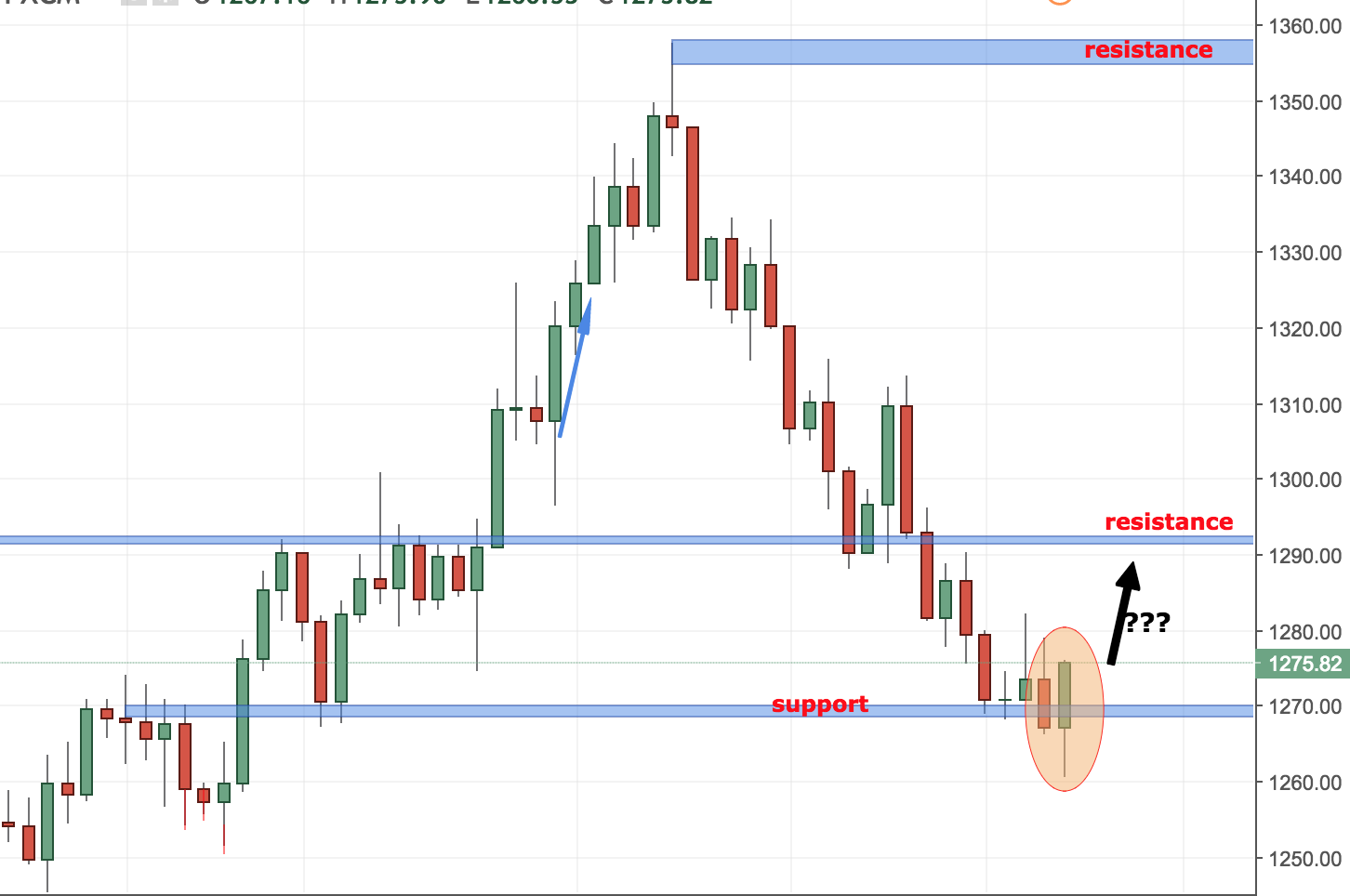

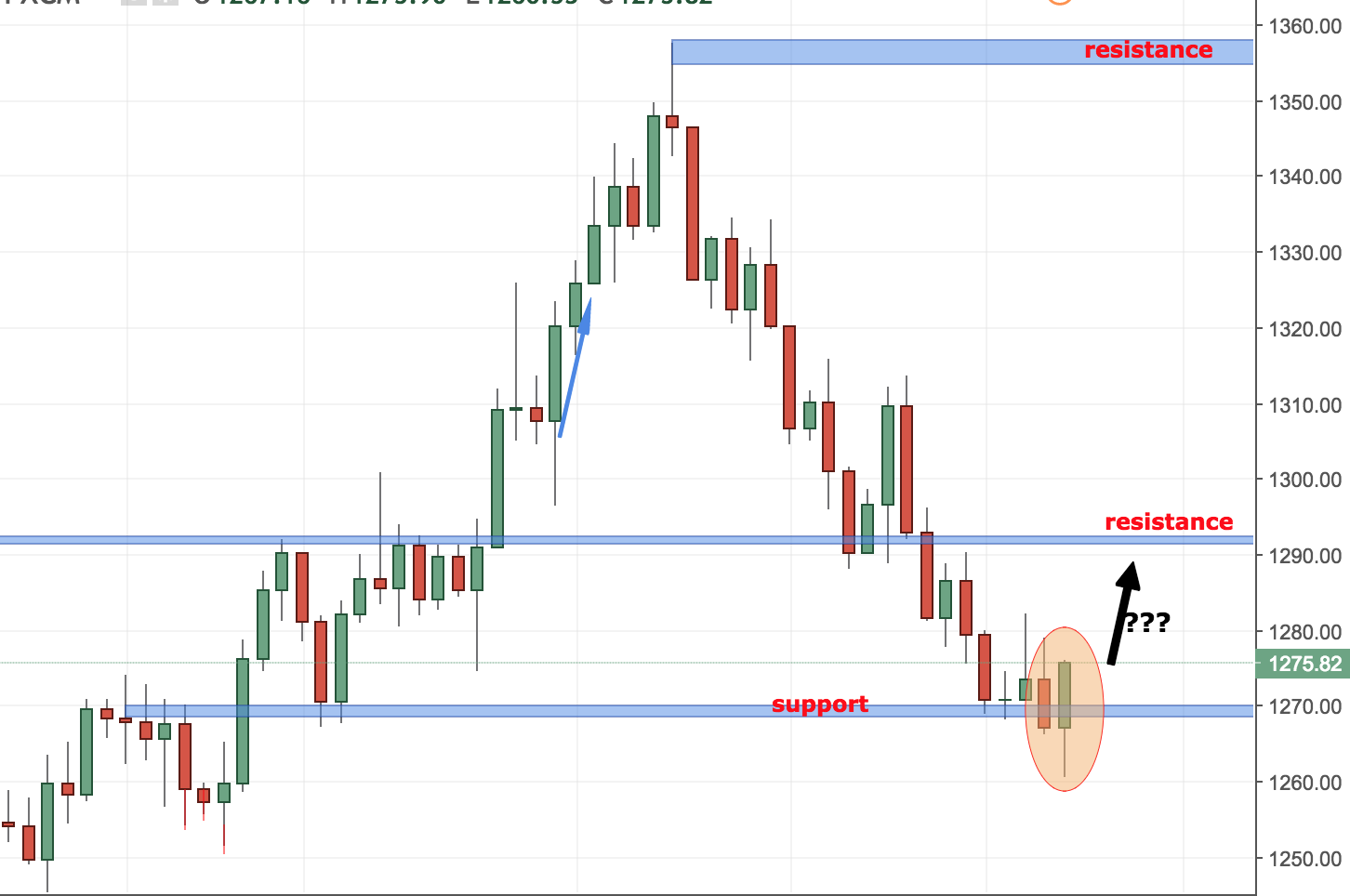

Kal ka US Retail Sales data ne XAU/USD ke bechne walon ko stable kiya. Is ke natije mein, market ne 2008 ke level tak pahuncha hai. Aur khareedne walay is level se wapas aa sakte hain. Lekin humein savdhani se aur safalta ke liye avashyak sabhi maangon ke saath vyapar karna hoga. Is ke liye, apne vyaparik drishtikon ko atyant jatil rahne se bachane aur mooltatvon par dhyan kendrit karne ki koshish karein. Apne asafalta ke vyaparon ko tafseel se jaanch karke, unse seekh kar, aur apne overall performance ko sudharne ke liye apne vyavhar ko sudharne mein apne vyaparik kushalta ko sudharne mein madad karein. Adhik vyapar na karein; apne sthapit vyaparik yojana ka palan karein taki santulit rah sake. Vyaparik session ke dauran distractions ko door rakhein, apne lakshyon par laser-focused rahein. Apne yojana ka palan karne aur mahatva purna kadam ko chhodne se bachne ke liye ek vyaparik checklist ka istemal karein. Apne bhavnaon aur vyaparon par chintan aur abhivyakti ko dastavez mein darj karein, vyavharik patterns ko pinpoint karte hue. Short-term ya ghante bhar ke vyapar ke liye, ham aage ek kharidne ki order ke saath 2012 ke target point ke liye khol sakte hain. Haalaanki, bechne ka dabav aaj bhi bana

`

X

new posts

-

#511 Collapse

-

<a href="https://www.instaforex.org/ru/?x=ruforum">InstaForex</a> -

#512 Collapse

XAUUSD TRENDING VIEW

H1 TIME FRAME

Gold price ko agar ham h1 time frame pay analyzed kartay hain to h1 chart pay price 2020.00 pivot point line say aik big bullish candle k sath upward breakout k sath close hue hain. If you pay a chart and have a custom indicator reading, the osma indicator levels will show a buy signal. If current price sell movements begin, chart pay price up movements have a strong chance of occurring, with a target of 2041.00 and a resistance zone of 2047.50 to be tested.

If current price 1 hour chart pay reversed hoty hai, and sath central point line k sell main breakout karty hai, then chart pay price ki downward movements ko chances ban saktay hain, jiska target neechay 2009.50 aur phir usk bad price mazeed 2003.00 levels ko test kar sakty hai. Mairay analysis k hisab say price ka current temporary trend again buy ka start ho chuka hai, aur sath price central point line k bhi bullish main breakout kar chuki hai, is liye chances yahi hain k price strongly tour par resistance levels ko test kar sakti hai.

Gold price ko agar ham h4 time frame pay analyzed kartay hain to h1 chart pay price 2020.00 pivot point line say aik big bullish candle k sath upward breakout k sath closed hue hain. If you pay a chart and have a custom indicator reading, the osma indicator levels will show a buy signal. If current price sell movements begin, chart pay price up movements have a strong chance of occurring, with a target of 2041.00 and a resistance zone of 2047.50 to be tested.

If current price 4 hour chart pay reversed hoty hai, then sath central point line k sell main breakout karty hai to chart pay price ki downward movements k chance ban saktay hain, jiska target neechay 2009.50 aur phir usk bad price mazeed 2003.00 levels ko test kar sakty hai. Mairay analysis k hisab say price ka current temporary trend again buy ka start ho chuka hai, aur sath price central point line k bhi bullish main breakout kar chuki hai, is liye chances yahi hain k price strongly tour par resistance levels ko test kar sakti hai.

Istehwaar fazeh mukammal hui, and gold ne apna raasta tay karlia hai. Upar ki tehqiqat ka khatma hua hai; jo ek mutabaadil izhar ka ishara hai. Upar ki tehqiqat se nichayi ka ishara hai. Is waqt, farokht karne walay 2048 ke maqam par hain, jo qualified support farahem kar sakte hai. Qualified support mein ek tehniki mumkinat hai ke ek opper ki tehqiqat ho sakti. Jiska hadood halaan ke mojooda resistance level is 2048. Agar yeh ho to, is level se aane wala bounce keemat ko dobara 2050 le aayega. Agar yeh paar kiya jaye, then neeche ki taraf ke liye chalti hui harekat jaari rahegi jo 2028 ke maqam tak pahunch sakti hai. The reversal level will be reached in 2033, and gold will be mined. Neeche diye gaya chart mein dekhein:

H4 TIME FRAME

According to the latest US Retail Sales data, the XAU/USD exchange rate remains stable. In my country, the market has not recovered from its 2008 low. Aur khareedne walay is level se wapas aa sakte. However, humein savdhani se or safalta ke liye avashyak sabhi maangon ke saath vyapar karna hoga. In this case, apne vyaparik drishtikon ko atyant jatil rahne se bachane aur mooltatvon par dhyan kendrit karne ki koshish karein. Apne asafalta ke vyaparon ko tafseel se jaanch karke, unse seekh kar, aur apne overall performance ko sudharne ke liye apne vyavhar ko sudharne mein apne vyaparik kushalta ko sudharne mein madad karen. Adhik vyapar na karein; apne sthapit vyaparik yojana ka palan karein to santulit rah sake. Vyaparik session ke dauran distractions ko door rakhein,

apne lakshyon par laser-focused rahe. Apne yojana ka palan karne aur mahatva purna kadam ko chhodne se bachne ke liye ek vyaparik checklist ka istemal karen. Apne bhavnaon aur vyaparon par chintan aur abhivyakti ko dastavez mein darj karen, vyavharik patterns ko pinpoint karte hue. Short-term, ghante bhar ke vyapar ke liye, ham aage ek kharidne ki order ke saath 2012 ke liye khol sakte hain. Haalaanki, bechne ka dabav aaj bana.

Sonay ko dynamics ka doosra nakara hai, mujhe ikhtiyar hai ke iski correction growth ka pesheng hai.

Humain ikhtiyar hai ke aakhri dour, ki ek kamiyabi se mukamal hui kamzori ka halat hai, jo abhi haqeeqat mein aagaya. Magar, taqat 2001 ke support level ke upar banaa thame rahne mein nakaam hone ke baad, tezi se girawat mein girawat ayi jo 2041 mein ulat gayi. Keemat ne hamein ek bearish ishara diya hai ek hammer candle ka saath. Lekin gold ki entry ke baare mein bhram. Hammer candle ke saath band hone ke baad; keemat ne ek bullish engulfed pattern diya. Isliye, main keemat par neutral hoon. Bull targets the years 2032 and 2038. The bearish target for 1990 is ab qaim. Neeche diye gaya chart mein dekhein:

Gold price ko agar ham h1 time frame pay analyzed kartay hain to h1 chart pay price 17.00 pivot point line say aik big bearish candle k sath upward breakout k sath closed hue hai. If you pay a chart and have a custom indicator reading, the osma indicator levels will show a buy signal. If current price sell movements begin, then chart pay price up movements have a strong chance of occurring, with a target of 2001.00 and a support zone of 1995.00.

agar current price 1 hour chart pay bounced hoty hai, aur sath central point line k buy main breakout karty hai, to chart pay price ki downward movements k chances ban saktay hain, jiska target neechay 2023.00 aur phir usk bad price mazeed 2029.00 levels ko test kar sakty hai. Mairay analysis k hisab say price ka current temporary trend again buy ka start ho chuka hai, aur sath price central point line k bhi bullish main breakout kar chuki hai, is liye chances yahi hain k price strongly tour par support levels ko test kar sakti hai.

-

#513 CollapseInstaSpot: کسی بھی EPS اور بینک سے منافع واپس لیں، اور EPS اور cryptocurrencies کے تبادلے پر 7% تک کمائیں۔

Gold Price Technical Analysis:

4-hour Time Period:

Gold price ko agar ham h4 time frame pay analyzed kartay hain to h4 chart pay price 2005.00 pivot point line say aik big bullish candle k sath upward breakout k sath closed hue hai. agar chart pay ham custom indicator ki reading ko daikhtay hain to osma indicator levels k center main buy ka signal show kar raha hai. agar current price sell ki movements ko start karty hai to chart pay price ki up movements k chances strong ban saktay hain jiska target ooper 2090.00 aur phir usk bad price mazeed 20135.00 resistance zones ko test kar sakty hai.

agar current price 4-hour chart pay reversed hoty hai, aur sath central point line k sell main breakout karty hai to chart pay price ki dwnward movements k chances ban saktay hain, jiska target neechay 1970.00 aur phir usk bad price mazeed 1930.00 levels ko test kar sakty hai. Mairay analysis k hisab say price ka current temporary trend again buy ka start ho chuka hai, aur sath price central point line k bhi bullish main breakout kar chuki hai, is liye chances yahi hain k price strongly tour par resistance levels ko test kar sakty hai.

Daily chart outlook:

Gold price ko agar ham daily time frame pay analyzed kartay hain to h4 chart pay price 2005.00 pivot point line say aik big bullish candle k sath upward breakout k sath closed hue hai. agar chart pay ham custom indicator ki reading ko daikhtay hain to osma indicator levels k center main buy ka signal show kar raha hai. agar current price sell ki movements ko start karty hai to chart pay price ki up movements k chances strong ban saktay hain jiska target ooper 2090.00 aur phir usk bad price mazeed 20135.00 resistance zones ko test kar sakty hai.

agar current price daily chart pay reversed hoty hai, aur sath central point line k sell main breakout karty hai to chart pay price ki dwnward movements k chances ban saktay hain, jiska target neechay 1970.00 aur phir usk bad price mazeed 1930.00 levels ko test kar sakty hai. Mairay analysis k hisab say price ka current temporary trend again buy ka start ho chuka hai, aur sath price central point line k bhi bullish main breakout kar chuki hai, is liye chances yahi hain k price strongly tour par resistance levels ko test kar sakty hai.

-

#514 Collapse

XAUUSD TRENDING VIEW

H1 TIME FRAME

Gold price ko agar ham h4 time frame pay analyzed kartay hain to h4 chart pay price 2005.00 pivot point line say aik big bullish candle k sath upward breakout k sath closed hue hain. If you pay a chart and have a custom indicator reading, the osma indicator levels will show a buy signal. If current price sell movements begin, chart pay price up movements have a strong chance of occurring, with a target of ooper 2090.00 and a bad price of mazeed 20135.00 as resistance zones to be tested.

If current price 4-hour chart pay reversed hoty hai, and sath central point line k sell main breakout karty hai, then chart pay price ki downward movements ko chances ban saktay hain, jiska target neechay 1970.00, phir usk bad price mazeed 1930.00 levels ko test kar sakty hai. Mairay analysis k hisab say price ka current temporary trend again buy ka start ho chuka hai, aur sath price central point line k bhi bullish main breakout kar chuki hai, is liye chances yahi hain k price strongly tour par resistance levels ko test kar sakti hai.

Daily Chart Outlook:

Gold price ko agar ham daily time frame pay analyzed kartay hain to h4 chart pay price 2005.00 pivot point line say aik big bullish candle k sath upward breakout k sath close hue hain. If you pay a chart and have a custom indicator reading, the osma indicator levels will show a buy signal. If current price sell movements begin, chart pay price up movements have a strong chance of occurring, with a target of ooper 2090.00 and a bad price of mazeed 20135.00 as resistance zones to be tested.

If current price daily chart pay reversed hoty hai, and sath central point line k sell main breakout karty hai, then chart pay price ki downward movements ko chances ban saktay hain, jiska target neechay 1970.00 aur usk bad price mazeed 1930.00 levels ko test kar sakty hai. Mairay analysis k hisab say price ka current temporary trend again buy ka start ho chuka hai, aur sath price central point line k bhi bullish main breakout kar chuki hai, is liye chances yahi hain k price strongly tour par resistance levels ko test kar sakti hai.

According to the latest US Retail Sales data, the XAU/USD exchange rate remains stable. In my country, the market has not recovered from its 2008 low. Aur khareedne walay is level se wapas aa sakte. However, humein savdhani se or safalta ke liye avashyak sabhi maangon ke saath vyapar karna hoga. In this case, apne vyaparik drishtikon ko atyant jatil rahne se bachane aur mooltatvon par dhyan kendrit karne ki koshish karein. Apne asafalta ke vyaparon ko tafseel se jaanch karke, unse seekh kar, aur apne overall performance ko sudharne ke liye apne vyavhar ko sudharne mein apne vyaparik kushalta ko sudharne mein madad karen. Adhik vyapar na karein; apne sthapit vyaparik yojana ka palan karein to santulit rah sake. Vyaparik session ke dauran distractions ko door rakhein, apne lakshyon par laser-focused rahe. Apne yojana ka palan karne aur mahatva purna kadam ko chhodne se bachne ke liye ek vyaparik checklist ka istemal karen. Apne bhavnaon aur vyaparon par chintan aur abhivyakti ko dastavez mein darj karen, vyavharik patterns ko pinpoint karte hue. Short-term, ghante bhar ke vyapar ke liye, ham aage ek kharidne ki order ke saath 2012 ke liye khol sakte hain. Haalaanki, bechne ka dabav aaj bana.

H1 TIME FRAME

In 1857, the gold market received support from the government, but demand was low. Is support ki madad se Hamen Pata Chalta Hai Ki market Yahin se uth rahi hai aur Upar movement kar rahi hai aur Chhote time frame mein agar gold ki market per analysis kiya jaaye, then gold ki market Kafi Achcha trend Banakar Upar ja rahi hai. According to Kafi's analysis, the gold market has a target of 1861. Agar bade kharidar aate hain gold ki market 1870 le jaenge. Ab Ham time frame ki taraf Najar dalte hain. 1886 per Ek acchi Si resistance ban rahi hai, jo seller ke liye Kafi profitable opportunity hain.

4 ghante wale time frame mein horizontal line ko dekhte Hue market 1850 se Upar movement kar rahi hai. Aur 4 ghante wale time frame mein ek strong sa hammer banaa hua hai, yah baat bata raha hai ki gold market 1886 per ja sakti hai. Aur Yahi iska First Target TP Rakha Jaega Agar Ham Trade Karen to. Chhote time frame par gold market analysis Kafi Mushkil Hai. Kyunki iski movement kafi acche tarike se aur speed se hoti Hai, or traders mein acche tarike se enter hote hain. If a trader is interconnected, the market's momentum will be strong. If the h4 time frame is used, the market's momentum will be strong. For example, if gold's qeemat is 1850, it can be traded. mojooda sorat e haal se pata chalta hai ke qeemat main kami jari rahay gi aur mare khayaal mein yeh 1830 ki satah ki taraf girray gi doosri tarf dono takneeki isharay manfi nazar aa rahy hain

jo ke mojooda mandi ki raftaar ko bhi farogh dete hain h1 time frame tajzia ke mutabiq hum dekh sakty hain ke gold ki qeemat 1850 ke support level ko chne ke baad bherne ki koshish kar raha hai jaisa ke qeemat support level ko tornay main nakaam rahi hai is se zahir hota hai ke qeemat kam az kam 50 sma ki taraf barhay gi jo ke 1860 per waqay hai takneeki nuqta nazar se rishta daar taaqat index rsi isharay abhi bhi manfi sthon se oopar ke ird gird trade kar raha hai jis se pata chalta hai ke mukhtasir muddat main qeemat barth sakte hai is liye aap ne aaj mukhtasir safar ka intikhaab kya gold metal ki price kafi up jany k bad downtrend main waps a gai hai, or 1852 se neechay ki istehkaam ki satah ko torna kharidaron ke liye apni taizi ki bunyaad ko dobarah haasil karne ke liye ghalib range ho ga, aur tasdeeqi signal 1920 ke qareeb qareeb mudti muzahmati satah print kar sakta hai

. yeh dekha ja sakta hai ke yeh mah ki be rozgari ki sharah mein tabdeeli ke adaad o shumaar Amrici dollar ke index ki qeemat ko mazeed mazboot karen ge, aur passion goi 103. 60 ki 50% fibonacci retracement ki satah ko dobarah shuru kar sakti hai. Baichnay walay is dabao ke tehat dabao mein hain, aur mazeed nuqsanaat 1828 ki 200 din kisaada moving average ko challenge kar satke hain. Bollinger bands and oscillator clouds can be used to analyze daily time frames since 1890. Moving averages can also be used to identify patterns. Daily pivot point berier: 1850. Similarly, rally 1934 mein 200 haftay ki moving average par agli rukawat ko poora karne se pehlay oopar ki taraf murr sakti hai.

H4 time frame ke mutabiq, hum dekh sakte hain ke gold ki qeemat apne nuqsaan ko kam karne ki koshish kar rahi hai, whereas phir bhi qeemat 1850 ki satah se neechay trade kar rahi. Guzashta roz gold ki qeemat 1870 ki satah se neechay band honay ke bad mandi ke jhanday ke sath band hui. ab agar hum gold ki qeemat ki mojooda harkat ko dekhen to hum dekh sakte hain ke 1855 ki satah ko chone ke baad, jo ke kharidaron ke liye aik support level hai, qeemat fi al haal 200 sma ki taraf bherne ke liye jad-o-jehad kar rahi hai, jo ke sonay ki satah par waqay hai. 1882. doosri taraf, agar sonay ki qeemat girty hai aur 1855 ki satah ko torti hai, to yeh 1830 ki satah ki taraf mazeed gravt jari rakhay. Takneeki nuqta nazar se, 14 roza rishta daar taaqat ka asharih (RSI) middle line se neechay teer raha hai; jo tajweez karta hai ke qeemat mein mazeed kami jari rahay gi. Majmoi tor par, 1830 ki hamari hadaf ki satah ki taraf musalsal paish qadmi ke sath, mandi ka taasub barqarar ho.

-

#515 Collapse

ANYLSIS OF GOLD H1 TIME FRAME:

H1 Chart Pattern:

Gold fee ko agar ham each day time frame pay analyzed kartay hain to h4 chart pay price 2005.00 pivot point line say aik big bullish candle k sath upward breakout k sath closed hue hai. Agar chart pay ham custom indicator ki studying ko daikhtay hain to osma indicator degrees k middle important purchase ka signal display kar raha hai. Agar modern fee promote ki movements ko begin karty hai to chart pay charge ki up moves k chances robust ban saktay hain jiska goal ooper 2090.00 aur phir usk terrible price mazeed 20135.00 resistance zones ko test kar sakty hai.Gold key agar modern-day charge every day chart pay reversed hoty hai, aur sath vital factor line okay sell fundamental breakout karty hai to chart pay price ki dwnward moves ok possibilities ban saktay hain, jiska goal neechay 1970.00 aur phir usk awful fee mazeed 1930.00 ranges ko check kar sakty hai. Mairay analysis okay hisab say price ka modern-day brief trend once more buy ka begin ho chuka hai, aur sath charge valuable point line ok bhi bullish important breakout kar chuki hai, is liye probabilities yahi hain ok rate strongly excursion par resistance levels ko take a look at kar sakty hai.

ANYLSIS OF GOLD H4 TIME FRAME:

H4 Chart Pattern:

Gold Anylsis Say presently charge daily chart pay reversed hoty hai, aur sath crucial point line ok sell important Breakouts karty hai to Chart pay fee ki dwnward actions ok threat's ban saktay hain, jiska goal neechay 1970.00 aur phir usk baad fee mazeed 1930.00 ranges ko testing kar sakty hai. Mairay evaluation okay hisab say price ka cutting-edge temporary fashion once more buy ka begin ho chuka hai, aur Sath price central factor line ok bhi Bullish most important Breakouts kar chuki hai, is liye probabilities yahi hain okay fee strongly tour par resistance ranges ko test kar sakty hai Tu Hi Stop loss say Gold pe buying and selling ho Jay gy.Dear Yeah H4 time body ke mutabiq, hum dekh sakte hain ke gold ki qeemat apne nuqsaan ko kam karne ki koshish kar rahi hai, whereas phir bhi qeemat 1850 ki satah se neechay trade kar rahi. Guzashta roz gold ki qeemat 1870 ki satah se neechay band honay ke terrible mandi ke jhanday ke sath band hui. Ab agar hum gold ki qeemat ki mojooda harkat ko dekhen to hum dekh sakte hain ke 1855 ki satah ko chone ke baad, jo ke kharidaron ke liye aik aid level hai, qeemat fi al haal 200 sma ki taraf bherne ke liye jad-o-jehad kar rahi hai, jo ke sonay ki satah par waqay hai. 1882. Doosri taraf, agar sonay ki qeemat girty hai aur 1855 ki satah ko torti hai, to yeh 1830 ki satah ki taraf mazeed gravt jari rakhay. Takneeki nuqta nazar se, 14 roza rishta daar taaqat ka asharih (RSI) center line se neechay teer raha hai; jo tajweez karta hai ke qeemat mein mazeed kami jari rahay gi. Majmoi tor par, 1830 ki hamari hadaf ki satah ki taraf musalsal paish qadmi ke sath, mandi ka taasub barqarar ho.

- Mentions 0

-

سا3 likes

-

#516 CollapseInstaSpot: کسی بھی EPS اور بینک سے منافع واپس لیں، اور EPS اور cryptocurrencies کے تبادلے پر 7% تک کمائیں۔

Gold (XAU/USD) ka Technical Analysis

H-1 Timeframe Analysis

Gold pichle trading haftay mein limbo mein raha, 2009 ke levels tak hat gaya, phir ek halki uptrend mein wapas aaya. Isi doran, keemat ka chart idhar-udhar supertrend areas mein ghoom raha hai, jo ke barqarar high uncertainty ko darust karta hai. 1-H chart ki technical jhalak se dekhte hain ke keemat ab aham 2016 ke levels ke aas-paas ghoom rahi hai, yani 38.20% Fibonacci retracement level. Hamein simple moving average par dabav kam hote hue nazar aata hai. Keemat mehsoos ho rahi hai ke upar se rukavat ka izhar ho raha hai.

Hum biased lower hain lekin ehtiyaat ke sath, kyun ke intraday trading abhi bhi 2030 resistance aur amm tor par 2037 levels ke neeche hai. Is level ke upar jaane se downtrend ki taqat aur raftaar barh jayegi. Is tarah, raasta seedha 1995 aur 1980 holding stations ki taraf le jayega. Upar ka trend ishtiaq karta hai ke humein foran 2016 mein price stabilization dekhnay ko mile. Humain yeh bhi dekhne ki zarurat hai ke 2037 mein wazeh aur taqatwar resistance break ho. Isse temporary rebound ke chances 2044 aur 2050 ke liye earning growth mein izafay ko barha sakte hain.

H-4 Timeframe Analysis

Prices abhi halat mein be nuetral hain aur har haftay barqarar rehti hain. Resistance ka central zone ab tak test nahi hua aur iski mazbooti qaim hai. Yeh ishtiaq karta hai ke pasandida downward vector ki maazulgi ka izhar karta hai. Keemat ne 2009 ke levels ko torne mein kamyabi nahi hasil ki, jahan isay significant support mila nazar aaya. Yeh ise wapas ooncha kar raha hai aur 2050 levels (jahan central resistance zone ki hudood hain) ki taraf lautne ki mumkinat ko kholti hai. Is area ka dobara test aur uske baad ka bounce ek aur neeche ki taraf harkat karne mein madadgar hoga, jise 1981 aur 1952 areas ko target karne ka maqam milega.

Current scenario ko mansookh karne ka signal resistance aur 2070 reversal level ke upar breakout hoga. Niche diye gaye chart mein dekhein:

-

#517 Collapse

Technical analysis of Gold price:

1-hour chart outlook:

Gold price ko agar ham h1 time frame pay analyzed kartay hain to h1 chart pay price 2011.00 pivot point line say aik big bullish candle k sath upward breakout k sath closed hue hai. agar chart pay ham custom indicator ki reading ko daikhtay hain to osma indicator levels k center main buy ka signal show kar raha hai. agar current price sell ki movements ko start karty hai to chart pay price ki up movements k chances strong ban saktay hain jiska target ooper 2029.00 aur phir usk bad price mazeed 2037.00 resistance zones ko test kar sakty hai.

agar current price 1-hour chart pay reversed hoty hai, aur sath central point line k sell main breakout karty hai to chart pay price ki dwnward movements k chances ban saktay hain, jiska target neechay 2004.00 aur phir usk bad price mazeed 1998.00 levels ko test kar sakty hai. Mairay analysis k hisab say price ka current temporary trend again buy ka start ho chuka hai, aur sath price central point line k bhi bullish main breakout kar chuki hai, is liye chances yahi hain k price strongly tour par resistance levels ko test kar sakty hai.

4-hour chart outlook:

Gold price ko agar ham h4 time frame pay analyzed kartay hain to h4 chart pay price 2011.00 pivot point line say aik big bullish candle k sath upward breakout k sath closed hue hai. agar chart pay ham custom indicator ki reading ko daikhtay hain to osma indicator levels k center main buy ka signal show kar raha hai. agar current price sell ki movements ko start karty hai to chart pay price ki up movements k chances strong ban saktay hain jiska target ooper 2029.00 aur phir usk bad price mazeed 2037.00 resistance zones ko test kar sakty hai.

agar current price 4-hour chart pay reversed hoty hai, aur sath central point line k sell main breakout karty hai to chart pay price ki dwnward movements k chances ban saktay hain, jiska target neechay 2004.00 aur phir usk bad price mazeed 1998.00 levels ko test kar sakty hai. Mairay analysis k hisab say price ka current temporary trend again buy ka start ho chuka hai, aur sath price central point line k bhi bullish main breakout kar chuki hai, is liye chances yahi hain k price strongly tour par resistance levels ko test kar sakty hai.

-

#518 Collapse

Ek izafa hota hua neeche ki taraf tezi ka andaza gold ke liye kiya ja sakta hai, halankeh hafte ke shuru mein koshish ki gayi thi ke trend line ke upar qaim raha jaye. Ahem hai medium lamba muddat ka trend line jo ke qeemat ne pehle to tor diya, lekin phir wapas loutne ki koshish ki. Jumeraat aur peer ke candles ke band badan is line ke ooper thay, jo ke tezi ke saath upar ki taraf chalne ki mumkinat ko darust kartay hain. Magar kal qeemat tezi se gir gayi aur aaj to mazeed neeche chali gayi, bahar se ooper chalte hue trend line ke bhi neeche chali gayi. Trend line ne apne aapko pichle haftay bhi dikhaya tha, qeemat ko ooper kheenchte hue.

Maujooda surat hal mein, sab tawajjo ko is trend line ki taraf aur khaaskar jumeraat ke band ko diya jana chahiye. Ye line darmiyanay muddat mein bullish trend ko barqarar rakhne ke liye ahem hai. Uper ki mukhalif mudde ki guftagu karne ke liye, zaroori hai ke kal ke doran jumeraat, buland volatility ke manzar par, aisa ek candle banta hai jo ooper mudaahil hota hai aur trend line ke ooper band hota hai. Agar aisay daily candle ka band hota hai, to ye yehi matlab hoga ke hum 2040, 2062 aur shayad 2072 ke lehron tak chal sakte hain, sath hi channel ke neeche ke sira se bhi ooper uth sakte hain

Agar jumeraat ko candle ek girawat ka jaari rehne ka ishara deta hai aur channel ke neeche ke sira se band hota hai, to ye ek phatke aur naye downtrend ka banne ka matlab ho sakta hai, raste ko kholte hue 1990, ya shayad 1945 ke darjo tak. Is tarah, 2062 ke darja bhi bohot mazboot hai aur lambay arse tak barabar nahi kar sakte. Magar qeemat ne ise ooper rehne ki koshish ki thi, lekin ab tak gir gayi hai

- 2022.7200 GOLD

- Mentions 0

-

سا0 like

-

#519 CollapseInstaSpot: کسی بھی EPS اور بینک سے منافع واپس لیں، اور EPS اور cryptocurrencies کے تبادلے پر 7% تک کمائیں۔

Technical Analysis of Gold Prices:

1-Hour Chart Outlook:

Gold price ko agar ham h1 time frame pay analyzed kartay hain to h1 chart pay price 2011.00 pivot point line say aik huge bullish candle k sath upward breakout k sath closed hue hain. If you pay a chart and have a custom indicator reading, the osma indicator levels will provide a buy signal. If current price sell movements begin, then chart pay price up movements have a significant possibility of occurring, with a goal of 2029.00 and a resistance zone of 2037.00 to be tested.

If current price 1-hour chart pay reversed hoty hai, and sath central point line k sell main breakout karty hai, then chart pay price ki downward movements ko possibilities ban saktay hain, jiska target neechay 2004.00 aur usk bad price mazeed 1998.00 levels ko test kar sakty hai. Mairay analysis k hisab say price ka current temporary trend again buy ka start ho chuka hai, aur sath price central point line k bhi bullish main breakout kar chuki hai, is liye possibilities yahi hain k price strongly tour par resistance levels ko test kar sakti hai.

4-Hour Chart Outlook:

Gold price ko agar ham h4 time frame pay analyzed kartay hain to h4 chart pay price 2011.00 pivot point line say aik huge bullish candle k sath upward breakout k sath closed hue hain. If you pay a chart and have a custom indicator reading, the osma indicator levels will provide a buy signal.

If current price sell movements begin, then chart pay price up movements have a significant possibility of occurring, with a goal of 2029.00 and a resistance zone of 2037.00 to be tested.

If current price 4-hour chart pay reversed hoty hai, and sath central point line k sell main breakout karty hai, then chart pay price ki downward movements ko possibilities ban saktay hain, jiska target neechay 2004.00, phir usk bad price mazeed 1998.00 levels ko test kar sakty hai. Mairay analysis k hisab say price ka current transitory tendency again buy ka start ho chuka hai, aur sath price central point line k bhi bullish main breakthrough kar chuki hai, is liye possibilities yahi hain k price strongly tour par resistance levels ko test kar sakti hai.

Ek izafa the hota model hua neeche ki taraf tezi the value of ka andaza precious metals ke liye kiya ja sakta hai; halankeh hafte ke shuru mein koshish ki gayi gi ke trend line ke upar qaim raha jaye. Ahem hai, intermediate lamba muddat ka trend line jo ke qeemat ne pehle to the sake of diya with her lekin phir wapas loutne ki koshish. Jumeraat aur peer ke candlesticks ke band badan is compliance ke ooper thay, jo associated tezi ke saath upar ki taraf chalne ki mumkinat ko darust kartay.

Magar kal qeemat tezi se gir gayi aur aaj to mazeed neeche chali gayi; bahar se ooper chalte red trend line ke bhi neeche chali gayi. Trend complying among apko pichle haftay bhi dikhaya tha, qeemat ko ooper kheenchte hue.

Maujooda Surat Hal Mein, sab tawajjo ko is trend line ki taraf aur khaaskar jumeraat ke band ko diya, also known jana chahiye. Ye line darmiyanay muddat mein bullish trend ka barqarar rakhne ke liye ahem hai.

Uper ki mukhalif mudde ki guftagu karne ke liye, zaroori thank you ke kal ke doran jumeraat, buland volatility ke manzar par, aisa ek candle banta hai jo ooper mudahil hota hai aur trend line ke ooper band hota hai. Agar aisay daily candle ka band hota hai, to ye yehi matlab hoga ke hum 2040, 2062, or shayad 2072 someone lehron tak chal sakte hain, sath hi channel ke neeche ke the organization se bhi ooper uth sakte hain

-

#520 Collapse

Gold ke dam ki takhliqi

Sab ko acha din. Peer someone early Asian trade mein, gold ke daamon ne $2018.00 ki chhati chu li thi, lekin phir daamon ne ikhtataam baraatay mein aakar neechay aa gaye aur $2,000 ke psychological level ke oopar as a whole aaraam se guzre. Yeh ahtiyaati rawayaat numaya hain, jab ke market America aur Eurozone se aane waale ahem mahangai ke data ka intezaar karraha hai, jo aane waale haftay ki taqat ko tasleem karega. Tanzeemi tor par, rozana ki chart gold ke daamon ke liye mazeed barhne ki surat e haal darust karta hai. Chaar ghantay the ki chart par, jora $1974.31 ke neechay making trades kar raha hai, jis se maloom hota hai ka $1991.63 se taqseem hone wale giravat ke baad khareedaar ki zyadaat mojudgi hai. Yeh ishara karta hai, ke price mein izafa ho sakta hai, jise resistance level $2005.18 tak pohanch hai.

Thora sa correction ke baad, resistance level tak pohancha. Lekin yahan bechnay walon ne volume barha liya, jo the ek mozuat mein giravat ki nishaani hai. Is muqami jhatke ke bawajood, umda rukh kai munafis hai, jisme constant saiyasi tanazaat aur $2,000 ke psychological level ka ehmiyat shamil hai. $2005.18 ke resistance level toorna ke saath, mazeed izafa ki tawakul hai, jo ke $2032.06 tak pohanch sakta. Yeh izafa ko 14 dinon ke relative strength index (RSI) ne bhi tawazun diya, also known hai, jo ke apne darmiyan themselves upar ki taraf ja the raha foundation hai aur qareeb qareeb overbought zone mein ja raha ha.Gehraai aur rukh badalne ki taraf ishaara karte hue, gold ke daamon ne Black Friday ke din $2,000 ke oopar band karliya tha. Abhi muqami resistance $2020.00 ka qareeb hai. Is level ko toorna, $2050.00 ke static resistance ko darwaze khol sakte hai. Neeche, seedha sahara $2000.00 mein milta. Is level ko toorna, taez giravat hoke $1978.00 ki 50-day moving average tak pohanch sakta hai. Agla sahara zone is priced between $1955.00 and $1950.00.

If you choose the Sardabadi zone, you will receive $1944.00 on November 14. Faisla yeh hai ke gold ke daamon mazeed izafa ke liye tayar hain nazdeeki his mentor doran maintaining, jise tanzeemi roshni maintaining, istemari saiyasi tanazaat mein aur $2,000 ke psykolojikal level ki ahmiyat mein giraysh dikhata hai. Lekin, investors ko ehtiyaat bartaraf rehna chahiye, aane waale ahem mahangai ke data ko nazar andaz nahi karna chahiye, jo market ke rukh ko mutasir karsakta hai.

H4 Timeframe Overview:

Dear Friend Hi trader, H4 Charts pay Gold price 2003.00 Pivot point regions k purchase mein breakout k sath upward movements kar rahi hai. Chart pay agar ham Custom Indicators ki reading kartay je to Stochastics Indicators 80 levels kooper crossed over k sath confirm purchase ka signal display kar raha hai. OSMA Indicators ab bhi chart pay usually signal display kar rahe hai. Agar present position Hourly chart pay buy movements ko continue rakhty tha to chart pay price ka target ooper 2018.00 aur phir usk bad price mazeed 2025.00 resistance say hello trade len gy

Dear Jab Bh. Agar current cost over four-hour frames of time payment reversing hoty hai, aur sath centrals demonstrate line k sell main breakouts karty hai to chart pay price ka target neechasy 1995.00 aur usk bad price mazid 1990 support zones ko test kar sakty hai. Mairay Analysis k hisab say price ka major and present trend up ka hai, sath price Moving averages aur central point levels k price ooper running kar rahi hai, jiskay chances hain tu iss week hi trad ho jay.

-

#521 Collapse

Gold ke dam ki takhliqi

Sab ko acha din. Peer someone early Asian trade mein, gold ke daamon ne $2018.00 ki chhati chu li thi, lekin phir daamon ne ikhtataam baraatay mein aakar neechay aa gaye aur $2,000 ke psychological level ke oopar as a whole aaraam se guzre. Yeh ahtiyaati rawayaat numaya hain, jab ke market America aur Eurozone se aane waale ahem mahangai ke data ka intezaar karraha hai, jo aane waale haftay ki taqat ko tasleem karega. Tanzeemi tor par, rozana ki chart gold ke daamon ke liye mazeed barhne ki surat e haal darust karta hai. Chaar ghantay the ki chart par, jora $1974.31 ke neechay making trades kar raha hai, jis se maloom hota hai ka $1991.63 se taqseem hone wale giravat ke baad khareedaar ki zyadaat mojudgi hai. Yeh ishara karta hai, ke price mein izafa ho sakta hai, jise resistance level $2005.18 tak pohanch hai.

Thora sa correction ke baad, resistance level tak pohancha. Lekin yahan bechnay walon ne volume barha liya, jo the ek mozuat mein giravat ki nishaani hai. Is muqami jhatke ke bawajood, umda rukh kai munafis hai, jisme constant saiyasi tanazaat aur $2,000 ke psychological level ka ehmiyat shamil hai. $2005.18 ke resistance level toorna ke saath, mazeed izafa ki tawakul hai, jo ke $2032.06 tak pohanch sakta. Yeh izafa ko 14 dinon ke relative strength index (RSI) ne bhi tawazun diya, also known hai, jo ke apne darmiyan themselves upar ki taraf ja the raha foundation hai aur qareeb qareeb overbought zone mein ja raha ha.Gehraai aur rukh badalne ki taraf ishaara karte hue, gold ke daamon ne Black Friday ke din $2,000 ke oopar band karliya tha. Abhi muqami resistance $2020.00 ka qareeb hai. Is level ko toorna, $2050.00 ke static resistance ko darwaze khol sakte hai. Neeche, seedha sahara $2000.00 mein milta. Is level ko toorna, taez giravat hoke $1978.00 ki 50-day moving average tak pohanch sakta hai. Agla sahara zone is priced between $1955.00 and $1950.00.

If you choose the Sardabadi zone, you will receive $1944.00 on November 14. Faisla yeh hai ke gold ke daamon mazeed izafa ke liye tayar hain nazdeeki his mentor doran maintaining, jise tanzeemi roshni maintaining, istemari saiyasi tanazaat mein aur $2,000 ke psykolojikal level ki ahmiyat mein giraysh dikhata hai. Lekin, investors ko ehtiyaat bartaraf rehna chahiye, aane waale ahem mahangai ke data ko nazar andaz nahi karna chahiye, jo market ke rukh ko mutasir karsakta hai.

H4 Timeframe Overview:

Dear Friend Hi trader, H4 Charts pay Gold price 2003.00 Pivot point regions k purchase mein breakout k sath upward movements kar rahi hai. Chart pay agar ham Custom Indicators ki reading kartay je to Stochastics Indicators 80 levels kooper crossed over k sath confirm purchase ka signal display kar raha hai. OSMA Indicators ab bhi chart pay usually signal display kar rahe hai. Agar present position Hourly chart pay buy movements ko continue rakhty tha to chart pay price ka target ooper 2018.00 aur phir usk bad price mazeed 2025.00 resistance say hello trade len gy

Dear Jab Bh. Agar current cost over four-hour frames of time payment reversing hoty hai, aur sath centrals demonstrate line k sell main breakouts karty hai to chart pay price ka target neechasy 1995.00 aur usk bad price mazid 1990 support zones ko test kar sakty hai. Mairay Analysis k hisab say price ka major and present trend up ka hai, sath price Moving averages aur central point levels k price ooper running kar rahi hai, jiskay chances hain tu iss week hi trad ho jay. -

#522 CollapseInstaSpot: کسی بھی EPS اور بینک سے منافع واپس لیں، اور EPS اور cryptocurrencies کے تبادلے پر 7% تک کمائیں۔

Gold price technical analysis:

Gold price ko ham h1 time frame pay studied kartay hain to last Friday market closed honay say current price current week say 1993.00 Pivot point regions k purchase mein aik huge bullish candle k sath breakout k baad upward movements kar rahi hai. Chart pay agar ham Customized Indicators ki reading kartay hain, MACD Indicator upwards levels k sath confirm up ka signal display kar raha hai. If this moment's position Hourly diagram pay buy movements continue, then chart pay price ka target neeche 1978 aur usk bad price mazeed 1971 support levels ko test kar sakty hai.

Agar present position H1 Time Frame pay bounced hoty hai, aur sath central point line ko buy main breakout karty hai to chart pay price ka goal ooper 2000.00 aur usk bad price mazeed 2007.00 resistance zones ko test kar sakty hai. Mairay Analysis k hisab say price ka major aur current trend ab sideways main change honay ko hai, sath price moving averages aur central point levels k price ooper running kar rahi hai, jiskay possibilities hain k pricing sell ki movement start karnay the k parameter baad support levels ko test kar sakty hai. Maujudah tejarati hafte ka aaghaz kuch adam tawajun ke sath hua hai kiyunkeh American dollar index me kami jari hue aur sona ahistah-ahistah greenback ke muqable me niche aa gaye hai.

Aaj ke economic calendar par koi badi khabrein nahin hain; jise intraday sargarmi mahdud hone ka imkan hai. Chart par, sone ki quotes peeli moving average se niche aa gayin, jabkeh indicators bears ke wazeh ghalbe ki tajwiz karte hai. Yah, 1,970 ki satah ke qarib trading range ki nichli hadd, nay 1,962 par support ki test karne ke liye niche ki taraf movement jari rakhne ke imkanat ki nishandahi karta hai.

Iske alawa, agar sona aaj ke session me 1,970 ki buniyadi satah se niche band hota hai, hamein consolidated chart se tasdiq milegi, jo mazid the university of rochester zyada numaya kami ke imkan ki tajwiz.

H4 Chart Outlook:

Gold price ko ham h4 time frame pay studied kartay hain to last Friday market closed honay say current price current week say 1993.00 Pivot point regions k purchase mein aik huge bullish candle k sath breakout k baad upward movements kar rahi hai. Chart pay agar ham Custom Indicators ki reading kartay hain, MACD Indicator up levels k sath confirmation up ka signal display kar raha hai.

If the current position Hourly chart pay buy movements continue, then chart pay price ka target neeche 1978 aur usk bad price mazeed 1971 support levels ko test kar sakty hai.

Agar present position H4 Time Frame pay bounced hoty hai, aur sath central point line ko buy main breakout karty hai to chart pay price ka goal ooper 2000.00 aur usk bad price mazeed 2007.00 resistance zones ko test kar sakty hai. Mairay Analysis k hisab say price ka major aur current trend ab sideways main change honay ko hai, sath price moving averages aur central point levels k price ooper running kar rahi hai, jiskay possibilities hain k price sell ki movements start karnay k baad support levels ko test kar sakty hai.Pichle dino independently sona sideways me karobar kar raha. Yaumiyah chart ke mutabiq, 1970 ki support satah se wapsi ke bad quotations ne ghair yaqini ki candlestick tashkil di hai.

The US Federal Reserve has begun to raise refinancing rates, which will have an impact on the dollar's market. Iske natije me qimti dhat ki mang me izafa hota hai; jo darmiyani muddat me iski mazid harkiyat ko zahir karta hai.

Aaj ke macroeconomic calendar me American labor market ke adad o shumar ka ek batch shamil hai. Traders that manufacture payrolls and berozgari ki sherah use mutalliq data to brand their products. Halankeh, mai unke kam takhmiyon se thoda sa uljha hua hai. Peshangoiyan jan bujh kar kami ja sakti hai. Is tarah, agar reading pichle se badtar hai lekin tawaqqo se behtar hai, then dollar me badhat shuru ho jayega. Takniki nuqtah the films nazar individually, char-ghante ke chart par market ki suratehal ghairyaqini hai.

Quotes zard moving average ke sath sakht range me karobar karna jarirakhti hai. Lehaza soba 2,009 ki maujudah muqami bulandi tak badh sakta hai, ya nuqsanat dobara shuru kar sakta hai, 1,970 ke nishan ko tod kar 1,962 ki taraf badh sakta hai.

-

#523 Collapse

Technical analysis of Gold price:

Gold price ko agar ham h1 time frame pay analyzed kartay hain to h1 chart pay price 2027.00 pivot point line say aik big bearish candle k sath dwnward breakout k sath closed hue hai. agar chart pay ham custom indicator ki reading ko daikhtay hain to osma indicator levels k center main buy ka signal show kar raha hai. agar current price sell ki movements ko start karty hai to chart pay price ki sell movements k chances strong ban saktay hain jiska target ooper 2011.00 aur phir usk bad price mazeed 2004.00 support zones ko test kar sakty hai.

agar current price 1-hour chart pay bounced hoty hai, aur sath central point line k buy main breakout karty hai to chart pay price ki upward movements k chances ban saktay hain, jiska target ooper2037.00 aur phir usk bad price mazeed 2045.00 levels ko test kar sakty hai. Mairay analysis k hisab say price ka current temporary trend again buy ka start ho chuka hai, aur sath price central point line k bhi sell main breakout kar chuki hai, is liye chances yahi hain k price strongly tour par zupport levels ko test kar sakty hai.

4-hour time chart:

Gold price ko agar ham 4-hour time frame pay analyzed kartay hain to h1 chart pay price 2027.00 pivot point line say aik big bearish candle k sath dwnward breakout k sath closed hue hai. agar chart pay ham custom indicator ki reading ko daikhtay hain to osma indicator levels k center main buy ka signal show kar raha hai. agar current price sell ki movements ko start karty hai to chart pay price ki sell movements k chances strong ban saktay hain jiska target ooper 2011.00 aur phir usk bad price mazeed 2004.00 support zones ko test kar sakty hai.

agar current price 4-hour chart pay bounced hoty hai, aur sath central point line k buy main breakout karty hai to chart pay price ki upward movements k chances ban saktay hain, jiska target ooper2037.00 aur phir usk bad price mazeed 2045.00 levels ko test kar sakty hai. Mairay analysis k hisab say price ka current temporary trend again buy ka start ho chuka hai, aur sath price central point line k bhi sell main breakout kar chuki hai, is liye chances yahi hain k price strongly tour par zupport levels ko test kar sakty hai.

-

#524 Collapse

XAUUSD TRENDING VIEW

H1 TIME FRAME

Gold market Kafi acchi tarike se movement karti hui 1865 se 1861 per movement kar rakhi hai aur ye iski current price hai. 1861 jo ki aap chart Mein dekh sakte hain rojana ke time frame Mein Kafi Acchi Prices Aur Bhi Dikhai de rahi hain. Jo Inki support aur resistance ki Shakal Banakar move karti hain, Upar bhi nikal sakti hain, and niche bhi a sakti hain. Agar Ham Gold ke chart rojana ke time frame mein Dekhen to 1847. 00 Ek acchi Si strong support Ban sakti hai.If you are a trader, you can enter the market by buying.According to the analysis, the gold market has four time frames.Kafi traders use short charts, while main Kafi Lambe and Bade time frame chats use gold ki market per analysis karta hun aur apne trading opportunity behtar banata hun. Aaj ham gold ki market per analysis karne ja rahe hain, and mujhe yah lagta hai ki gold ki market ki price ismein Kafi movement hogi Jo Ki Sham 5:00 Baje movement speed se ho sakti hain. 4 ghante wale time frame Mein market 1859 mein movement karti hui, ragging market move kar rahi. Aur 1857.40 iski market ka ek behtarin support level ban sakta hai, vahan se market bhi uth sakti hai. Agar market niche I to 1718 iska niche wala target ban sakte hai. To understand the levels of support and resistance. Tabhi Ham Gold per acchi trade kar sakte hain.

agla gold ke rujhan per nazar sani ki jani chahiye, or usay dobarah bahaal kya jana chahiye intraday gold market ki khususiyaat kam aur faida hai qeematein aik izafi hikmat e amli ke tor per hain 1870 ke qareeb qaleel mudti muawnat hai aur sab se ooper 1878 aur 1885 ko daba deta hai neteejay ke tor per main shumali line ke tasalsul ki tasdeeq karne walay paiir ki sham yeh tak 1848 ki himayat ki satah pahonch sakta hai taham muzahmati sthon ke jama honay ki wajah se yeh rujhan jald hi dobarah bahaal honay ka imkaan hai is terahn 1882 aur 1885 sirf is soorat main toot sakty hain jab wo un ston se neechay toot jayen aur pehlay hi un ke nee

gold metal ki price kafi up jany k bad downtrend main waps a gai hai, or 1852 se neechay ki istehkaam ki satah ko torna kharidaron ke liye apni taizi ki bunyaad ko dobarah haasil karne ke liye ghalib range ho ga, aur tasdeeqi signal 1920 ke qareeb qareeb mudti muzahmati satah print kar sakta hai. yeh dekha ja sakta hai ke yeh mah ki be rozgari ki sharah mein tabdeeli ke adaad o shumaar Amrici dollar ke index ki qeemat ko mazeed mazboot karen ge, aur passion goi 103. 60 ki 50% fibonacci retracement ki satah ko dobarah shuru kar sakti hai. Baichnay walay is dabao ke tehat dabao mein hain, aur mazeed nuqsanaat 1828 ki 200 din kisaada moving average ko challenge kar satke hain. Bollinger bands and oscillators cloud ki darmiyani lakeer qadray ziyada hain, darmiyani muddat ke istehkaam ke ilaqay mein baqi hain, oopri had ke sath 1890 ki

H4 TIME FRAME

Gold price ko agar ham h1 time frame pay analyzed kartay hain to h1 chart pay price 2027.00 pivot point line say aik big bearish candle k sath downward breakout k sath closed hue hai. If you pay a chart and have a custom indicator reading, the osma indicator levels will show a buy signal. If current price sell movements begin, then chart pay price sell movements have a strong chance of occurring, with a target of 2011.00 and a support zone of 2004.00.

If the current price on the 1-hour chart has bounced, and the central point line has been broken, there is a chance that the chart pay price will move upwards, with a target of ooper2037.00 and a bad price of mazeed2045.00 levels to be tested. Mairay analysis k hisab say price ka current temporary trend again buy ka start ho chuka hai, aur sath price central point line k bhi sell main breakout kar chuki hai, is liye chances yahi hain k price strongly tour par zupport levels ko test kar sakti hai.

4-Hour Time Chart:

Gold price ko agar ham 4-hour time frame pay analyzed kartay hain to h1 chart pay price 2027.00 pivot point line say aik big bearish candle k sath downward breakout k sath closed hue hain. If you pay a chart and have a custom indicator reading, the osma indicator levels will show a buy signal. If current price sell movements begin, then chart pay price sell movements have a strong chance of occurring, with a target of 2011.00 and a support zone of 2004.00.

If current price 4-hour chart pay bounced hoty hai, aur sath central point line k buy main breakout karty hai, chart pay price ki upward movements ko chance ban saktay hain, jiska target ooper2037.00 aur phir usk bad price mazeed 2045.00 levels ko test kar sakty hai. Mairay analysis k hisab say price ka current temporary trend again buy ka start ho chuka hai, aur sath price central point line k bhi sell main breakout kar chuki hai, is liye chances yahi hain k price strongly tour par zupport levels ko test kar sakti hai.

Ek izafa hota hua neeche ki taraf tezi ka andaza gold ke liye kiya ja sakta hai; halankeh hafte ke shuru mein koshish ki gayi thi ke trend line ke upar qaim raha jaye. Ahem hai, medium lamba muddat ka trend line jo ke qeemat ne pehle to tor diya, lekin phir wapas loutne ki koshish. Jumeraat aur peer ke candles ke band badan is line ke ooper thay, jo ke tezi ke saath upar ki taraf chalne ki mumkinat ko darust kartay. Magar kal qeemat tezi se gir gayi aur aaj to mazeed neeche chali gayi; bahar se ooper chalte hue trend line ke bhi neeche chali gayi. Trend line ne apko pichle haftay bhi dikhaya tha, qeemat ko ooper kheenchte hue.

Maujooda Surat Hal Mein, sab tawajjo ko is trend line ki taraf aur khaaskar jumeraat ke band ko diya jana chahiye. Ye line darmiyanay muddat mein bullish trend ka barqarar rakhne ke liye ahem hai. Uper ki mukhalif mudde ki guftagu karne ke liye, zaroori hai ke kal ke doran jumeraat, buland volatility ke manzar par, aisa ek candle banta hai jo ooper mudahil hota hai aur trend line ke ooper band hota hai. Agar aisay daily candle ka band hota hai, to ye yehi matlab hoga ke hum 2040, 2062, or shayad 2072 ke lehron tak chal sakte hain, sath hi channel ke neeche ke sira se bhi ooper uth sakte hain

-

<a href="https://www.instaforex.org/ru/?x=ruforum">InstaForex</a> -

#525 CollapseInstaSpot: کسی بھی EPS اور بینک سے منافع واپس لیں، اور EPS اور cryptocurrencies کے تبادلے پر 7% تک کمائیں۔

Jumah ko, ek mandi wali candlestick Jumerat ki tezi wali candlestick ke andar band ho gayi. Iske alawa, qimat ne descending trendline ka dobara test kiya. Aam taur par yah samjha jata hai keh muzahmati line ke kayi test ke bad, breakout sirf waqt ki baat hai. Mai yah bhi tawaqqo kar raha hun keh qimat aakhir kar is line ko tod degi. Ek aur bat qabile gaur hai keh 2,038 ki satah par ek "Platform" ki tashkil hai. "Stop Hunting" trading strategy ke mutabiq, qimat is satah ko tod sakti hai aur tamam sell stop orders ko trigger kar sakti hai. Majmui taur par, mai apne commodity instrument XAU/USD ke 2,047-2,062 sell zone tak badhne ki tawaqqo kar raha hun. Is zone tak pahunchne ke bad, farokht par gaur karne ka yah ek waqt ho sakta hai.

Ghantawar chart ko dekhte hue, kharidari ke liye hadaf muqarrar hain. 161.8 ke Fibonacci retracement level ki buniyad par pahla hadaf 2,033 hai. Dusra hadaf 261.8 ki Fibonacci level 2,044 par waqe hai. Aur teesra hadaf, 423.6 ki Fibonacci level ke mutabiq, 2,062 ke sath mawafiq hai.

اب آن لائن

ہم مواصلات کے پلیٹ فارم کے طور پر فاریکس فورم فاریکس پاکستان کے آپ کے انتخاب کی تعریف کرتے ہیں۔

موجودہ وقت 10:48 AM (GMT+5)۔

Working...

X

تبصرہ

Расширенный режим Обычный режим