Theek hai, dekhtay hain

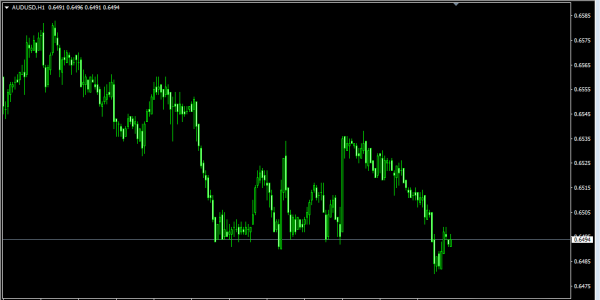

AUD/USD Currency Pair ka ahem resistance darja 0.6580 par hai 0.6444 ke support level ki itni ahmiyat ko qaim rakhna zaroori hai, kyunkay agar yeh level barkarar rahe to qareebi arsay mein keemat mein izafa hone ki umeed hai Agar yeh support level qaim rahe, to AUD/USD ke liye aage barhne ka wada hota hai jis takreeban 0.6720 ke resistance level tak hai, jo doosra resistance level hai Iske baad, AUD/USD ke rastay ka ishara hai ke tezi se aage barhti rahegi jis tak 0.6870 ke darja tak hai, jo teesra aur aakhri resistance level hai Ye ahem darjay aik makhsoos teal rang mein screen par numaya kiye gaye hain takay inki ahmiyat ko support levels ke tor par zor diya ja sake

Mukhalif taur par, AUD/USD ke liye ahem support level 0.6440 par hai Is ibtidaai support level ka tootna ek downtrend ka andesha laa sakta hai, jo AUD/USD ko 0.6110 ke support level ki taraf girne par majboor kar sakta hai Iske baad, mazeed girawat ka intezar hai, jo currency pair ko 0.5821 ke darjay tak le ja sakta hai, jo teesra aur aakhri support level hai Is tarah, upar di gayi technical tajziya ke mutabiq, AUD/USD ke liye ek dhaai strategy ka intizar hai

Toh is tarah, AUD/USD ke liye technical nazar-e-ijazat ek ahtiyaati umeed ko zahir karta hai jo 0.6440 support level ka barqarar rehne par mojood hai 0.6720 aur 0.6870 resistance levels jaise mumkin targets, traders ko long positions ke liye dakhilay ke potential points faraham karte hain Lekin, ehtiyaat ka mashwara diya jata hai, kyunke 0.6440 support level ka tootna ek bearish trend ka ishara ho sakta hai, jo ke sell position ke liye ghor kiya ja sakta hai jiska nateejay mein 0.6115 aur 0.5850 ke support levels par nazar lagai ja sakti hai

AUD/USD Currency Pair ka ahem resistance darja 0.6580 par hai 0.6444 ke support level ki itni ahmiyat ko qaim rakhna zaroori hai, kyunkay agar yeh level barkarar rahe to qareebi arsay mein keemat mein izafa hone ki umeed hai Agar yeh support level qaim rahe, to AUD/USD ke liye aage barhne ka wada hota hai jis takreeban 0.6720 ke resistance level tak hai, jo doosra resistance level hai Iske baad, AUD/USD ke rastay ka ishara hai ke tezi se aage barhti rahegi jis tak 0.6870 ke darja tak hai, jo teesra aur aakhri resistance level hai Ye ahem darjay aik makhsoos teal rang mein screen par numaya kiye gaye hain takay inki ahmiyat ko support levels ke tor par zor diya ja sake

Mukhalif taur par, AUD/USD ke liye ahem support level 0.6440 par hai Is ibtidaai support level ka tootna ek downtrend ka andesha laa sakta hai, jo AUD/USD ko 0.6110 ke support level ki taraf girne par majboor kar sakta hai Iske baad, mazeed girawat ka intezar hai, jo currency pair ko 0.5821 ke darjay tak le ja sakta hai, jo teesra aur aakhri support level hai Is tarah, upar di gayi technical tajziya ke mutabiq, AUD/USD ke liye ek dhaai strategy ka intizar hai

Toh is tarah, AUD/USD ke liye technical nazar-e-ijazat ek ahtiyaati umeed ko zahir karta hai jo 0.6440 support level ka barqarar rehne par mojood hai 0.6720 aur 0.6870 resistance levels jaise mumkin targets, traders ko long positions ke liye dakhilay ke potential points faraham karte hain Lekin, ehtiyaat ka mashwara diya jata hai, kyunke 0.6440 support level ka tootna ek bearish trend ka ishara ho sakta hai, jo ke sell position ke liye ghor kiya ja sakta hai jiska nateejay mein 0.6115 aur 0.5850 ke support levels par nazar lagai ja sakti hai

تبصرہ

Расширенный режим Обычный режим