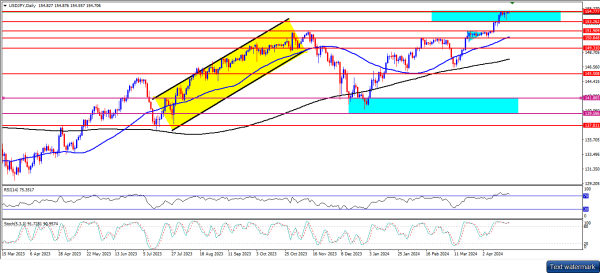

USD/JPY Ka Technical Analysis

Hello, sab log. Kaise hain aap? Aaj, maine forum mein apni tajziya share ki hai takay forex market ko pehchan sakein. USD/JPY ne early 2024 se upar jaane ka rasta apna liya hai lekin yeh ab 13 mahinay ka uncha hone ke baad chauthi bar lagataar haftay ke nuksan ka samna kar raha hai, jab yeh 155.90 ka uncha chhod kar peeche hat gaya. Takniki tor par, kharidar abhi bhi control mein ho sakte hain kyunke market lambay arsay ke uptrend line ke oper hai. Magar, takniki indicators neeche ki correction ka mumkin ishara de rahe hain, jo hilne wali qeemat ka paigham hai. RSI 50 ke aas paas ke equilibrium level ki taraf gir raha hai, aur stochastic oversold zone ki taraf ja raha hai. Neeche di gayi chart dekhein.

Agar prices 155.00 ke oper qaim rahain, to kharidard pair ko 13 mahinay ke unchayi 156.90 ke oper close kar sakte hain. Is tarah, jab market agle manfi darjat 157.00 aur 159.00 ko todega, to yeh turant April 1990 ki unchi 160.70 par tawajju par laga sakta hai.

Agar ek ghair tabiyat mein, agar kami jaari rahe, to bechnay wali dabao afzayega aur 152.00 support ki taraf jaega. Uske baad, agar kami jaari rahe, to yeh ek retest ke liye uptrend line ki taraf le jaega jo 50-day moving average ke saath 150.00 par milta hai. Is ke agay ki harkat is raaste ko khol sakti hai pair ke liye 149.20 ki taraf ja rahi hai. Mukhtasir tor par, USD/JPY agle sessions mein support mil sakta hai lekin agle downtrend line tak zaroori tor par wapas nahi aaega.

Hello, sab log. Kaise hain aap? Aaj, maine forum mein apni tajziya share ki hai takay forex market ko pehchan sakein. USD/JPY ne early 2024 se upar jaane ka rasta apna liya hai lekin yeh ab 13 mahinay ka uncha hone ke baad chauthi bar lagataar haftay ke nuksan ka samna kar raha hai, jab yeh 155.90 ka uncha chhod kar peeche hat gaya. Takniki tor par, kharidar abhi bhi control mein ho sakte hain kyunke market lambay arsay ke uptrend line ke oper hai. Magar, takniki indicators neeche ki correction ka mumkin ishara de rahe hain, jo hilne wali qeemat ka paigham hai. RSI 50 ke aas paas ke equilibrium level ki taraf gir raha hai, aur stochastic oversold zone ki taraf ja raha hai. Neeche di gayi chart dekhein.

Agar prices 155.00 ke oper qaim rahain, to kharidard pair ko 13 mahinay ke unchayi 156.90 ke oper close kar sakte hain. Is tarah, jab market agle manfi darjat 157.00 aur 159.00 ko todega, to yeh turant April 1990 ki unchi 160.70 par tawajju par laga sakta hai.

Agar ek ghair tabiyat mein, agar kami jaari rahe, to bechnay wali dabao afzayega aur 152.00 support ki taraf jaega. Uske baad, agar kami jaari rahe, to yeh ek retest ke liye uptrend line ki taraf le jaega jo 50-day moving average ke saath 150.00 par milta hai. Is ke agay ki harkat is raaste ko khol sakti hai pair ke liye 149.20 ki taraf ja rahi hai. Mukhtasir tor par, USD/JPY agle sessions mein support mil sakta hai lekin agle downtrend line tak zaroori tor par wapas nahi aaega.

تبصرہ

Расширенный режим Обычный режим