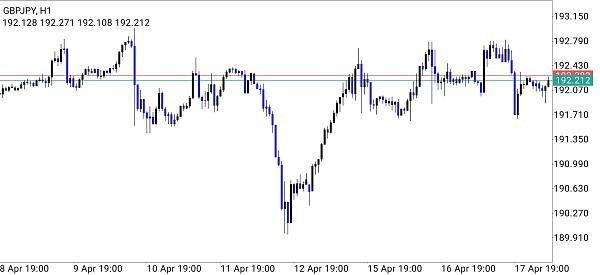

GBP/JPY jodi ka tajziya karte hue, panchwa point saaf tor par dikhata hai ke chart seedha upar ja raha hai. Iska matlab hai ke hum aur kharidenge. Hum 191.97 se lekar 191.62 ke darmiyan nivesh karna chahte hain. Jab maine sabhi khatron ka andaza lagaya, to maine set stop ko 191.57 ke aas-pass rakha. Is tarah, muawza Rs. 192.78 ke qeemat par ada kiya jaana hoga. Is situation mein, munafa 5 guna set stop hona chahiye. Abhi meri chaat meri manzil tak nahi pahunchi hai. Pehle maine slippage ka istemal karke trading ki aur munafa par tawajju di. Kuch nahi mila. Mois ki khabron ko todna aur apna munafa tax trading mein talash karna, is khatarnak aamal ne mujhe waqt ke sath samajhaya ke ye bewakoofana amal nahi madad karega. Isliye, maine khabron ke dauran trading puri tarah band kar di.

GBP/JPY jodi ek range mein trade ho rahi hai aur mukhya intraday dynamics neutral hain. 193.51 ke neeche ek break aur lambi taur par resistance tak aur lambi taur par resistance tak aur 195.86 ke dar par aur tezi shuru kar dega. Lekin, bazaar ki taraqqi 123.94 (2020 ki kamai) se shuru hone wale ek up trend ka hissa hai aur yeh lambi taur par 195.86 (2015 ki unchai) tak lambi taur par resistance ke saath jaari hai. 187.94 ka support aaj mid-term support ka pehla nishaan tha. Warna, agar koi peechey jaata hai, to raftaar phir bhi wahi hogi.

Is chhotey se maqal mein humne GBP/JPY H1 time frame par trading ki situation ka tajziya kiya hai. Ye tajziya Mukhtar ne bazaar ke trends ko dhyaan mein rakhte hue likha hai. Apne maqsad ko saaf taur par pehchankar aur hamesha apne khatron ka tasavvur karte hue trading mein behtar nateeje hasil kiye ja sakte hain. Bandobast aur tajurba trading mein kamiyabi ke liye bohot ahem kirdaar ada karte hain. Jo log apne karobaar ke kamiyabi ke liye dua karte hain, unki umeed achhi qismat par hai.

GBP/JPY jodi ek range mein trade ho rahi hai aur mukhya intraday dynamics neutral hain. 193.51 ke neeche ek break aur lambi taur par resistance tak aur lambi taur par resistance tak aur 195.86 ke dar par aur tezi shuru kar dega. Lekin, bazaar ki taraqqi 123.94 (2020 ki kamai) se shuru hone wale ek up trend ka hissa hai aur yeh lambi taur par 195.86 (2015 ki unchai) tak lambi taur par resistance ke saath jaari hai. 187.94 ka support aaj mid-term support ka pehla nishaan tha. Warna, agar koi peechey jaata hai, to raftaar phir bhi wahi hogi.

Is chhotey se maqal mein humne GBP/JPY H1 time frame par trading ki situation ka tajziya kiya hai. Ye tajziya Mukhtar ne bazaar ke trends ko dhyaan mein rakhte hue likha hai. Apne maqsad ko saaf taur par pehchankar aur hamesha apne khatron ka tasavvur karte hue trading mein behtar nateeje hasil kiye ja sakte hain. Bandobast aur tajurba trading mein kamiyabi ke liye bohot ahem kirdaar ada karte hain. Jo log apne karobaar ke kamiyabi ke liye dua karte hain, unki umeed achhi qismat par hai.

تبصرہ

Расширенный режим Обычный режим