What is gartley pattern

`

X

new posts

-

#1 Collapse

-

<a href="https://www.instaforex.org/ru/?x=ruforum">InstaForex</a> -

#2 Collapse

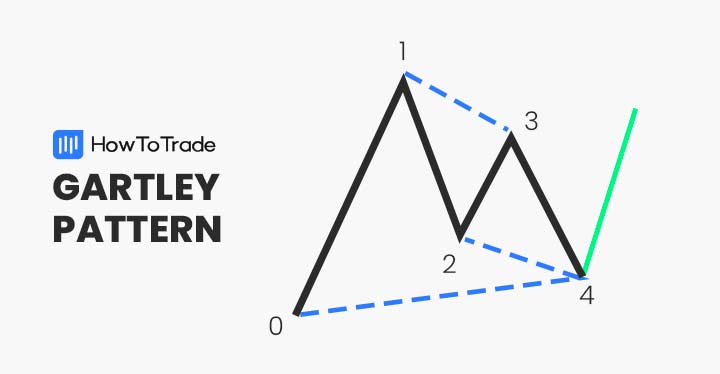

AOA Introduction Friends kya haal hai aapke main ummid karta hun aapka Kaise Honge Aaj Jis topic ko Ham discuss Karenge vah Hai gartley pattern is pattern ko ham Ek technical analysis tool kah sakte hain forex market Mein use hote hain yah Ek specific chart pattern hai jo price movement ko analyse karne mein help karta hai Ham isko understand karne ki koshish Karenge Details of Gartley pattern Gratley Pattern a technical analysis tool hai jo traders use karte hain market Mein potential turning point ko pata karne ke liye gratley pattern ko 1935 Mein H. M Gratley mein apni book profit in the stock market mein develope kiya tha gartley pattern Fibonacci ratio aur price movement ki concept per based Kiya gaya hai Components gratley pattern Gratley pattern 4 different points set banta hai 1# XA leg ( xa tang) ye frist leg hota hai or price movement ka start point hota hai 2# AB leg (AB tang) XA leg ke bad AB leg banta hai Jo price Mein Ek corrective movement hai 3# BC leg (BC tang) AB leg my bad BC leg aata hai Jo price mein ek strong movement hoti hai 4# CD leg (CDleg) BC leg ke bad CD leg aata hai Jo price movement ka end point Hota Hai Pattern Ratios Gartley pattern Main specific Fibonacci ratio ka use Hota Hai 1# AB=0.618 xxA, AN leg ka Length XA leg ka 1.618 double hota hai 2# BC= 0.382x AB:BC leg ka length ABLeg ka 0.382guna hota hai 3# CD=1.618 BC:CD leg ka length BC leg ka 1.618 guns hota hai Identification Gartley pattern Ka Pata Lagane ke liye aapko price movment ko closely monitor karna hoga Jab rice movement Mein specific ratio ke sath X A, AB, BC aur CD legs milati Hai tab aap Gartley pattern ko identify kar saktehain Trading Gartley pattern ka use trading Mein karne ke liye hota hai agar aap gartley pattern ko successfully identify Karte Hain To aap buy ya Sell position Le sakte hain dependent on the direction of the pattern -

#3 CollapseInstaSpot: کسی بھی EPS اور بینک سے منافع واپس لیں، اور EPS اور cryptocurrencies کے تبادلے پر 7% تک کمائیں۔

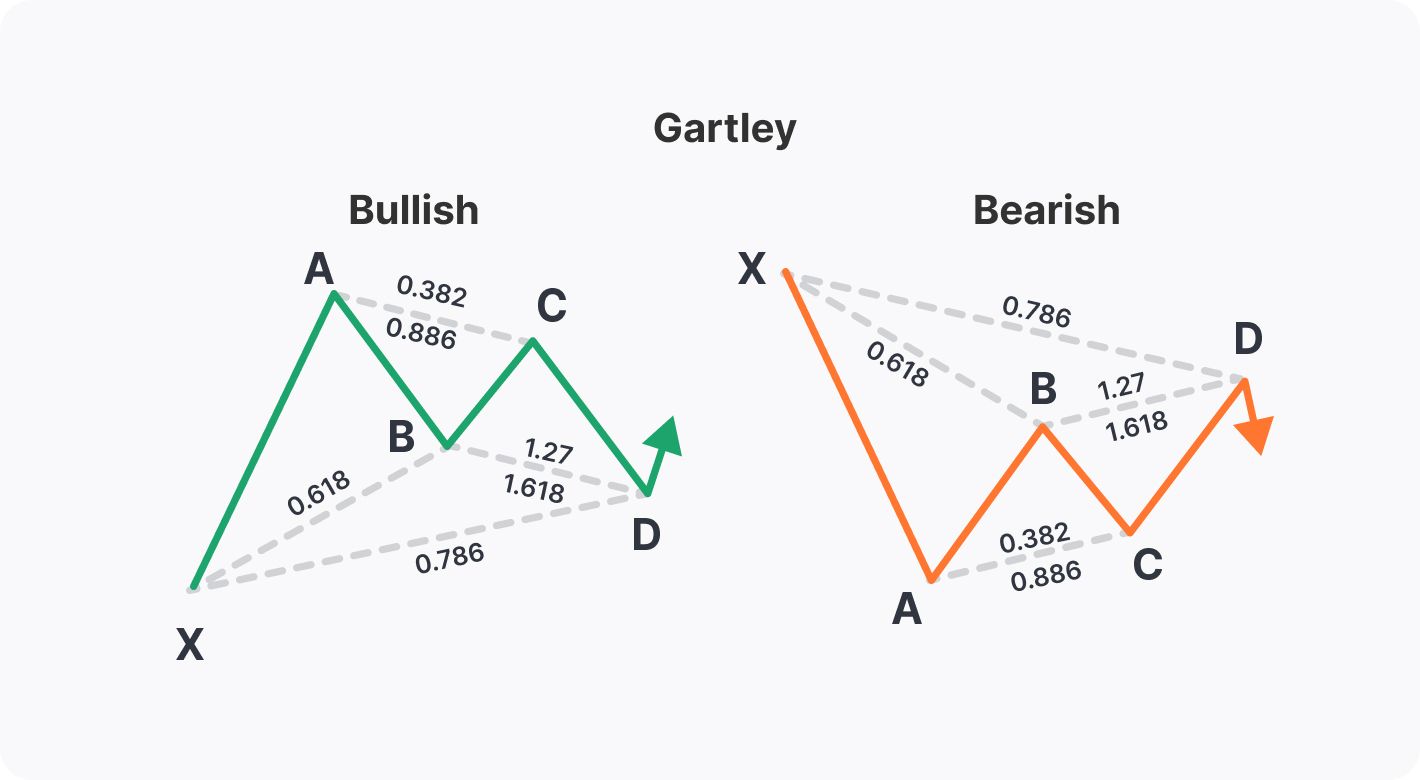

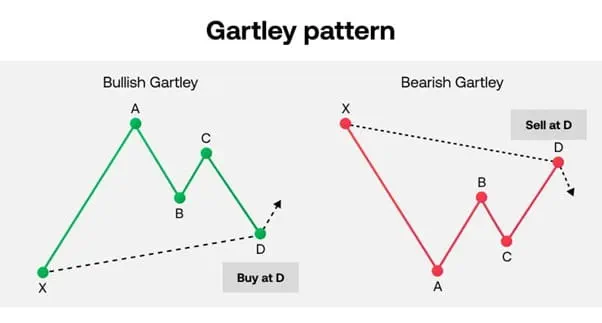

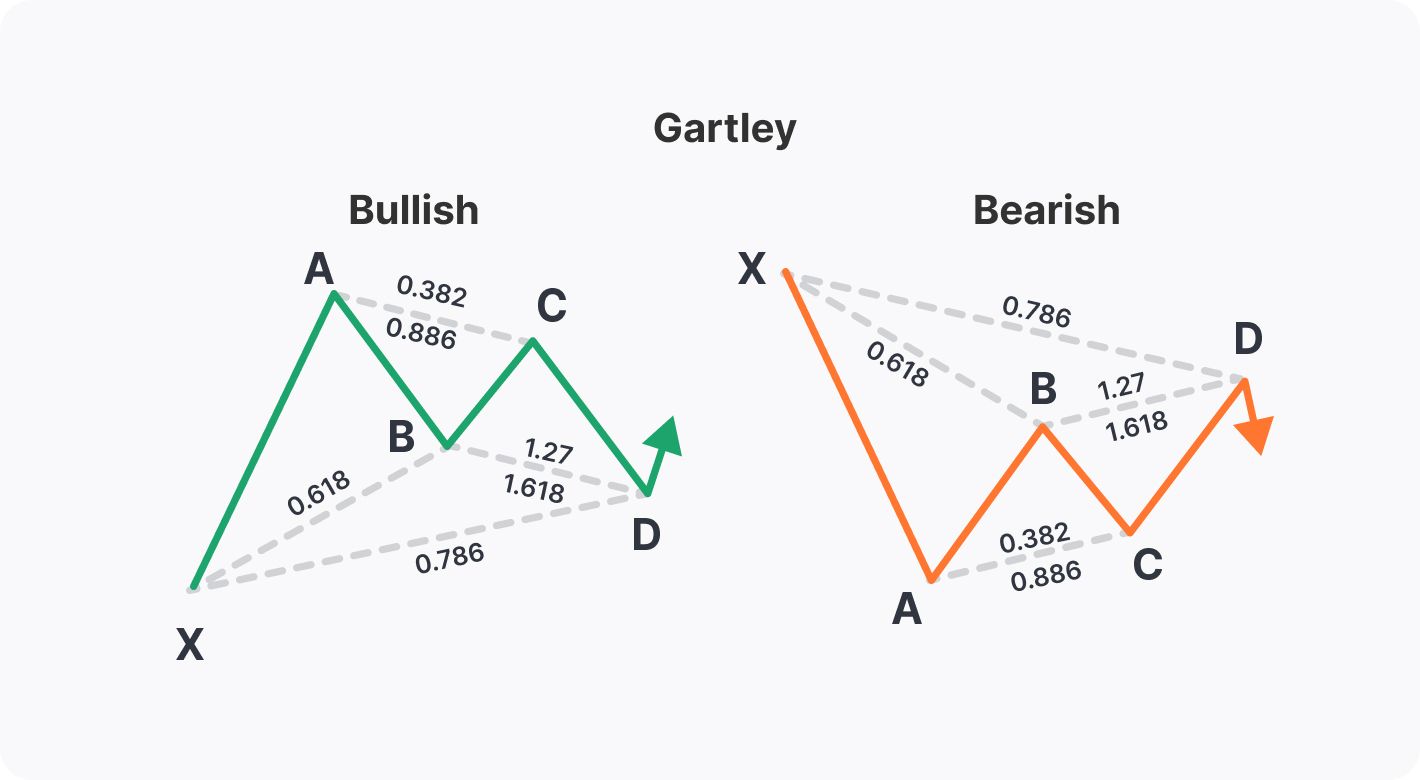

Gartley Pattern Forex trading mein Gartley pattern ek mukhtasir tijarat tanqeedi sazish hai jo technical analysis ke teht istemal hoti hai. Ye pattern trader ko market mein hone wale mukhtalif trends ko samajhne mein madadgar hota hai. Gartley pattern mein ek khaas tarah ki geometry hoti hai jo market mein hone wale reversals ko pehchanne mein madadgar hoti hai. Identification: Gartley pattern ka ban aik specific sequence ya pattern hota hai, jo mukhtalif points par hota hai. Is pattern mein chand key points hotay hain, jaise ke X, A, B, C, aur D. Har point ki alag ahmiyat hoti hai, aur in points ko milakar ek geometric shape banti hai jo trader ko market ke future movements ka andaza lagane mein madadgar hoti hai. Types: Gartley pattern kai mukhtalif types mein aata hai, jinmein se chand mashhoor hain, jaise ke Bullish Gartley pattern aur Bearish Gartley pattern. Bullish Gartley pattern jab market mein bearish trend hota hai aur is mein reversal hone ki sambhavna hoti hai. Jabke Bearish Gartley pattern mein market mein bullish trend hota hai aur is mein reversal hone ki sambhavna hoti hai. Uses: Gartley pattern ka estemal traders market analysis mein karte hain. Jab ek trader ye pattern market mein pehchan leta hai, toh usay ye idea milta hai ke market mein reversal hone ki sambhavna hai. Iske bad trader apne trades ko is pattern ke mutabiq plan karte hain, jisse unka risk kam ho aur unka profit potential ziyada ho. Gartley pattern ke istemal mein dhyan rakhna zaroori hai ke ye ek technical analysis tool hai aur iske bharose par puri tarah naa aayein. Market mein hamesha uncertainty hoti hai, aur isliye trader ko apni analysis ko dusri factors ke sath milakar samajhna zaroori hai. To conclude, Gartley pattern forex trading mein ek ahmiyat se istemal hone wala technical analysis tool hai jo market mein hone wale reversals ko pehchanne mein madadgar hota hai. Lekin, iske istemal mein caution aur aur market analysis ki mukhtalif factors ka bhi dhyan rakhna zaroori hai. -

#4 Collapse

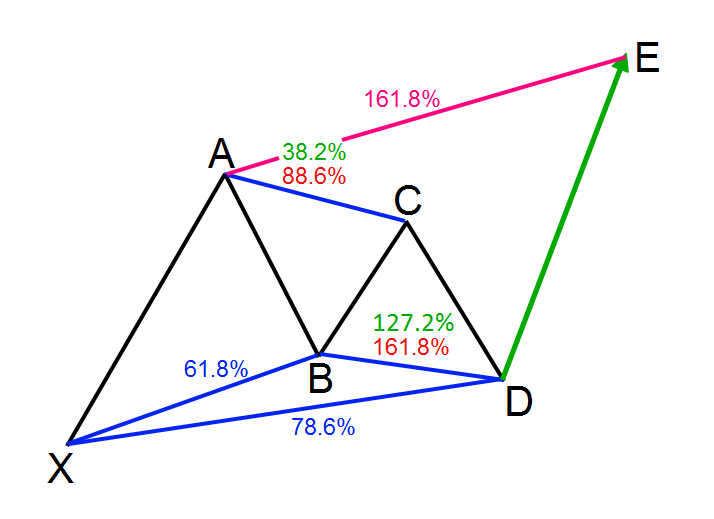

INTRODUCTION TO THE GARTLEY PATTERN: Gartley pattern, jise forex traders price movements mein potential reversals ki pehchaan karne ke liye istemaal karte hain, ka aaghaz H.M. Gartley ne 1935 mein apni kitab "Profits in the Stock Market" mein kiya. Ye pattern price swings aur Fibonacci ratios se bana hota hai, jiske karan ye technical analysts ke beech mein pasand kiya jaata hai. Gartley pattern char consecutive price swings ki combination hai. Ye swings XA, AB, BC, aur CD ke naam se label kiye jaate hain. Pattern ko identify karne ke liye in swings ke beech specific Fibonacci ratios ka istemaal hota hai. Gartley pattern mein istemal hone wale mukhya ratios 0.618 aur 0.786 hote hain, jo Fibonacci sequence se derive kiye jaate hain. GARTLEY PATTERN STRUCTURE: Gartley pattern ka dhancha uski pehchaan aur trade karne ke liye mahatvapurna hota hai. Pattern XA ke roop mein label ki gayi ek majboot price move se shuru hota hai. Ye move bullish ya bearish ho sakta hai. XA ke baad, ek retracement AB ke roop mein hota hai, jo aam taur par XA ka 38.2-61.8% tak retracement karta hai. Agla move BC leg hota hai, jo AB ka 38.2-88.6% tak retracement kar sakta hai. Ye move potential reversal zone (PRZ) ko banata hai, jahan par do Fibonacci ratios overlap karte hain. PRZ ek mahatvapurna kshetra hai jahan traders pattern ka poora hone ka intezar karte hain. Aakhri move, CD, AB ka extension hota hai aur XA ka 78.6% tak retracement karna chahiye. Ye move pattern ko complete karta hai agar ye 0.618 ya 0.786 retracement level of XA tak pahunchta hai. Traders phir potential reversal signs dhoondh sakte hain trading mein dakhil hone ke liye. GARTLEY PATTERN RATIOS: Gartley pattern potential reversal zones tay karte waqt specific Fibonacci ratios par nirbhar karta hai. Gartley pattern mein istemal hone wale mukhya ratios 0.618 aur 0.786 hote hain. Ye ratios Fibonacci sequence se derive kiye jaate hain, jo ek ganitik sequence hai jahan har number do pehle wale numbers ka jod hota hai. 0.618 ratio ko "golden ratio" ke naam se jaana jaata hai aur ye Fibonacci ratios mein ek mahatvapurna ratio mana jata hai. Iska istemal Gartley pattern ke alawa dusre technical analysis ke tajurbe mein bhi hota hai. 0.786 ratio ek aur mahatvapurna ratio hai jo Fibonacci sequence se derive hota hai. Gartley pattern mein PRZ XA leg ke 0.618 aur 0.786 retracement levels ke overlap hone se banta hai. Ye PRZ ek mahatvapurna kshetra hai jahan traders ko potential reversal hone ka intezar hota hai. Fibonacci ratios ke saath-judav pattern ko weightage deta hai aur reversal hone ki sambhavna ko badhata hai. GARTLEY PATTERN ENTRY AND STOP LOSS PLACEMENT: Gartley pattern mein trade karte waqt traders aam taur par potential reversal signs ka intezar karte hain PRZ ke andar trade karne se pehle. Ye signs candlestick patterns, divergences, ya dusre technical indicators mein se kisi ko bhi hosakte hain jo reversal ki nishani dete hain. Jab ek reversal sign aa jaaye, tab traders stop loss ke saath trade mein shaamil ho sakte hain. Stop loss ko PRZ ke bahar set karna chahiye taaki pattern ka potential failure se bacha ja sake. Ek aam approach ye hota hai ki stop loss pattern ke X point ke niche rakha jaaye. Darj-e-aqsam mein dakhil hone aur stop loss placement ko sahi risk management techniques se samarthit hona chahiye. Traders ko apna risk-reward ratio calculate karna chahiye aur us ke hisab se position sizing ko adjust karna chahiye taki unki exposure ko manage kiya ja sake. GARTLEY PATTERN TARGETS AND TRADE MANAGEMENT: Gartley pattern par trade dakhil karne ke baad, traders ko muqarrar karke price targets zaroor rakhne chahiye. Ye targets pichle support aur resistance levels, Fibonacci extensions, ya dusre technical analysis methods par base ho sakte hain. Jab target tak pahunche, traders poora trade exit karne ya hisse ke faide lena aur stop loss ki taraf tailing karne ka faisla kar sakte hain. Sahi trade management faide ko maximize aur nuksan ko minimize karne ke liye bahut zaroori hota hai jab Gartley pattern ke saath trade kiya jata hai. Yeh yaad rakhna zaroori hai ke Gartley pattern behtareen nateeja dene wala nahi hai aur yeh safalta yukt trades ki guarantee nahi deta. Traders ko aur technical analysis tools, risk management techniques ka istemal karna chahiye aur sabse zaroori hai ke woh sound judgment aur discretion se trading karein jab pattern ke saath trade kar rahe hain. -

#5 Collapse

Forex mein Gartley pattern ek technical analysis pattern hai, jo traders ki traf se price movements aur trend reversals ke liye istemaal kiya jata hai. Gartley pattern H.M. Gartley ke naam par rakha gaya hai, jo is pattern ko pehli bar describe kiya tha. Gartley pattern harmonic pattern category mein aata hai aur Fibonacci retracement levels ke upyog se identify kiya jata hai. Yeh pattern market ke turning points ko anticipate karne ke liye istemaal hota hai. Gartley pattern mein typically 4 price points ya levels hote hain - X, A, B, C, aur D. Gartley pattern ke 2 primary types hote hain: 1. Bullish Gartley Pattern: - XA leg: Price move upwards (Uptrend) - AB leg: Price correction in a downtrend (Retracement of XA leg) - BC leg: Price move upwards (Retracement of AB leg) - CD leg: Final price move downwards creating a new low (Extension of BC leg) 2. Bearish Gartley Pattern: - XA leg: Price move downwards (Downtrend) - AB leg: Price correction in an uptrend (Retracement of XA leg) - BC leg: Price move downwards (Retracement of AB leg) - CD leg: Final price move upwards creating a new high (Extension of BC leg) Is pattern ka upyog kisi bhi timeframe par kiya ja sakta hai, lekin traders generally isko medium to long-term trading mein prefer karte hain. Gartley pattern ke alawa bhi kai aur harmonic patterns hote hain jaise ki Butterfly pattern, Bat pattern, Crab pattern, aur Cypher pattern. In sabhi patterns ke liye Fibonacci retracement aur extension levels ka istemaal hota hai. Harmoni pattern analysis ke sath-sath technical indicators aur price action analysis bhi use kiya jata hai, taki traders ko ek better trading decision leni mein madad mile. Isliye, Gartley pattern ko samjhne ke liye aapko Fibonacci retracement aur harmonic patterns ke basic concepts ko samajhna zaruri hai. -

#6 CollapseInstaSpot: کسی بھی EPS اور بینک سے منافع واپس لیں، اور EPS اور cryptocurrencies کے تبادلے پر 7% تک کمائیں۔

What is gartley pattern Gartley pattern ek technical analysis ka pattern hai jo financial markets mein price movements ko predict karne aur trading decisions banane ke liye istemal hota hai. Yeh pattern H.M. Gartley ke naam par rakha gaya hai, jo ek famous technical analyst thay. Gartley pattern harmonic patterns ki ek qisam hai aur iska maqsad price reversals ke potential points ko identify karna hota hai.Gartley pattern mein kuch key points hote hain:

Initial Impulse Leg: Gartley pattern ki pehli leg hoti hai jo price movement ka initial impulse hota hai. Isme price ek direction mein tezi se badhti hai, yaani ke uptrend ya downtrend hota hai. Retracement: Iske baad price retracement karta hai, yaani ke woh thori der ke liye wapas jata hai, lekin initial impulse leg ke opposite direction mein. Retracement usually Fibonacci retracement levels par hota hai, jaise ke 38.2%, 50%, ya 61.8%. Extension : Retracement ke baad, price ek extension leg mein phir se move karta hai, jo initial impulse leg ki direction mein hoti hai. Yeh extension leg bhi Fibonacci ratios ko follow karti hai, jaise ke 127.2% ya 161.8%. Completion: Gartley pattern complete hota hai jab extension leg retracement leg ko overlap karti hai, aur yeh ek specific price level ke paas hota hai jo Gartley pattern ke rules ke mutabiq hota hai.Gartley pattern ki pehchan aur trading decision banane ke liye traders Fibonacci retracement aur extension tools ka istemal karte hain. Jab pattern complete hota hai, to traders entry aur exit points decide karte hain. Gartley pattern traders ke liye price reversals ya trend changes ko identify karne mein madadgar hota hai.Gartley pattern, jaise ke baqi harmonic patterns, market analysis mein complex hota hai, aur iski sahi samajh aur istemal ke liye practice aur experience ki zarurat hoti hai. Traders ko market conditions aur risk management ko bhi madde nazar rakhte hue is pattern ka istemal karna chahiye.

-

#7 Collapse

Introduction; Friends kya haal hai aapke major ummid karta hun aapka Kaise Honge Aaj Jis topic ko Ham speak Karenge vah Hai gartley sample is sample ko ham Ek technical evaluation tool kah sakte hain forex market Mein use hote hain yah Ek precise chart pattern hai jo charge movement ko examine karne mein help karta hai Ham isko understand karne ki koshish Karenge,Gartley sample ka use buying and selling Mein karne ke liye hota hai agar aap gartley sample ko efficaciously become aware of Karte Hain To aap buy ya Sell function Le sakte hain depending on the course of the sample Details of Gartley sample; Gratley Pattern a technical evaluation tool hai jo buyers use karte hain marketplace Mein capability turning point ko pata karne ke liye gratley sample ko 1935 Mein H. M Gratley mein apni book earnings inside the inventory market mein develope kiya tha gartley pattern Fibonacci ratio aur price movement ki idea in line with primarily based Kiya gaya hai.Forex trading mein Gartley pattern ek mukhtasir tijarat tanqeedi sazish hai jo technical evaluation ke teht istemal hoti hai. Ye pattern trader ko market mein hone wale mukhtalif trends ko samajhne mein madadgar hota hai. Gartley pattern mein ek khaas tarah ki geometry hoti hai jo market mein hone wale reversals ko pehchanne mein madadgar hoti hai.Identification: Gartley pattern ka ban aik specific sequence ya sample hota hai, jo mukhtalif factors par hota hai. Is pattern mein chand key points hotay hain, jaise ke X, A, B, C, aur D. Har point ki alag ahmiyat hoti hai, aur in factors ko milakar ek geometric form banti hai jo trader ko marketplace ke future movements ka andaza lagane mein madadgar hoti hai.Gartley sample kai mukhtalif kinds mein aata hai, jinmein se chand mashhoor hain, jaise ke Bullish Gartley sample aur Bearish Gartley pattern. Bullish Gartley pattern jab marketplace mein bearish fashion hota hai aur is mein reversal hone ki sambhavna hoti hai. Jabke Bearish Gartley sample mein marketplace mein bullish fashion hota hai aur is mein reversal hone ki sambhavna hoti hai. GARTLEY PATTERN: Gartley sample, jise forex investors charge actions mein capability reversals ki pehchaan karne ke liye istemaal karte hain, ka aaghaz H.M. Gartley ne 1935 mein apni kitab "Profits inside the Stock Market" mein kiya. Ye pattern fee swings aur Fibonacci ratios se bana hota hai, jiske karan ye technical analysts ke beech mein pasand kiya jaata hai.Gartley sample char consecutive charge swings ki combination hai. Ye swings XA, AB, BC, aur CD ke naam se label kiye jaate hain. Pattern ko pick out karne ke liye in swings ke beech precise Fibonacci ratios ka istemaal hota hai. Gartley sample mein istemal hone wale mukhya ratios zero.618 aur 0.786 hote hain, jo Fibonacci sequence se derive kiye jaate hain. Gartley sample ka dhancha uski pehchaan aur exchange karne ke liye mahatvapurna hota hai. Pattern XA ke roop mein label ki gayi ek majboot fee move se shuru hota hai. Ye pass bullish ya bearish ho sakta hai. XA ke baad, ek retracement AB ke roop mein hota hai, jo aam taur par XA ka 38.2-61.Eight% tak retracement karta hai.

-

#8 Collapse

What is gartley pattern Gartley pattern ek technical analysis tool hai jo financial markets mein price movements ka study karne ke liye istemal hota hai, particularly stock market, forex market, aur commodities market mein. Ye pattern primarily price reversal ko identify karne ke liye istemal hota hai. Gartley pattern, ek specific geometric shape ya pattern ko represent karta hai, jo Fibonacci ratios par adharit hota hai. Is pattern ko pehli baar H.M. Gartley ne 1935 mein introduce kiya tha. Ye pattern harmonics trading ki ek subset hai, jisme Fibonacci retracement levels ka istemal trend reversal points ko detect karne ke liye hota hai. Gartley pattern ek aise pattern hai jo aksar traders aur investors dwara price movement ko predict karne mein istemal hota hai. Is pattern mein kuch important points hote hain:- X-A Leg: Ye pattern shuru hota hai jab ek stock ya market instrument ka price ek specific trend se move karne lagta hai. Isse "X" leg kehte hain.

- A-B Leg: X leg ke baad price reversal hoti hai aur price opposite direction mein move karti hai. Isse "A" leg kehte hain. A leg ki length Fibonacci ratios par based hoti hai.

- B-C Leg: A leg ke baad ek aur retracement hoti hai, jo "B" leg kehlata hai. B leg bhi Fibonacci ratios se calculate hoti hai.

- C-D Leg: B leg ke baad price phir se reversal karti hai aur "C" leg hoti hai. C leg ke end tak price ek specific Fibonacci level tak ja sakti hai.

- D Point: C leg ke baad, price D point tak move karta hai, jo Fibonacci levels ke madhyam se calculate kiya jata hai. Agar D point Fibonacci levels ke kareeb hota hai, to ye ek potential reversal point indicate karta hai.

-

#9 CollapseInstaSpot: کسی بھی EPS اور بینک سے منافع واپس لیں، اور EPS اور cryptocurrencies کے تبادلے پر 7% تک کمائیں۔

What is gartley pattern: AOA Presentation: Companions kya haal hai aapke principal ummid karta hun aapka Kaise Honge Aaj Jis theme ko Ham talk about Karenge vah Hai gartley design is design ko ham Ek specialized examination apparatus kah sakte hain forex market Mein use hote hain yah Ek explicit graph design hai jo cost development ko break down karne mein help karta hai Ham isko comprehend karne ki koshish KarengeSubtleties of Gartley designGratley Example a specialized investigation instrument hai jo merchants use karte hain market Mein potential defining moment ko pata karne ke liye gratley design ko 1935 Mein H. M Gratley mein apni book benefit in the securities exchange mein develope kiya tha gartley design Fibonacci proportion aur cost development ki idea per based Kiya gaya hai Parts gratley design: Gratley design 4 unique focuses set banta hai 1# XA leg ( xa tang) ye frist leg hota hai or cost development ka start point hota hai 2# Stomach muscle leg (Abdominal muscle tang) XA leg ke awful Stomach muscle leg banta hai Jo value Mein Ek restorative development hai 3# BC leg (BC tang) Stomach muscle leg my awful BC leg aata hai Jo cost mein ek solid development hoti hai 4# Disc leg (CDleg) BC leg ke terrible Album leg aata hai Jo cost development ka end point Hota Hai Design Proportions: Gartley design Primary explicit Fibonacci proportion ka use Hota Hai 1# AB=0.618 xxA, A leg ka Length XA leg ka 1.618 twofold hota hai 2# BC= 0.382x AB:BC leg ka length ABLeg ka 0.382guna hota hai 3# CD=1.618 BC:CD leg ka length BC leg ka 1.618 firearms hota hai

Design Proportions: Gartley design Primary explicit Fibonacci proportion ka use Hota Hai 1# AB=0.618 xxA, A leg ka Length XA leg ka 1.618 twofold hota hai 2# BC= 0.382x AB:BC leg ka length ABLeg ka 0.382guna hota hai 3# CD=1.618 BC:CD leg ka length BC leg ka 1.618 firearms hota hai Recognizable proof: Gartley design Ka Pata Lagane ke liye aapko cost movment ko intently screen karna hoga Hit rice development Mein explicit proportion ke sath X A, Stomach muscle, BC aur Cd legs milati Hai tab aap Gartley design ko recognize kar saktehain

Recognizable proof: Gartley design Ka Pata Lagane ke liye aapko cost movment ko intently screen karna hoga Hit rice development Mein explicit proportion ke sath X A, Stomach muscle, BC aur Cd legs milati Hai tab aap Gartley design ko recognize kar saktehain :max_bytes(150000):strip_icc()/audusd-chart-02152019-5c66d7e0c9e77c0001e75c9c.png) Exchanging: Gartley design ka use exchanging Mein karne ke liye hota ha. agar aap gartley design ko effectively distinguish Karte Hain To aap purchase ya Sell position Le sakte hain reliant upon the heading of the example

Exchanging: Gartley design ka use exchanging Mein karne ke liye hota ha. agar aap gartley design ko effectively distinguish Karte Hain To aap purchase ya Sell position Le sakte hain reliant upon the heading of the example

-

#10 Collapse

Introduction of Gratley Pattern AOA Dear hm js Technical analysis tool pr baat krne wale hain wo he Gratley pattern ye pattern market me bhot impotance ke hamal hain ye ek specific chart pattern hai jo price movement ko analyse karne mein help karta hai technical analysis tool hai jo traders use karte hain market Mein potential turning point ko pata karne ke successfully identify Karte Hain To aap buy ya Sell position Le sakte hain dependent on the direction idea milta hai ke market mein reversal hone ki sambhavna hai. Iske bad trader apne waqt traders aam taur par potential reversal signs ka intezar karte hain is ke andar trade karne se pehle Ye signs candlestick patterns, divergences, ya dusre technical indicators mein se kisi ko bhi hosakte hain jo reversal ki nishani dete hain trades ko is pattern ke mutabiq plan karte hain, jisse unka risk kam ho aur unka profit of the pattern ko samajhne mein madadgar hota hai. Gartley pattern mein ek khaas tarah ki geometry hoti hai jo market mein hone wale reversals ko pehchanne mein madadgar hoti hai iske istemal mein caution aur aur market analysis ki mukhtalif factors ka bhi dhyan rakhna zaroori hai. Identification and working of this pattern Dear agr hm is pattern ke identification ke baat kree tu ye pattern bhot he easily identify ho skta he agr hm market ko gair se dekhae jase ke two triangles with opposite direction me show hote hain jo price movement ka initial impulse hota hai. Isme price ek direction mein tezi se badhti hai, yaani ke uptrend ya downtrend hota hai. traders entry aur exit points kinds mein aata hai, jinmein se chand mashhoor hain, jaise ke Bullish Gartley sample aur Bearish Gartley pattern. Bullish Gartley pattern jab marketplace mein bearish fashion hota hai aur is mein reversal hone ki sambhavna hoti hai. Jabke Bearish Gartley sample mein marketplace mein bullish fashion hota ha decide karte hain. Gartley pattern traders ke liye price reversals ya trend changes ko identify karne mein madadgar sabat hota he use buying and selling Mein karne ke liye hota hai agar aap gartley sample ko efficaciously become aware of Karte Hain ye pattern hmme market ke flow ko samjhne me kaam aata he -

#11 Collapse

FOREX ME GARTLY PATTERN:-Forex mein Gartley pattern ek technical analysis pattern hai, jise traders price charts par dekhte hain taki woh potential trend reversal points aur trading opportunities identify kar saken. Gartley pattern ek harmonic pattern hota hai, aur iska primary objective hota hai price movement ka prediction karna.XA Leg: Ye pattern ka shuruwat ka part hota hai, jisme price move karta hai. AB Leg: Ye XA leg ke baad hota hai, aur isme price retracement hota hai. BC Leg: BC leg AB leg se shuru hota hai aur extended move hota hai, lekin XA leg ke kuch specific Fibonacci retracement levels tak pahunchta hai. CD Leg: Ye BC leg ke baad hota hai aur isme price phir se reversal karta hai. CD leg, XA leg ke 0.786 Fibonacci retracement level tak pahunchta hai. Gartley pattern ko recognize karne ke liye traders Fibonacci retracement levels ka use karte hain aur pattern ki completion point ko identify karte hain. Completion point pe, traders trading opportunities dekhte hain, jaise ki entry point aur stop-loss level. Gartley pattern ke variations hote hain, jaise ki Bullish Gartley aur Bearish Gartley, jo market direction ke hisab se alag hote hain. Bullish Gartley pattern uptrend ke reversal ko indicate karta hai, jabki Bearish Gartley pattern downtrend ke reversal ko suggest karta hai. Gartley pattern ki sahi pehchan aur samajhna trading mein mahatvapurna hota hai, lekin yaad rahe ki ye ek tool hai, aur uske saath trading ke aur bhi factors ko consider karna important hota hai, jaise ki risk management, market sentiment, aur fundamental analysis. Trading mein success ke liye proper research, practice, aur experience bhi jaruri hote hain.OREX ME GARTLY PATTERN K COMPONENTS:-

-

#12 CollapseInstaSpot: کسی بھی EPS اور بینک سے منافع واپس لیں، اور EPS اور cryptocurrencies کے تبادلے پر 7% تک کمائیں۔

Gartley Chart Pattern: Gartley design ke alawa, iske varieties bhi hote hain jaise ki Butterfly design, Bat design, Crab design, aur Shark design, jo bhi Fibonacci retracement levels standard adharit hote hain.Traders Gartley design ko istemal karke cost inversions ko anticipate karne ki koshish karte hain, aur isse passage aur leave focuses choose karne ki koshish karte hain. Lekin yaad rahe ki kisi bhi specialized examination instrument ki tarah, Gartley design bhi 100 percent exact nahi hota, aur iska istemal risk the executives ke saath kiya jana chahiye. design shuru hota hai punch ek stock ya market instrument ka cost ek explicit pattern se move karne lagta ha design ek specialized examination device hai jo monetary business sectors mein cost developments ka study karne ke liye istemal hota hai, especially financial exchange, forex market, aur products market mein. Ye design principally cost inversion ko recognize karne ke liye istemal hota hai.Gartley design, ek explicit mathematical shape ya design ko address karta hai, jo Fibonacci proportions standard adharit hota hai. Is design ko pehli baar H.M. Gartley ne 1935 mein present kiya tha. Ye design music exchanging ki ek subset hai, jisme Fibonacci retracement levels ka istemal pattern inversion focuses ko identify karne ke liye hota hai. Gartley design ko recognize karne ke liye Fibonacci retracement aur expansion levels ka istemal kiya jata hai. Is design mein explicit proportions aur cost levels ko dekh kar pattern inversion ko expect kiya jata hai.Gartley design ke section focuses ko recognize karne ke liye aap candle diagrams aur specialized markers ka istemal kar sakte hain. Aapko corroborative signs ki talash karni hogi, jaise ki cost activity designs aur other specialized indicators.Trading ke saath hamesha risk the executives ko dhyan mein rakhein. Passage point ke saath stop misfortune aur target levels ko set karein, jisse aap apne risk ko oversee kar sakein.Gartley design ke saath exchanging karte waqt persistence aur discipline bahut zaroori hai. Aapko apne exchanging plan ko follow karna hoga aur feelings ko control mein rakhna hoga Yeh attributes aapko Gartley design ke saath exchanging karne mein madad karenge. Lekin hamesha apni research karein aur apne exchanging plan ko follow karein. Identification Of Gartley Chart Pattern: Gartley design ek specialized investigation device hai jo cost development ko distinguish karne mein madad karta hai. Ye negative ya bullish inversion design ho sakta hai. Is design mein explicit proportions aur Fibonacci levels ka istemal hota hai. Gartley design ko distinguish karne ke liye aap Fibonacci retracement aur expansion levels ka istemal kar sakte hain. Is design mein explicit proportions aur cost levels ko dekh kar pattern inversion ko expect kiya jata hai. Aap candle graphs aur specialized pointers ka bhi istemal kar sakte hain.Gartley design ka boycott aik explicit succession ya test hota hai, jo mukhtalif factors standard hota hai. Is design mein chand central issues hotay hain, jaise ke X, A, B, C, aur D. Har point ki alag ahmiyat hoti hai, aur in factors ko milakar ek mathematical structure banti hai jo broker ko commercial center ke future developments ka andaza lagane mein madadgar hoti hai.Gartley test kai mukhtalif sorts mein aata hai, jinmein se chand mashhoor hain, jaise ke Bullish Gartley test aur Negative Gartley design. Bullish Gartley design punch commercial center mein negative style hota hai

Gartley design ko recognize karne ke liye Fibonacci retracement aur expansion levels ka istemal kiya jata hai. Is design mein explicit proportions aur cost levels ko dekh kar pattern inversion ko expect kiya jata hai.Gartley design ke section focuses ko recognize karne ke liye aap candle diagrams aur specialized markers ka istemal kar sakte hain. Aapko corroborative signs ki talash karni hogi, jaise ki cost activity designs aur other specialized indicators.Trading ke saath hamesha risk the executives ko dhyan mein rakhein. Passage point ke saath stop misfortune aur target levels ko set karein, jisse aap apne risk ko oversee kar sakein.Gartley design ke saath exchanging karte waqt persistence aur discipline bahut zaroori hai. Aapko apne exchanging plan ko follow karna hoga aur feelings ko control mein rakhna hoga Yeh attributes aapko Gartley design ke saath exchanging karne mein madad karenge. Lekin hamesha apni research karein aur apne exchanging plan ko follow karein. Identification Of Gartley Chart Pattern: Gartley design ek specialized investigation device hai jo cost development ko distinguish karne mein madad karta hai. Ye negative ya bullish inversion design ho sakta hai. Is design mein explicit proportions aur Fibonacci levels ka istemal hota hai. Gartley design ko distinguish karne ke liye aap Fibonacci retracement aur expansion levels ka istemal kar sakte hain. Is design mein explicit proportions aur cost levels ko dekh kar pattern inversion ko expect kiya jata hai. Aap candle graphs aur specialized pointers ka bhi istemal kar sakte hain.Gartley design ka boycott aik explicit succession ya test hota hai, jo mukhtalif factors standard hota hai. Is design mein chand central issues hotay hain, jaise ke X, A, B, C, aur D. Har point ki alag ahmiyat hoti hai, aur in factors ko milakar ek mathematical structure banti hai jo broker ko commercial center ke future developments ka andaza lagane mein madadgar hoti hai.Gartley test kai mukhtalif sorts mein aata hai, jinmein se chand mashhoor hain, jaise ke Bullish Gartley test aur Negative Gartley design. Bullish Gartley design punch commercial center mein negative style hota hai Design total hota hai poke expansion leg retracement leg ko cross-over karti hai, aur yeh ek explicit cost level ke paas hota hai jo Gartley design ke rules kemutabiq hota hai.Gartley design ki pehchan aur exchanging choice banane ke liye dealers Fibonacci retracement aur expansion apparatuses ka istemal karte hain. design complete hota hai, to dealers section aur leave focuses choose karte hain. Gartley design brokers ke liye cost inversions ya pattern changes ko distinguish karne mein madadgar hota hai.Gartley design, jaise ke baqi consonant examples, market examination mein complex hota hai, aur iski sahi samajh aur istemal ke liye practice aur experience ki zarurat hoti hai. Dealers ko economic situations aur risk the board ko bhi madde nazar rakhte shade is design ka istemal karna chahiye. Gartley Chart Pattern Importance: Gartley design ki pehli leg hoti hai jo cost development ka introductory drive hota hai. Isme cost ek heading mein tezi se badhti hai, yaani ke upturn ya downtrend hota hai.Iske baad cost retracement karta hai, yaani ke woh thori der ke liye wapas jata hai, lekin introductory drive leg ke inverse heading mein. Retracement generally Fibonacci retracement levels standard hota hai, jaise ke 38.2%, half, ya 61.8%.Retracement ke baad, cost ek augmentation leg mein phir se move karta hai, jo starting motivation leg ki heading mein hoti hai. Yeh augmentation leg bhi Fibonacci proportions ko follow karti hai, jaise ke 127.2% ya 161.8%.artley example symphonious examples ki ek qisam hai aur iska maqsad cost inversions kepotential focuses ko recognize karna hota hai.Gartley design mein kuch central issues hote hain

Merchants by and large isko medium to long haul exchanging mein favor karte hain. Gartley design ke alawa bhi kai aur symphonious examples hote hain jaise ki Butterfly design, Bat design, Crab design, aur Code design. In sabhi designs ke liye Fibonacci retracement aur expansion levels ka istemaal hota hai.Harmoni design examination ke sath specialized markers aur cost activity examination bhi use kiya jata hai, taki brokers ko ek better exchanging choice leni mein madad mile. Isliye, Gartley design ko samjhne ke liye aapko Fibonacci retracement aur consonant examples ke essential ideas ko samajhna zaruri hai. Trading Of Gartley Chart Pattern: Diagram Example ek specialized design hai, jo dealers ki traf se cost developments aur pattern inversions ke liye istemaal kiya jata hai. Gartley design H.M. Gartley ke naam standard rakha gaya hai, jo is design ko pehli bar portray kiya tha.Gartley design symphonious example class mein aata hai aur Fibonacci retracement levels ke upyog se recognize kiya jata hai. Yeh design market ke defining moments ko expect karne ke liye istemaal hota hai. Gartley design mein regularly 4 price tags ya levels hote hain - X, A, B, C, aur D.Gartley design ke 2 essential sorts hote hain Gartley design standard exchange dakhil karne ke baad, dealers ko muqarrar karke cost targets zaroor rakhne chahiye. Ye targets pichle support aur obstruction levels, Fibonacci augmentations, ya dusre specialized investigation strategies standard base ho sakte hain. dealers poora exchange exit karne ya hisse ke faide lena aur stop misfortune ki taraf following karne ka faisla kar sakte hain. Sahi exchange the executives faide ko boost aur nuksan ko limit karne ke liye bahut zaroori hota hai punch Gartley design ke saath exchange kiya jata hai.

Merchants by and large isko medium to long haul exchanging mein favor karte hain. Gartley design ke alawa bhi kai aur symphonious examples hote hain jaise ki Butterfly design, Bat design, Crab design, aur Code design. In sabhi designs ke liye Fibonacci retracement aur expansion levels ka istemaal hota hai.Harmoni design examination ke sath specialized markers aur cost activity examination bhi use kiya jata hai, taki brokers ko ek better exchanging choice leni mein madad mile. Isliye, Gartley design ko samjhne ke liye aapko Fibonacci retracement aur consonant examples ke essential ideas ko samajhna zaruri hai. Trading Of Gartley Chart Pattern: Diagram Example ek specialized design hai, jo dealers ki traf se cost developments aur pattern inversions ke liye istemaal kiya jata hai. Gartley design H.M. Gartley ke naam standard rakha gaya hai, jo is design ko pehli bar portray kiya tha.Gartley design symphonious example class mein aata hai aur Fibonacci retracement levels ke upyog se recognize kiya jata hai. Yeh design market ke defining moments ko expect karne ke liye istemaal hota hai. Gartley design mein regularly 4 price tags ya levels hote hain - X, A, B, C, aur D.Gartley design ke 2 essential sorts hote hain Gartley design standard exchange dakhil karne ke baad, dealers ko muqarrar karke cost targets zaroor rakhne chahiye. Ye targets pichle support aur obstruction levels, Fibonacci augmentations, ya dusre specialized investigation strategies standard base ho sakte hain. dealers poora exchange exit karne ya hisse ke faide lena aur stop misfortune ki taraf following karne ka faisla kar sakte hain. Sahi exchange the executives faide ko boost aur nuksan ko limit karne ke liye bahut zaroori hota hai punch Gartley design ke saath exchange kiya jata hai.  Gartley design mein exchange karte waqt merchants aam taur standard potential inversion signs ka intezar karte hain PRZ ke andar exchange karne se pehle. Ye signs candle designs, divergences, ya dusre specialized markers mein se kisi ko bhi hosakte hain jo inversion ki nishani dete hain.ek inversion sign aa jaaye, tab brokers stop misfortune ke saath exchange mein shaamil ho sakte hain. Stop misfortune ko PRZ ke bahar set karna chahiye taaki design ka potential disappointment se bacha ja purpose. Ek aam approach ye hota hai ki stop misfortune design ke X point ke specialty rakha jaaye. stop misfortune situation ko sahi risk the executives methods se samarthit hona chahiye. Brokers ko apna risk-reward proportion compute karna chahiye aur us ke hisab se position measuring ko change karna chahiye taki unki openness ko oversee kiya

Gartley design mein exchange karte waqt merchants aam taur standard potential inversion signs ka intezar karte hain PRZ ke andar exchange karne se pehle. Ye signs candle designs, divergences, ya dusre specialized markers mein se kisi ko bhi hosakte hain jo inversion ki nishani dete hain.ek inversion sign aa jaaye, tab brokers stop misfortune ke saath exchange mein shaamil ho sakte hain. Stop misfortune ko PRZ ke bahar set karna chahiye taaki design ka potential disappointment se bacha ja purpose. Ek aam approach ye hota hai ki stop misfortune design ke X point ke specialty rakha jaaye. stop misfortune situation ko sahi risk the executives methods se samarthit hona chahiye. Brokers ko apna risk-reward proportion compute karna chahiye aur us ke hisab se position measuring ko change karna chahiye taki unki openness ko oversee kiya

-

#13 Collapse

What is gartley design :Gartley design ek specialized investigation ka design hai jo monetary business sectors mein cost developments ko anticipate karne aur exchanging choices banane ke liye istemal hota hai. Yehdesign H.M. Gartley ke naam standard rakha gaya hai, jo ek popular specialized expert thay. Gartley design symphonious examples ki ek qisam hai aur iska maqsad cost inversions kepotential focuses ko distinguish karna hota hai.Gartley design mein kuch central issues hote hain:

Beginning Motivation Leg: Gartley design ki pehli leg hoti hai jo cost development ka beginning motivation hota hai. Isme cost ek course mein tezi se badhti hai, yaani ke upturn ya downtrend hota hai. Retracement: Iske baad cost retracement karta hai, yaani ke woh thori der ke liye wapas jata hai, lekin beginning motivation leg ke inverse heading mein. Retracement typically Fibonacciretracement levels standard hota hai, jaise ke 38.2%, half, ya 61.8%. Expansion : Retracement ke baad, cost ek expansion leg mein phir se move karta hai, jo introductory motivation leg ki course mein hoti hai. Yeh augmentation leg bhi Fibonacci proportions ko followkarti hai, jaise ke 127.2% ya 161.8%. Fruition: Gartley design total hota hai punch augmentation leg retracement leg ko cross-over karti hai, aur yeh ek explicit cost level ke paas hota hai jo Gartley design ke rules kemutabiq hota hai.Gartley design ki pehchan aur exchanging choice banane ke liye dealers Fibonacci retracement aur augmentation instruments ka istemal karte hain. Poke designcomplete hota hai, to merchants section aur leave focuses choose karte hain. Gartley design brokers ke liye cost inversions ya pattern changes ko distinguish karne mein madadgarhota hai.Gartley design, jaise ke baqi consonant examples, market examination mein complex hota hai, aur iski sahi samajh aur istemal ke liye practice aur experienceki zarurat hoti hai. Merchants ko economic situations aur risk the executives ko bhi madde nazar rakhte tint is design ka istemal karna chahiye.

-

#14 Collapse

GARTLEY PATTERN IN FOREX TRADING INTRODUCTION Gartley Pattern, ek technical analysis pattern hai jo traders ko market mein hone wale potential reversals ya trend changes ke signals provide karta hai.Gartley Pattern, harmonic trading ki ek qisam hai jisme price aur time relationships ko analyze kiya jata hai.Gartley Pattern mein Fibonacci retracement levels ka istemal hota hai. Yeh levels market ki previous moves ke based par banaye jate hain.Gartley Pattern mein AB=CD structure paya jata hai, jisme ek move ke baad doosra similar move hota hai. GARTLEY PATTERN COMPONENTS Gartley Pattern mein kuch mukhtalif points aur ratios hote hain jese ke XA, AB, BC, aur CD, jo Fibonacci levels aur ratios par mabni hote hain.Bullish Gartley Pattern jab hota hai jab market down trend mein hota hai aur reversal hone ka indication deta hai, jabke Bearish Gartley Pattern up trend mein hota hai aur reversal ko darust karta hai.Traders Gartley Pattern ka istemal karke apne trading decisions ko inform karte hain, lekin yeh zaroori hai ke isay confirmatory signals ke sath istemal karein.Gartley Pattern mein AB=CD structure paya jata hai, jisme ek move ke baad doosra similar move hota hai. CONCLUSION Gartley Pattern, traders ko market ke potential reversals ke bare mein malumat farahem karta hai. Gartley Pattern ki trading mein risk aur reward ka tawazun banaye rakhna zaroori hai, taake trading plan mei consistency qaim rahe.isay samajhne aur istemal karne mein tajaweez aur experience ki zarurat hoti hai.Traders Gartley Pattern ka istemal karke apne trading decisions ko inform karte hain, lekin yeh zaroori hai ke isay confirmatory signals ke sath istemal karein. -

<a href="https://www.instaforex.org/ru/?x=ruforum">InstaForex</a> -

#15 CollapseInstaSpot: کسی بھی EPS اور بینک سے منافع واپس لیں، اور EPS اور cryptocurrencies کے تبادلے پر 7% تک کمائیں۔

What's Gartley pattern :

Gartley pattern ek technical analysis tool hai jo price movement ko identify karne mein madad karta hai. Ye bearish ya bullish reversal pattern ho sakta hai. Is pattern mein specific ratios aur Fibonacci levels ka istemal hota hai. Gartley pattern ko identify karne ke liye aap Fibonacci retracement aur extension levels ka istemal kar sakte hain. Is pattern mein specific ratios aur price levels ko dekh kar trend reversal ko anticipate kiya jata hai. Aap candlestick charts aur technical indicators ka bhi istemal kar sakte hain.

Trading with gartley pattern:

Gartley pattern ke saath trading karne ke kuch khaas characteristics hain:

1. Pattern Recognition:

Gartley pattern ko identify karne ke liye Fibonacci retracement aur extension levels ka istemal kiya jata hai. Is pattern mein specific ratios aur price levels ko dekh kar trend reversal ko anticipate kiya jata hai.

2. Entry Points:

Gartley pattern ke entry points ko identify karne ke liye aap candlestick charts aur technical indicators ka istemal kar sakte hain. Aapko confirmatory signals ki talash karni hogi, jaise ki price action patterns aur other technical indicators.

3. Risk Management:

Trading ke saath hamesha risk management ko dhyan mein rakhein. Entry point ke saath stop loss aur target levels ko set karein, jisse aap apne risk ko manage kar sakein.

4. Patience and Discipline:

Gartley pattern ke saath trading karte waqt patience aur discipline bahut zaroori hai. Aapko apne trading plan ko follow karna hoga aur emotions ko control mein rakhna hoga. Yeh characteristics aapko Gartley pattern ke saath trading karne mein madad karenge. Lekin hamesha apni research karein aur apne trading plan ko follow karein.

- Mentions 0

-

سا0 like

اب آن لائن

ہم مواصلات کے پلیٹ فارم کے طور پر فاریکس فورم فاریکس پاکستان کے آپ کے انتخاب کی تعریف کرتے ہیں۔

موجودہ وقت 10:23 AM (GMT+5)۔

Working...

X

تبصرہ

Расширенный режим Обычный режим