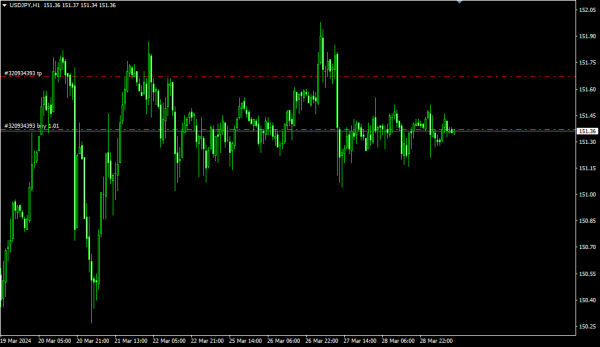

Forex trading, jise aam taur par FX trading kehte hain, ek aham tajziya hai jahan mukhtalif currencies ke darmiyan ke muqablay par paisay kamaye jaate hain. USD-JPY, yaani United States Dollar aur Japanese Yen, ek aham currency pair hai jo traders ke liye aik mukhtasir munafa ka zariya ban sakta hai. Agle haftay ki trading strategy ke mutalliq jo tajziya diya gaya hai, woh H4 ki upper half par mabni hai. Is tajziye ke mutabiq, pair ka breakdown ho chuka hai aur yeh bohot zyada ahtimam ke saath dekha ja raha hai. Tajziye ke mutabiq, hum 138.2 aur 152.50 ki taraf jaenge, jahan ek correction hone ki ummeed hai. Is ke baad, mukhtasir dair mein, hum 161.8–153.53 ke maqasid tak pohanchenge. Yeh strategy ko tajziya karne ke liye moujooda doori ko shamil karte hue kam se kam 210 points ka faasla zaroori hai. Yeh baat yaad rakhi jaani chahiye ke yeh maqasid Instagram spread ke size ko shamil nahi karta.

Technology ke istemal se, jo hamesha se forex trading mein aham hota hai, is tajziye ko monitor kiya ja sakta hai. American session ke baad 17:00 Moscow waqt par specifically US session ke mutalliq tafseel se ghor kiya jana chahiye. Yeh waqt session ke ikhtitami dor ko darust karta hai, jo ke aksar volatile hota hai aur aham trading opportunities deta hai. Forex trading mein itna ahtimam aur tajziye ka durust istemal karna, khaas tor par currencies ke darmiyan mukhtalif muqabalay mein faasla karna, traders ke liye zaroori hai. Yeh ek roshni deta hai jo trading decisions ko informed banata hai aur nuqsaan se bachne mein madad karta hai. Is tajziye ke mutabiq, traders ko amanat aur sahi hawale ke saath kaam karna chahiye, taake unki trading strategy mukammal taur par kaamyaab ho sake.

Technology ke istemal se, jo hamesha se forex trading mein aham hota hai, is tajziye ko monitor kiya ja sakta hai. American session ke baad 17:00 Moscow waqt par specifically US session ke mutalliq tafseel se ghor kiya jana chahiye. Yeh waqt session ke ikhtitami dor ko darust karta hai, jo ke aksar volatile hota hai aur aham trading opportunities deta hai. Forex trading mein itna ahtimam aur tajziye ka durust istemal karna, khaas tor par currencies ke darmiyan mukhtalif muqabalay mein faasla karna, traders ke liye zaroori hai. Yeh ek roshni deta hai jo trading decisions ko informed banata hai aur nuqsaan se bachne mein madad karta hai. Is tajziye ke mutabiq, traders ko amanat aur sahi hawale ke saath kaam karna chahiye, taake unki trading strategy mukammal taur par kaamyaab ho sake.

تبصرہ

Расширенный режим Обычный режим