What is gartley pattern

Gartley pattern ek harmonic trading pattern hai jo traders ko maaliyat ke markets mein muntakhib hone wale umooman maazi (reversal) points ko pehchanne mein madad karti hai. Isay harmonic patterns ki category mein rakha jata hai. Gartley pattern ka naam H.M. Gartley ke baad aya hai, jo ne isay apne kitab "Profits in the Stock Market" mein 1935 mein introduce kiya.

Gartley pattern ka bunyadi concept ye hai ke markets mein makhsoos aur peshgiar patterns hotay hain, jo ke aksar Fibonacci ratios ki asar mein atay hain.

Yahan Gartley pattern ke key components hain:

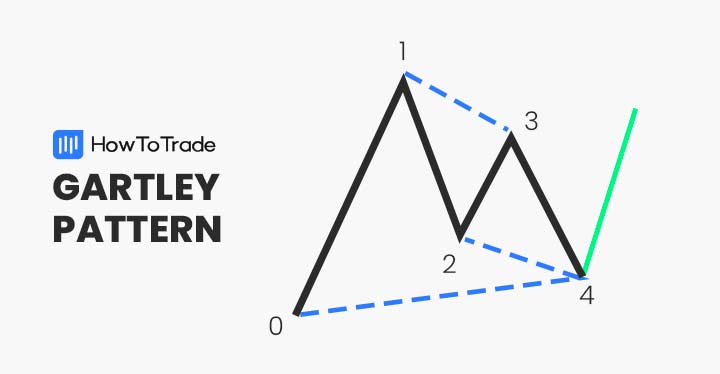

Gartley pattern ko price chart par uski makhsoos "M" ya "W" shakal se pehchana ja sakta hai. Traders jo Gartley pattern istemal karte hain, wo market mein dakhil hone ke liye point D ke qareeb mouqa talash karte hain, umeed hai ke wahaan reversal ya kam az kam aik numaya retracement hone wala hai.

Yaad rahe ke harmonic patterns, jese ke Gartley pattern, sirf technical analysts ki kuch tools mein se aik hain. Traders aksar in patterns ko doosre indicators aur analysis techniques ke saath mila kar istemal karte hain taake unhain behtar faislay karne mein madad mile. Aur wazeh rahe ke jese ke har technical analysis tool, Gartley pattern bhi 100% kaamyaab nahi hota, is liye traders ko apne trading strategies mein ehtiyaat aur risk management ka bhi khayal rakhna chahiye.

Gartley pattern ek harmonic trading pattern hai jo traders ko maaliyat ke markets mein muntakhib hone wale umooman maazi (reversal) points ko pehchanne mein madad karti hai. Isay harmonic patterns ki category mein rakha jata hai. Gartley pattern ka naam H.M. Gartley ke baad aya hai, jo ne isay apne kitab "Profits in the Stock Market" mein 1935 mein introduce kiya.

Gartley pattern ka bunyadi concept ye hai ke markets mein makhsoos aur peshgiar patterns hotay hain, jo ke aksar Fibonacci ratios ki asar mein atay hain.

Yahan Gartley pattern ke key components hain:

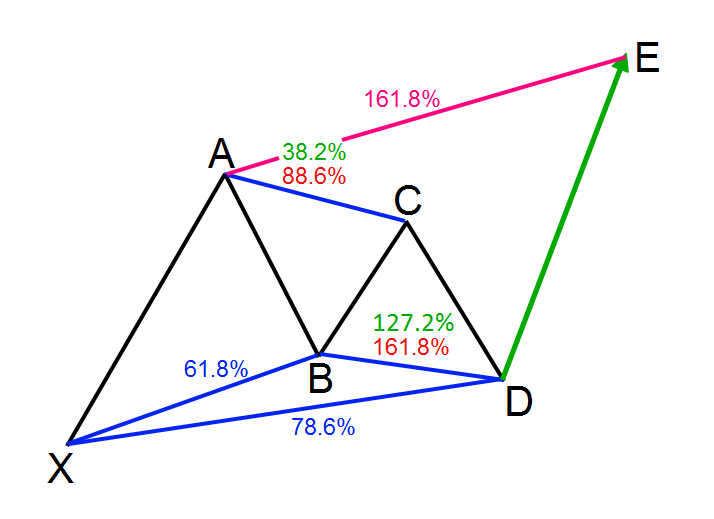

- X to A: Pattern ek asal price move se shuru hota hai (X to A), jo ke ek uptrend ya downtrend ho sakta hai.

- A to B: Asal move ke baad, aik retracement hoti hai point A se point B tak. Ye retracement aam taur par X to A leg ka 61.8% Fibonacci retracement level ke mutabiq hoti hai.

- B to C: Point B se, price asal raaste par (up ya down) chalti hai aur C point banati hai, jo ke aksar X to A leg ka 1.272 Fibonacci extension tak pohanchti hai.

- C to D: Aakhir mein, point C se point D tak dobara retracement hoti hai. Ye retracement aam taur par X to A leg ka 78.6% Fibonacci retracement level ke mutabiq hoti hai. Is retracement ki mukammal hone par (point D) traders umooman reversal ka intezar karte hain.

Gartley pattern ko price chart par uski makhsoos "M" ya "W" shakal se pehchana ja sakta hai. Traders jo Gartley pattern istemal karte hain, wo market mein dakhil hone ke liye point D ke qareeb mouqa talash karte hain, umeed hai ke wahaan reversal ya kam az kam aik numaya retracement hone wala hai.

Yaad rahe ke harmonic patterns, jese ke Gartley pattern, sirf technical analysts ki kuch tools mein se aik hain. Traders aksar in patterns ko doosre indicators aur analysis techniques ke saath mila kar istemal karte hain taake unhain behtar faislay karne mein madad mile. Aur wazeh rahe ke jese ke har technical analysis tool, Gartley pattern bhi 100% kaamyaab nahi hota, is liye traders ko apne trading strategies mein ehtiyaat aur risk management ka bhi khayal rakhna chahiye.

تبصرہ

Расширенный режим Обычный режим