USD is rukawat ka sabab ban sakti hai wo aane wale iqtisadi reports ya central bank ke elan ka intezar ho sakta hai. Market participants aksar bade trades karne se pehle rok jate hain jab significant data releases ka intezar hota hai, taake market ke galat side par na phans jayein. Misal ke tor par, agar GDP growth, employment figures, ya inflation data jaise key economic indicators jald release hone wale hain, to traders aksar in reports ka intezar karte hain taake unhein market ka wazeh rukh mil sake. Isi tarah, agar central banks ke upcoming statements ya policy decisions hone wale hain, to yeh bhi market movements par bara asar dal sakte hain. Aise scenarios mein, market aam tor par khamosh rehta hai jab tak traders in critical information ka intezar karte hain.Ek aur mumkin sabab jo aaj ki inakti ko contribute kar sakta hai wo broader market sentiment aur overall investor caution ho sakta hai. Kabhi kabhi low volatility aur lack of movement broader sense of uncertainty ya risk aversion ko reflect karte hain jo market participants ke darmiyan hota hai. Yeh un waqt mein ho sakta hai jab geopolitical tensions, economic uncertainties, ya bade global events ke lead-up mein ho. Jab investors ko future direction ke baray mein shak hota hai, to wo aksar wait-and-see approach apnate hain, jo subdued trading activity ko janam deta hai.

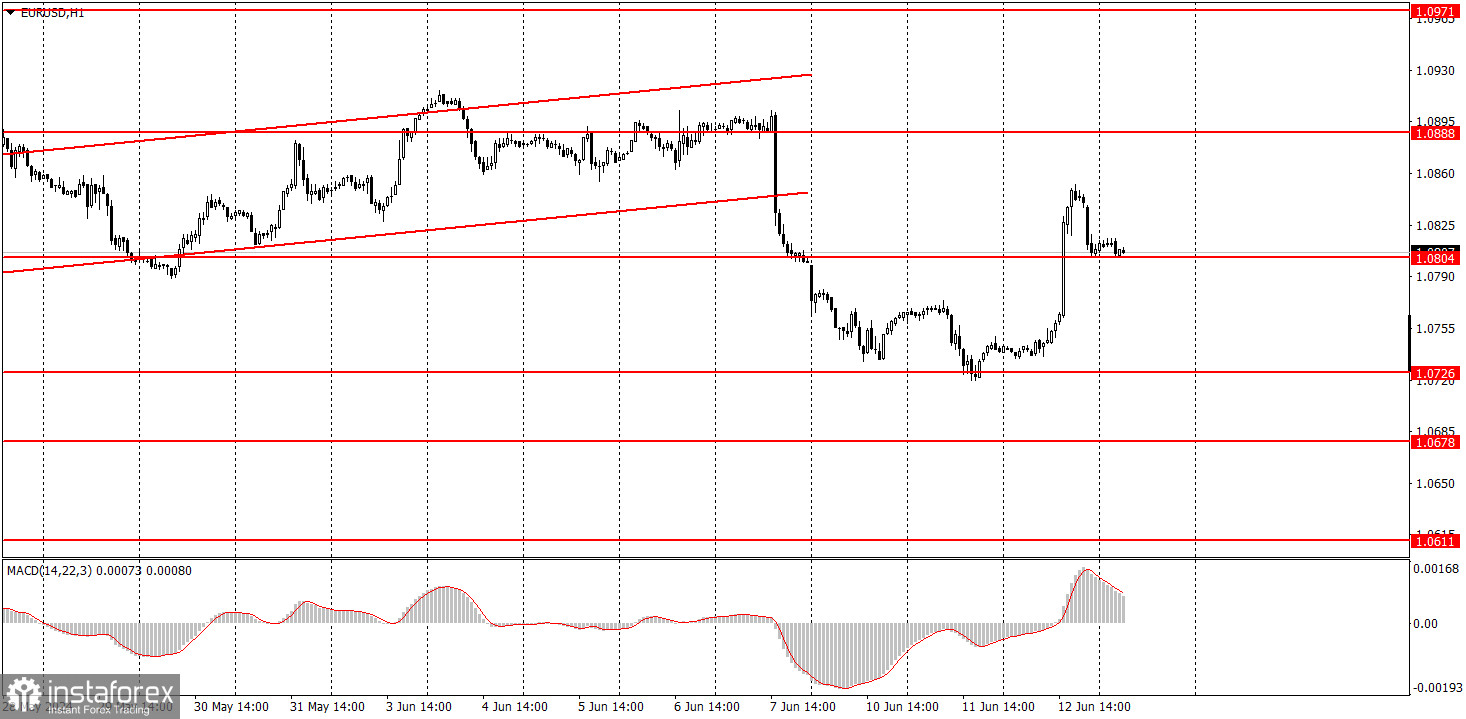

Technically, initial movement ke baad 1.0700 level par lack of follow-through ko bhi market ka ek breather lena kaha ja sakta hai. Yeh tab hota hai jab price ek significant level par pohanchti hai lekin aage barhne ki momentum nahi hoti. Aise cases mein, market consolidation phase mein enter hota hai jahan yeh narrow range mein trade karta hai jab buyers aur sellers ek dusre ko balance karte hain. Yeh consolidation market cycle ka ek healthy hissa hota hai, jo next significant move se pehle energy accumulate karne ka moka deta hai.Aage dekhte hue, kal ka trading session ziada wazeh information de sakta hai. Yeh current pause wakai temporary ho sakta hai, aur market anticipated data ya events ke baad apni movement resume kar sakta hai. Traders ko vigilant rehna chahiye aur new developments par nazar rakhni chahiye jo market ke direction ke baray mein clearer insights provide kar sakti hain.Akhir mein, aaj ka din market mein ek inactive din tha, jo initial movement ke baad lack of further development se characterized tha. Yeh inactivity upcoming economic data, central bank announcements, broader market sentiment, ya ek technical consolidation phase ki wajah se ho sakti hai. Kal ka trading session ziada wazeh information de sakta hai, aur traders ko alert rehna chahiye taake kisi bhi emerging opportunities ko capitalize kar sakein. Market developments ko closely monitor karte hue aur adaptable rehkar, traders periods of inactivity ko navigate kar sakte hain aur next significant move ke liye ready reh sakte hain.

Technically, initial movement ke baad 1.0700 level par lack of follow-through ko bhi market ka ek breather lena kaha ja sakta hai. Yeh tab hota hai jab price ek significant level par pohanchti hai lekin aage barhne ki momentum nahi hoti. Aise cases mein, market consolidation phase mein enter hota hai jahan yeh narrow range mein trade karta hai jab buyers aur sellers ek dusre ko balance karte hain. Yeh consolidation market cycle ka ek healthy hissa hota hai, jo next significant move se pehle energy accumulate karne ka moka deta hai.Aage dekhte hue, kal ka trading session ziada wazeh information de sakta hai. Yeh current pause wakai temporary ho sakta hai, aur market anticipated data ya events ke baad apni movement resume kar sakta hai. Traders ko vigilant rehna chahiye aur new developments par nazar rakhni chahiye jo market ke direction ke baray mein clearer insights provide kar sakti hain.Akhir mein, aaj ka din market mein ek inactive din tha, jo initial movement ke baad lack of further development se characterized tha. Yeh inactivity upcoming economic data, central bank announcements, broader market sentiment, ya ek technical consolidation phase ki wajah se ho sakti hai. Kal ka trading session ziada wazeh information de sakta hai, aur traders ko alert rehna chahiye taake kisi bhi emerging opportunities ko capitalize kar sakein. Market developments ko closely monitor karte hue aur adaptable rehkar, traders periods of inactivity ko navigate kar sakte hain aur next significant move ke liye ready reh sakte hain.

تبصرہ

Расширенный режим Обычный режим