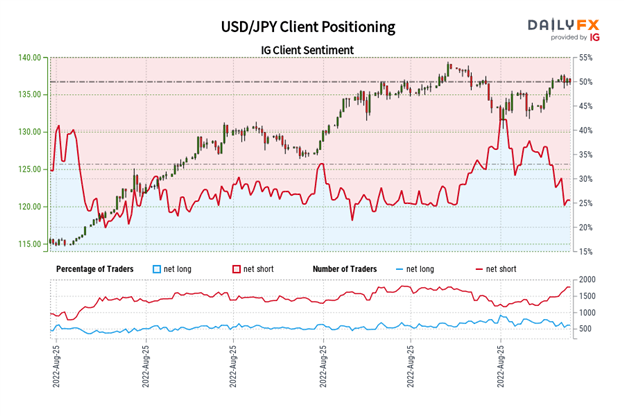

Dear Members: Ess USD/JPY kay new trader kay adad o shumar say pata chalta hiya 27.Sixty six dealer net lengthy hotay hein or foreign exchange trading ka quick say long ke ratio 2.Sixty two say 1 hiya net long trader ke general tadad four.Ninety eight say zyada hello or guzashta week say 5.22% say kam howdy jab keh internet quick dealer ke kul tadad mokabelay 1. 10 % say kam hey or guzashta week say 16.67 % say zyada whats upyeh aam tor par crowd kay emotion kay opposite point of view rakhtay hein or reality yeh hiya keh dealer khales short hey es say pata yeh chalta hiya keh USD/JPY ke prices growth ho rehe hein positions kull net kay makbelay mein zyada short hein laken last week kay makebalay mein zyada short hote hein majodah feelings or currently tabdeleon ke wajah say mazeed makhlot USD/JPY trading tasub frahm karty hein

Ess chart Mn July ke height kay ezafay kay awful USD/JPY ke sharah pechlay kuch days say forestall ho benefit hein jo keh forex marketplace mein trend line chamtay hovay hein goya yeh es bat ko discover karte hello keh trader mein hein breakout ya dobara breakout ke koi pain wajah ho sakte hello ya nahe yahan say ache wajah yeh howdy 139.39 ke salana onchai ko awareness lay kar aay ga jab keh july ke swing low say nechay dahkailnay ke wajah march or August ke swing low say barahtay hovay trend line ke taraf h jay ge jo keh month kay end mein 133.00 kay kareen ho jay ge

Ess chart Mn July ke height kay ezafay kay awful USD/JPY ke sharah pechlay kuch days say forestall ho benefit hein jo keh forex marketplace mein trend line chamtay hovay hein goya yeh es bat ko discover karte hello keh trader mein hein breakout ya dobara breakout ke koi pain wajah ho sakte hello ya nahe yahan say ache wajah yeh howdy 139.39 ke salana onchai ko awareness lay kar aay ga jab keh july ke swing low say nechay dahkailnay ke wajah march or August ke swing low say barahtay hovay trend line ke taraf h jay ge jo keh month kay end mein 133.00 kay kareen ho jay ge

تبصرہ

Расширенный режим Обычный режим