GBP/JPY: Technical outlook

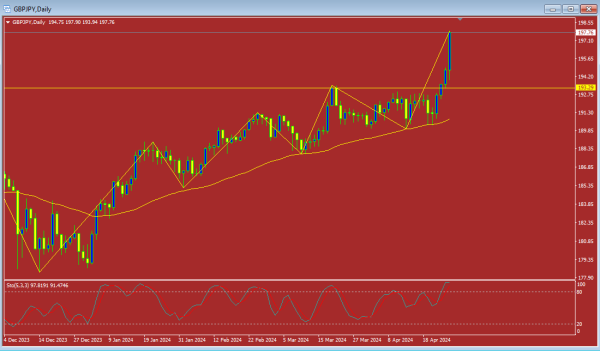

April 25 ko GBP/JPY currency pair ki trading situation ka tajziyah. GBP/JPY currency pair musalsal shumali paharon mein toofan barpaar hai. Guzishta din kuch khaas nahi tha siwaaye unchaai mein izafa karne ke ilawa. Trading din ka ikhtitam hone par, jodi ke qareeb qarz hadaf tak pohanch gayi thi - gray NKZ. Aaj Asian session mein, intehai ProMaker indicator ke liye target No. 2 ko pohanchna jari raha - gray NKZ. Hadaf ko update karne ke baad, mansooba mein tabdeeli nahi hui aur quotes musalsal barh rahe hain. Maazi se acha daam ka ilaqa mojooda buland tareen se banaya gaya hai, lekin buland tareen ki tajdeed hone ka zyada imkaan hai ke qareebi zones par taqreeban ek islah ho. Abhi ke liye, khareedari ke liye faida-mand daam ka ilaqa margin zones ke lehaz se haray zones 1/4 aur 1/2 ke darmiyan mojood hai jo 04/25/2024 ke buland darja par banaya gaya hai. Zones 1/4 ke buland darja ka qarz - 193.409 aur zones 1/2 ke buland darja ka qarz - 191.909. Takneeki hadaf No. 1: 04/25/2024 ke buland darja ko update karna - 194.909. Margin hadaf No. 2: sunehri rang ke NKZ ke lower limit ka quote test karna - 196.686. Margin hadaf No. 3: gray NKZ ke lower limit ka quote test karna - 199.686. Aala inaam: faida-mand daam ke ilaqa se khareedari. Kharidain: 193.409-191.909, TP1-194.909, TP2- 196.686, TP3- 199.686.

Pound/yen apni urooj ki movement jari rakhta hai, aaj jodi ne phir se maqami maximum ko update kiya hai aur 2015 ke buland darjoo tak qareeb aagaya hai. Pichli dafa humne is ilaqe se khaas inkar dekha tha, aur mumkin hai ke yeh barabar hone ka imkaan hai. Magar, main is assumption par short positions nahi kholunga, kyun ke takneeki tajziyah mein is ka koi ishara nahi hai. Ghantawar chart par, indicators musalsal oopar ki taraf ishara dete hain, haal hi ki bullish candles par Bollinger Bands phelne lage hain, is liye urooj ki impulse ka jari rehne ka imkaan hai. Asaas indicators ko ye jazba seemit karna lagta hai, bearish divergences dikha rahe hain. Magar seedha mukhalifat ke liye koi direct signals nahi hain. 4 ghantay ka chart dekhte hue, indicators bhi urooj ki movement ka mukammal support karte hain, sirf Bollinger Bands ek mumkinah maqami islah ke isharaat dete hain, jo ke us ke darmiyan se upar se test karne ka maqsad rakhte hain.

April 25 ko GBP/JPY currency pair ki trading situation ka tajziyah. GBP/JPY currency pair musalsal shumali paharon mein toofan barpaar hai. Guzishta din kuch khaas nahi tha siwaaye unchaai mein izafa karne ke ilawa. Trading din ka ikhtitam hone par, jodi ke qareeb qarz hadaf tak pohanch gayi thi - gray NKZ. Aaj Asian session mein, intehai ProMaker indicator ke liye target No. 2 ko pohanchna jari raha - gray NKZ. Hadaf ko update karne ke baad, mansooba mein tabdeeli nahi hui aur quotes musalsal barh rahe hain. Maazi se acha daam ka ilaqa mojooda buland tareen se banaya gaya hai, lekin buland tareen ki tajdeed hone ka zyada imkaan hai ke qareebi zones par taqreeban ek islah ho. Abhi ke liye, khareedari ke liye faida-mand daam ka ilaqa margin zones ke lehaz se haray zones 1/4 aur 1/2 ke darmiyan mojood hai jo 04/25/2024 ke buland darja par banaya gaya hai. Zones 1/4 ke buland darja ka qarz - 193.409 aur zones 1/2 ke buland darja ka qarz - 191.909. Takneeki hadaf No. 1: 04/25/2024 ke buland darja ko update karna - 194.909. Margin hadaf No. 2: sunehri rang ke NKZ ke lower limit ka quote test karna - 196.686. Margin hadaf No. 3: gray NKZ ke lower limit ka quote test karna - 199.686. Aala inaam: faida-mand daam ke ilaqa se khareedari. Kharidain: 193.409-191.909, TP1-194.909, TP2- 196.686, TP3- 199.686.

Pound/yen apni urooj ki movement jari rakhta hai, aaj jodi ne phir se maqami maximum ko update kiya hai aur 2015 ke buland darjoo tak qareeb aagaya hai. Pichli dafa humne is ilaqe se khaas inkar dekha tha, aur mumkin hai ke yeh barabar hone ka imkaan hai. Magar, main is assumption par short positions nahi kholunga, kyun ke takneeki tajziyah mein is ka koi ishara nahi hai. Ghantawar chart par, indicators musalsal oopar ki taraf ishara dete hain, haal hi ki bullish candles par Bollinger Bands phelne lage hain, is liye urooj ki impulse ka jari rehne ka imkaan hai. Asaas indicators ko ye jazba seemit karna lagta hai, bearish divergences dikha rahe hain. Magar seedha mukhalifat ke liye koi direct signals nahi hain. 4 ghantay ka chart dekhte hue, indicators bhi urooj ki movement ka mukammal support karte hain, sirf Bollinger Bands ek mumkinah maqami islah ke isharaat dete hain, jo ke us ke darmiyan se upar se test karne ka maqsad rakhte hain.

تبصرہ

Расширенный режим Обычный режим