Tijarat ke daimi aur hamesha tabdeel hone wale manzar mein, choti arsi mein faida hasil karne ka kashish hararat se bulaata hai. Magar, tajroba kar tijaratgar samajhte hain ke bazaar mein safar karte waqt sabr aur disiplin ka ehemiyat ko samajhna intehai zaroori hai. Mouqaan ke intezar mein dakhil ya ikhtitaam ka intezar karte waqt trading ke natayej ko nihayat farq karta hai, jo kamyaab ko beasar se alag karta hai.Kam karne aur ek disiplin bardasht karne ke zariye, tijaratgar bazaar mein mojood ghaalib uncertainities ko effectively taraqqi dene ke liye aur faida uthane ke liye tayyari kar sakte hain jab woh maujooda trading setups ko seize karte hain. Haalat ko samajhne ke liye hal koi bhi recent movements mein USD/JPY currency pair mein dekha ja sakta hai. Ye fluctuations forex market ki aasmani tabiyat ka yakeeni hisa hain aur price action ko qareeb se nigrani rakhne ka ehemiyat samjhaate hain.

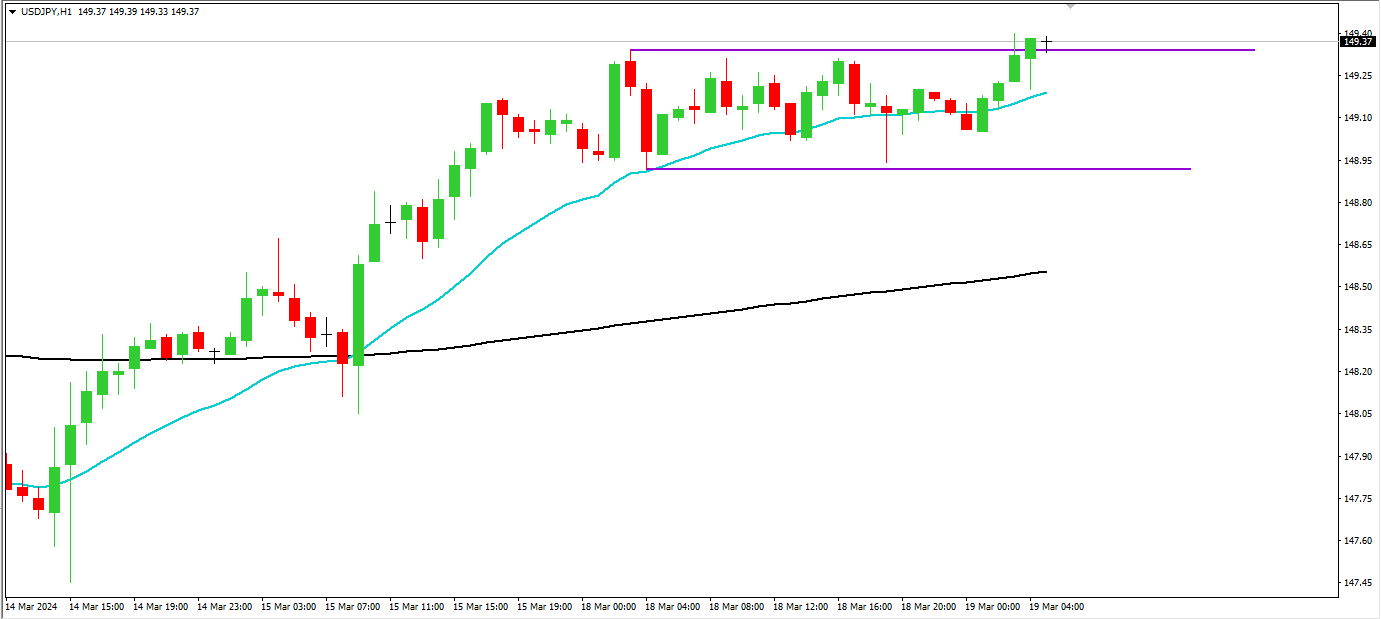

usd/jpy analysis:

Tijaratgar jo mutawazan rehkar aur istidrak ke saath amal karte hain apne aapko potential market opportunities par qaboo rakhte hain jab ke woh juraat se asaar ke sath mutasir hone wale khatraat ko kamyabi se manage karte hain. Har waqt ke is mohlik mahol mein, qeemat ke harek harkat ko pehchaan karne mein proactive taur par shiraki hona laazim hai. USD/JPY pair is badalne wale paradigm shift ka ek shandar misaal hai, jo bazaar ki tabdeeliyon ke tasur aur samajh ke liye zaroori hai.

Jab hum USD/JPY pair ke maujooda haalat ke pechida pechida mein gehrai tak ghushte hain, to in tabdilon ko pehchaanne aur samajhne ki ehemiyat taizi se zahir hoti hai. Har tabdil, chahe wo subtile ho ya zahir, tijaratgaron ke liye bazaar ke nuances ke mawafiq qeemat hain jo bazaar ki sarasar imrazi ke liye mashhoor hain.

Bunyadi taur par, tijarat mein kamiyabi sirf bazaar ki harkat ko peshgoi karne ki salahiyat par nahi muntazim hai, balki ye muntazim hone ki disiplin par bhi hai aur mushkil halaat ke istiqbal ko adapt karne ki qudrat par bhi. Is mein bazaar dynamics ki mukammal samajh, ek maqool tijarati tareeqa ke sath mazbooti se juraat shamil hai.Is ke ilawa, USD/JPY pair aam forex market ka ek misal hai, jo aalam-e-aqsaam ki iqtisadi trends, siyasi o arzi tabadlaat aur mawazan siyasi intizamat ka aks dikhata hai. Is tarah, is khaas currency pair ke pichide haseel karne se, tijaratgar bazaar mein aam intezamat par qabu paate hain.

Ikhtitami taur par, choti arsi mein faida hasil karne ka kashish bakhshi ja sakta hai, tijarat mein mustaqil kamiyabi ka rasta sabr, disiplin aur mustanadgi mein hai. Price action ko qareeb se nigrani rakhkar, patterns ko pehchaankar aur bazaar ke asasiyat ke bare mein maaloomat ikhtiyaar karke, tijaratgar forex market ke complexities ko pur itminan aur durusti se samjha ja sakta hai.

usd/jpy analysis:

Tijaratgar jo mutawazan rehkar aur istidrak ke saath amal karte hain apne aapko potential market opportunities par qaboo rakhte hain jab ke woh juraat se asaar ke sath mutasir hone wale khatraat ko kamyabi se manage karte hain. Har waqt ke is mohlik mahol mein, qeemat ke harek harkat ko pehchaan karne mein proactive taur par shiraki hona laazim hai. USD/JPY pair is badalne wale paradigm shift ka ek shandar misaal hai, jo bazaar ki tabdeeliyon ke tasur aur samajh ke liye zaroori hai.

Jab hum USD/JPY pair ke maujooda haalat ke pechida pechida mein gehrai tak ghushte hain, to in tabdilon ko pehchaanne aur samajhne ki ehemiyat taizi se zahir hoti hai. Har tabdil, chahe wo subtile ho ya zahir, tijaratgaron ke liye bazaar ke nuances ke mawafiq qeemat hain jo bazaar ki sarasar imrazi ke liye mashhoor hain.

Bunyadi taur par, tijarat mein kamiyabi sirf bazaar ki harkat ko peshgoi karne ki salahiyat par nahi muntazim hai, balki ye muntazim hone ki disiplin par bhi hai aur mushkil halaat ke istiqbal ko adapt karne ki qudrat par bhi. Is mein bazaar dynamics ki mukammal samajh, ek maqool tijarati tareeqa ke sath mazbooti se juraat shamil hai.Is ke ilawa, USD/JPY pair aam forex market ka ek misal hai, jo aalam-e-aqsaam ki iqtisadi trends, siyasi o arzi tabadlaat aur mawazan siyasi intizamat ka aks dikhata hai. Is tarah, is khaas currency pair ke pichide haseel karne se, tijaratgar bazaar mein aam intezamat par qabu paate hain.

Ikhtitami taur par, choti arsi mein faida hasil karne ka kashish bakhshi ja sakta hai, tijarat mein mustaqil kamiyabi ka rasta sabr, disiplin aur mustanadgi mein hai. Price action ko qareeb se nigrani rakhkar, patterns ko pehchaankar aur bazaar ke asasiyat ke bare mein maaloomat ikhtiyaar karke, tijaratgar forex market ke complexities ko pur itminan aur durusti se samjha ja sakta hai.

تبصرہ

Расширенный режим Обычный режим