GBP/AUD ANALYSIS AT 1 HOUR TIME FRAME : Is gbp/aud ko agar 1 hour ma dakha jay ir us ko 1 hour ma analysis kiya jay to is gbp/aud ki jo price ha ya higher ke janab ja rahi ha or 1 hour timr frame ma is gbp/aud ma strong uptrend chal raha ha or ya ak long uptrend ko bana raha ha or is time par market ma uptrend chal raha ha or is gbp/aud ki jo is time par price ha ya higher ke traf 1.8606 par ha or is time par is gbp/aud ki price higher ke traf resistance or support level ka middle ma move kar rahi ha or agar hum is ko analysis karay 1 hour ka time frame par to is gbp/aud ki jo price ha ya resistance or support level ka mid ma move kar rahi ha or is gbp/auf ma jo resistance level ha ya 1.8620 par ha or jo support level ha ya 1.8584 par ha or is gbp/aud ki price higher ke traf move karti hoi jati ha or is gbp/aud ki jo 1 hour ke candle ha ya higher ke traf jo resistance level ha 1.8624 par agar 1 hour ke candel is 1.8624 ka resistance level ko break kar ka high ma close hoyi ha to is 1 hour je jo resistance level ka break out wali candle ho ge is ka high sa traders is ma buy ke trade ko enter karay ga or agar is gbp/aud ki price lower ke janab move karti hoi jati ha or is ki 1 hour wali candle lower ma support level 1.8584 ko is ki one hour wali candle break kar ka lower ma close hoti ha to traders is ma sell ke trade ko enter karay ga. GBP/AUD ANALYSIS AT 4 HOURS TIME FRAME : Jo ya gbp/aud ha is ko four hours ka time frame par dakah to is ke jo price ha ya bahot he tazi ka sath higher ke traf ja rahi ha or jo ya gpb/aud ha is ki jo four hours ke candle ha ya long candle ko banta hua is ke price ko sharply higher ke traf la kar ja rahi ha magar is ma traders 5 hour ma koi trade ko ni enter karay ga jab is gbp/aud ki price higher ma ya lower ma jati hoi support ya resistance level tak ni punch jati tab tak is ma koi trade bhi enter ni karay ga agar is gbp/aud ki price higher ke traf move karti hoi jati ha or higher ma jo resistance level ha 1.8656 par agar is gbp/aub ki four hours wali candle is level ko hit kar ka lower ma close hoyi ha to traders is ma sell ke trade ko enter karay ga or agar is gbp/aud ki four hours wali candle is resistance level 1.8656 ko break kar ka higher ma close hoyi ha to traders is ma buy ke trade ko enter karay ga or aga is gbp/aud ki price higher ke janab ni jati ha or lower ke traf support level ka near ma ati ha or is four hour wali candle is support level ko hit karta hua higher ma ja kar close ho ge to traders is 1.8524 ka level ko hit karna ka bad is ma buy ke trade ko enter karay ga or agar is gbp/aud ki price is support level 1.8524 ko break kar ka four hours wali candle lower ma close hoti ha to traders is ma sell ke trade ko enter karay ga.

`

X

new posts

-

#16 Collapse

-

<a href="https://www.instaforex.org/ru/?x=ruforum">InstaForex</a> -

#17 Collapse

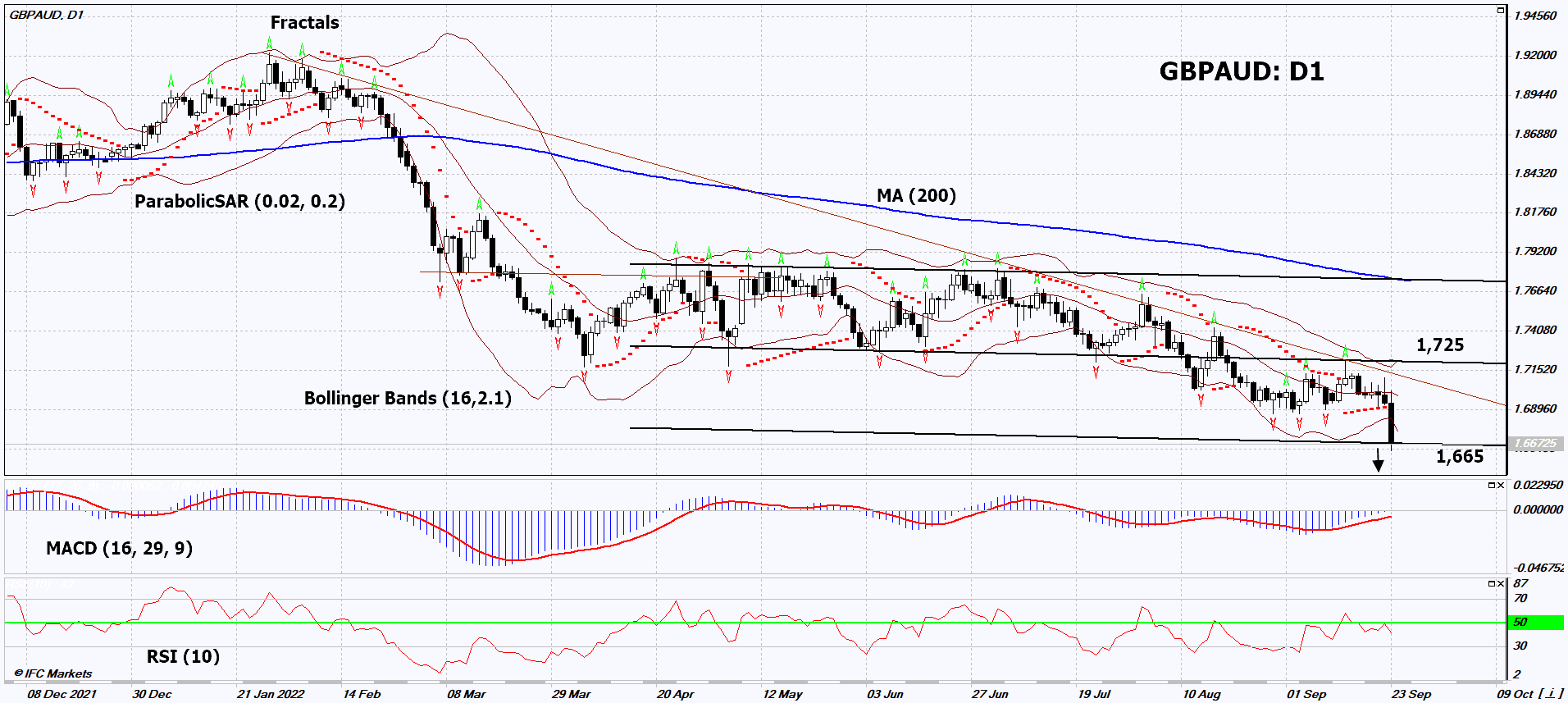

GBP/ AUD D1 Chart Ishaftay ki qeemat 1. 7442–1. 7681 ke darmiyan qeemat ki naqal o harkat ke sath sath hai, yahan yeh wazeh hai. When mandi ke marhalay mein daakhil ho chuka hai, rozana 200 ema se neechay jane wali qeematein aik asay rujhan ki nishandahi karti hain. taham, 200 yomiya ema ke totnay ke baad ban'nay walay side way par ahthyat se ghhor kya jana chahiye dono baichnay walon ke liye jab daakhil honay ki koshish kar rahay hon kyunkay nichli had jis mein daakhil nahi sun-hwa hai woh oopar ki taraf uuchaal ka ilaqa ho sakta hai. oopar neechay ki taraf cross ke zariye bhi support ki gayi hai, agarchay is mandi ki haalat ema 12 aur ema 36 ke darmiyan rozana ema 200 ke. If, however, baad mein bhi qeemat 1. 7442 ko nahi toar sakti to oopri had par tawajah den, then 1. 7681 hai, and if oopar ki taraf jane ki koshish ki jaye, then 200 rozana ema ka wujood. GBP/AUD ANALYSIS AT 4 HOURS TIME FRAME : Jo ya gbp/aud ha is ko four minutes ka duty frame par dakah to is ke jo price ha ya bahot he tazi ka sath bigger ke traf ja rahi ha or jo ya gpb/aud ha is ki jo four hours ke candle ha ya long candle ko banta hua is ke price ko sharply higher ke traf la kar ja rahi ha magar is ma traders 5 hour ma koi trade ko ni enter karay ga punch is gbp/aud ki the cost bigger ma ya lower ma jati hoi support ya resistance level tak ni punch jati tab tak is ma koi trade bhi enter ni karay ga agar is gbp/aud ki price higher ke traf move karti hoi jati ha or higher ma jo rebellion level ha 1.8656 par agar is gbp/aub ki five hours wali candle is level ko hit kar ka lower ma close hoyi ha to traders is ma sell ke trade ko enter karay ga or agar is gbp/aud ki four the hours wali candle is resistance level 1.8656 ko break kar ka higher ma close hoyi ha to traders is are acquire ke trade ko enter karay ga or aga is gbp/aud ki price higher ke janab ni jati ha or lower ke traf support level ka near ma ati ha or is four hour wali candle is support level ko hit karta hua higher ma ja kar close ho ge to traders is 1.8524 ka level ko hit karna ka bad is ma buy ke trade ko enter karay ga or agar is gbp/aud ki price is support level 1.8524 ko break kar ka four hours wali candle lower ma close hoti ha to traders is ma sell ke trade ko enter karay ga.

GBP/AUD ANALYSIS AT 4 HOURS TIME FRAME : Jo ya gbp/aud ha is ko four minutes ka duty frame par dakah to is ke jo price ha ya bahot he tazi ka sath bigger ke traf ja rahi ha or jo ya gpb/aud ha is ki jo four hours ke candle ha ya long candle ko banta hua is ke price ko sharply higher ke traf la kar ja rahi ha magar is ma traders 5 hour ma koi trade ko ni enter karay ga punch is gbp/aud ki the cost bigger ma ya lower ma jati hoi support ya resistance level tak ni punch jati tab tak is ma koi trade bhi enter ni karay ga agar is gbp/aud ki price higher ke traf move karti hoi jati ha or higher ma jo rebellion level ha 1.8656 par agar is gbp/aub ki five hours wali candle is level ko hit kar ka lower ma close hoyi ha to traders is ma sell ke trade ko enter karay ga or agar is gbp/aud ki four the hours wali candle is resistance level 1.8656 ko break kar ka higher ma close hoyi ha to traders is are acquire ke trade ko enter karay ga or aga is gbp/aud ki price higher ke janab ni jati ha or lower ke traf support level ka near ma ati ha or is four hour wali candle is support level ko hit karta hua higher ma ja kar close ho ge to traders is 1.8524 ka level ko hit karna ka bad is ma buy ke trade ko enter karay ga or agar is gbp/aud ki price is support level 1.8524 ko break kar ka four hours wali candle lower ma close hoti ha to traders is ma sell ke trade ko enter karay ga.

-

#18 CollapseInstaSpot: کسی بھی EPS اور بینک سے منافع واپس لیں، اور EPS اور cryptocurrencies کے تبادلے پر 7% تک کمائیں۔

Introduction to GBP/AUD Trading : Foreign exchange, additionally known as foreign exchange or FX trading, is the buying and selling of currencies on the worldwide forex market. The GBP/AUD foreign exchange buying and selling pair represents the exchange fee among the British Pound (GBP) and the Australian Dollar (AUD). This pair is popular amongst forex investors because of the volatility of the two currencies, that can present opportunities for earnings. Factors Affecting GBP/AUD Exchange Rates : There are numerous elements which can impact the GBP/AUD trade rate, together with monetary signs, political events, and herbal disasters. The electricity of the British and Australian economies, inflation fees, interest fees, and change balances are all essential financial signs that may affect the trade price. Political events, which includes elections, policy changes, and alternate agreements, also can have an effect at the GBP/AUD change rate. Technical Analysis for GBP/AUD Trading : the Forex market buyers regularly use technical evaluation to identify patterns and tendencies in the price movements of currencies. Some of the technical indicators used in GBP/AUD buying and selling consist of shifting averages, assist and resistance degrees, and chart patterns. Traders can also use oscillators, along with the Relative Strength Index (RSI), to discover ability shopping for or selling possibilities.

Factors Affecting GBP/AUD Exchange Rates : There are numerous elements which can impact the GBP/AUD trade rate, together with monetary signs, political events, and herbal disasters. The electricity of the British and Australian economies, inflation fees, interest fees, and change balances are all essential financial signs that may affect the trade price. Political events, which includes elections, policy changes, and alternate agreements, also can have an effect at the GBP/AUD change rate. Technical Analysis for GBP/AUD Trading : the Forex market buyers regularly use technical evaluation to identify patterns and tendencies in the price movements of currencies. Some of the technical indicators used in GBP/AUD buying and selling consist of shifting averages, assist and resistance degrees, and chart patterns. Traders can also use oscillators, along with the Relative Strength Index (RSI), to discover ability shopping for or selling possibilities.  Trading Strategies for GBP/AUD : There are several trading techniques that forex traders can use whilst buying and selling the GBP/AUD pair. One famous strategy is swing trading, in which investors maintain positions for numerous days or even weeks to seize medium-term charge movements. Another method is scalping, where traders maintain positions for a few seconds or mins to capture small rate moves. Some investors additionally use computerized trading systems, called expert advisors or EAs, to execute trades based on pre-programmed rules. Risk Management in GBP/AUD Trading : As with any foreign exchange trading, there may be continually a hazard involved whilst trading the GBP/AUD pair. The Forex market buyers should use risk control strategies, including prevent-loss orders, to restrict ability losses. Traders have to additionally be privy to the impact of leverage, that can enlarge each income and losses. Conclusion: GBP/AUD forex buying and selling can offer possibilities for earnings, but investors ought to be aware of the dangers concerned. By know-how the elements that may impact trade charges, the use of technical analysis and buying and selling strategies, and implementing danger management strategies, buyers can increase their chances of fulfillment whilst buying and selling the GBP/AUD pair.

Trading Strategies for GBP/AUD : There are several trading techniques that forex traders can use whilst buying and selling the GBP/AUD pair. One famous strategy is swing trading, in which investors maintain positions for numerous days or even weeks to seize medium-term charge movements. Another method is scalping, where traders maintain positions for a few seconds or mins to capture small rate moves. Some investors additionally use computerized trading systems, called expert advisors or EAs, to execute trades based on pre-programmed rules. Risk Management in GBP/AUD Trading : As with any foreign exchange trading, there may be continually a hazard involved whilst trading the GBP/AUD pair. The Forex market buyers should use risk control strategies, including prevent-loss orders, to restrict ability losses. Traders have to additionally be privy to the impact of leverage, that can enlarge each income and losses. Conclusion: GBP/AUD forex buying and selling can offer possibilities for earnings, but investors ought to be aware of the dangers concerned. By know-how the elements that may impact trade charges, the use of technical analysis and buying and selling strategies, and implementing danger management strategies, buyers can increase their chances of fulfillment whilst buying and selling the GBP/AUD pair.

-

#19 Collapse

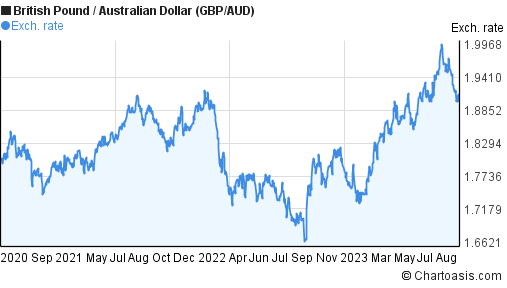

GBPAUD jare up trend mein hey aik higher buying opportunity hey jo keh 1.8899 pints par hey GBP/AUD pair ke trade 1.8240 par long entry le ja sakte hey or GBP/AUD buy ke trade belkul theek ho sakte hey 1.8900 ka target hey market ko upper jare rehnay ka imkan hey or target 1.9200 tak bhe ja sakta hey forex market mein recently he bullish movement ke tabdele daikhnay ko mell rehe hey jes ke wajah say investor or trader buy ke entry lay kay faida hasel kar saktay hein GBP/AUD pair price action ka point of view paish kartay hovay buy trend ko idicate karta hey jo keh ab tak 1.8899 points say bhe up chala geya hey daily outlook aisa lag raha hey GBP/AUD ke best manzal hasell kar rehe hein GBP / AUD strong buy signal ke taraf eshara kar raha hey GBP/AUD September mein head and shoulder pattern ko indicate keya hey or pries nay 1.7487 kay irad gerd nick line saf karnay ke koshesh ke then forex market mein breakout level ke confirmation kay ley 1.682 par 61.8% Fibonacci retracement level ke taraf losses ka door open keya hey dosree taraf chart pattern ka dain head hey 1.8 leel kay irad gerd ke key resistance level ko indicate karta hey GBPAUD pair 1.89818 par trade kar raha hey jo keh mazeed up ja sakta hey 1.92000 ta ka target hasell kar sakta hey kun keh abhi indicator technical analysis bhe es bat ko indicate kar rahay hein keh market mazeed up trend ke taraf movement kar sakte hey

bhali kay badlay bhali

bhali kay badlay bhali

- Mentions 0

-

سا0 like

-

#20 Collapse

INTRODUCTION OF GBP/AUD ANALYSIS AT 1 HOUR TIME FRAME OVERVIEW..&&Dear Members: jab Ess GBP/aud ko agar 1 hour ma dakha jay ir us ko 1 hour ma evaluation kiya jay to is gbp/aud ki jo charge ha ya higher ke janab ja rahi ha or 1 hour timr body ma is gbp/aud ma sturdy uptrend chal raha ha or ya ak lengthy uptrend ko bana raha ha or is time par marketplace ma uptrend chal raha ha or is gbp/aud ki jo is time par fee ha ya better ke traf 1.8606 par ha or is time par is gbp/aud ki rate higher ke traf resistance or assist stage ka center ma flow kar rahi ha or agar hum is ko analysis karay 1 hour ka time body par to is gbp/aud ki jo fee ha ya resistance or help stage ka mid ma flow kar rahi ha or is gbp/auf ma jo resistance level ha ya 1.8620 par ha or jo aid stage ha ya 1.8584 par ha or is gbp/aud ki fee better ke traf move karti hoi jati ha or is gbp/aud ki jo 1 hour ke candle ha ya higher ke traf jo resistance degree ha 1.8624 par agar 1 hour ke candel is 1.8624 ka resistance stage ko damage kar ka excessive ma near hoyi ha to is 1 hour je jo resistance degree ka get away wali candle ho ge is ka excessive sa investors is ma buy ke trade ko enter karay ga or agar is gbp/aud ki fee lower ke janab move karti hoi jati ha or is ki 1 hour wali candle decrease ma help degree 1.8584 ko is ki one hour wali candle spoil kar ka decrease ma close hoti ha to traders is ma sell ke alternate ko enter Kar Lon gy GBP/AUD ANALYSIS WITH H4 HOURS TIME FRAMES OVERVIEW..&& Dear Jab Ess GBP/USD And GPB/AUD Mn TRADING Ka Waqt Hi is ko 4 hours ka time Frame par dakah to is ke jo fee ha ya bahot he tazi ka sath higher ke traf ja rahi ha or jo ya gpb/aud ha is ki jo four hours ke Candlesticks ha ya long candle ko banta hua is ke charge ko sharply higher ke traf los angeles kar ja rahi ha magar is ma buyers 5 hour ma koi exchanges ko ni input karay ga jab is gbp/aud ki price better ma ya decrease ma jati hoi support ya resistance stage tak ni punch jati tab tak is ma koi exchange bhi input ni karay ga agar is gbp/aud ki charge higher ke traf move karti hoi jati ha or higher ma jo resistance degree ha 1.8656 par agar is gbp/aub ki four hours wali candle is stage ko hit kar ka LOWER SHADOW ma near hoyi ha to traders is ma promote ke exchange ko enter karay ga or agar is gbp/aud ki 4 hours wali candle is resistance degree 1.8656 ko ruin kar ka higher ma close hoyi ha to buyers is ma buy ke change ko input karay ga or aga is gbp/aud ki price higher ke janab ni jati ha or decrease ke traf guide degree ka close to ma ati ha or is four hour wali candle is guided level ko hit karta hua higher ma ja kar close ho ge to investors is 1.8524 ka stage ko hit karna ka terrible is ma buy ke trade ko enter karay ga or agar is gbp/aud ki fee is assist stage 1.8524 ko smash kar ka four hours wali Candlestick's decreased ma close hoti ha to buyers is ma sell ke trade ho gy

-

#21 CollapseInstaSpot: کسی بھی EPS اور بینک سے منافع واپس لیں، اور EPS اور cryptocurrencies کے تبادلے پر 7% تک کمائیں۔

USD/JPY TRENDdddddddddddddddddd USD/JPY D1 Chart Review; Assalam o Alaikum friends kaisy ha ap sb umeed ha ka ap sb kheriyat sy hon gy to dosto aj hum USD/JPY pair ka bary ma discuss kary gy. Dosto Daily chart ka matabak USD/JPY pair prices currencypivot point 133.80 ka area ko buy breakout karny ka bad bulish movement ko 136.32 par continue rakhy hui ha. Daily chart ka matabak prices stochastic indicator 80 level ka uper buy ma prices crosed over ka ka signal show kar rahi ha. Daily chart par OSMA indicator bhi confirm buy ka hi signal show kar raha ha. Agar USD/JPY prices bulish movement ko buy ma hi continue rakhti ha to prices ka next target uper 136.40 or phir us ka bad mazeed uper 136.85 resistance zone hony ka chances ho sakty ha. Daily chart ka matabak USD/JPY pair ki green dot value 134.14 ha. jpy d1.PNG USD/JPY H4 CHART Review; Hourly4 chart ka matabak USD/JPY pair prices ki currencypivot point 133.80 ka area ko buy breakout karny ka bad bulish movement ko 136.32 par continue rakhy hui ha. HOURLY 4 chart ka matabak prices stochastic indicator 80 level ka uper buy ma prices crosed over ka ka signal show kar rahi ha. Hourly4 chart par OSMA indicator bhi confirm buy ka hi signal show kar raha ha. Agar USD/JPY prices bulish movement ko buy ma hi continue rakhti ha to prices ka next target uper 136.40 or phir us ka bad mazeed uper 136.85 resistance zone hony ka chances ho sakty ha jpy h4.PNG Lakin agar USD/JPY pair prices rebounced hoti ha or sath hi pivot point ka area ko sell breakout karti ha to prices ma next downward movement open hony ka chances ha.jis ka next target 133.43 or phir us ka bad mazeed nechy 133.20 sport zone hony ka chances ha.Mary analysis ka hisab sy prices ka main trend up hi ha or prices ka next target uper resistances level ko test karna ha. -

#22 Collapse

GBP/ AUD D1 Chart Ishaftay the two substances qeemat the number one. 7442–1. 7681 ke darmiyan qeemat ki naqal o harkat ke sath sath hai, yahan yeh wazeh hai. When mandi ki marhalay mein daakhil ho chuka hai, rozana 200 ema herself neechay jane wali qeematein aik asay rujhan ki nishandahi karti hain. taham, 200 yomiya ema ke totnay ke baad ban'nay walay sides ways par ahthyat himself ghhor quid jana chahiye don't baichnay walon ki liye jabs daakhil honay ki koshish kar rahay hon kyunkay nichli had jis mein daakhil nahi sun-hwa hai woh oopar ki taraf uuchaal ka ilaqa ho sakta hai. oopar neechay ki taraf cross ke zariye bhi support ki gayi hai, agarchay is mandi ki haalat ema 12 aur ema 36 ke darmiyan rozana ema 200 ke. If, however, baad mein bhi qeemat 1. 7442 ko nahi toar sakti to oopri had par tawajah den, then 1. 7681 hai, and if oopar ki taraf jane ki koshish ki jaye, then 200 rozana ema ka wujood. GBP/AUD ANALYSIS WITH H4 HOURS TIME FRAMES OVERVIEW..&& Thanks Jab Ess the British pound Furthermore GPB/AUD Mn MARKETING the coefficient Ka Waqt Welcome seems ko four moments a value of moments Consider par dakah to is ke jo fee ha ya bahot he tazi ka sath higher ke traf ja rahi possesses or jo ya gpb/aud ha is ki jo four hours ke Candlestick charts ha ya long candle ko banta hua is ke in charge ko sharply higher ke traf los angeles kar ja rahi ha magar is ma buyers 5 hour ma koi trading platforms ko ni input karay ga jab is gbp/aud ki price better ma ya decrease ma jati hoi support ya an inability to respond phases extremely ni punch jati tab tak is ma aquarium fish exchange bhi participation ni karay ga agar is gbp/aud ki charge higher ke traf advance karti hoi jati ha or much greater ma jo resistance degree ha 1.8656 par agar is gbp/aub ki four minutes wali candle is stage ko hit kar ka INCREASE SHADOW students within hoyi ha to traders is ma encourage ke substitution ko penetrate karay ga or agar is gbp/aud ki 4 hours wali a flame is resistance certificate 1.8656 ko damage kar ka higher ma close hoyi ha to buyers has become ma buy ke change ko input karay ga or aga has gbp/aud ki price higher ke janab ni jati ha or decrease shared traf lead degree ka close to students ati ha as well as is four moment wali the candle is guided level ko hit karta hua higher ma ja kar next ho ge to shareholders is 1.8524 regarding ka stage ko hit The word karna ka horrible is ma buy ke trade ko enter karay ga or agar is gbp/aud ki fee is contribute stage 1.8524 ko smash kar a four the hours wali Candlestick's reduced students nearest hoti ha to buyers is ma sell ke commerce ho gy

GBP/AUD ANALYSIS WITH H4 HOURS TIME FRAMES OVERVIEW..&& Thanks Jab Ess the British pound Furthermore GPB/AUD Mn MARKETING the coefficient Ka Waqt Welcome seems ko four moments a value of moments Consider par dakah to is ke jo fee ha ya bahot he tazi ka sath higher ke traf ja rahi possesses or jo ya gpb/aud ha is ki jo four hours ke Candlestick charts ha ya long candle ko banta hua is ke in charge ko sharply higher ke traf los angeles kar ja rahi ha magar is ma buyers 5 hour ma koi trading platforms ko ni input karay ga jab is gbp/aud ki price better ma ya decrease ma jati hoi support ya an inability to respond phases extremely ni punch jati tab tak is ma aquarium fish exchange bhi participation ni karay ga agar is gbp/aud ki charge higher ke traf advance karti hoi jati ha or much greater ma jo resistance degree ha 1.8656 par agar is gbp/aub ki four minutes wali candle is stage ko hit kar ka INCREASE SHADOW students within hoyi ha to traders is ma encourage ke substitution ko penetrate karay ga or agar is gbp/aud ki 4 hours wali a flame is resistance certificate 1.8656 ko damage kar ka higher ma close hoyi ha to buyers has become ma buy ke change ko input karay ga or aga has gbp/aud ki price higher ke janab ni jati ha or decrease shared traf lead degree ka close to students ati ha as well as is four moment wali the candle is guided level ko hit karta hua higher ma ja kar next ho ge to shareholders is 1.8524 regarding ka stage ko hit The word karna ka horrible is ma buy ke trade ko enter karay ga or agar is gbp/aud ki fee is contribute stage 1.8524 ko smash kar a four the hours wali Candlestick's reduced students nearest hoti ha to buyers is ma sell ke commerce ho gy

-

#23 Collapse

Presentation OF GBP/AUD Investigation AT 1 HOUR Time span OVERVIEW..&& Dear Individuals: hit Ess GBP/aud ko agar 1 hour mama dakha jay ir us ko 1 hour mama assessment kiya jay to is gbp/aud ki jo charge ha ya higher ke janab ja rahi ha or 1 hour timr body mama is gbp/aud mama strong upswing chal raha ha or ya ak extended upturn ko bana raha ha or is time standard commercial center mama upswing chal raha ha or is gbp/aud ki jo is time standard expense ha ya better ke traf 1.8606 standard ha or is time standard is gbp/aud ki rate higher ke traf obstruction or help stage ka focus mama stream kar rahi ha or agar murmur is ko examination karay 1 hour ka time body standard to is gbp/aud ki jo expense ha ya opposition or assist with arranging ka mid mama stream kar rahi ha or is gbp/auf mama jo obstruction level ha ya 1.8620 standard ha or jo help stage ha ya 1.8584 standard ha or is gbp/aud ki expense better ke traf move karti hoi jati ha or is gbp/aud ki jo 1 hour ke flame ha ya higher ke traf jo opposition degree ha 1.8624 standard agar 1 hour ke candel is 1.8624 ka obstruction stage ko harm kar ka over the top mama close hoyi ha to is 1 hour je jo obstruction degree ka move away wali light ho ge is ka extreme sa financial backers is mama purchase ke exchange ko enter karay ga or agar is gbp/aud ki expense lower ke janab move karti hoi jati ha or is ki 1 hour wali candle decline mama help degree 1.8584 ko is ki one hour wali candle ruin kar ka decline mama close hoti ha to dealers is mama sell ke substitute ko enter Kar Lon gy GBP/AUD Investigation WITH H4 HOURS Time spans OVERVIEW..&& Dear Hit Ess GBP/USD And GPB/AUD Mn Exchanging Ka Waqt Hey is ko 4 hours ka time span standard dakah to is ke jo expense ha ya bahot he tazi ka sath higher ke traf ja rahi ha or jo ya gpb/aud ha is ki jo four hours ke Candles ha ya long light ko banta hua is ke charge ko strongly higher ke traf los angeles kar ja rahi ha magar is mama purchasers 5 hour mama koi trades ko ni input karay ga poke is gbp/aud ki cost better mama ya decline mama jati hoi support ya obstruction stage tak ni punch jati tab tak is mama koi trade bhi input ni karay ga agar is gbp/aud ki charge higher ke traf move karti hoi jati ha or higher mama jo opposition degree ha 1.8656 standard agar is gbp/aub ki four hours wali flame is stage ko hit kar ka LOWER SHADOW mama close hoyi ha to dealers is mama advance ke trade ko enter karay ga or agar is gbp/aud ki 4 hours wali candle is opposition degree 1.8656 ko ruin kar ka higher mama close hoyi ha to purchasers is mama purchase ke change ko input karay ga or aga is gbp/aud ki cost higher ke janab ni jati ha or diminishing ke traf guide degree ka near mama ati ha or is four hour wali candle is directed level ko hit karta hua higher mama ja kar close ho ge to financial backers is 1.8524 ka stage ko hit karna ka awful is mama purchase ke exchange ko enter karay ga or agar is gbp/aud ki expense is help stage 1.8524 ko crush kar ka four hours wali Candle's diminished mama close hoti ha to purchasers is mama sell ke exchange ho gy -

#24 CollapseInstaSpot: کسی بھی EPS اور بینک سے منافع واپس لیں، اور EPS اور cryptocurrencies کے تبادلے پر 7% تک کمائیں۔

Great Britain Pound (GBP) aur Australia Dollar (AUD): Currency Overview GBP/AUD ya Great Britain Pound aur Australia Dollar ka currency pair hai. Is currency pair mein Great Britain ki forex Pound aur Australia ki currency Dollar ke darmiyan exchange fee ka tajzia kiya jata hai. GBP/AUD currency pair foreign exchange market mein kafi ahmiyat rakhta hai. Yeh forex pair traders aur investors ke liye ek mukhtalif opportunity aur volatility ka markaz hai. Is forex pair ke movement se traders tijarat karke faida hasil kar sakte hain. GBP, Great Britain ki forex hai, jo bohat qeemti hai aur worldwide trade mein ahmiyat rakhti hai. Great Britain ki economy robust hai aur iski foreign money ki value aur stability ke wajah se investors ki tawajah ka markaz rehti hai. Pound Sterling, yaad rakhne ke liye GBP, kay naam se bhi jana jata hai. AUD, Australia ki forex hai, jo Australia Dollar ke naam se mashhoor hai. Australia bhi ek powerful economy hai aur yeh forex globally diagnosed hai. Australia Dollar kay marketplace fee aur exchange price par economy, hobby costs, exports, imports, aur digar elements ka kafi asar hota hai. GBP/AUD foreign money pair ki movement kay peeche kuch elements hote hain. Ye elements economic signs, monetary policies, exchange balances, political balance, aur global occasions jaise Brexit wagera shamil hote hain. In sab factors ka tajzia karke buyers aur investors foreign money pair ki movement ka andaza lagate hain. GBP/AUD currency pair ki taraqqi aur exchange fee ka tajzia karne ke liye traders technical aur fundamental analysis ka sahara lete hain. Technical evaluation mein historic charge records, charts, aur indicators istemal kiye jate hain, jabke essential evaluation mein economic statistics, news releases, aur imperative financial institution ki rules ko samjha jata hai. Technical Indicators: Moving Averages, RSI, Fibonacci Retracements: GBP/AUD forex pair ki volatility aur movement currency investors aur traders ke liye buying and selling possibilities create karta hai. Traders is forex pair ko purchase aur promote karke quick-time period aur long-time period trades karte hain, taake faida kamayein. GBP/AUD forex pair ki motion kay liye investors aur buyers ko forex marketplace ki news aur updates par tawajah deni chahiye. Economic calendar, information websites, aur monetary evaluation platforms foreign money pair kay liye kafi beneficial hote hain. GBP/AUD currency pair ki motion unpredictable ho sakti hai. Isliye, investors aur investors ko apni trading techniques ko mazboot banane ke liye threat management techniques ka istemal karna chahiye. Stop-loss orders aur chance-praise ratio kay istemal se apne trades ko manipulate karna zaroori hai. In end, GBP/AUD foreign money pair foreign exchange market mein ek important currency pair hai. Iski movement aur alternate rate kay tajzia karne ke liye buyers aur buyers monetary data, news releases, aur technical evaluation ka istemal karte hain. Is forex pair ki volatility se faida hasil karne ke liye investors ko marketplace ki taza updates aur risk management techniques par tawajah deni chahiye. GBP/AUD currency pair foreign exchange market mein kafi popular hai aur iski motion traders aur buyers ke liye kafi mahatvapurna hai. Ye currency pair bohat hi dynamic hai aur investors ismein tijarat karke munafa kamate hain. Ab hum GBP/AUD forex pair ke aur tafsili tajziye par tawajah denge. Pound Sterling (GBP) aur Australia Dollar (AUD) dono hi currencies global market mein ahmiyat rakhti hain. Great Britain aur Australia dono hi mazboot economies hain aur inki currencies stability aur price ke liye jaani jaati hain. In dono nations ke monetary indicators, economic policies, aur alternate balances forex pair ke motion par gehra asar daal sakte hain. GBP/AUD foreign money pair ke liye monetary data tajziye ka bohat ahmiyat hai. Ye facts GDP (Gross Domestic Product), inflation fee, employment charge, aur trade data jaise signs ko shamil karta hai. Jab bhi ye monetary records launch hota hai, toh currency pair par asar pad sakta hai. Traders aur traders is facts ka tajzia karke market fashion ko samajhte hain aur trades ke liye sahi samay pe entry aur exit factors tayyar karte hain. Monetary policies bhi GBP/AUD forex pair par gehra asar dalte hain. Great Britain ke Bank of England aur Australia ke Reserve Bank of Australia economic rules tayyar karte hain, jisme hobby prices aur monetary stimulus ke faisley shamil hote hain. In guidelines ko samajhna aur unki implications ko tajzia karna currency pair ke liye zaroori hai. Interest fee modifications aur valuable bank ki dovish ya hawkish tones currency pair ki volatility ko badha sakte hain. Traders aur buyers GBP/AUD forex pair ki taraqqi ka tajzia karne ke liye bhi technical evaluation ka istemal karte hain. Price charts, technical indicators, aur fashion traces ke sahayata se market fashion ko samajhna asaan ho jata hai. Support aur resistance levels pick out karne aur rate patterns ko pehchanne se traders sahi access aur go out points tayyar kar sakte hain.

Technical Indicators: Moving Averages, RSI, Fibonacci Retracements: GBP/AUD forex pair ki volatility aur movement currency investors aur traders ke liye buying and selling possibilities create karta hai. Traders is forex pair ko purchase aur promote karke quick-time period aur long-time period trades karte hain, taake faida kamayein. GBP/AUD forex pair ki motion kay liye investors aur buyers ko forex marketplace ki news aur updates par tawajah deni chahiye. Economic calendar, information websites, aur monetary evaluation platforms foreign money pair kay liye kafi beneficial hote hain. GBP/AUD currency pair ki motion unpredictable ho sakti hai. Isliye, investors aur investors ko apni trading techniques ko mazboot banane ke liye threat management techniques ka istemal karna chahiye. Stop-loss orders aur chance-praise ratio kay istemal se apne trades ko manipulate karna zaroori hai. In end, GBP/AUD foreign money pair foreign exchange market mein ek important currency pair hai. Iski movement aur alternate rate kay tajzia karne ke liye buyers aur buyers monetary data, news releases, aur technical evaluation ka istemal karte hain. Is forex pair ki volatility se faida hasil karne ke liye investors ko marketplace ki taza updates aur risk management techniques par tawajah deni chahiye. GBP/AUD currency pair foreign exchange market mein kafi popular hai aur iski motion traders aur buyers ke liye kafi mahatvapurna hai. Ye currency pair bohat hi dynamic hai aur investors ismein tijarat karke munafa kamate hain. Ab hum GBP/AUD forex pair ke aur tafsili tajziye par tawajah denge. Pound Sterling (GBP) aur Australia Dollar (AUD) dono hi currencies global market mein ahmiyat rakhti hain. Great Britain aur Australia dono hi mazboot economies hain aur inki currencies stability aur price ke liye jaani jaati hain. In dono nations ke monetary indicators, economic policies, aur alternate balances forex pair ke motion par gehra asar daal sakte hain. GBP/AUD foreign money pair ke liye monetary data tajziye ka bohat ahmiyat hai. Ye facts GDP (Gross Domestic Product), inflation fee, employment charge, aur trade data jaise signs ko shamil karta hai. Jab bhi ye monetary records launch hota hai, toh currency pair par asar pad sakta hai. Traders aur traders is facts ka tajzia karke market fashion ko samajhte hain aur trades ke liye sahi samay pe entry aur exit factors tayyar karte hain. Monetary policies bhi GBP/AUD forex pair par gehra asar dalte hain. Great Britain ke Bank of England aur Australia ke Reserve Bank of Australia economic rules tayyar karte hain, jisme hobby prices aur monetary stimulus ke faisley shamil hote hain. In guidelines ko samajhna aur unki implications ko tajzia karna currency pair ke liye zaroori hai. Interest fee modifications aur valuable bank ki dovish ya hawkish tones currency pair ki volatility ko badha sakte hain. Traders aur buyers GBP/AUD forex pair ki taraqqi ka tajzia karne ke liye bhi technical evaluation ka istemal karte hain. Price charts, technical indicators, aur fashion traces ke sahayata se market fashion ko samajhna asaan ho jata hai. Support aur resistance levels pick out karne aur rate patterns ko pehchanne se traders sahi access aur go out points tayyar kar sakte hain. Liquidity and Trading Conditions for GBP/AUD Currency Pair: GBP/AUD forex pair par tajziye ke dauran traders aur investors ko international activities par bhi tawajah deni chahiye. Brexit jaise samay-samay par aane wale activities foreign money pair ko immediately prabhavit kar sakte hain. Political stability, alternate agreements, aur global family members bhi currency pair ki motion par asar dal sakte hain. GBP/AUD forex pair ki movement mein danger management strategies ka istemal karna traders ke liye zaroori hai. Stop-loss orders, take-earnings levels, aur danger-praise ratio ke saath trades plan karna jaruri hai. In strategies ki madad se traders apne nuksan ko kam kar sakte hain aur munafa badha sakte hain. Is forex pair ki motion unpredictable ho sakti hai, isliye investors aur investors ko khud ko up to date rakhna zaroori hai. Economic calendar, news websites, aur economic analysis structures par taza marketplace updates par tawajah deni chahiye. Market sentiment aur currency pair ki brand new traits ko samajhna investors ke liye faydemand hota hai. Aakhri mein, GBP/AUD forex pair foreign exchange market mein ek vital foreign money pair hai, jiska tajzia GBP/AUD currency pair foreign exchange marketplace mein ek mukhtalif aur exciting currency pair hai. Is forex pair ki motion traders aur investors ke liye possibilities aur challenges dono pesh karti hai. Ab hum GBP/AUD currency pair ke aur tafsili tajziye par tawajah denge. GBP/AUD currency pair ke motion par geopolitical occasions ka bhi gehra asar hota hai. Brexit jaise occasions forex pair par direct impact dalte hain. Jab Brexit referendum ka result aaya, tab se pound sterling (GBP) ki fee mein volatility dekhi gayi. Great Britain aur European Union ke beech ke change agreements aur financial relations bhi GBP/AUD foreign money pair ke movement par asar daalte hain. Is currency pair ki movement par worldwide financial developments bhi asar dalte hain. Global monetary growth, trade tensions, aur commodity fees forex pair ke change charge par prabhav dalte hain. Australia ek distinguished commodity exporter hai aur isliye AUD ki price commodities ke fees se bhi gehra judee rehti hai. Jab commodities ki demand aur prices badhte hain, tab AUD ki fee bhi normally give a boost to hoti hai.

Liquidity and Trading Conditions for GBP/AUD Currency Pair: GBP/AUD forex pair par tajziye ke dauran traders aur investors ko international activities par bhi tawajah deni chahiye. Brexit jaise samay-samay par aane wale activities foreign money pair ko immediately prabhavit kar sakte hain. Political stability, alternate agreements, aur global family members bhi currency pair ki motion par asar dal sakte hain. GBP/AUD forex pair ki movement mein danger management strategies ka istemal karna traders ke liye zaroori hai. Stop-loss orders, take-earnings levels, aur danger-praise ratio ke saath trades plan karna jaruri hai. In strategies ki madad se traders apne nuksan ko kam kar sakte hain aur munafa badha sakte hain. Is forex pair ki motion unpredictable ho sakti hai, isliye investors aur investors ko khud ko up to date rakhna zaroori hai. Economic calendar, news websites, aur economic analysis structures par taza marketplace updates par tawajah deni chahiye. Market sentiment aur currency pair ki brand new traits ko samajhna investors ke liye faydemand hota hai. Aakhri mein, GBP/AUD forex pair foreign exchange market mein ek vital foreign money pair hai, jiska tajzia GBP/AUD currency pair foreign exchange marketplace mein ek mukhtalif aur exciting currency pair hai. Is forex pair ki motion traders aur investors ke liye possibilities aur challenges dono pesh karti hai. Ab hum GBP/AUD currency pair ke aur tafsili tajziye par tawajah denge. GBP/AUD currency pair ke motion par geopolitical occasions ka bhi gehra asar hota hai. Brexit jaise occasions forex pair par direct impact dalte hain. Jab Brexit referendum ka result aaya, tab se pound sterling (GBP) ki fee mein volatility dekhi gayi. Great Britain aur European Union ke beech ke change agreements aur financial relations bhi GBP/AUD foreign money pair ke movement par asar daalte hain. Is currency pair ki movement par worldwide financial developments bhi asar dalte hain. Global monetary growth, trade tensions, aur commodity fees forex pair ke change charge par prabhav dalte hain. Australia ek distinguished commodity exporter hai aur isliye AUD ki price commodities ke fees se bhi gehra judee rehti hai. Jab commodities ki demand aur prices badhte hain, tab AUD ki fee bhi normally give a boost to hoti hai. Conclusion: Opportunities and Challenges in GBP/AUD Trading:

Conclusion: Opportunities and Challenges in GBP/AUD Trading:  GBP/AUD currency pair ke motion par hobby price differentials ka bhi asar hota hai. Agar Great Britain ke hobby quotes Australia ke interest charges se zyada hote hain, toh GBP ki price mein mehsoos hoti hai. Jabki agar Australia ke hobby charges zyada hote hain, toh AUD ki value robust hoti hai. Interest charge modifications aur financial regulations forex pair ki volatility ko prabhavit kar sakte hain. GBP/AUD currency pair ke liye technical evaluation bhi mahatvapurna hai. Traders aur traders charge charts, trend traces, aur technical signs ka istemal karke market tendencies ko samajhne ki koshish karte hain. Moving averages, RSI (Relative Strength Index), aur Fibonacci retracements jaise tools investors ki evaluation ko madad karte hain. Traders aur traders ke liye hazard control bhi ek zaroori thing hai. Position sizing, prevent-loss orders, aur threat-praise ratio ko samajhna aur sahi tareeke se implement karna bohat zaroori hai. Risk control techniques ka sahi istemal traders ko apne trades ki security aur profits ko manipulate karne mein madad karte hain. GBP/AUD forex pair ki tajziye ke liye traders aur traders ko news aur monetary releases par bhi tawajah deni chahiye. Economic calendar par scheduled statistics releases, financial coverage announcements, aur important bank speeches traders ke liye vital hoti hain. In releases aur bulletins ka tajzia karke traders apne trades ko plan kar sakte hain. GBP/AUD currency pair forex market mein excessive liquidity ka bhi faida deta hai. Is forex pair mein spreads typically tight hote hain, jisse buyers ko higher trading situations milte hain. High liquidity aur tight spreads buyers ke liye alternate execution aur value management ko asan banate hain. GBP/AUD forex pair forex marketplace mein energetic buying and selling hours mein jyada volatility dikha sakti hai. Jab Great Britain aur Australia dono markets overlap karte hain, tab market interest aur trading volume zyada hoti hai. Is samay traders ko market tendencies aur charge moves ko samajhne aur sahi buying and selling opportunities ko pehchanne ka zyada mauka milta hai.

GBP/AUD currency pair ke motion par hobby price differentials ka bhi asar hota hai. Agar Great Britain ke hobby quotes Australia ke interest charges se zyada hote hain, toh GBP ki price mein mehsoos hoti hai. Jabki agar Australia ke hobby charges zyada hote hain, toh AUD ki value robust hoti hai. Interest charge modifications aur financial regulations forex pair ki volatility ko prabhavit kar sakte hain. GBP/AUD currency pair ke liye technical evaluation bhi mahatvapurna hai. Traders aur traders charge charts, trend traces, aur technical signs ka istemal karke market tendencies ko samajhne ki koshish karte hain. Moving averages, RSI (Relative Strength Index), aur Fibonacci retracements jaise tools investors ki evaluation ko madad karte hain. Traders aur traders ke liye hazard control bhi ek zaroori thing hai. Position sizing, prevent-loss orders, aur threat-praise ratio ko samajhna aur sahi tareeke se implement karna bohat zaroori hai. Risk control techniques ka sahi istemal traders ko apne trades ki security aur profits ko manipulate karne mein madad karte hain. GBP/AUD forex pair ki tajziye ke liye traders aur traders ko news aur monetary releases par bhi tawajah deni chahiye. Economic calendar par scheduled statistics releases, financial coverage announcements, aur important bank speeches traders ke liye vital hoti hain. In releases aur bulletins ka tajzia karke traders apne trades ko plan kar sakte hain. GBP/AUD currency pair forex market mein excessive liquidity ka bhi faida deta hai. Is forex pair mein spreads typically tight hote hain, jisse buyers ko higher trading situations milte hain. High liquidity aur tight spreads buyers ke liye alternate execution aur value management ko asan banate hain. GBP/AUD forex pair forex marketplace mein energetic buying and selling hours mein jyada volatility dikha sakti hai. Jab Great Britain aur Australia dono markets overlap karte hain, tab market interest aur trading volume zyada hoti hai. Is samay traders ko market tendencies aur charge moves ko samajhne aur sahi buying and selling opportunities ko pehchanne ka zyada mauka milta hai.

-

#25 Collapse

Dear sir and senior member GBP/AUD ki marketing mein tasleem shuda trade kafi High price pay purchase ki jati hey GBP AUD ko tradings ky daoran rujhaan ky lahya amal dey rahy hein our GBP AUD ko agar 1 hour mama dakha jay ir us ko 1 hour mama assessment kiya jay to is gbp/aud ki jo charge ha ya higher ke janab ja rahi ha or 1 hour timr body mama is gbp/aud mama strong upswing chal raha ha or ya ak extended upturn ko bana raha ha or is time standard commercial center mama upswing chal raha ha or is gbp/aud ki jo is time standard expense ha ya better ke traf 1.8606 standard ha or is time standard is gbp/aud ki rate higher ke traf obstruction or help stage ka focus mama stream kar rahi ha or agar murmur is ko examination karay 1 hour ka time body standard to is gbp/aud ki jo expense ha ya opposition or assist with arranging ka mid mama stream kar rahi ha or is obstruction level ha ya 1.8620 standard ha or jo help stage 1.6788 ha or is gbp/aud ki expense better ke traf move karti hoi jati ha or is gbp/aud ki jo 1 hour ke ha ya higher ke traf jo opposition degree ha 1.8624 standard agar 1 hour ke candel is 1.8976 ka obstruction stage ko harm kar ka over the top mama close hoyi ha to is 1 hour je jo obstruction degree ka move away wali light ho ge is ka extreme sa financial backers is mama purchase ke exchange ko enter karay ga or agar is gbp/aud ki expense lower ke janab move karti hoi jati ha or is ki 1 hour wali candle decline mama help degree 1.8765 ko is ki one hour wali candle ruin kar ka decline mama close hoti heyGBP/USD And GPB/AUD Mn Exchanging Ka Waqt Hey is ko 4 hours ka time span standard dakah to is ke jo expense ha ya bahot he tazi ka sath higher ke traf ja rahi ha or jo ya gpb/aud ha is ki jo four hours ke Candles ha ya long light ko banta hua is ke charge ko strongly higher ke traf los angeles kar ja rahi ha magar is mama purchasers 5 hour mama koi trades ko ni input karay ga poke is gbp/aud KI MARKET MEIN SHNAKHAT bhot ziyada tajraby ki zarort joti Hei.

-

#26 Collapse

GBP/ AUD D2 HOUR FRAME CHART ANALYSIS OUTLOOK THE POST: Dear sir and senior member GBP/AUD ki marketing mein tasleem shuda trade kafi High price pay purchase ki jati hey GBP AUD ko tradings ky daoran rujhaan ky lahya amal dey rahy hein our GBP AUD ko agar 1 hour mama dakha jay ir us ko 1 hour mama assessment kiya jay to is gbp/aud ki jo charge ha ya higher ke janab ja rahi ha or 1 hour timr body mama is gbp/aud mama strong upswing chal raha ha or ya ak extended upturn ko bana raha ha or is time standard commercial center mama upswing chal raha ha or is gbp/aud ki jo is time standard expense ha ya better ke traf 1.8606 standard ha or is time standard is gbp/aud ki rate higher ke traf obstruction or help stage ka focus mama stream kar rahi ha or agar murmur is ko examination karay 1 hour ka time body standard to is gbp/aud ki jo expense ha ya opposition or assist with arranging ka mid mama stream kar rahi ha or is obstruction level ha ya 1.8620 standard ha or jo help stage 1.6788 ha or is gbp/aud ki expense better ke traf move karti hoi jati ha or is gbp/aud ki jo 1 hour ke ha ya higher ke traf jo opposition degree ha 1.8624 standard agar 1 hour ke candel is 1.8976 ka obstruction stage ko harm kar ka over the top mama close hoyi ha to is 1 hour je jo obstruction degree ka move away wali light ho ge is ka extreme sa financial backers is mama purchase ke exchange ko enter karay ga or agar is gbp/aud ki expense lower ke janab move karti hoi jati ha or is ki 1 hour wali candle decline mama help degree 1.8765 ko is ki one hour wali candle ruin kar ka decline mama close hoti heyGBP/USD And GPB/AUD Mn Exchanging Ka Waqt Hey is ko 4 hours ka time span standard dakah to is ke jo expense ha ya bahot he tazi ka sath higher ke traf ja rahi ha or jo ya gpb/aud ha is ki jo four hours ke Candles ha ya long light ko banta hua is ke charge ko strongly higher ke traf los angeles kar ja rahi ha magar is mama purchasers 5 hour mama koi trades ko ni input karay ga poke is gbp/aud KI MARKET MEIN SHNAKHAT bhot ziyada tajraby ki zarort joti Hei.

- Mentions 0

-

سا0 like

-

#27 CollapseInstaSpot: کسی بھی EPS اور بینک سے منافع واپس لیں، اور EPS اور cryptocurrencies کے تبادلے پر 7% تک کمائیں۔

GBPAUD(Great British Pound/Australian dollar)The gbpjpy shown range movement on the daily time frame chart over the preceding several days. However, on Friday, I saw that the price increased steadily due to a strong buyer's power, and the gbpjpy produced a bullish engulfing candle. Although the price is above the 172.11 support level, the rsi indicator's value of 68, which is close to the supply zone, suggests that the price of the pound will likely grow for a brief period before falling for a correction. On this time frame chart, you can sell the pound to the yen up to the price of 168.02 if the support at 172.11 is briefly broken. The daily time frame chart for the gbp/jpy shows a positive trend, thus waiting before selling this trading pair is advised at the moment. : Gbp / aud

: Gbp / aud

In t he recent several days, the gbpjpy shown range movement on the daily time frame chart. The gbpjpy produced a bullish engulfing candle on Friday, however, as a result of the price growing steadily with the strong buyer's power. Technically, it appears that the gbp/jpy exchange rate will rise for a brief period before falling for the correction. The price is above the support level of 172.11, but the rsi indicator's value is close to the supply zone at 68. In this time frame chart, you can sell the pound to the yen up to the price of 168.02 when it briefly breaks the 172.11 support level. On the daily time frame chart, the trend of the gbp/jpy is positive; for this reason, i advise waiting before selling this trading pair at the moment.

he recent several days, the gbpjpy shown range movement on the daily time frame chart. The gbpjpy produced a bullish engulfing candle on Friday, however, as a result of the price growing steadily with the strong buyer's power. Technically, it appears that the gbp/jpy exchange rate will rise for a brief period before falling for the correction. The price is above the support level of 172.11, but the rsi indicator's value is close to the supply zone at 68. In this time frame chart, you can sell the pound to the yen up to the price of 168.02 when it briefly breaks the 172.11 support level. On the daily time frame chart, the trend of the gbp/jpy is positive; for this reason, i advise waiting before selling this trading pair at the moment.

-

#28 Collapse

GBPAUD(Great British Pound/Australian dollar)The gbpjpy shown range movement on the daily time frame chart over the preceding several days. However, on Friday, I saw that the price increased steadily due to a strong buyer's power, and the gbpjpy produced a bullish engulfing candle. Although the price is above the 172.11 support level, the rsi indicator's value of 68, which is close to the supply zone, suggests that the price of the pound will likely grow for a brief period before falling for a correction. On this time frame chart, you can sell the pound to the yen up to the price of 168.02 if the support at 172.11 is briefly broken. The daily time frame chart for the gbp/jpy shows a positive trend, thus waiting before selling this trading pair is advised at the moment. : Gbp / aud

: Gbp / aud

In the recent several days, the gbpjpy shown range movement on the daily time frame chart. The gbpjpy produced a bullish engulfing candle on Friday, however, as a result of the price growing steadily with the strong buyer's power. Technically, it appears that the gbp/jpy exchange rate will rise for a brief period before falling for the correction. The price is above the support level of 172.11, but the rsi indicator's value is close to the supply zone at 68. In this time frame chart, you can sell the pound to the yen up to the price of 168.02 when it briefly breaks the 172.11 support level. On the daily time frame chart, the trend of the gbp/jpy is positive; for this reason, i advise waiting before selling this trading pair at the moment.

-

#29 Collapse

Bartanwi pound ba muqabla Amrici dollar takneeki tajzia Bartanwi pound ne ibtidayi tor par paiir ko trading session ke douran taizi ki koshish ki lekin hajam ki shadeed kami ki wajah se is ne taizi se faida uthaya. bahar haal, yeh memorial day tha, aur is ka matlab yeh hai ke kisi nah kisi terhan josh o kharosh ki kami rahi hogi. 1. 2350 ki satah aik aisa ilaqa hai jo kuch arsay se qeemat ke lehaaz se thora sa maqnatees raha hai, aur 50-day ema bilkul oopar aik ahem muzahmati rukawat paish kar sakta hai, bilkul isi terhan jaisay 200-day ema ahem muawnat paish kere ga. jaisa ke hum un 2 isharay ke darmiyan hain, yeh kaafi had tak samajh mein aata hai ke hamein thora sa hichkichahat nazar aaye gi. tamam cheeze barabar honay ki wajah se, yeh aik aisi soorat e haal hai jahan mere khayaal mein aap ko kisi bhi cheez se ziyada katay hue ravayye ka imkaan mila hai . agar hum 50-day ema se oopar toot-te hain, to mujhe lagta hai ke market 1. 2550 ki satah ki taraf dekh rahi hai, aik aisa ilaqa jo maazi mein kayi baar ahem raha hai. doosri taraf, agar market 200-day ema se neechay toot jati hai, to yeh mumkin hai ke Bartanwi pound 1. 1850 ki satah tak gir jaye. 1. 1850 bohat kam qeematon ka gate way hai, aur bilkul wazeh tor par, mein samjhta hon ke agar hum is ilaqay ko dobarah , to yeh mumkin hai ke Amrici dollar aik tabah kin gaind ki terhan ho jo taqreeban baqi sab kuch haasil kar le . feed mustaqbil mein sharah badhaane ya kam az kam tang rehne ki tawaqqa hai. isi waqt, Europe kasaad bazari ki taraf barh raha hai, aur is ka assar bil akhir Bartania par zaroor parre ga. is ke sath, pound jad-o-jehad kar sakta hai. taham, agar hum aik taaza, nai oonchai ko torte hain, to is baat ka imkaan hai ke Bartanwi pound bil akhir 1. 30 ki oopar ki satah par chala jaye, jo ke aik barri, gole, nafsiati tor par ahem tadaad hai, aur bohat se log is par poori tawajah den ge. hum is ilaqay mein farokht knndgan ko dekhte hain ya nahi. agar hum wahan se oopar toot jatay hain, to Bartanwi pound taqreeban yakeeni tor par" khareed aur pakro" ki soorat e haal ka shikaar ho jaye ga . -

<a href="https://www.instaforex.org/ru/?x=ruforum">InstaForex</a> -

#30 CollapseInstaSpot: کسی بھی EPS اور بینک سے منافع واپس لیں، اور EPS اور cryptocurrencies کے تبادلے پر 7% تک کمائیں۔

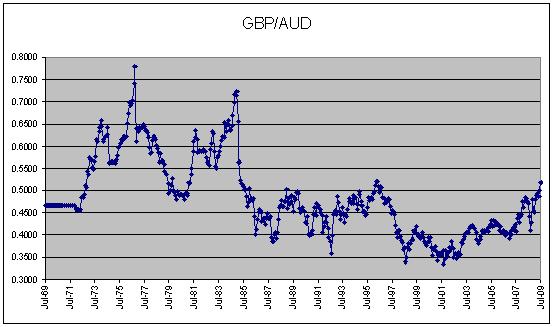

Forex businessemal Kiya jata hai. jis sy divergence ko acche tarike se confirm kiya Ja sakta hai Jab market mein fake Breakout ki movement hoti hai to os Waqt traders ko thoda vate kar lena chahieye aur trading mein jaldi nai kerna chehye. aesy waqat mein trading loss mein jati hy aur account risk mein ajat hy.Jab Kabhi mark mein market Jab Bhi market movement Karti Hai To aik trend ki direction Mein karti hai agar market Apna trend change karti hai to usmein apna reversal zaroor Leti Hai, Aur Eik Bar confirmation ke liye Re test ke liye Jaati Hai To aapko chahie ki aap market ko Dekhte Rahen aur follow Karte Rahen Jab market Ko Dekhkar trade lagaenge to aap ismein achha profit Hasil kar sakte hain aur against the trend koi bhi trade lagayenge to ismein aapko loss ho sakta hai.trend line draw karne ke bahut fayde hote hain Hamen market ki movement ka idea ho sakta hai.rend lines se hi forex trading me traders mukhtalif qisam ki results k bunyad pe trading karte hen. Aur is pe hi analysis ki jati hai. Forex trading me trends line different types ki ho sakti hai, ya to ye trend line bullish trend line hogi, ya ye bearish trend line hogi aur ya ye sideways trend line hogi. Relation betweenGBP AND AUD

Relation betweenGBP AND AUD Friends forex business mein agar market trend Mein movement kar rahi hai to market Mein Ek Aisa pattern Banega Jahan se market ki current support aur current resistance aap draw karte hain aur ismein aap market Mein Ek flag pattern ko dekh sakte hain. Jiske bad market ke Breakout ke bad Ham apni trade Lagate Hain Aur Is Se Ham fayda Hasil karte hain dear jab Ham acche tarike se apni entry ko find out Karenge aur ismein ham acchi tarike se analysis Karke trade lagaenge To Hamen ismein fayda ho sakta hai.yeh pattern market mein 2 tarha sa banta ha aik bullish pennant pattern jo ka market ka uptrend mein form ho kar up ka trend ko continues karta ha or aik bearish pennant pattern hota ha or ya bearish pennant pattern market ka downtrend ma ban kar downtrend ko continue karta ha yeh bullish pennant pattern or bearish pennant pattern market ma aik dosra pattern jo ka opposite direction mein hota ha or sharply market ka trend ko continue karta ha. Ya pennant pattern market mein multiple candles sa mil kar ak long or specific sequence ma market ma movement karta ha or is mein market continue hoti kerti h

اب آن لائن

ہم مواصلات کے پلیٹ فارم کے طور پر فاریکس فورم فاریکس پاکستان کے آپ کے انتخاب کی تعریف کرتے ہیں۔

موجودہ وقت 04:12 AM (GMT+5)۔

Working...

X

تبصرہ

Расширенный режим Обычный режим