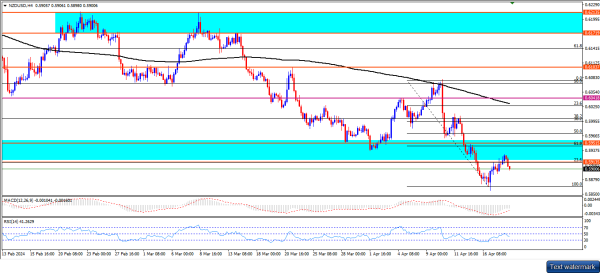

H-4 Timeframe Analysis

NZD/USD jora pichle haftay ki resistance ke qareeb barhna rok gaya. Umeedain aab pastar taraf hai. Currency pair traders Bank of NEW ZEALAND ke interest rate decision ka intezaar kar rahe hain. NZD/USD ne din ko kuch niche shuru kiya, jab uski izafa last week ki resistance ke qareeb ruk gayi thi, jo 0.5993 par thi. Khaas tor par, traders Bank of NEW ZEALAND ke interest rate decision ka intezaar kar rahe hain. 0.5990 level July se October ki upar ki taraf rukhne ki 38.2% Fibonacci retracement level ke sath milta hai, jo ek pullback ko mumkin banata hai. Overbought halaat se phir se chadhne ke bawajood, RSI abhi tak 50 equillibrium level se upar nahi utha hai, aur MACD levels laal signal line ke neeche hain, jisse yeh zahir hota hai ke nazdeeki muddat ki bharakari abhi shuru nahi hui hai.

Saral 20- aur 50-day moving averages aur 2020 ke unchayiyo se draw ki gayi ek descending trendline 0.60410 mark ke kareeb kisi bhi upside ko rok sakti hai. Agar buyers in rukawaton ko paar kar sakein, to 23.6% Fibonacci retracement level 0.6137 aur 0.62750 compression zone advance ko rok sakte hain, taake taqatwar karkardagi ko taal sakte hain, jo 0.63840 aur 0.64870 areas ki taraf tezi se hamla karte hain.

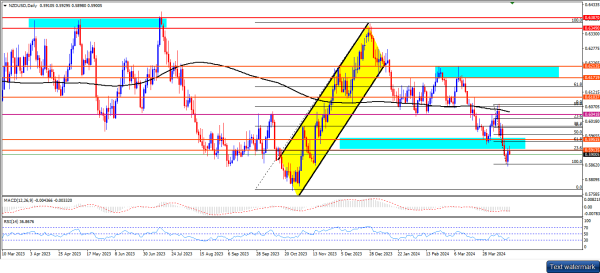

Daily Timeframe Analysis

Ek downside correction sab se pehle 200-day moving average aur 0.58494 ke 50% Fibonacci retracement level ke darmiyan ho sakta hai. Agar sellers yahan apna dabav mazboot karen, toh prices 0.5742 limit line ki taraf gir sakti hain jo November se held hai, ya phir 61.8% Fibonacci retracement level at.0.56400. Mazeed nuqsanat ki sambhavna hai ke pair 2024 ki up trend line ko test kare jo 0.6300 area mein hai. Mukhtasir tor par, jab NZD/USD ne is haftay mein apne kuch izafaat ko kam kar liya hai, to NZD/USD ke liye downside risks abhi khatam nahi hue hain. Ek mustaqil ralley ka istiqamat 0.6200 aur 0.6250 resistance zones ke upar shayad zaroori ho ga takay bullish outlook ko palat diya ja sake. Yeh raat neeche di gayi chart hai:

NZD/USD jora pichle haftay ki resistance ke qareeb barhna rok gaya. Umeedain aab pastar taraf hai. Currency pair traders Bank of NEW ZEALAND ke interest rate decision ka intezaar kar rahe hain. NZD/USD ne din ko kuch niche shuru kiya, jab uski izafa last week ki resistance ke qareeb ruk gayi thi, jo 0.5993 par thi. Khaas tor par, traders Bank of NEW ZEALAND ke interest rate decision ka intezaar kar rahe hain. 0.5990 level July se October ki upar ki taraf rukhne ki 38.2% Fibonacci retracement level ke sath milta hai, jo ek pullback ko mumkin banata hai. Overbought halaat se phir se chadhne ke bawajood, RSI abhi tak 50 equillibrium level se upar nahi utha hai, aur MACD levels laal signal line ke neeche hain, jisse yeh zahir hota hai ke nazdeeki muddat ki bharakari abhi shuru nahi hui hai.

Saral 20- aur 50-day moving averages aur 2020 ke unchayiyo se draw ki gayi ek descending trendline 0.60410 mark ke kareeb kisi bhi upside ko rok sakti hai. Agar buyers in rukawaton ko paar kar sakein, to 23.6% Fibonacci retracement level 0.6137 aur 0.62750 compression zone advance ko rok sakte hain, taake taqatwar karkardagi ko taal sakte hain, jo 0.63840 aur 0.64870 areas ki taraf tezi se hamla karte hain.

Daily Timeframe Analysis

Ek downside correction sab se pehle 200-day moving average aur 0.58494 ke 50% Fibonacci retracement level ke darmiyan ho sakta hai. Agar sellers yahan apna dabav mazboot karen, toh prices 0.5742 limit line ki taraf gir sakti hain jo November se held hai, ya phir 61.8% Fibonacci retracement level at.0.56400. Mazeed nuqsanat ki sambhavna hai ke pair 2024 ki up trend line ko test kare jo 0.6300 area mein hai. Mukhtasir tor par, jab NZD/USD ne is haftay mein apne kuch izafaat ko kam kar liya hai, to NZD/USD ke liye downside risks abhi khatam nahi hue hain. Ek mustaqil ralley ka istiqamat 0.6200 aur 0.6250 resistance zones ke upar shayad zaroori ho ga takay bullish outlook ko palat diya ja sake. Yeh raat neeche di gayi chart hai:

تبصرہ

Расширенный режим Обычный режим