Japan ki maeeshat mein normalisation ke signs dikhayi dena shuru ho rahe hain, kuch companies apni faida mandi ko barqarar rakhne ke liye staff ko kam kar rahe hain. Uron ke saath mazid munafa barhane ke liye, BOJ ko apne negative interest rate regime ko khatam karne ka ghor karna hai. Magar, jab ke kai CEOs negative interest rates ka khatma ummed karte hain, woh kisi policy ki tangi ka intezar nahi karte hain. Suntory Holdings Ltd. ke CEO Takeshi Niinami ka khayal hai ke zyada uchh uchayi ke zariye khapat ko barhane ke zaroorat ke maqam par, nisbatan dhela policy measures ka qayam munasib hai, dekhte hue consumer sentiment aur zarurat.

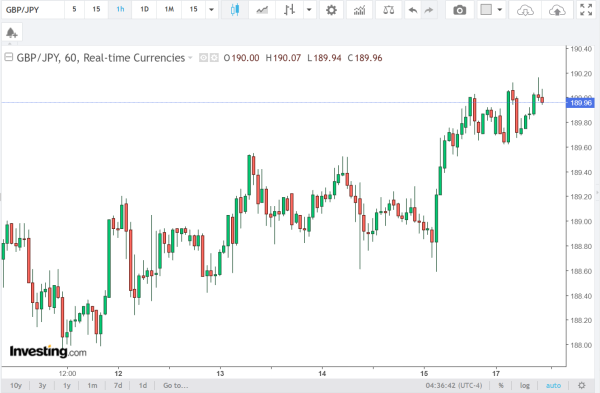

GBPJPY jodi ne waziha nichli rawani ko dikhaya hai, jismain girawat ka quwatnuma imtihan hai. Kharidari ke iraade ko qeemat barhane ki koshishon ke bawajood, unki koshishen wohi mumkinat se mehdood hain, jo ke musalsal nichle rawani ka nateeja hai. Nichli taraf structural violations aam hain, jo ek bearish trend ko darust karte hain. Kharidar ke dilchaspi ka ek ahem darja 190 ke as paas hai, lekin haal hi mein qeemat ki harkat ke mutabiq, ek significant support zone 186.50-186.00 ke paas hai. Yeh darja kharidoron ka tawajju ko apne taraf kheenchne ke liye taiyar hai aur yeh bazaar ki dynamics mein ek ahem nukaat ban sakta hai.

Mausool rawani ke mojooda bearish junoon ko palatne ke liye, farokht karne waleon ko 190 ke as paas apni positions ko barqarar rakhna parega. Is darje ka tootna market ki dilchaspi ko badal sakta hai, jise ke ek bullish reversal aur naye unche maqamat tak pohanchne ki koshish karne ka ishara ho sakta hai.

Mukhtasar mein, GBPJPY jodi ek waziha nichli rawani ka gawah hai, jisme farokht karne wale control mein hain. Ab tawajju key support levels par hoti hai, khaaskar 186.50-186.00 ke as paas, jo future market dynamics ko darust kar sakte hain. Kharidoron aur farokht karne walon ke darmiyan is darje ke ird gird interaction nazukati se samhalne wale hain jo qareebi muddaton mein jodi ke rukh ko taayun karega.

GBPJPY jodi ne waziha nichli rawani ko dikhaya hai, jismain girawat ka quwatnuma imtihan hai. Kharidari ke iraade ko qeemat barhane ki koshishon ke bawajood, unki koshishen wohi mumkinat se mehdood hain, jo ke musalsal nichle rawani ka nateeja hai. Nichli taraf structural violations aam hain, jo ek bearish trend ko darust karte hain. Kharidar ke dilchaspi ka ek ahem darja 190 ke as paas hai, lekin haal hi mein qeemat ki harkat ke mutabiq, ek significant support zone 186.50-186.00 ke paas hai. Yeh darja kharidoron ka tawajju ko apne taraf kheenchne ke liye taiyar hai aur yeh bazaar ki dynamics mein ek ahem nukaat ban sakta hai.

Mausool rawani ke mojooda bearish junoon ko palatne ke liye, farokht karne waleon ko 190 ke as paas apni positions ko barqarar rakhna parega. Is darje ka tootna market ki dilchaspi ko badal sakta hai, jise ke ek bullish reversal aur naye unche maqamat tak pohanchne ki koshish karne ka ishara ho sakta hai.

Mukhtasar mein, GBPJPY jodi ek waziha nichli rawani ka gawah hai, jisme farokht karne wale control mein hain. Ab tawajju key support levels par hoti hai, khaaskar 186.50-186.00 ke as paas, jo future market dynamics ko darust kar sakte hain. Kharidoron aur farokht karne walon ke darmiyan is darje ke ird gird interaction nazukati se samhalne wale hain jo qareebi muddaton mein jodi ke rukh ko taayun karega.

تبصرہ

Расширенный режим Обычный режим