aud/usd pair outlook:

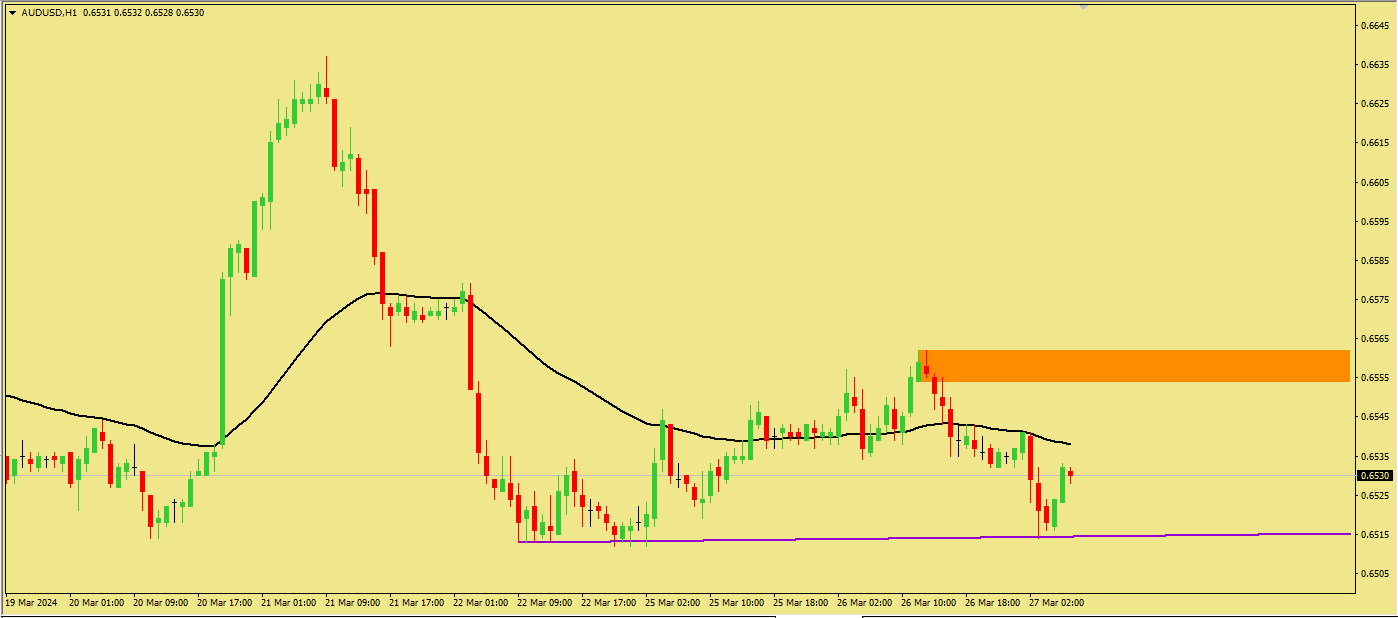

Sabko ek shandar din mubarak ho! Linear regression channel ke neeche ki taraf slope ne bechne wale ki taqat ko zahir kiya hai, jo 0.65114 ke level tak neeche jane ki koshish kar raha hai. Maqsad level par, movement rukawat ka samna hoga. Ghabrahat ke bais, chunayi volatility ke nateeje mein, aham hota hai ke ek mumkin pullback ke saath recharg ki zaroorat hogi. Channel ke neeche, bechna ghor nahi kiya jana chahiye; aapko 0.65392 tak correction ka intizaar karna chahiye. Wahan se, aapko bechne ka option muntazir karna chahiye. Agar ye 0.65392 ke upar consolidate hota hai, to bullish mood zahir hoga, jo ke market ko urooj par push kar sakta hai. Isliye, bechnay ka intezaar karna padega. Channel ka angle dikhata hai ke bear kitna neeche jana chahta hai, jitna zyada angle hoga, bechnay wala utna zyada faal hai. Aam tor par, ek bada angle wala channel market ke news action ka ishara hota hai.

AUDUSD pair ke liye bearish trend ab bhi mazboot nazar aata hai, haalaanki 0.6600 ke level par tezi se izafi rahi. Keemat ne phir se tezi se gir kar support 0.6509 ke qareeb aane ka samna kiya. Darmiyan mein keemat EMA 50 ke upar uthne ki koshish kar rahi hai lekin consolidate hone ka andaza lagta hai. Agar keemat EMA 50 ke upar chalne mein nakam rehti hai, to iska matlab hai ke keemat bearish trend ke raaste mein support ko test karegi. Ye mumkin hai ke keemat minor supply area 0.6579 - 0.6571 ki taraf taveel aur correct phase ki taraf ja sakti hai keemat SMA 200 ko dynamic resistance ke tor par cross karne ke baad. Stochastic indicator ke parameters basically keemat ko upar jane mein kam taqwiyat faraham karte hain, kyunke parameters overbought zone tak pohnchnay se pehle cross ho gaye hain. Darmiyan mein, Awesome Oscillator (AO) indicator ka histogram jo level 0 ke ooper hai, uska volume wide nahi hai. Ye be shak isko downtrend ki taraf lotne mein asani faraham karega.

Sabko ek shandar din mubarak ho! Linear regression channel ke neeche ki taraf slope ne bechne wale ki taqat ko zahir kiya hai, jo 0.65114 ke level tak neeche jane ki koshish kar raha hai. Maqsad level par, movement rukawat ka samna hoga. Ghabrahat ke bais, chunayi volatility ke nateeje mein, aham hota hai ke ek mumkin pullback ke saath recharg ki zaroorat hogi. Channel ke neeche, bechna ghor nahi kiya jana chahiye; aapko 0.65392 tak correction ka intizaar karna chahiye. Wahan se, aapko bechne ka option muntazir karna chahiye. Agar ye 0.65392 ke upar consolidate hota hai, to bullish mood zahir hoga, jo ke market ko urooj par push kar sakta hai. Isliye, bechnay ka intezaar karna padega. Channel ka angle dikhata hai ke bear kitna neeche jana chahta hai, jitna zyada angle hoga, bechnay wala utna zyada faal hai. Aam tor par, ek bada angle wala channel market ke news action ka ishara hota hai.

AUDUSD pair ke liye bearish trend ab bhi mazboot nazar aata hai, haalaanki 0.6600 ke level par tezi se izafi rahi. Keemat ne phir se tezi se gir kar support 0.6509 ke qareeb aane ka samna kiya. Darmiyan mein keemat EMA 50 ke upar uthne ki koshish kar rahi hai lekin consolidate hone ka andaza lagta hai. Agar keemat EMA 50 ke upar chalne mein nakam rehti hai, to iska matlab hai ke keemat bearish trend ke raaste mein support ko test karegi. Ye mumkin hai ke keemat minor supply area 0.6579 - 0.6571 ki taraf taveel aur correct phase ki taraf ja sakti hai keemat SMA 200 ko dynamic resistance ke tor par cross karne ke baad. Stochastic indicator ke parameters basically keemat ko upar jane mein kam taqwiyat faraham karte hain, kyunke parameters overbought zone tak pohnchnay se pehle cross ho gaye hain. Darmiyan mein, Awesome Oscillator (AO) indicator ka histogram jo level 0 ke ooper hai, uska volume wide nahi hai. Ye be shak isko downtrend ki taraf lotne mein asani faraham karega.

تبصرہ

Расширенный режим Обычный режим