Technical Analysis of XAU/USD

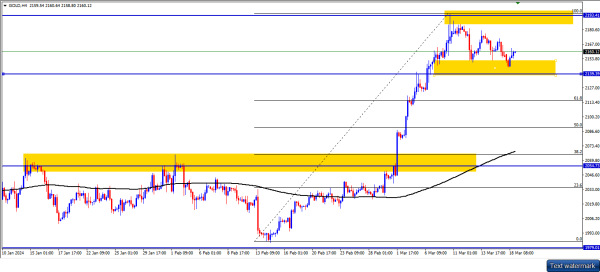

Gold ke prices ne 2150 support level se phir se rebound kiya hai jab strong gains ke baad wo lower correction ki taraf gaye thay, jinse unka naya record high 2195 par pohnchna tha. Agar gold prices mazeed barhne lagte hain, toh wo 20-period moving average par 2171 mein resistance encounter kar sakte hain pehle 2185 level ko challenge karte hue. Uske baad, rally naye record level 2195 par pohnchte hi tham sakti hai. Ummeed hai ke gold prices jo 2150 support aur 23.6% Fibonacci retracement of 1984-2195 uptrend at 2145 ko break karte hain, aagey ki taraf pullback ko trigger kar sakein 50-period MA at 2139 tak. Downtrend phir 2123 area aur 38 Fibonacci retracement level tak extend ho sakta hai. Overall, uptrend haal mein bearish moves ke bawajood strong hai char ghantay ki chart par. Agar 200-period moving average ke upar jaaye toh technical outlook zyada neutral ho jayega.

Gold ne ek shooting star reversal pattern banaya hai. Device ab downward wave par reverse signal experience kar rahi hai. Correction ke liye nishana 2130.00 level ho sakta hai. Support level ko test karne ke baad, price rebound kar sakti hai aur uptrend ka development jari rakh sakti hai. Lekin agar support level test nahi kiya gaya toh quotes 2190.00 tak barh sakte hain.

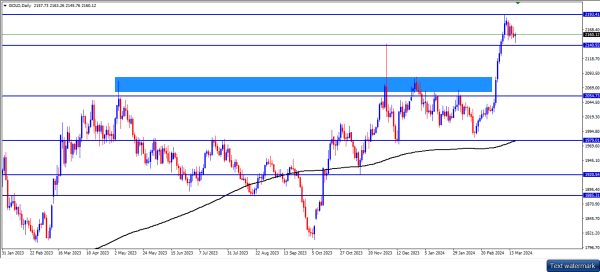

Haal mein ki sell-off ke bawajood, overall gold price trend bullish hai, aur daily chart ke hisaab se, gold prices kaafi kamzor nahi hone waale hain jo 2080 support level ke taraf ja rahe hain. US$2,020 per ounce. Overall upward trend ke zariye, resistance $2165 aur $2180 per ounce par rahega. Behtareen hai gold ko bechna lekin bina kisi risk ke. Gold price ka tajwez hai $2,067.94 per ounce. Mahine ke end tak, global macroeconomic models aur analyst forecasts ke mutabiq. Aage dekhte hue, hum ummeed karte hain ke gold 12 mahine mein 2134.44 par trade karega.

Gold ke prices ne 2150 support level se phir se rebound kiya hai jab strong gains ke baad wo lower correction ki taraf gaye thay, jinse unka naya record high 2195 par pohnchna tha. Agar gold prices mazeed barhne lagte hain, toh wo 20-period moving average par 2171 mein resistance encounter kar sakte hain pehle 2185 level ko challenge karte hue. Uske baad, rally naye record level 2195 par pohnchte hi tham sakti hai. Ummeed hai ke gold prices jo 2150 support aur 23.6% Fibonacci retracement of 1984-2195 uptrend at 2145 ko break karte hain, aagey ki taraf pullback ko trigger kar sakein 50-period MA at 2139 tak. Downtrend phir 2123 area aur 38 Fibonacci retracement level tak extend ho sakta hai. Overall, uptrend haal mein bearish moves ke bawajood strong hai char ghantay ki chart par. Agar 200-period moving average ke upar jaaye toh technical outlook zyada neutral ho jayega.

Gold ne ek shooting star reversal pattern banaya hai. Device ab downward wave par reverse signal experience kar rahi hai. Correction ke liye nishana 2130.00 level ho sakta hai. Support level ko test karne ke baad, price rebound kar sakti hai aur uptrend ka development jari rakh sakti hai. Lekin agar support level test nahi kiya gaya toh quotes 2190.00 tak barh sakte hain.

Haal mein ki sell-off ke bawajood, overall gold price trend bullish hai, aur daily chart ke hisaab se, gold prices kaafi kamzor nahi hone waale hain jo 2080 support level ke taraf ja rahe hain. US$2,020 per ounce. Overall upward trend ke zariye, resistance $2165 aur $2180 per ounce par rahega. Behtareen hai gold ko bechna lekin bina kisi risk ke. Gold price ka tajwez hai $2,067.94 per ounce. Mahine ke end tak, global macroeconomic models aur analyst forecasts ke mutabiq. Aage dekhte hue, hum ummeed karte hain ke gold 12 mahine mein 2134.44 par trade karega.

تبصرہ

Расширенный режим Обычный режим