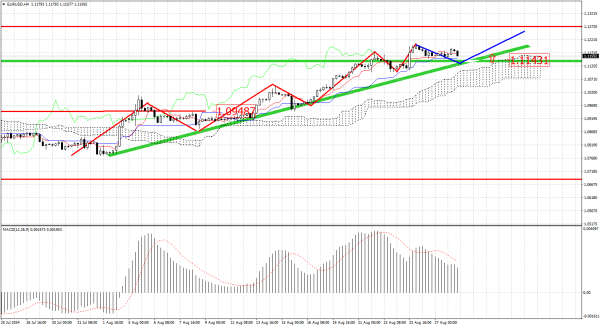

European session se pehle, Wednesday ko, EURUSD ke four-hour timeframe pe nazar daalain to market ka jazbaat dollar ko bechne ka lagta hai, jo ke established trend ko follow kar raha hai. Magar ab ye saaf hai ke market ab anticipation mode mein chali gayi hai, aur agle round ki news ka intezaar kar rahi hai jo USD ke baare mein hogi. Market ke hissedaar yeh samajhna chahte hain ke Fed 25 ya 50 basis points ka interest rate cut karega. Is sawal ka jawab kuch had tak Friday ke personal spending statistics pe depend karta hai, jo ke Fed ke liye ek aham inflation indicator hai. Aaj, price 1.1150 ke aas-paas fluctuate kar sakti hai, aur shayad 1.1140 pe trend line ki taraf retrace kare. Agar price is se neeche girti hai, to mujhe filhal koi zyada niche jaane ki potential nazar nahi aati. Statistics ka intezaar karna padega.

Market ke mood ka asar trading decisions pe padta hai, aur abhi ke liye dollar ki strength pe shak hai. Agar market ka reaction negative hota hai ya economic data expectations se mismatch karta hai, to dollar ko kuch nuksan ho sakta hai. Is waqt, traders ko market trends aur upcoming economic data ka dhyan rakhna zaroori hai. Friday ke personal spending figures ki base par trading strategy adjust ki ja sakti hai. Yeh bhi dekhna hoga ke Fed ki policy statement aur economic indicators ke beech ka taluq kaisa hai, aur market kis direction mein ja rahi hai. Overall, abhi ke liye stability aur market ke upcoming news ka intezaar zaroori hai.

Market ke mood ka asar trading decisions pe padta hai, aur abhi ke liye dollar ki strength pe shak hai. Agar market ka reaction negative hota hai ya economic data expectations se mismatch karta hai, to dollar ko kuch nuksan ho sakta hai. Is waqt, traders ko market trends aur upcoming economic data ka dhyan rakhna zaroori hai. Friday ke personal spending figures ki base par trading strategy adjust ki ja sakti hai. Yeh bhi dekhna hoga ke Fed ki policy statement aur economic indicators ke beech ka taluq kaisa hai, aur market kis direction mein ja rahi hai. Overall, abhi ke liye stability aur market ke upcoming news ka intezaar zaroori hai.

تبصرہ

Расширенный режим Обычный режим