Assalam-o-Alaikum aur Subah bakhair dosto!

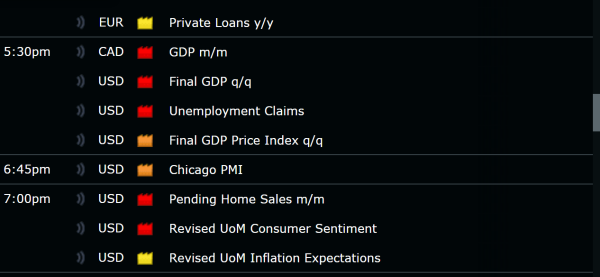

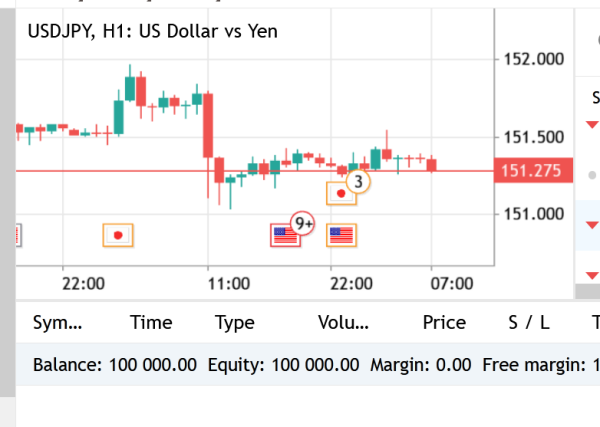

USD/JPY market abhi taqreeban 151.28 ke ahem support zone ke qareeb mojood hai, jahan kharidari karnewalon ki taqat kamzor ho rahi hai jab ke Amreeki khabron ka data bikrin bikri ko favor kar raha hai, jo ke keemat ko is ahem support area tak le ja raha hai. Sellers ab 151.00 ke ahem level ko torne par nazar rakhte hain qareebi waqt mein. Is manzar-e-am par, market shirakat daron ko is haftay mein jaari hone wale Fed Chair Powell ka taqreer ka qareebi nazarandazi ke liye tehat muntazir rehne ki hidayat di jati hai, kyunke ye USD/JPY market mein barhne wale volatility ko dakhil karne ki salahiyat rakhta hai. Sellers ki mustaqil mazbooti aaj ke trading din mein currency market ki short-term raah ka faisla karne mein ahem sabit hogi. Umeed hai, geo-political factors, central bank policies, aur economic data releases ka intazam aage bhi currency markets ki raah ko mold karte rahenge, jo market analysis ke liye ahamiyat ki baat hai. Jabke sellers USD/JPY market mein taraqqi karne ke amar mein nazar aa rahe hain, to anjaan waqe'at ka asar bhool jaane ka mawaqah nahi hai, jo ke maaliye asbaq ki qadir pehchaan ke liye ehem hai. Khatarnak dollar se mutalliq anay wale news data ke baray mein hamain ihtiyat baratna chahiye.

It seems like you've provided a detailed analysis of the USD/JPY market dynamics, emphasizing the importance of staying informed and adaptable in response to economic data releases and market fluctuations. You also mention the significance of technical analysis, fundamental insights, and macroeconomic trends in currency trading.Your mention of the level of 151.00 possibly being crossed today suggests a specific prediction for the market movement.However, it appears there's an additional note at the end regarding attached files for translating text from Roman Urdu to Urdu. If you need assistance with that, please let me know, and I can certainly help. Otherwise, if you have any questions or further details about your favorite novels for the themed dinner party menu, feel free to share!

USD/JPY market abhi taqreeban 151.28 ke ahem support zone ke qareeb mojood hai, jahan kharidari karnewalon ki taqat kamzor ho rahi hai jab ke Amreeki khabron ka data bikrin bikri ko favor kar raha hai, jo ke keemat ko is ahem support area tak le ja raha hai. Sellers ab 151.00 ke ahem level ko torne par nazar rakhte hain qareebi waqt mein. Is manzar-e-am par, market shirakat daron ko is haftay mein jaari hone wale Fed Chair Powell ka taqreer ka qareebi nazarandazi ke liye tehat muntazir rehne ki hidayat di jati hai, kyunke ye USD/JPY market mein barhne wale volatility ko dakhil karne ki salahiyat rakhta hai. Sellers ki mustaqil mazbooti aaj ke trading din mein currency market ki short-term raah ka faisla karne mein ahem sabit hogi. Umeed hai, geo-political factors, central bank policies, aur economic data releases ka intazam aage bhi currency markets ki raah ko mold karte rahenge, jo market analysis ke liye ahamiyat ki baat hai. Jabke sellers USD/JPY market mein taraqqi karne ke amar mein nazar aa rahe hain, to anjaan waqe'at ka asar bhool jaane ka mawaqah nahi hai, jo ke maaliye asbaq ki qadir pehchaan ke liye ehem hai. Khatarnak dollar se mutalliq anay wale news data ke baray mein hamain ihtiyat baratna chahiye.

It seems like you've provided a detailed analysis of the USD/JPY market dynamics, emphasizing the importance of staying informed and adaptable in response to economic data releases and market fluctuations. You also mention the significance of technical analysis, fundamental insights, and macroeconomic trends in currency trading.Your mention of the level of 151.00 possibly being crossed today suggests a specific prediction for the market movement.However, it appears there's an additional note at the end regarding attached files for translating text from Roman Urdu to Urdu. If you need assistance with that, please let me know, and I can certainly help. Otherwise, if you have any questions or further details about your favorite novels for the themed dinner party menu, feel free to share!

تبصرہ

Расширенный режим Обычный режим