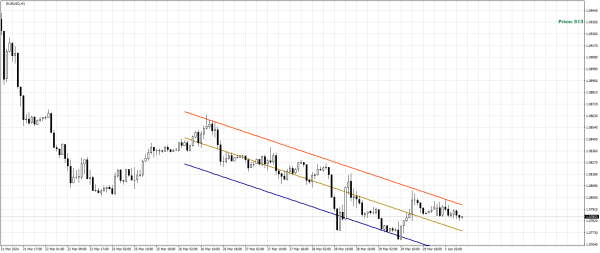

Salam, EUR/USD ney Asian session mein apni intraday izafay ko kam kiya aur 1.0780 ke qareeb buland trading kar raha hai Jumeraat ko. Pair ko 1.0800 ke nafsiyati nishaan par ahem rukawat mil sakti hai. Agar yeh rukawat paar hojaye to EUR/USD pair ko 1.0818 ka 23.6% Fibonacci retracement level aur nine-day Exponential Moving Average jo 1.0820 hai, ke aas paas jaa kar talaash karni paregi. Mazeed rukawat 1.0900 ke nafsiyati rukawat ke baad 1.0850 ke baray level par hai. Takneeki tajziyah EUR/USD pair ke liye bearish jazbat ko darust karta hai. 14 dinon ka relative strength index 50 mark ke neeche hai, jisse kharidari ke momentum mein kamzori darust hoti hai. Mazeed, moving average ne convergence divergence signal line ke neeche bhinnata dikhaya aur central line ke neeche rehta hai. Haan, yeh ek dairpa indicator hai, lekin yeh hamwaar bearish momentum ki tasdeeq karta hai EUR/USD pair ke liye. Tehqiqati tajziyah ke mutabiq, fori support March ki kam se kam 1.0767 ke naye low par nazar aata hai, jise major support 1.0750 par follow karta hai. Iss se neeche girne par, EUR/USD pair ko 1.0700 ke nafsiyati level ke aas paas safar karna padega. EUR/USD pair abhi 1.0803 par 1.0694/1.0981 rally ke 61.8% Fibonacci retracement ke neeche taraqqi kar raha hai, jo khatra ko kam karta hai. EUR/USD ke daily chart mein pair apni saari moving averages ke neeche rehta hai, jahan flat 200 simple moving average agle Fibonacci resistance level 1.0835 ke saath ulta hota hai. Aakhir mein, takneeki indicators ne apni ghiri hui surat e haal ko manaa rakha hai, apni neeche ki raah ko barqarar rakhtay hain aur agle kam level ki tawaqqo ko jari rakhtay hain.

Qareebi muddat mein, 4-hour chart bhi bearish tauseeat ko support karta hai, jab EUR/USD apni saari moving averages ke neeche taraqqi kar raha hai jabke bearish forokhtkar 20 SMA ke qareeb hain. Intehai asar daari ke sath lambi muddat ka trend chhota moving average ke oopar be-gair hai. Aakhir mein, takneeki indicators ne apni ریاست ko dobara shuru kiya hai.

تبصرہ

Расширенный режим Обычный режим