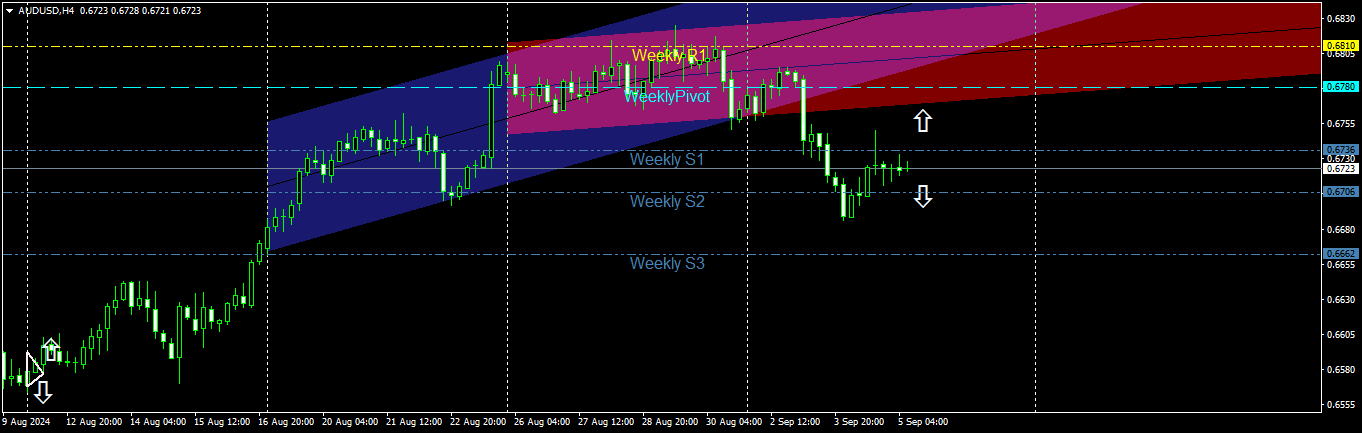

AUD/USD pair mein hume additional purchasing opportunities nazar aa rahi hain aur price 0.67622 zone ko cross kar sakti hai. Lekin, yaad rahe ke AUD/USD mein trade karte waqt khas kar jab news data release ho rahi ho, hume ehtiyaat se kaam lena chahiye aur high volumes se gurez karna chahiye. High trading volumes se market mein volatility aur risk barh jati hai, jo trading ko mushkil bana deti hai. News release ke dauran, market mein sharp aur unexpected movements ho sakte hain, jo agar sahi tareeke se manage na kiye gaye toh bade nuqsaanat ka sabab ban sakte hain. Is liye, yeh behtar hota hai ke moderate volumes ke saath trade karein aur risk management strategies ko implement karein, jaise ke stop-loss orders lagana aur predetermined levels par profit lena. Aaj ke liye ek buy order 0.68355 ka short target rakhna hamare liye kaafi hoga.

Hamare trading approach ko diversify karna bhi madadgar ho sakta hai, khas kar jab market mein high volatility ho. Sirf ek strategy par depend karne ke bajaye, hum technical aur fundamental analysis ka combination use kar sakte hain taake informed trading decisions le sakein. Technical analysis mein price charts ko dekhna aur indicators ka istemal karna shamil hota hai taake patterns aur trends identify kiye ja sakein, jabke fundamental analysis market ko affect karne wale economic factors ko samajhne par focus karta hai.

Technical analysis tools, jaise ke moving averages, trend lines, aur oscillators ka istemal, hume potential entry aur exit points identify karne mein madad de sakte hain. Moving averages, jaise 50-day aur 200-day moving averages, hume overall trend ka pata dene mein madad karte hain aur market ke bullish ya bearish phase mein hone ka andaza lagane mein madadgar hote hain. Trend lines hume support aur resistance levels identify karne mein madad karte hain, jabke oscillators jaise ke Relative Strength Index (RSI 14) overbought ya oversold conditions ko indicate karte hain. In tools ko price action ke saath combine karna hume accurate trading

Hamare trading approach ko diversify karna bhi madadgar ho sakta hai, khas kar jab market mein high volatility ho. Sirf ek strategy par depend karne ke bajaye, hum technical aur fundamental analysis ka combination use kar sakte hain taake informed trading decisions le sakein. Technical analysis mein price charts ko dekhna aur indicators ka istemal karna shamil hota hai taake patterns aur trends identify kiye ja sakein, jabke fundamental analysis market ko affect karne wale economic factors ko samajhne par focus karta hai.

Technical analysis tools, jaise ke moving averages, trend lines, aur oscillators ka istemal, hume potential entry aur exit points identify karne mein madad de sakte hain. Moving averages, jaise 50-day aur 200-day moving averages, hume overall trend ka pata dene mein madad karte hain aur market ke bullish ya bearish phase mein hone ka andaza lagane mein madadgar hote hain. Trend lines hume support aur resistance levels identify karne mein madad karte hain, jabke oscillators jaise ke Relative Strength Index (RSI 14) overbought ya oversold conditions ko indicate karte hain. In tools ko price action ke saath combine karna hume accurate trading

تبصرہ

Расширенный режим Обычный режим