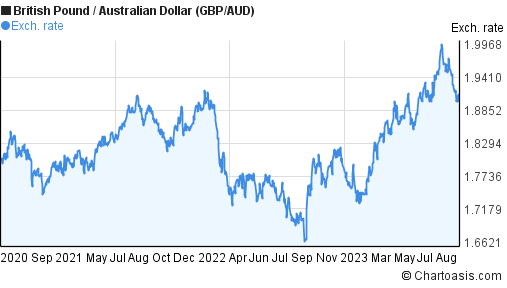

Gbp/aud aaj takneeki tajzia ke liye gbp / aud ka intikhab kya gaya hai. market ki qeemat barh rahi hai Ø› yeh aglay chand dinon mein taizi se neechay chala gaya hai aur ab barhna shuru ho raha hai. market aik naye channel mein tabdeel ho jati hai, aik oopar ki taraf channel banata hai jis ka market mein bohat ehtram kya jata hai. qeematein barhti hain, chingariyan peda hoti hain, aur kharidari ki raftaar barh jati hai. jab qeemat qareeb anay wali muzahmati satah se guzarti hai to market mein izafay mein madad karta hai. darin Isna , market ki qeemat muzahmat se oopar 174. 11 par tay hui. market ki qeemat agli muzahmati satah par hogi aur agar market ki qeemat is muzahmati satah ko toar sakti hai, to aik raddi mom batii charhtay hue channel ke hissay aur muzahmati satah tak pounchanay ke baad namodaar hogi. phir jad-o-jehad karne wali qeemat peechay hatt gayi aur market ki qeemat ko channel ke neechay 172. 40 par support mil sakti hai. gbp / aud ko dekhte hue, qeemat 1 ghantay ki muddat mein barhi hai, 50-day aur 200-day ki harkat pazeeri fi al haal market se oopar hai. aur hamari muzahmat ki satah. rsi index 30-70 ke darmiyan hai, 70 par. rsi index zahir karta hai ke market support level gir raha hai. agar market muzahmati satah ko toar deti hai to yeh oopar ki taraf jari rahay gi. agar yeh mustaqbil mein taizi ke rastay mein rehta hai, to market mein izafah hota rahay ga, aur muzahmati satah ko tornay ke baad usay khareeda ja sakta hai. khususiyaat aur market ke dhanchay mein jitne ziyada isharay istemaal kiye jayen ge, qeemat mein izafah itna hi ziyada Muawin hoga . is chart mein istemaal honay wala isharay 50 din ki saada moving average colour navy 200 din ki saada moving average colour chocolate rsi isharay ki muddat 14

`

X

new posts

-

#31 Collapse

-

<a href="https://www.instaforex.org/ru/?x=ruforum">InstaForex</a> -

#32 Collapse

s qeemat the numtrades ko ni input karay ga poke is gbp/aud ki cost better mama ya decline mama jati hoi support ya obstruction stage tak ni punch jati tab tak is mama koi trade bhi input ni karay ga agar is gbp/aud ki charge higher ke traf move karti hoi jati ha or higher mama jo opposition degree ha 1.8656 standard agar is gbp/aub ki four hours wali flame is stage ko hit kar ka LOWER SHADOW mama close hoyi ha to dealers is mama advance ke trade ko enter karay ga or agar is gbp/aud ki 4 hours wali candle is opposition degree 1.8656 ko ruin kar ka higher mama close hoyi ha to purchasers is mama purchase ke chber one. 7442–1. 7681 ke darmiyan qeemat ki naqal o harkat ke sath sath hai, yahan yeh wazeh hai. When mandi ki marhalay mein daakhil ho chuka hai, rozana 200 ema herself neechay jane wali qeematein aik asay rujhan ki nishandahi karti hain. taham, 200 yomiya ema ke totnay ke baad ban'nay walay sides ways par ahthyat himself ghhor quid jana chahiye don't baichnay walon ki liye jabs daakhil honay ki koshish kar rahay hon kyunkay nichli had jis mein daakhil nahi sun-hwa hai woh oopar ki taraf uuchaal ka ilaqa ho sakta hai. oopar neechay ki taraf cross ke zariye bhi support ki gayi hai, agarchay is mandi ki haalat ema 12 aur ema 36 ke darmiyan rozana ema 200 ke. If, however, baad mein bhi qeemat 1. 7442 ko nahi toar sakti to oopri had par tawajah den, then 1. 7681 hai, and if oopar ki taraf jane ki koshish ki jaye, then 200 rozana ema ka wujood. GBP/AUD ANALYSIS AT 4 HOURS TIME FRAME : hours katter ma ya decrease ma jati hoi support ya resistance stage tak ni punch jati tab tak is ma koi exchange bhi input ni karay ga agar is gbp/aud ki charge higher ke traf move karti hoi jati ha or higher ma jo resistance degree ha 1.8656 par agar is gbp/aub ki four hours wali candle is stage ko hit kar ka LOWER SHADOW ma near hoyi ha to traders is ma promote ke exchange ko enter time Frame par dakah to is ke jo fee ha ya bahot he tazi ka sath higher ke traf ja rahi ha or jo ya gpb/aud ha is ki jo four hours ke Candlesticks ha ya long candle ko banta hua is ke charge ko sharply higher ke traf los angeles kar ja rahi ha magar is ma buyers 5 hour ma koi exchanges ko ni input karay ga jab is gbp/aud ki price be ga or agar is gbp/aud ki 4 hours wali candle is resistance degree 1.8656 ko ruin kar ka higher ma close hoyi ha to buyers is ma buy ke change ko input karay ga or aga is gbp/aud ki price higher ke janab ni jati ha or decrease ke traf guide degree ka close to ma ati ha or is four hour wali candle is guided level ko hit karta hua higher ma ja kar close ho ge to investors is 1.8524 ka stage ko hit karna ka terrible is ma buy ke trade ko enter karay ga or agar is gbp/aud ki fee is assist stage 1.8524 ko smash kar ka four hours wali Candlestick's d

GBP/AUD ANALYSIS AT 4 HOURS TIME FRAME : hours katter ma ya decrease ma jati hoi support ya resistance stage tak ni punch jati tab tak is ma koi exchange bhi input ni karay ga agar is gbp/aud ki charge higher ke traf move karti hoi jati ha or higher ma jo resistance degree ha 1.8656 par agar is gbp/aub ki four hours wali candle is stage ko hit kar ka LOWER SHADOW ma near hoyi ha to traders is ma promote ke exchange ko enter time Frame par dakah to is ke jo fee ha ya bahot he tazi ka sath higher ke traf ja rahi ha or jo ya gpb/aud ha is ki jo four hours ke Candlesticks ha ya long candle ko banta hua is ke charge ko sharply higher ke traf los angeles kar ja rahi ha magar is ma buyers 5 hour ma koi exchanges ko ni input karay ga jab is gbp/aud ki price be ga or agar is gbp/aud ki 4 hours wali candle is resistance degree 1.8656 ko ruin kar ka higher ma close hoyi ha to buyers is ma buy ke change ko input karay ga or aga is gbp/aud ki price higher ke janab ni jati ha or decrease ke traf guide degree ka close to ma ati ha or is four hour wali candle is guided level ko hit karta hua higher ma ja kar close ho ge to investors is 1.8524 ka stage ko hit karna ka terrible is ma buy ke trade ko enter karay ga or agar is gbp/aud ki fee is assist stage 1.8524 ko smash kar ka four hours wali Candlestick's d

-

#33 Collapse

GBP/AUD

INTRODUCTION 👇 👇

GBP/AUD ya Great Britain Pound aur Australia Dollar ka currency pair hai. Is currency pair mein Great Britain ki forex Pound aur Australia ki currency Dollar ke darmiyan exchange fee ka tajzia kiya jata hai. GBP/AUD currency pair foreign exchange market mein kafi ahmiyat rakhta hai. Yeh forex pair traders aur investors ke liye ek mukhtalif opportunity aur volatility ka markaz hai. Is forex pair ke movement se traders tijarat karke faida hasil kar sakte hain. GBP, Great Britain ki forex hai, jo bohat qeemti hai aur worldwide trade mein ahmiyat rakhti hai. Great Britain ki economy robust hai aur iski foreign money ki value aur stability ke wajah se investors ki tawajah ka markaz rehti hai. Pound Sterling, yaad rakhne ke liye GBP, kay naam se bhi jana jata hai. AUD, Australia ki forex hai, jo Australia Dollar ke naam se mashhoor hai. Australia bhi ek powerful economy hai aur yeh forex globally diagnosed hai. Australia Dollar kay marketplace fee aur exchange price par economy, hobby costs, exports, imports, aur digar elements ka kafi asar hota hai. GBP/AUD foreign money pair ki movement kay peeche kuch elements hote hain. Ye elements economic signs, monetary policies, exchange balances, political balance, aur global occasions jaise Brexit wagera shamil hote hain. In sab factors ka tajzia karke buyers aur investors foreign money pair ki movement ka andaza lagate hain. GBP/AUD currency pair ki taraqqi aur exchange fee ka tajzia karne ke liye traders technical aur fundamental analysis ka sahara lete hain. Technical evaluation mein historic charge records, charts, aur indicators istemal kiye jate hain, jabke essential evaluation mein economic statistics, news releases, aur imperative financial institution ki rules ko i. Technical Indicators: Moving Averages, RSI, Fibonacci Retracements:

Technical Indicators: Moving Averages, RSI, Fibonacci Retracements:

GBP/AUD forex pair ki volatility aur movement currency investors aur traders ke liye buying and selling possibilities create karta hai. Traders is forex pair ko purchase aur promote karke quick-time period aur long-time period trades karte hain, taake faida kamayein. GBP/AUD forex pair ki motion kay liye investors aur buyers ko forex marketplace ki news aur updates par tawajah deni chahiye. Economic calendar, information websites, aur monetary evaluation platforms foreign money pair kay liye kafi beneficial hote hain. GBP/AUD currency pair ki motion unpredictable ho sakti hai. Isliye, investors aur investors ko apni trading techniques ko mazboot banane ke liye threat management techniques ka istemal karna chahiye. Stop-loss orders aur chance-praise ratio kay istemal se apne trades ko manipulate karna zaroori hai. In end, GBP/AUD foreign money pair foreign exchange market mein ek important currency pair hai. Iski movement aur alternate rate kay tajzia karne ke liye buyers aur buyers monetary data, news releases, aur technical evaluation ka istemal karte hain. Is forex pair ki volatility se faida hasil karne ke liye investors ko marketplace ki taza updates aur risk management techniques par tawajah deni chahiye. GBP/AUD currency pair foreign exchange market mein kafi popular hai aur iski motion traders aur buyers ke liye kafi mahatvapurna hai. Ye currency pair bohat hi dynamic hai aur investors ismein tijarat karke munafa kamate hain. Ab hum GBP/AUD forex pair ke aur tafsili tajziye par tawajah denge. Pound Sterling (GBP) aur Australia Dollar (AUD) dono hi currencies global market mein ahmiyat rakhti hain. Great Britain aur Australia dono hi mazboot economies hain aur inki currencies stability aur price ke liye jaani jaati hain. In dono nations ke monetary indicators, economic policies, aur alternate balances forex pair ke motion par gehraLike tu banta hay ik🙏 -

#34 Collapse

GBP/AUD ya Great Britain Pound aur Australia Dollar ka currency pair hai. Is currency pair mein Great Britain ki forex Pound aur Australia ki currency Dollar ke darmiyan exchange fee ka tajzia kiya jata hai. GBP/AUD currency pair foreign exchange market mein kafi ahmiyat rakhta hai. Yeh forex pair traders aur investors ke liye ek mukhtalif opportunity aur volatility ka markaz hai. Is forex pair ke movement se traders tijarat karke faida hasil kar sakte hain. GBP, Great Britain ki forex hai, jo bohat qeemti hai aur worldwide trade mein ahmiyat rakhti hai. Great Britain ki economy robust hai aur iski foreign money ki value aur stability ke wajah se investors ki tawajah ka markaz rehti hai. Pound Sterling, yaad rakhne ke liye GBP, kay naam se bhi jana jata hai. AUD, Australia ki forex hai, jo Australia Dollar ke naam se mashhoor hai. Australia bhi ek powerful economy hai aur yeh forex globally diagnosed hai. Australia Dollar kay marketplace fee aur exchange price par economy, hobby costs, exports, imports, aur digar elements ka kafi asar hota hai. GBP/AUD foreign money pair ki movement kay peeche kuch elements hote hain. Ye elements economic signs, monetary policies, exchange balances, political balance, aur global occasions jaise Brexit wagera shamil hote hain. In sab factors ka tajzia karke buyers aur investors foreign money pair ki movement ka andaza lagate hain. GBP/AUD currency pair ki taraqqi aur exchange fee ka tajzia karne ke liye traders technical aur fundamental analysis ka sahara lete hain. Technical evaluation mein historical charge records, charts, aur indicators istemal kiye jate hain, jabke essential evaluation mein economic statistics, news releases, aur imperative financial institution ki rules ko samjha jata hai

-

#35 Collapse

Aaj GBPAUD pair mein lagbhag 30 pips ka kafi zyada spike dekhne ko mila, jo subah AUD se mutaliq khabron ki wajah se hua, lekin foran dobara gir ke 1.93940 par aa gaya. Yeh girawat Australian dollar ke exchange rate ke mazboot hone ki wajah se hui, kyun ke Australia mein employment changes ka data aaya jo 58.2 hazaar afraad ka izafa dikhata hai. Sath hi Australia ki unemployment rate mein bhi 0.1% ka izafa dekhne ko mila. Iska nateeja yeh hua ke GBPAUD 30 pips upar gaya, lekin phir gir ke dobara 1.93940 par aagaya. Iske ilawa, aaj pound sterling ka exchange rate bhi kaafi kamzor hai, kyun ke UK GDP ka nateeja aaj 0.4% ka girawat dikhata hai aur Goods Trade Balance bhi -18.9 billion pounds tak gir gaya hai. Yeh sab mila ke GBPAUD ki movement phir se gir ke 1.93250 par aagayi. Mere fundamental analysis ke mutabiq aaj raat ko GBPAUD ki movement ko dekhte hue, maine faisla kiya ke GBPAUD ko 1.93250 tak SELL karoon.

Agar main technical analysis ke zariye GBPAUD pair ki movement ka tajziya karoon, toh yeh bhi dobara gir ke 1.93250 tak jaane ke imkaanat ko dikhata hai. H1 time frame mein GBPAUD ki movement ne bearish engulfing candle banayi hai, jo ke ek bohot mazboot signal hai ke GBPAUD ko 1.93250 tak SELL kiya jaaye. Iske ilawa, meri RSI 14 indicator par observation ke mutabiq, GBPAUD ki price 1.95250 par overbought yaani zyada khareedari ke aasar dikhata hai, jo is baat ka imkaan barhata hai ke aaj GBPAUD apni girawat par focus karegi jo ke 1.93250 tak ja sakti hai. Ye GBPAUD SELL signal SNR aur Fibonacci methods se bhi mazid support hota hai, kyun ke jab GBPAUD price 1.94200 par gayi, toh yeh SBR area mein thi. Is wajah se aaj raat SELLER kaafi zyada imkaan hai ke is pair mein entry karein aur GBPAUD ko SELL karke 1.93250 tak le jaayein. Mere technical analysis ke mutabiq aaj GBPAUD ki movement ko dekhte hue maine faisla kiya hai ke GBPAUD ko 1.93250 tak SELL karoon. -

#36 Collapse

GBP/AUD Currency Pair Forecast

Current Market Analysis

Aaj GBP/AUD currency pair mein kafi volatility dekhi ja rahi hai, jahan pe peak 1.92893 aur low 1.89073 record kiya gaya hai. Ye extremes potential buying aur selling objectives ke liye benchmarks hain. Filhal market 1.91685 ke aas-paas trade kar rahi hai, jo 1.90983 ke threshold ke upar hai, isse long positions ke liye favorable environment signal mil raha hai. Buyers ke dominance ko dekhte hue, meri strategy hai GBP/AUD ke liye buy orders initiate karna.

Key Levels and Strategy

Agar market 1.91938 mark ko breach karti hai, toh corrective movement ka prospect aur bhi zyada enticing ho jata hai. Ye level ek strategic point ban jata hai jahan purchase positions ko augment kiya ja sakta hai, aur trading landscape mein ek additional opportunity create hoti hai. Agar market expected trajectory follow karti hai, toh success mere bullish sentiment ke sath align ho jayegi. Current market conditions ko strategically assess karte hue, main GBP/AUD currency pair ke dynamics ko capitalize karne ka plan bana raha hoon.

Emphasis on Timing and Precision

Ye trading strategy precision aur timing par emphasize karti hai, khaaskar anticipated corrective movement ke baad 1.91938 breach hone ke. Currency market mein fluctuations ko navigate karte waqt well-informed decisions lena crucial hai. Identified order level jaise technical levels ko incorporate karke trading approach ko sophistication milti hai. Jaise market unfold hoti hai, is plan ki success price movements ko meticulously observe karne aur outlined strategy par adhere karne par depend karegi. 1.91938 mark ko cross karne ke baad envisaged corrective movement strategy ki linchpin banegi. Success ke liye astute observation aur timely decision-making zaroori hai. -

#37 Collapse

GBP-AUD PAIR REVIEW

Aaj GBP-AUD pair ne subah ke waqt AUD se aayi khabron ke bawajood lagbhag 30 pips ka kaafi zyada spike experience kiya, lekin yeh turant phir se gir kar 1.93940 par aa gaya. Yeh girawat is wajah se hui ke Australian dollar ki exchange rate mazboot hui jab Australia ke employment data release hue. Australia mein employment 58.2 hazar log badh gaya aur unemployment rate bhi 0.1% se badh gaya, isliye GBPAUD ka movement 30 pips tak upar gaya aur phir se 1.93940 par aa gaya. Iske ilawa, pound sterling ki exchange rate aaj bhi kafi kamzor hai kyunki UK GDP ka result 0.4% gir gaya aur Goods Trade Balance bhi -18.9 billion pounds tak gir gaya, jisse GBPAUD currency pair phir se 1.93250 tak gir gaya. Mere fundamental analysis ke mutabiq, main aaj raat GBPAUD ko 1.93250 tak sell karne ka faisla kiya hai.

Agar main technical analysis ki madad se GBPAUD currency pair ka analysis karoon, to yeh bhi girne ki taraf hi indicate karta hai aur 1.93250 tak aa sakta hai. H1 time frame mein, GBPAUD ka movement bearish engulfing candle form kar raha hai, jo ke sell karne ke liye ek mazboot signal hai. Iske ilawa, mere observations ke mutabiq, RSI 14 indicator bhi dikhata hai ke GBPAUD price 1.95250 par overbought hai, yaani ki buying mein zyada saturation ho gayi hai, isliye aaj GBPAUD ke girne ki sambhavana kafi zyada hai jo 1.93250 tak pohnch sakta hai.

Yeh GBPAUD sell signal SNR aur Fibonacci methods se bhi support kiya jata hai kyunki jab GBPAUD price 1.94200 par pohncha, to yeh SBR (Support Becomes Resistance) area mein tha, isliye aaj raat sellers ka enter karna aur GBPAUD ko bechna kafi mumkin hai, jo shayad 1.93250 tak pohnch sakta hai. Mere technical analysis ke mutabiq, aaj main GBPAUD ko 1.93250 tak sell karne ka faisla kiya hai. -

#38 Collapse

**GBP-AUD Pair Forecast**

Trend ke perspective se dekha jaye to GBP/AUD pair ne pehle ek significant increase dekha, jo ke ek strong bullish movement se mark kiya gaya. Yeh trend yeh dikhata hai ke GBP ne observed period ke doran AUD ke muqablay mein strength gain ki. Lekin, peak ko reach karne ke baad, price correction ya consolidation ke signs dikhane lagi, jahan price pichle mentioned resistance aur support levels ke darmiyan fluctuate kar rahi hai.

Resistance level jo ke 1.94674 pe hai, wo ek key area hai jise dekhna zaroori hai. Price ne is level ko kai dafa break karne ki koshish ki, lekin strong bullish momentum ko maintain nahi kar payi. Yeh dikhata hai ke is area mein kaafi zyada selling pressure hai, jiski wajah se price level ke paas aane ke baad phir se neeche chali gayi. Dusri taraf, support level 1.93208 bhi price decline ko rokne mein important role play karta hai. Yeh area strong support provide karta hai, jahan price ne kai dafa bounce kiya, jo yeh indicate karta hai ke yahan par buying interest bhi kaafi zyada hai.

Iske ilawa, price movement jo ke closer time frame mein dekha gaya, consolidation pattern dikhata hai. Price sideways move kar rahi hai, jo market uncertainty ya strong fundamental trigger ka wait karne ki indication hai jo next direction determine karega. Aise situation mein, traders aksar key levels (resistance ya support) se breakout ka confirmation wait karte hain taake further trading decisions le sakein. Agar price resistance level 1.94674 ko break karne mein kamiyab hoti hai, to bullish trend continue hone ke potential hai, aur next upside target pehle ke peak ke aas-paas ho sakta hai. Lekin agar price support level 1.93208 ko break karti hai, to decline continue hone ka potential hai, jo price ko agle support level ke taraf le ja sakta hai.

Overall, GBP/AUD pair ka trend abhi consolidation phase mein hai aur key resistance aur support levels pe nazar rakhna zaroori hai. Traders ko breakout confirmation ka intezar karna hoga taake agle trading decisions liye ja sakein. -

#39 Collapse

GBP/AUD

**GBP/AUD Ka Tajziya aur Forecast**

### 1. **GBP/AUD Ka Overview**

GBP/AUD ek kafi mashhoor currency pair hai jisme ek taraf British Pound (GBP) aur doosri taraf Australian Dollar (AUD) hota hai. Ye pair zyadatar risk appetite, global markets ki halaat, aur economic events se mutasir hota hai. Australian economy commodity-driven hai jabke UK ki economy zyada service-oriented hai, is liye dono countries ki economy mein bohot faraq hai jo market ke movement par asar andaz hota hai.

### 2. **Technical Indicators**

Agar hum technical analysis karein to GBP/AUD mein RSI (Relative Strength Index) ne oversold aur overbought zones mein movement dikhayi hai. Abhi ke dauran, RSI neutral zone ke qareeb hai, jo yeh indicate karta hai ke abhi market ek clear direction ki talaash mein hai. 50-day aur 200-day moving averages bhi hume range-bound movement ka pata deti hain.

Support aur resistance levels ki baat karein to immediate resistance 1.9200 ke qareeb hai, jabke neeche support 1.8900 par maujood hai. Agar price 1.9200 ko breach kar leti hai to hum ek bullish trend dekh sakte hain. Warna price 1.8900 ke neeche girne ka khatka bhi hai, jo pair ko bearish side ki taraf le ja sakta hai.

### 3. **Fundamental Factors**

Fundamental analysis mein hum dekhtay hain ke Australian economy ko commodities, khaaskar iron ore aur coal ki prices direct asar detay hain. Jab in commodities ki prices barhti hain to AUD strong hota hai. Dosri taraf, UK economy ko inflation aur interest rate decisions bohot ziada mutasir kartay hain. Agar Bank of England interest rates mein izafa karta hai to GBP mein strength dekhne ko mil sakti hai.

Abhi ki halaat ko dekhte huye, global market mein uncertainty ke bawajood, AUD thoda weak nazar aa raha hai. Lekin yeh sab depend karega aglay economic data releases aur global risk sentiment par.

### 4. **Conclusion**

GBP/AUD ek ahem currency pair hai jo economic events, commodities ki prices, aur risk sentiment se mutasir hota hai. Is waqt market ek neutral phase mein hai lekin agle kuch dinon mein hum ek clear breakout ya breakdown ki umeed kar saktay hain. Trading ke liye zaroori hai ke support aur resistance levels ko closely follow kiya jaye, aur fundamental factors ko madde nazar rakha jaye.

-

#40 Collapse

GBP-AUD PAIR REVIEW

Aaj ke din mein AUD ki news ki wajah se 30 pips ka kaafi zyada spike dekhne ko mila, lekin phir price wapas gir kar 1.93940 par aagai. Yeh girawat Australia mein employment changes ka data release hone ke baad hui, jisme 58.2 hazar logon ka izafa hua aur Australia ka unemployment rate bhi 0.1% barh gaya. Is wajah se pehle GBPAUD ka movement 30 pips barha, lekin phir se price 1.93940 par gir gayi. Iske ilawa, pound sterling ka exchange rate aaj kaafi kamzor raha, kyun ke UK ka GDP aaj 0.4% gir gaya, aur Goods Trade Balance bhi -18.9 billion pounds tak gir gaya, jo GBPAUD currency pair ko dobara se 1.93250 tak girne ka sabab bana. Mere fundamental analysis ke mutabiq, aaj raat ke liye GBPAUD ke movement par main ne faisla kiya ke main GBPAUD ko SELL karun ga 1.93250 tak.

Agar main technical analysis ko dekhu toh GBPAUD ka movement bhi wapas 1.93250 tak girne ka imkaan zahir karta hai. H1 time frame mein dekhne par, GBPAUD currency pair ne ek bearish engulfing candle banayi hai, jo ke ek bohot mazboot signal hai SELL ke liye. Iske ilawa, mere RSI 14 indicator ke mutabiq, GBPAUD ka price jab 1.95250 par tha toh overbought ho chuka tha, yaani ke market mein bohot zyada buying ho chuki thi. Is liye, aaj ke din GBPAUD ka focus girawat par hoga jo ke 1.93250 tak ja sakti hai. Is GBPAUD SELL signal ko SNR aur Fibonacci methods bhi mazid support karte hain, kyun ke jab GBPAUD ka price 1.94200 tak aaya, toh yeh already SBR area mein tha, jahan se ye imkaan hai ke SELLER is pair mein enter karein aur isko girawat tak le jayen jo ke shayad 1.93250 tak pohoch jaye.

Mere technical analysis ke natijay ke mutabiq, aaj GBPAUD ke movement ke liye main ne faisla kiya ke main GBPAUD ko SELL karun ga 1.93250 tak. Kisi educator se madad lene ki koshish karein aur dusre tools ka istemal karein. Aakhri baat, analysis ke dauran ek bohot ahem cheez time frames ka alignment hai. Jab daily aur hourly charts dono ek hi direction mein point kar rahe hon, toh is se market mein entry ke liye kaafi weightage milti hai. Agar market bullish ho, aur hourly chart short-term momentum upar ki taraf dikhata ho aur daily chart bhi long-term upward trend ko reinforce kare, toh is direction mein entry ko zyada confidence ke sath liya ja sakta hai.

Aap ke liye behtareen khwahishaat! -

#41 Collapse

GBP/AUD Pair Forecast

Trend ke hawale se dekha jaye to, GBP/AUD pair ne pehle kaafi bara izafa dekha, jo ke ek strong bullish movement thi. Yeh trend yeh dikhata hai ke GBP ne AUD ke muqablay mein quwati hasil ki thi. Lekin, peak par pohnchne ke baad, price correction ya consolidation dikhane lagi, jahan price resistance aur support levels ke darmiyan fluctuate kar rahi hai.

Resistance level 1.94674 ek key area hai. Price ne is level ko kai baar break karne ki koshish ki, lekin strong bullish momentum maintain nahi kar paayi. Isse yeh pata chalta hai ke is area mein kaafi selling pressure hai, jiski wajah se price ne is level ke nazdeek aane ke baad phir se neeche aagayi. Iske baraks, support level 1.93208 bhi price ke decline ko rokne mein important role ada kar raha hai. Yeh area price ko support provide kar raha hai, jahan price ne is level se bounce kiya hai, jo ke buying interest dikhata hai.

Qareeb ke time frame mein price movement consolidation pattern dikhati hai. Price sideways move karti hai, jo ke market ki uncertainty ya kisi strong fundamental trigger ka intezar dikhata hai jo agle direction ko tay kare. Aise mein, traders aksar key levels (resistance ya support) ke breakout ka confirmation wait karte hain taake agle trading decisions liye ja sakein. Agar price resistance 1.94674 ko break kar leti hai, to bullish trend continue hone ki potential hai, aur next upside target previous peak ke aas paas ho sakta hai. Lekin agar price support 1.93208 ko break kar leti hai, to decline continue hone ki potential hai, jo price ko next support level ke paas le ja sakta hai.

Technical analysis ke mutabiq, GBPAUD pair ka H1 time frame mein bearish engulfing candle ban gaya hai, jo strong signal hai ke GBPAUD ko 1.93250 tak sell karna chahiye. RSI 14 indicator ke mutabiq, GBPAUD price 1.95250 par overbought ho chuki hai, isliye aaj GBPAUD ka decline hone ke chances hain jo 1.93250 tak ja sakta hai. SNR aur Fibonacci methods bhi is SELL signal ko support karte hain, kyunki GBPAUD price 1.94200 par SBR area mein hai, toh yeh possibility hai ke tonight SELLER is pair ko 1.93250 tak sell karenge. -

#42 Collapse

GBP/AUD: Ek Hourly Time Frame Analysis

Maujooda market conditions ke mutabiq, GBPAUD mein buy entry recommend ki ja rahi hai, jisme short-term goal 1.9745 level tak pahunchna hai. Bullish sentiment jo market mein dominate kar raha hai, yeh is baat ka ishara karta hai ke bulls dobara se qabza le sakte hain, jab ke dono buyers aur sellers kamzor reh sakte hain. Yeh traders ke liye ek acha moka hai ke woh anticipated upward movement se faida utha sakein. Market dynamics un traders ke haq mein lagti hain jo long positions lene ka soch rahe hain, khaaskar jab London ya UK trading session shuru hoti hai. In sessions mein activity zyada hoti hai jo ke traders ke liye zyada clear direction dete hain, aur iss case mein yeh bulls ke faide mein hai.

London ya UK session ke doran, GBPAUD market zyada active hoti hai, jo ke bulls ke liye ek faidamand environment banati hai taake informed decisions li ja sakein. Is waqt market ka sentiment upward trend ke continuation ki taraf hai, jo ke sellers ko zyada moka nahi dega ke woh control le sakein. Iska matlab yeh hai ke aaj, ya aglay kuch dinon mein, sellers ke liye zyada chances nahi hain ke woh momentum gain kar sakein, kyun ke bullish sentiment apni strength barqarar rakhega. Yeh trend yeh ishara karta hai ke market ke zyada chances hain ke yeh higher levels tak push kare, khaaskar 1.9745 resistance ko break kare. Maujooda market ke factors bulls ke haq mein hain, jo unhein zyada strong aur upward movement karne ke liye achi position mein rakhte hain. Technical indicators aur market sentiment dono is baat ko support karte hain ke bulls asaani se 1.9745 ke upper level ko cross kar sakte hain, ya to aaj ya phir iss hafta ke end tak. Is baat ko madde nazar rakhte hue, traders ko buy position enter karne ka sochna chahiye taake potential price break ka faida uthaya ja sake.

Wish you all the best!

### Trading Overview:

Agar overall dekha jaye, to mein yeh suggest karunga ke GBPAUD mein buy order place kiya jaye. Price iss waqt 1.9673 ke qareeb hover kar rahi hai, aur chances hain ke yeh agle resistance zone ko breach kar sakti hai. Sabse prudent approach yeh hogi ke take profit ka target 1.9700 par set kiya jaye. Yeh level strategy ke lehaz se current price action ke thoda upar rakha gaya hai, jo ke traders ko gains secure karne ka moka dega pehle ke koi retracements ya reversals aayein. Take profit 1.9700 ek realistic target hai jo ongoing bullish movement ke saath align karta hai. Aakhri baat yeh hai ke GBPAUD market ko aaj upward movement continue karte hue dekha ja raha hai, jo ke technical factors aur positive sentiment ka mix hai. Mukhtalif indicators, jaise ke moving averages aur trendlines, is forecast ko support kar rahe hain, jo is baat ko reinforce karte hain ke pair agle range ko break kar sakta hai. Agar aisa hota hai to naye resistance levels khulne ke chances hain, jo zyada upward movement ki taraf le ja sakte hain, aur un logon ke liye naye opportunities create kar sakte hain jo already long positions hold kar rahe hain. Mein buy orders dene aur US dollar se mutaliq aane wali news events ka tajzia karne ka mashwara deta hoon. -

#43 Collapse

**GBP/AUD: Har Ghante Ka Analysis**

Mojooda market conditions ke mutabiq, GBP/AUD pair ke liye buying entry ki tajwez di ja rahi hai, jiska short-term goal 1.9745 level tak pahunchna hai. Market ka bullish sentiment yeh darshata hai ke bulls dobara control le sakte hain, jabke buyers aur sellers dono kamzor lag rahe hain. Yeh situation traders ke liye ek accha mauka faraham karti hai taake woh upar ki taraf hone wale movement ka faida utha sakein. London ya UK trading session ke doran, GBPAUD market zyada active hoti hai, jo bulls ko fayda deta hai aur unhe behtar faisle lene mein madad karta hai.

London ya UK session ke doran, GBPAUD market zyada activity dikhati hai, jo bulls ke liye faida mand environment faraham karti hai. Market ka sentiment is waqt upward trend ke continue hone ki taraf jhuk raha hai, jiska matlab hai ke aaj ya aane wale kuch dino tak sellers ko momentum gain karne ke zyada mauqe nahi milenge. Yeh trend darshata hai ke market zyada levels ki taraf push karne ka zyada chance hai, khaaskar 1.9745 resistance ko break karne ka. Mojooda factors market mein bulls ko support kar rahe hain, jo unki upward movement ko barhawa dete hain. Technical indicators aur market sentiment dono is baat ko support karte hain ke bulls aasan se 1.9745 ka upper level cross kar sakte hain, chahe aaj ho ya is hafte ke dauran. Iske madde nazar, traders ko buying position mein enter karna chahiye taake potential price break ka faida utha sakein.

**Market Sentiment aur Trading Plan**

Mojooda market sentiment GBPAUD mein bulls ko support kar raha hai jo 1.9635 level ko test kar chuke hain. Bears ya sellers ko aaj zyada mauqe nahi milenge. Lekin woh agle trading week ke liye ek accha trading plan tayyar kar sakte hain. Trading karte waqt careful aur risk management ka khayal rakhna zaroori hai, khaaskar jab buying position mein enter kar rahe hain. Charts aur market conditions is waqt upward movement ko support kar rahe hain, lekin yeh kabhi bhi nahi maan sakte ke koi trend bina correction ya pullback ke continue karega. Appropriate stop-loss levels set karna aur key resistance levels ko monitor karna jahan selling pressure emerge ho sakta hai, yeh successful strategy ke critical components hain. In risk management techniques ko incorporate karke, capital ko protect karna aur market ke bullish bias ka faida uthana mumkin hai.

- GBPAUD

- Mentions 0

-

سا0 like

-

#44 Collapse

**GBP-AUD Pair Forecast**

Trend ke perspective se dekha jaye to GBP/AUD pair ne pehle ek significant increase dekha, jo ke ek strong bullish movement se mark kiya gaya. Yeh trend yeh dikhata hai ke GBP ne observed period ke doran AUD ke muqablay mein strength gain ki. Lekin, peak ko reach karne ke baad, price correction ya consolidation ke signs dikhane lagi, jahan price pichle mentioned resistance aur support levels ke darmiyan fluctuate kar rahi hai.

Resistance level jo ke 1.94674 pe hai, wo ek key area hai jise dekhna zaroori hai. Price ne is level ko kai dafa break karne ki koshish ki, lekin strong bullish momentum ko maintain nahi kar payi. Yeh dikhata hai ke is area mein kaafi zyada selling pressure hai, jiski wajah se price level ke paas aane ke baad phir se neeche chali gayi. Dusri taraf, support level 1.93208 bhi price decline ko rokne mein important role play karta hai. Yeh area strong support provide karta hai, jahan price ne kai dafa bounce kiya, jo yeh indicate karta hai ke yahan par buying interest bhi kaafi zyada hai.

Iske ilawa, price movement jo ke closer time frame mein dekha gaya, consolidation pattern dikhata hai. Price sideways move kar rahi hai, jo market uncertainty ya strong fundamental trigger ka wait karne ki indication hai jo next direction determine karega. Aise situation mein, traders aksar key levels (resistance ya support) se breakout ka confirmation wait karte hain taake further trading decisions le sakein. Agar price resistance level 1.94674 ko break karne mein kamiyab hoti hai, to bullish trend continue hone ke potential hai, aur next upside target pehle ke peak ke aas-paas ho sakta hai. Lekin agar price support level 1.93208 ko break karti hai, to decline continue hone ka potential hai, jo price ko agle support level ke taraf le ja sakta hai.

Overall, GBP/AUD pair ka trend abhi consolidation phase mein hai aur key resistance aur support levels pe nazar rakhna zaroori hai. Traders ko breakout confirmation ka intezar karna hoga taake agle trading decisions liye ja sakein

- GBPAUD

- Mentions 0

-

سا0 like

-

<a href="https://www.instaforex.org/ru/?x=ruforum">InstaForex</a> -

#45 Collapse

Filhal, GBPAUD market ek bullish concept ko follow kar raha hai. Yeh 1.9673 level ke aas paas trade kar raha hai, aur buyers ke isay upar push karne ke chances barh rahe hain. Isliye, main suggest karta hoon ke aap GBPAUD mein buy order place karein, jiska take profit target 1.9700 set kiya jaye. Mera khayal hai ke GBPAUD market aaj bhi upar ki taraf move karta rahega aur agle range ko break kar sakta hai. Isliye, humein iske mutabiq sochna chahiye aur apni trading priorities ko accordingly adjust karna chahiye.

Agar hum broad view se dekhein, to main phir se recommend karta hoon ke GBPAUD mein buy order place kiya jaye. Jab price 1.9673 level ke aas paas hover kar rahi hai, to yeh possibility hai ke yeh next resistance zone ko breach kar sakti hai. Is situation mein sabse prudent approach yeh hogi ke take profit target 1.9700 par set kiya jaye. Yeh level strategically current price action ke upar hai, jo traders ko mauka deta hai ke wo gains secure kar lein pehle se hi potential retracements ya reversals ke hone se pehle. 1.9700 par take profit set karna ek realistic target hai jo ongoing bullish movement ke sath align karta hai.

Aaj ke din, GBPAUD market ke upward movement ki expectation hai, jo technical factors aur positive sentiment ke mix se driven hai. Moving averages aur trendlines jaise various indicators bhi is forecast ko support kar sakte hain, jo reinforce karte hain ke pair agle range ko break kar sakta hai. Agar yeh hota hai, to naye resistance levels khul sakte hain aur further upward movement ko lead kar sakte hain, jo long positions rakhne wale traders ke liye aur bhi zyada opportunities create kar sakti hai.

Ek or baat jo important hai woh yeh hai ke market mein news events related to the US dollar ko bhi analyze karna chahiye. Yeh news events market ki overall sentiment ko impact kar sakte hain aur trading decisions ko influence kar sakte hain. Aapko har waqt market ki latest news aur economic indicators ko track karna chahiye jo aapke trading strategy ko support kar sakti hain ya usme changes la sakti hain.

Technical analysis ke sath sath, market ke broader context ko bhi samajhna zaroori hai. Agar aap market trends aur economic news ko analyze karenge, to aapko better insights milengi ke GBPAUD ke upar ya niche jane ke chances kitne hain. Is analysis ke zariye, aap apne trading decisions ko zyada informed aur strategic bana sakte hain.

GBPAUD ke bullish trend ko dekhte hue, buy orders ko strategically place karna aur take profit target ko realistically set karna aapke trading success ke chances ko barha sakta hai. Current price action aur market sentiment ke analysis ke sath, aapko trading decisions lene mein madad milegi jo aapko favorable outcomes ki taraf le ja sakti hai.

Aapko yeh bhi dhyan rakhna chahiye ke market conditions frequently change hoti hain aur aapko apne trading strategy ko adapt karna pad sakta hai. Isliye, regular market analysis aur updates ko follow karna zaroori hai taake aap kisi bhi sudden market movements se bach sakein aur apni positions ko accordingly adjust kar sakein.

GBPAUD market ka bullish trend jo hum dekh rahe hain, woh ek positive signal hai aur agar aap buy orders place karenge aur take profit target ko 1.9700 par set karenge, to aapko trading mein achhe results milne ke chances hain. Lekin, aapko yeh bhi samajhna hoga ke trading mein risk management bhi important hai.

Hamesha stop-loss orders ko bhi consider karein jo aapko potential losses se bachane mein madad kar sakte hain. Trading decisions ko market trends aur technical indicators ke base par banayein aur news events ko bhi monitor karte rahein. Yeh approach aapko market ki changes ke sath synchronize rakhne mein madad karega aur aapko zyada successful trading outcomes milne ke chances barha dega.

In sab cheezon ko dhyan mein rakhte hue, main recommend karta hoon ke aap GBPAUD mein buy orders place karein aur 1.9700 par take profit target set karein. Yeh level aapko ek realistic opportunity dega gains secure karne ke liye aur market ke bullish trend se fayda uthane ka mauka dega. Trading decisions ko carefully analyze karke aur market conditions ko samajhkar, aap apne trading strategy ko enhance kar sakte hain aur better results achieve kar sakte hain.

- GBPAUD

- Mentions 0

-

سا0 like

اب آن لائن

ہم مواصلات کے پلیٹ فارم کے طور پر فاریکس فورم فاریکس پاکستان کے آپ کے انتخاب کی تعریف کرتے ہیں۔

موجودہ وقت 08:51 PM (GMT+5)۔

Working...

X

تبصرہ

Расширенный режим Обычный режим