T E C H N I C A L _ A N A L Y S I S

G B P / U S D

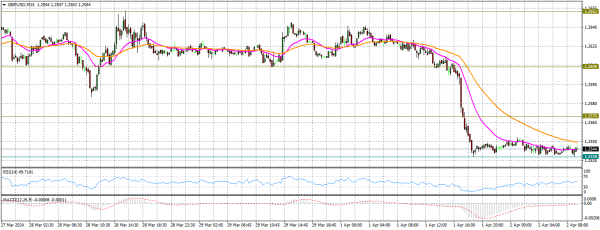

Meray aziz dosto, umeed hai ke aap sab theek hain aur forum par acha kaam kar rahe hain. Aaj ka mera article GBP/USD market ki mojooda keemat ke rawayya par hai. To chaliye, hum apna trading system shuru karte hain. Mojudah waqt mein, GBP/USD 1.2538 se ooncha hai. Is haftay bhi, GBP/USD ka girnay ka silsila jaari reh sakta hai kyun ke ab bhi dollar kafi had tak mazboot ho raha hai. Relative Strength Index (RSI) indicator girnay ki ihtimal ko tasdeeq karta hai. Ye indicator cross kar chuka hai aur neechay ki taraf ishaarah kar raha hai. Oversold zone ka had 20 tak lamba safar abhi bhi hai. Iske baad, meri tajwez hai ke keemat phir se bulish trend jaari rakhnay ke liye upar uthaygi. Intehai wakt par, moving average convergence divergence (MACD) dikhata hai ke bearish momentum shuru ho chuka hai. Jabke EMA 50 aur EMA 20 keemat ko negative support faraham karte hain. Keemat 50 exponential moving average tak pohanchti hai, to dekhen ke iska kaisa reaction hota hai.

G B P / U S D

Meray aziz dosto, umeed hai ke aap sab theek hain aur forum par acha kaam kar rahe hain. Aaj ka mera article GBP/USD market ki mojooda keemat ke rawayya par hai. To chaliye, hum apna trading system shuru karte hain. Mojudah waqt mein, GBP/USD 1.2538 se ooncha hai. Is haftay bhi, GBP/USD ka girnay ka silsila jaari reh sakta hai kyun ke ab bhi dollar kafi had tak mazboot ho raha hai. Relative Strength Index (RSI) indicator girnay ki ihtimal ko tasdeeq karta hai. Ye indicator cross kar chuka hai aur neechay ki taraf ishaarah kar raha hai. Oversold zone ka had 20 tak lamba safar abhi bhi hai. Iske baad, meri tajwez hai ke keemat phir se bulish trend jaari rakhnay ke liye upar uthaygi. Intehai wakt par, moving average convergence divergence (MACD) dikhata hai ke bearish momentum shuru ho chuka hai. Jabke EMA 50 aur EMA 20 keemat ko negative support faraham karte hain. Keemat 50 exponential moving average tak pohanchti hai, to dekhen ke iska kaisa reaction hota hai.

Is chart par, 6 horizontal lines hain jo support aur resistance areas ko darust karte hain jo neechay dikhaya gaya hai. GBP/USD ne 1.2570 ke level par mazboot resistance dhoondha hai. Agar ye level tor diya jaaye to agla upside target hai 2nd level of resistance jo 1.2609 par waqai hai. Iske baad, kharidar naye upar ki taraf rukh talash karenge crucial $1.2652 mark ki taraf jo 3rd level of resistance hai. Dosri taraf, GBP/USD ne 1.2538 ke level par mazboot support dhoondha hai. Agar ye level tor diya jaaye to agla downside target hai 2nd level of support jo 1.2232 par waqai hai. Iske baad, farokht karne wale naye neeche ki taraf rukh talash karenge crucial $1.1921 mark ki taraf jo 3rd level of support hai. Main aapka shukriya ada karta hoon ke aapne meri tajwez ko parhne ka waqt nikala. Ye kuch aisi cheez hai jo mujhe umeed hai ke aapke kaam aayegi.

تبصرہ

Расширенный режим Обычный режим