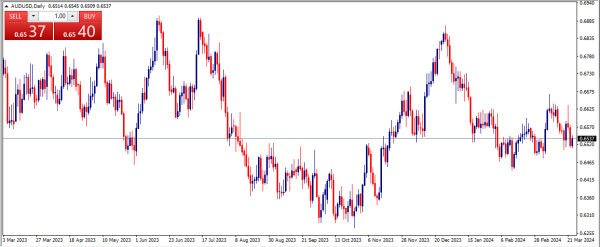

AUD/USD Technical Analysis.

AUD/USD ka local high 0.66395 hai aur iske upar aana ek acha khareedne ka mauqa hai. Market mein kafi saare buyers hain. Jab exchange rate 0.65155 area tak pohanchta hai, jaise is mamle mein hai, to ek solid signal samne aata hai; 0.6665 range mein ek thori si correction ho sakti hai phir se growth shuru hogi. Agar adjustments hote hain, to growth jari reh sakti hai. Market ne ek substantial correction dekha hai, isliye humein apna khareedna barhana chahiye. Humain 0.6725 area ke local top ka breakout dekhna hoga aur uske upar consolidation ho to aur khareedna chahiye. 0.6800 ke local high ka breakout hoga aur uske upar consolidation hoga, to yeh ek behtareen signal hoga khareedne ka. Interest jald hi badhega, jo khareedne ke liye ek mudda hoga. Thori si correction ke baad south mein, price ko barhane jari rakhna behtareen hoga. 0.6610 area mein breakout aur consolidation mumkin hai, jo ek behtareen mauqa hoga khareedne ka. Outlook growth ke liye hai thori si south ki correction ke baad. Jab hum 0.65630 ke upar chale gaye, toh humein continued strength dekhne ko mil sakti hai. AUD/USD H4 Timeframe: Agar ek downward impulse banega aur 0.6540 ke upar break hoga, toh yeh ek acha signal hoga khareedne ka, lekin main aaj itni zyada girawat ka intezaar nahi karta.

AUD/USD pair ka current status: Isne persistent upward movement dikhaya hai, jo bullish momentum ko dikhata hai jisse isne initial resistance ko paar karne ki ijaazat mili. Pair filhal 0.6800 par trade ho raha hai, sab se latest data ke mutabiq. Projections dekhne par focus classic Pivot levels' resistance points par shift hota hai potential growth ke liye. Umeed hai ke upward trajectory filhal ke levels se jari rahegi, shayad second resistance level at 0.6837 ko paar karne ka rasta kholegi. AUD/USD positive trend ek strong stance ko dikhata hai bulls ki taraf se market mein, jo ek significant push ko dikhata hai bulls ki taraf se. Traders aur investors ke liye jo potential opportunities dhund rahe hain is currency pair mein, unke liye consolidation initial resistance level ke upar ek mukammal raasta dikhata hai further ascent ke liye. Is upward movement mein kai factors hain jo ek broader context mein contribute kar rahe hain.

AUD/USD ka local high 0.66395 hai aur iske upar aana ek acha khareedne ka mauqa hai. Market mein kafi saare buyers hain. Jab exchange rate 0.65155 area tak pohanchta hai, jaise is mamle mein hai, to ek solid signal samne aata hai; 0.6665 range mein ek thori si correction ho sakti hai phir se growth shuru hogi. Agar adjustments hote hain, to growth jari reh sakti hai. Market ne ek substantial correction dekha hai, isliye humein apna khareedna barhana chahiye. Humain 0.6725 area ke local top ka breakout dekhna hoga aur uske upar consolidation ho to aur khareedna chahiye. 0.6800 ke local high ka breakout hoga aur uske upar consolidation hoga, to yeh ek behtareen signal hoga khareedne ka. Interest jald hi badhega, jo khareedne ke liye ek mudda hoga. Thori si correction ke baad south mein, price ko barhane jari rakhna behtareen hoga. 0.6610 area mein breakout aur consolidation mumkin hai, jo ek behtareen mauqa hoga khareedne ka. Outlook growth ke liye hai thori si south ki correction ke baad. Jab hum 0.65630 ke upar chale gaye, toh humein continued strength dekhne ko mil sakti hai. AUD/USD H4 Timeframe: Agar ek downward impulse banega aur 0.6540 ke upar break hoga, toh yeh ek acha signal hoga khareedne ka, lekin main aaj itni zyada girawat ka intezaar nahi karta.

AUD/USD pair ka current status: Isne persistent upward movement dikhaya hai, jo bullish momentum ko dikhata hai jisse isne initial resistance ko paar karne ki ijaazat mili. Pair filhal 0.6800 par trade ho raha hai, sab se latest data ke mutabiq. Projections dekhne par focus classic Pivot levels' resistance points par shift hota hai potential growth ke liye. Umeed hai ke upward trajectory filhal ke levels se jari rahegi, shayad second resistance level at 0.6837 ko paar karne ka rasta kholegi. AUD/USD positive trend ek strong stance ko dikhata hai bulls ki taraf se market mein, jo ek significant push ko dikhata hai bulls ki taraf se. Traders aur investors ke liye jo potential opportunities dhund rahe hain is currency pair mein, unke liye consolidation initial resistance level ke upar ek mukammal raasta dikhata hai further ascent ke liye. Is upward movement mein kai factors hain jo ek broader context mein contribute kar rahe hain.

تبصرہ

Расширенный режим Обычный режим