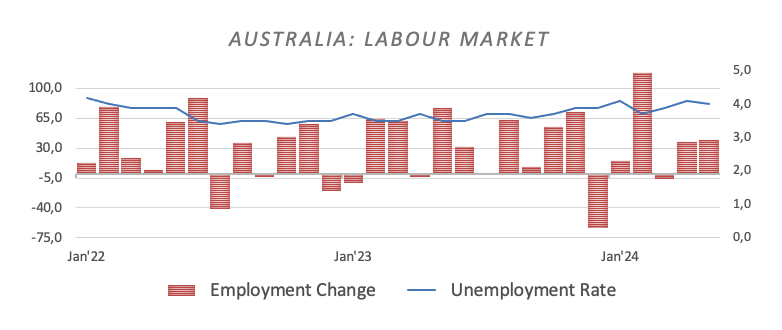

Australian Dollar (AUD) ne Thursday ko jaari hone wale musbat rozgar data ke bawajood mehngai ko samjha aur US Dollar (USD) ke khilaf gir gaya. Ye hairat angaiz waqia is ke bawajood aya ke taqatwar Aussie jobs numbers ke sath aya, Australian Bureau of Statistics ne May mein 39,700 jobs ki izafah darj kiya, jo ke 30,000 ki tawaqo ko peechay chor kar guzishta mahine ke 38,500 ke hasool ko bhi paar kar gaya. Berozgari dar bhi behtar hui, jo ke April mein tawaqo ki gayi 4.1% se 4.0% tak gir gayi. AUD ki kamzori ke peechay wajah lag rahi hai ke mojudah USD ke phir se ubhartay hue hone ki wajah se. Federal Reserve ke June ke imtehan mein iska qadri rukh le kar USD mazboot hua. Federal Open Market Committee (FOMC) ne mustaqbil ki mushahedat ke doran benchmark interest rate ko 5.25% se 5.50% tak sath qaim rakha, jo ke zyadatar market ke mohtamimun ki tawaqo thi. Ye faisla, sath hi investors ke umeedwar hote hue ke Thursday ke baad US ki maqool arziyon aur producer price index figures shamil honge, USD ko mazboot kiya.

Jab ke AUD/USD pair Thursday ko 0.6660 ke aas paas tha. Daily chart ki takhleeq ka takniki jaiza AUD/USD ke darmiyan ek musallas pattern ke andar ek consolidation phase ka izhar karta hai, jo ke ek be-jan market sentiment ko darust karta hai. 14-day Relative Strength Index (RSI) 50 ke thora neeche mojood hai, jo ke kisi wazeh rehnumai ki kami ko mazeed wazeh karta hai. Is level ke upar ya neeche faislay mustaqbil ke trend ka ishara kar sakte hain. Aglay dekhiye, AUD/USD ke liye fori support 50-day Exponential Moving Average (EMA) ke qareeb hai jo 0.6604 par hai, isay rectangle pattern ke nichle hadood ke 0.6585 par dekha jata hai. Agar AUD/USD upar ki taraf ko mojooda kiya to woh mazeed takhleeqati halchal ka samna kar sakta hai, yeh shayad 0.6700 ke aas paas ke area ko test kare, shayad May ke uchchatam 0.6714 tak bhi pohonch sake. Jab ke AUD/USD apni 0.63618 ke qareeb se kamiyon se tezabiat ko dur kar raha hai, kuch analysts ke mutabiq girawat abhi khatam nahi hui hai. Unka khayal hai ke jab tak ke qeemat 0.6699 ke neeche rahe, pair ke liye mazeed neeche ki taraf ka rukh mubtala rehta hai, jahan tak 0.6576-0.65002 ka maqsad hai. Magar yeh analysts is waqt AUD/USD ko farokht karne ki taqat nahi dete. Unka tajwez hai ke jab qeemat "neela dabba area" ko paunchti hai, to kharidne ki fa'alat mein izafa hone ka imkan hai, jo ke naye uchchatam ki taraf ya kam az kam aik ahem islahi bounce ki taraf le ja sakta hai.

تبصرہ

Расширенный режим Обычный режим