EUR/USD

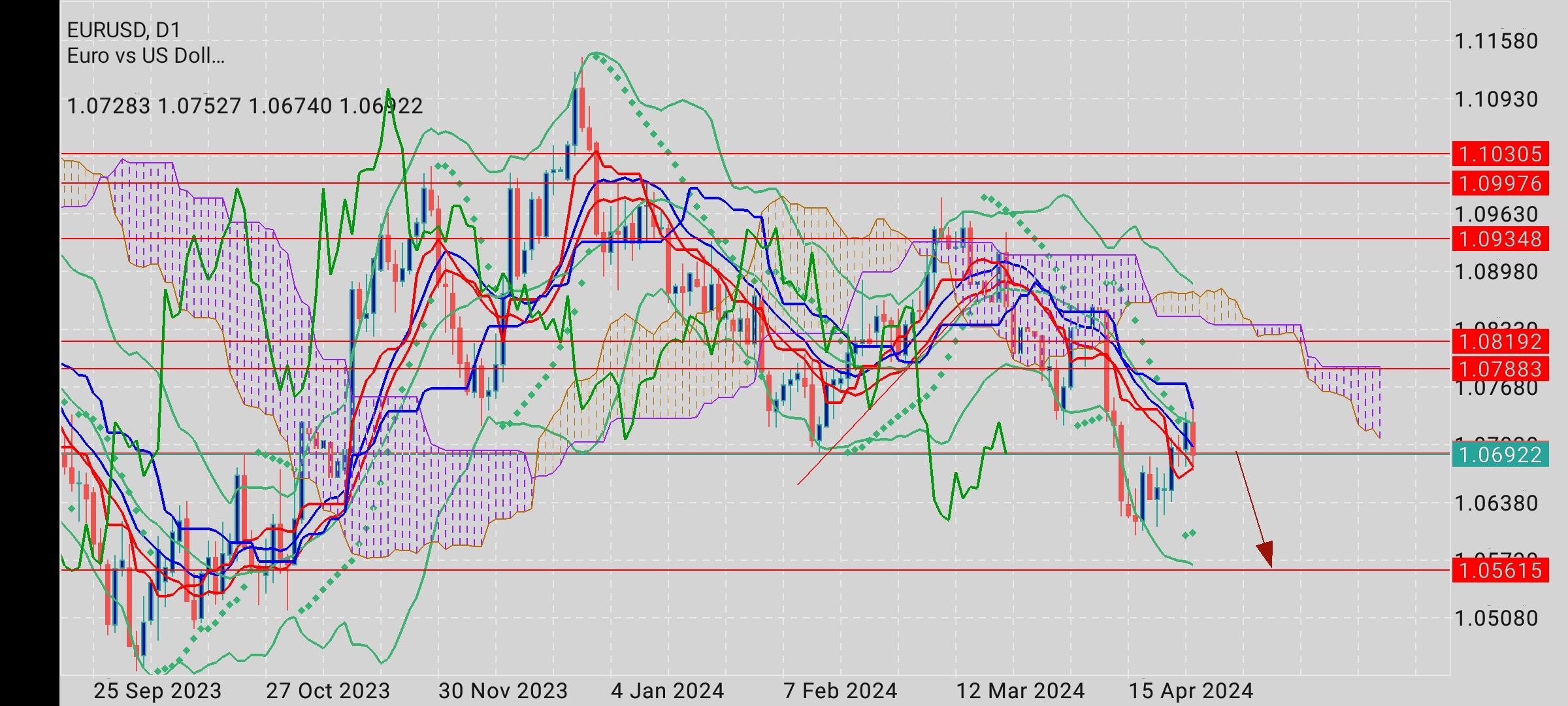

Currency market mein Euro (EUR) ne Thursday ko apnay kuch nuqsanat ko kuch had tak kam karne ki koshish ki US Dollar (USD) ke khilaf, jab ke pehle haftay mein tezi se gir gaya tha. EUR/USD jodi Asian session mein 1.0710 ke aas paas tair rahi thi, jo ke is ke neeche ki rukh mein thori sudhar ko zahir karta tha. Takneeki tahlil Euro ke liye aik mumkinah mor ka ishara de rahi hai. Jodi ne ahem support levels 1.0695 aur 1.0700 ke oopar chadh gaya, jo ke ek kamzor hoti hui girawat ki nishandahi karta hai. Mazeed is par, MACD indicator, jo ke center line ke neeche position mein hai, ab signal line ke oopar hai, jo Euro ke faavor mein momentum mein tabdeeli ka ishara de sakta hai. Magar, in musbat isharat ke bawajood, Euro ke liye tajurbaati nazar-e-aqeedat mahfooz rehti hai. 14-day RSI indicator 50 ke neeche baitha hua hai, jo ke bearish jazbaat ka aik sirahe parinda ho sakta hai. Ye naumeedi Euro/USD jodi ka haal 1.0600 ke qareeb aik naye paanch mahine ka kamzor aurzi nuqsan ke baad se hai, jo ke 2.5% se zyada gir gaya. Pichlay haftay se broad market ka jazba bearish raha hai, jahan aik nami bohot badi farokht Euro ko neeche ki taraf daba rahi hai. Takneeki indicators jaise ke RSI jo 30 ke neeche hawaai aur MACD jo manfi ilaqa mein hai, is bearish nazar-e-aqeedat ko barhawa de rahay hain. Agar ye farokht ka dabao mazeed barhta hai, to Euro ka pehla line of defense 1.0515 support level hoga, jo ke November ke shurwat mein pohancha tha.

Aik mazeed ahem support zone psychological level 1.0700 ke ird gird waqe hai. Is level ke tootne se Euro ke mazeed depreciate hone ka khatra hai, jo ke usay 1.0650 ke key support area ki taraf khinch sakta hai. Is ke ilawa, April ki kamzor terk 1.0601, jo ke psychological level 1.0600 ke milta hai, kisi mazeed girawat ke case mein kuch rahat pesh kar sakta hai. Ulta, agar Euro thodi taqat hasil kar leta hai, to usay pehli rukawat 21-day EMA (exponential moving average) se milti hai jo ke ab 1.0727 par maujood hai. Is rukawat ko paar karne se rasta 38.2% Fibonacci retracement level tak khulta hai jo ke halqi oonchiyon 1.0981 aur khamiyon 1.0606 ke darmiyan waqe hai, aur ye bhi major resistance level 1.0750 ke sath milta hai. Aam tor par, EUR/USD jodi apnay aap ko aik charahgar rukawat par pa rahi hai. Jabke takneeki indicators aik mumkinah ulat pher ki ishara dete hain, to moujooda market ka jazba aur halqi ke qeemat ka amal aage ki taraf girne ke khatrat zahir karte hain. Anay wale din Euro ke raftar ko tay karna ke liye nihayat ahem honge, jahan key support aur resistance levels currency market ke medan-e-jung ki tarah kaam karenge.

Currency market mein Euro (EUR) ne Thursday ko apnay kuch nuqsanat ko kuch had tak kam karne ki koshish ki US Dollar (USD) ke khilaf, jab ke pehle haftay mein tezi se gir gaya tha. EUR/USD jodi Asian session mein 1.0710 ke aas paas tair rahi thi, jo ke is ke neeche ki rukh mein thori sudhar ko zahir karta tha. Takneeki tahlil Euro ke liye aik mumkinah mor ka ishara de rahi hai. Jodi ne ahem support levels 1.0695 aur 1.0700 ke oopar chadh gaya, jo ke ek kamzor hoti hui girawat ki nishandahi karta hai. Mazeed is par, MACD indicator, jo ke center line ke neeche position mein hai, ab signal line ke oopar hai, jo Euro ke faavor mein momentum mein tabdeeli ka ishara de sakta hai. Magar, in musbat isharat ke bawajood, Euro ke liye tajurbaati nazar-e-aqeedat mahfooz rehti hai. 14-day RSI indicator 50 ke neeche baitha hua hai, jo ke bearish jazbaat ka aik sirahe parinda ho sakta hai. Ye naumeedi Euro/USD jodi ka haal 1.0600 ke qareeb aik naye paanch mahine ka kamzor aurzi nuqsan ke baad se hai, jo ke 2.5% se zyada gir gaya. Pichlay haftay se broad market ka jazba bearish raha hai, jahan aik nami bohot badi farokht Euro ko neeche ki taraf daba rahi hai. Takneeki indicators jaise ke RSI jo 30 ke neeche hawaai aur MACD jo manfi ilaqa mein hai, is bearish nazar-e-aqeedat ko barhawa de rahay hain. Agar ye farokht ka dabao mazeed barhta hai, to Euro ka pehla line of defense 1.0515 support level hoga, jo ke November ke shurwat mein pohancha tha.

Aik mazeed ahem support zone psychological level 1.0700 ke ird gird waqe hai. Is level ke tootne se Euro ke mazeed depreciate hone ka khatra hai, jo ke usay 1.0650 ke key support area ki taraf khinch sakta hai. Is ke ilawa, April ki kamzor terk 1.0601, jo ke psychological level 1.0600 ke milta hai, kisi mazeed girawat ke case mein kuch rahat pesh kar sakta hai. Ulta, agar Euro thodi taqat hasil kar leta hai, to usay pehli rukawat 21-day EMA (exponential moving average) se milti hai jo ke ab 1.0727 par maujood hai. Is rukawat ko paar karne se rasta 38.2% Fibonacci retracement level tak khulta hai jo ke halqi oonchiyon 1.0981 aur khamiyon 1.0606 ke darmiyan waqe hai, aur ye bhi major resistance level 1.0750 ke sath milta hai. Aam tor par, EUR/USD jodi apnay aap ko aik charahgar rukawat par pa rahi hai. Jabke takneeki indicators aik mumkinah ulat pher ki ishara dete hain, to moujooda market ka jazba aur halqi ke qeemat ka amal aage ki taraf girne ke khatrat zahir karte hain. Anay wale din Euro ke raftar ko tay karna ke liye nihayat ahem honge, jahan key support aur resistance levels currency market ke medan-e-jung ki tarah kaam karenge.

تبصرہ

Расширенный режим Обычный режим