AUD/USD

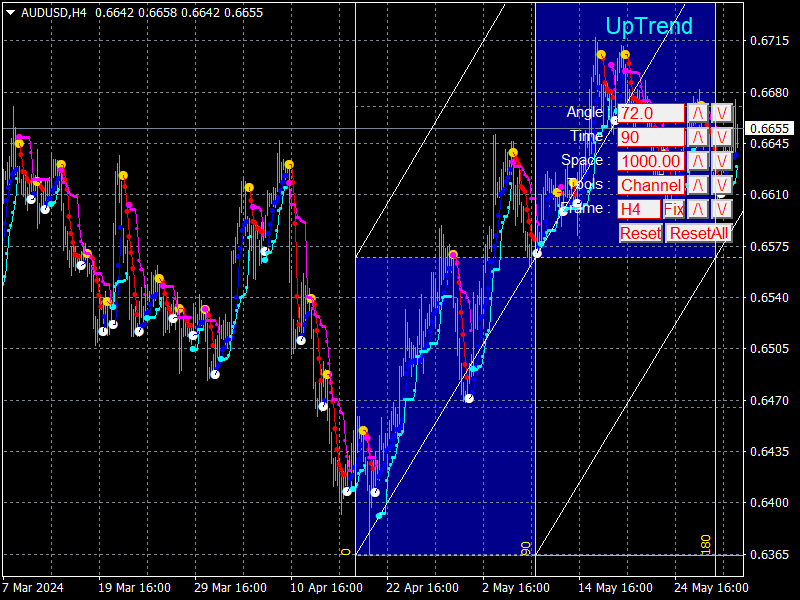

Pair ne shayad ek segment trend mein entry ki hai aur kyun ke “quality is your friend,” ye category-bound market approach phail sakti hai. Australian trading volume mein 0.6680 ka ek high (May 26 ko high) aur 0.6591 ka ek low (May 30 ko low) nazar aata hai.

Range mein ek leg up 0.6680 ke range ceiling tak pohanch sakta hai, phir wapas aata hai aur ek down leg shuru karta hai range ke bottom tak.

Moving Average Convergence Divergence (MACD) momentum indicator ne apni red signal line ke upar cross kiya hai, jo ek buy signal de raha hai aur upward move ko support kar raha hai.

Agar AUD/USD apne highs ya inke qareeb pohanchta hai aur phir ek Japanese candle turning pattern banata hai, to ye ishara ho sakta hai ke pair apna sideways trend extend kar raha hai aur ek leg down shuru kar raha hai. Agar MACD signal line ke neeche cross karta hai - khas taur par agar ye positive territory mein hai - to ye mazeed saboot provide karega ke ek downtrend narrow range mein develop ho raha hai.

Impossible breakdown: AUD/USD ne May 22 ko apne uptrend se breakout kiya, jo established rally par shak paida karta hai. Mountain ke neeche chase kamzor thi, aur pair ne jald apne pairo par khada ho gaya. Koi wazeh short-term guidance trend nahi hai jo yeh dikhata ho ke trend asal mein sidelines par hai.

Mazeed problems ki tasdeeq ke liye zaroori hai ke 0.6591 ke neeche ek decisive break ho, aur agla target shayad 0.6560 par ho jahan 100-day aur 50-day SMAs locate hain (nahi dikhaya gaya).

Decisive breaks long candles ke saath hoti hain jo level ko break karti hain aur apne high ya low ke qareeb close hoti hain. Teen candles row mein jo level ko break karti hain aur sab same color mein hoti hain (bearish decisive break ke liye red, aur bullish ke liye green).

Pair ne shayad ek segment trend mein entry ki hai aur kyun ke “quality is your friend,” ye category-bound market approach phail sakti hai. Australian trading volume mein 0.6680 ka ek high (May 26 ko high) aur 0.6591 ka ek low (May 30 ko low) nazar aata hai.

Range mein ek leg up 0.6680 ke range ceiling tak pohanch sakta hai, phir wapas aata hai aur ek down leg shuru karta hai range ke bottom tak.

Moving Average Convergence Divergence (MACD) momentum indicator ne apni red signal line ke upar cross kiya hai, jo ek buy signal de raha hai aur upward move ko support kar raha hai.

Agar AUD/USD apne highs ya inke qareeb pohanchta hai aur phir ek Japanese candle turning pattern banata hai, to ye ishara ho sakta hai ke pair apna sideways trend extend kar raha hai aur ek leg down shuru kar raha hai. Agar MACD signal line ke neeche cross karta hai - khas taur par agar ye positive territory mein hai - to ye mazeed saboot provide karega ke ek downtrend narrow range mein develop ho raha hai.

Impossible breakdown: AUD/USD ne May 22 ko apne uptrend se breakout kiya, jo established rally par shak paida karta hai. Mountain ke neeche chase kamzor thi, aur pair ne jald apne pairo par khada ho gaya. Koi wazeh short-term guidance trend nahi hai jo yeh dikhata ho ke trend asal mein sidelines par hai.

Mazeed problems ki tasdeeq ke liye zaroori hai ke 0.6591 ke neeche ek decisive break ho, aur agla target shayad 0.6560 par ho jahan 100-day aur 50-day SMAs locate hain (nahi dikhaya gaya).

Decisive breaks long candles ke saath hoti hain jo level ko break karti hain aur apne high ya low ke qareeb close hoti hain. Teen candles row mein jo level ko break karti hain aur sab same color mein hoti hain (bearish decisive break ke liye red, aur bullish ke liye green).

تبصرہ

Расширенный режим Обычный режим