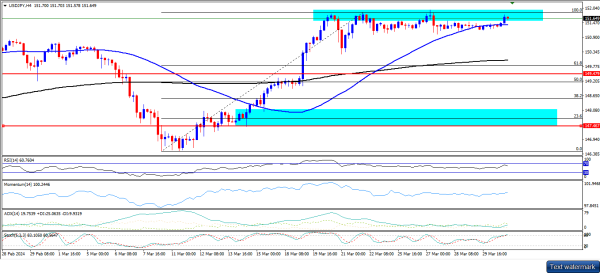

H-4 Timeframe Analysis

USD/JPY currency pair aaj thoda neeche ja rahi hai jab market ke shirkat daron ka tawajjo geo-political waqiat aur mazeed oil ke daamon ke barhne ki taraf mabni hai. Pair abhi ek nisf nek phase ka samna kar raha hai, lekin intervention ke khatrey hain jab tak pair 150 ke level ke neeche trade kar raha hai. Halankay aaj ka Hangman candle aik mazboot bearish signal tha, lekin momentum indicator abhi bhi mix signals dikhata hai. Average directional movement indicator 25 ke level ke neeche hai, jo dikhata hai ke trading market sideways hai. Doosri taraf, RSI ne apne equilibrium level 50 tak pohonch kar do aur aadhi mahinay se zyada guzar chuki hai, jo ek mazboot market rebound ko tasdeeq karta hai. Zyada ahmiyat se, stochastic ne apne moving averages ke upar chadh kar temporary tor par overbought territory mein chala gaya hai. Agar yeh movement tezi se barhta hai, toh yeh bullish signal consider kiya ja sakta hai.

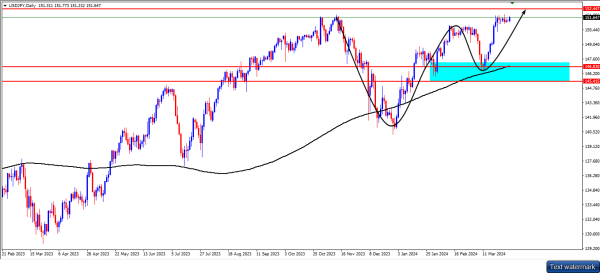

Daily Timeframe Analysis

Agar sellers faisla karen ke buyers ki hichkichahat ka faida uthayen, toh woh pair ko 149.53 aur 147.46 areas ke neeche daba sakte hain. Uske baad, woh support area ko toorna chahenge, jo downtrend ke 38.2% Fibonacci retracement level ko shamil karta hai, jo 146.65 par hai. Lekin unhein samajhdar 144.49 aur 144.99 area ko paar karne mein mushkil ho sakti hai, jo qareebi arsay mein market sentiment ke liye ahmiyat rakhta hai.

Warna, buyers pair ko buland karne ki koshish karenge bina Japani authorities ko gussa dilaye. Woh dobara all-time high 152.44 tak pohanchne ki koshish kar sakte hain. Agar unhein is level ko toorna hai, toh unhein ek naya uncha muqam hasil karne ka mauka mil sakta hai aur mukhtalif 155.94 high tak pohanch sakte hain. Toh, USDJPY sellers hal ke quiet trading session aur Japani sarkar ke intervention ke khula khatra ka faida uthane ki koshish kar rahe hain.

Yeh raha chart neeche:

USD/JPY currency pair aaj thoda neeche ja rahi hai jab market ke shirkat daron ka tawajjo geo-political waqiat aur mazeed oil ke daamon ke barhne ki taraf mabni hai. Pair abhi ek nisf nek phase ka samna kar raha hai, lekin intervention ke khatrey hain jab tak pair 150 ke level ke neeche trade kar raha hai. Halankay aaj ka Hangman candle aik mazboot bearish signal tha, lekin momentum indicator abhi bhi mix signals dikhata hai. Average directional movement indicator 25 ke level ke neeche hai, jo dikhata hai ke trading market sideways hai. Doosri taraf, RSI ne apne equilibrium level 50 tak pohonch kar do aur aadhi mahinay se zyada guzar chuki hai, jo ek mazboot market rebound ko tasdeeq karta hai. Zyada ahmiyat se, stochastic ne apne moving averages ke upar chadh kar temporary tor par overbought territory mein chala gaya hai. Agar yeh movement tezi se barhta hai, toh yeh bullish signal consider kiya ja sakta hai.

Daily Timeframe Analysis

Agar sellers faisla karen ke buyers ki hichkichahat ka faida uthayen, toh woh pair ko 149.53 aur 147.46 areas ke neeche daba sakte hain. Uske baad, woh support area ko toorna chahenge, jo downtrend ke 38.2% Fibonacci retracement level ko shamil karta hai, jo 146.65 par hai. Lekin unhein samajhdar 144.49 aur 144.99 area ko paar karne mein mushkil ho sakti hai, jo qareebi arsay mein market sentiment ke liye ahmiyat rakhta hai.

Warna, buyers pair ko buland karne ki koshish karenge bina Japani authorities ko gussa dilaye. Woh dobara all-time high 152.44 tak pohanchne ki koshish kar sakte hain. Agar unhein is level ko toorna hai, toh unhein ek naya uncha muqam hasil karne ka mauka mil sakta hai aur mukhtalif 155.94 high tak pohanch sakte hain. Toh, USDJPY sellers hal ke quiet trading session aur Japani sarkar ke intervention ke khula khatra ka faida uthane ki koshish kar rahe hain.

Yeh raha chart neeche:

تبصرہ

Расширенный режим Обычный режим