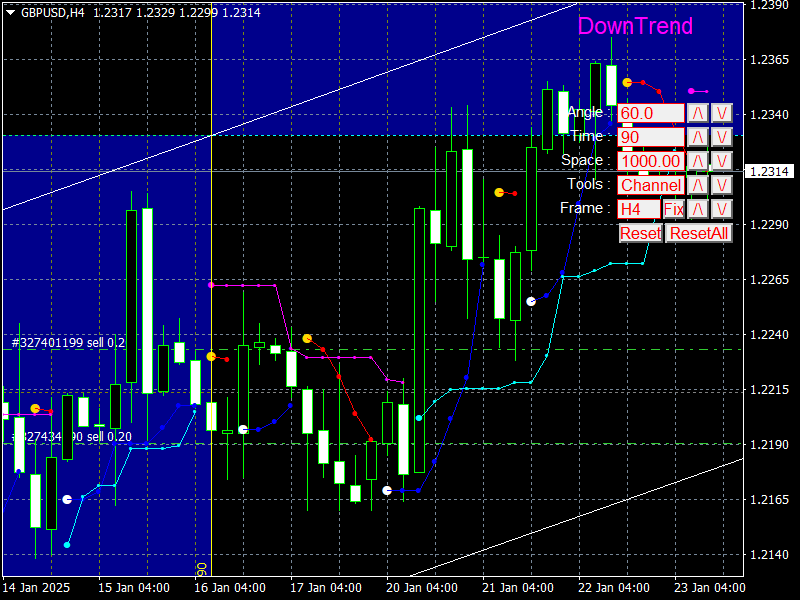

Scenario no. 1: Agar price 1.2323 (chart par green line) ko touch kare, toh main pound kharidne ka plan karunga. Target hoga 1.2369 (mazboot green line). 1.2369 par long positions close karunga aur short positions open karunga, jahan se 30-35 pips ka faida lena chahunga. Zaroori hai ke MACD indicator zero line ke upar ho aur rise start kar raha ho.

Scenario no. 2: Dusri buying opportunity tab hogi jab 1.2290 ka do dafa test ho aur MACD indicator oversold zone mein ho. Is se downside potential limit ho jayega aur market reversal upar ki taraf ho sakta hai. Target levels 1.2323 aur 1.2369 hain.

Sell Signal:

Scenario no. 1: Main pound ko 1.2290 (chart par red line) todhne ke baad bechunga. Target hoga 1.2245, jahan short positions close kar ke long positions kholunga, 20-25 pips ka rebound lenay ke liye. Bechne se pehle confirm karna zaroori hai ke MACD indicator zero line ke neeche hai aur decline kar raha hai.

Scenario no. 2: Dusra plan yeh hai ke agar 1.2323 ka do dafa test ho aur MACD indicator overbought zone mein ho, toh pound bechunga. Is se upside potential limit ho jayega aur market downward reversal karega. Target hoga 1.2290 aur 1.2245.

Dopehar mein, 1.2341 par test hua aur yeh MACD indicator ke saath coincident tha, jo zero line se downward movement start kar raha tha. Yeh ek mazboot entry point confirm karta tha pound bechne ke liye, jis ne pair ko 30 pips se zyada neeche bheja. Forex market ab bhi challenges pesh kar raha hai, jahan aksar investors side line par rehtay hain aur developments ka intezar karte hain.

Technical indicators yeh suggest karte hain ke pound apne uptrend ko continue kar sakta hai, lekin market sentiment par fundamentals ka zyada asar hai. Sabse bara reason yeh hai ke Bank of England ki monetary policy mein mumkin adjustment ka intezar hai. Agar interest rates mein tabdeeliyan hoti hain, toh yeh pound ki demand par zyada asar dal sakti hain aur market uncertainty barh sakti hai.

Saath hi, Europe mein geopolitical instability aur economic concerns investor sentiment par asar dalte hain. Tareekhi taur par, yeh factors ziada volatility ka sabab banay hain, jis ki wajah se traders ehtiyat se kaam lete hain, aur yeh riskier assets, jaise ke British pound, ke outlook ko negative karte hain.

Is mahal mein, pound kharidne ka jazba kam ho sakta hai, kyun ke market participants apne profits ko secure karna pasand karenge. Agar UK mein interest rates cut hoti hain, toh yeh pound bechne ka naya daur shuru kar sakti hai, jo market dynamics ko badal dega aur shayad trend correction la sakta hai.

Yeh concerns zyadah tar agle hafte ke liye hain. Aaj traders CBI ke industrial orders data ka intezar kar rahe hain. Yeh data business conditions aur economic activity ka indicator hota hai. Agar numbers umeed se kam hue, toh yeh traders ke liye concern ban sakta hai aur pound bechne ka sabab ban sakta hai.

Key focus: Scenario no. 1 aur Scenario no. 2 par hoga.

Buy Signal:

Scenario no. 1: Agar price 1.2323 (chart par green line) ko touch kare, toh main pound kharidne ka plan karunga. Target hoga 1.2369 (mazboot green line). 1.2369 par long positions close karunga aur short positions open karunga, jahan se 30-35 pips ka faida lena chahunga. Zaroori hai ke MACD indicator zero line ke upar ho aur rise start kar raha ho.

Scenario no. 2: Dusri buying opportunity tab hogi jab 1.2290 ka do dafa test ho aur MACD indicator oversold zone mein ho. Is se downside potential limit ho jayega aur market reversal upar ki taraf ho sakta hai. Target levels 1.2323 aur 1.2369 hain.

Sell Signal:

Scenario no. 1: Main pound ko 1.2290 (chart par red line) todhne ke baad bechunga. Target hoga 1.2245, jahan short positions close kar ke long positions kholunga, 20-25 pips ka rebound lenay ke liye. Bechne se pehle confirm karna zaroori hai ke MACD indicator zero line ke neeche hai aur decline kar raha hai.

Scenario no. 2: Dusra plan yeh hai ke agar 1.2323 ka do dafa test ho aur MACD indicator overbought zone mein ho, toh pound bechunga. Is se upside potential limit ho jayega aur market downward reversal karega. Target hoga 1.2290 aur 1.2245.

تبصرہ

Расширенный режим Обычный режим