Technical Analysis: GBP/USD Upside Potential

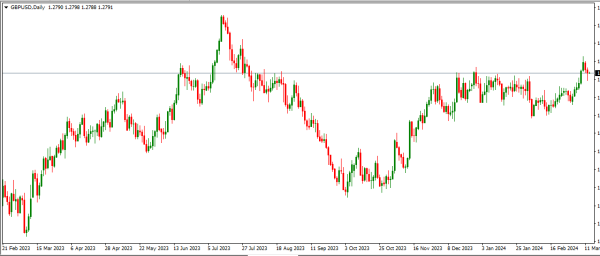

GBP/USD ka 20-day Exponential Moving Average (EMA) abhi bhi ek upward trend par hai, jiska haal 1.2720 hai, jo mustaqbil mein izafa ka imkaan darust karta hai. Haal hi mein 1.2894 se gira hai, lekin yeh abhi bhi August (1.2819) ke level ke qareeb support hasil kar raha hai, jo ke mazid istiqamat ki alamat hai. Momentum indicators mukhtalif signals faraham karte hain: 14-period Relative Strength Index (RSI) apne peak se thoda neeche hai lekin ab bhi 50 ke neutral hadood ke ooper hai, jo ke mustaqbil ki bullish momentum ki tawajo ko ishara karta hai. Dusri taraf, Moving Average Convergence Divergence (MACD) haal hi mein apne trigger line ke ooper se guzra hai lekin mazid taqatwar uparward momentum ki kami hai. Agar GBP/USD ke price simple moving average ke ooper se guzar jaye, toh yeh 1.2785 ke channel cap ko dobara test kar sakta hai aur mazid chadhne ki mumkinat ko andaza dilata hai. Aik ahem uparward move bhi mukhtalif outlooq ko bullish taraf muqarrar kar sakta hai, jis mein 1.3000 ke psychological level ko challenge karne ka imkaan hai. Karobarion ko in technical indicators ko mazid tawajo se dekhna chahiye takay market sentiment aur trading opportunities ka andaza lagaya ja sake.

Market Mood Ka Technical analysis: Bullish Sentiment

Daily chart ka tafseeli jaeza wave technique ke zariye GBP/USD ke liye aik bullish outlooq zahir karta hai. Dono moving averages, MA100 aur MA18, mustaqil bullish signals faraham karte hain, jahan MA100 das degree ke aik trend angle par aur MA18 tees degree ke zyada upward trend par hai. Yeh darust bullish sentiment ka saboot hai jo market mein mojood hai. Mazeed iske sath, Ichimoku Cloud hamare mukhtarar karne wale moving average ke ooper maujood hai, jo ke aik mazid bullish bias ke liye support faraham karta hai. Mazeed iske sath, candles local Cloud ke ooper maujood hain, jo ke bullish sentiment ko mustaqil karte hain. Natije mein, price mein kisi bhi giravat ko aik overall bullish trend ke andar correction ke tor par samjha jana chahiye, jahan mukhya focus mazeed mazeed chadhne ke opportunities par hota hai.

Short-Term Strategy: Selling Opportunities Ka Istifada

Chhotay arse mein, traders ko selling opportunities ka faiyda uthana chahiye jo ke indicators jese HamaSystem aur RSI Trend H1 timeframe par bearish mood faraham karte hain. Dono indicators laal rang mein hain, jo ke market mein selleron ki numaya taaqat ko ishara karte hain. Yeh aik mufeed mahol faraham karta hai sell transactions ke liye. Traders magnetic levels indicator ka istemal karke positions ko band kar sakte hain, jahan maujood ideal level kaam karne ke liye 1.26772 hai. Mazeed, traders ko price ke harkaat ko nazdeek se monitor karna chahiye aur dekhna chahiye ke positions ko jari rakhne ya faida hasil karne ka faisla kaise kiya jaye. Ziada munafa hasil karne ke liye, traders ko ek Trailing Stop order bhi lagana chahiye, jise unhone pehle se zyadah hissa band kar diya hai aur baqi hissa ko breakeven par rakha hai.

Market Outlook: GBP/USD Bearish Trend

Technical indicators ishara karte hain ke GBP/USD ke liye qareebi dor mein neeche ki taraf ka rukh mumkin hai. Relative Strength Index (RSI) darmiyani rekha ke neeche hai aur shayad pichle October se iske kam level par girne wala hai, jo ke Pound ko oversold darust karta hai aur iske liye ek correction ka waqt aya hai. Agar GBP/USD pair ne giravat jari rakhi, toh yeh qareebi dor mein 1.2486-1.2553 range ko test kar sakta hai. Yeh zone October 26, 2023 ke trend line aur 100 aur 200 dinon ke moving averages ke zariye wazeh hota hai, jo is potential support level ko mazeed ahmiyat faraham karta hai. Agar Pound is level ke neeche gir jata hai, toh phir yeh 1.2287-1.2393 zone ki taraf gir sakta hai, jo January 3, 2019 ke low aur June 1, 2021 se September 26, 2022 tak ke downtrend ka 50% Fib retracement level daryaft karta hai. Aam tor par, GBP/USD pair ke liye outlooq abhi bearish hai, jabke US dollar mazid mustaqbil hai aur UK ki maeeshat kamzoriyat ka izhar kar rahi hai. Traders ko ahtiyaat aur aham support aur resistance levels ko nazdeek se dekh kar forex market mein potential trading opportunities ko samajhne ke liye mashqiyat ka tajziya karna chahiye.

Navigating Market Uncertainty

Jaise ke traders ko 1.2794 ka darwaza kehtara hai jo ke market ka palatnay ka imkaan darust karta hai, aik strategy mein trading operations ka a temporary cessation trading activities ke sath-sath ahtiyat ke sath karna chahiye takay market ke anjam ko wazehi ke sath dekha ja sake. Lachari aur badlne ke liye tayar rehna financial markets mein kaam karne ke liye lazmi hai, jo ke emerging opportunities ya incoming risks se apni positions ko bachane ke liye rukhsat hai. Ghairat aur adaptability ke sath trading karne se traders apni ships ko turbulant paniyon mein bharakna seekhte hain, jante hain ke unke paas mukhtalif maqamein aur agle kadam ke liye sahi tayyari hai.

Market Dynamics

Geopolitical developments aur changing market conditions forex market ke dynamics par bada asar dal sakte hain. Agar achhe trends mojood hain, toh fluctuations aur corrections laazmi hai, jo trading strategies ke mutadil nazriye ko zaroori banata hai. Effective risk management strategies, jese ke diversification aur stop-loss orders, potential nuksan ko kam karne aur trading portfolios ko mehfooz rakhne ke liye lazmi hain. Iske alawa, macroeconomic trends aur geopolitical developments ke baray mein maloomat hasil karne se potential market shifts ke baray mein aham insights mil sakte hain, jo ke traders ko apni strategies ko mutabiq tayyar karne aur emerging opportunities ka faida uthane mein madad faraham karta hai.

Potential Growth

GBP/USD pair mein potential growth ke mukhtalif scenarios mein se ek ahem role key resistance levels ke toorna shamil hai, jese ke 1.2890 aur 1.2900, jo ke mazid mazid mazid karanay aur upward momentum ki taraf muqarrar kar sakta hai. Maazi ke movement ke mutabiq, agar pair 1.2707 ke darmiyan giravat ka samna karta hai, toh mazeed chadhne ki sambhavna hai. Traders ko price ke harkaat aur key levels, jese ke 1.2895, ko ghaur se monitor karna chahiye taake mazeed chadhne ya ulte pulta hone ke signals ko pehchan sakein. Lekin, USD ke rukh aur market participants ke reactions ke bare mein uncertainties is manzar ko mazeed tawazo aur adaptability se samajhna zaroori banate hain, taa ke market ke potential scenarios ko effectivly navigate kiya ja sake.

GBP/USD ka 20-day Exponential Moving Average (EMA) abhi bhi ek upward trend par hai, jiska haal 1.2720 hai, jo mustaqbil mein izafa ka imkaan darust karta hai. Haal hi mein 1.2894 se gira hai, lekin yeh abhi bhi August (1.2819) ke level ke qareeb support hasil kar raha hai, jo ke mazid istiqamat ki alamat hai. Momentum indicators mukhtalif signals faraham karte hain: 14-period Relative Strength Index (RSI) apne peak se thoda neeche hai lekin ab bhi 50 ke neutral hadood ke ooper hai, jo ke mustaqbil ki bullish momentum ki tawajo ko ishara karta hai. Dusri taraf, Moving Average Convergence Divergence (MACD) haal hi mein apne trigger line ke ooper se guzra hai lekin mazid taqatwar uparward momentum ki kami hai. Agar GBP/USD ke price simple moving average ke ooper se guzar jaye, toh yeh 1.2785 ke channel cap ko dobara test kar sakta hai aur mazid chadhne ki mumkinat ko andaza dilata hai. Aik ahem uparward move bhi mukhtalif outlooq ko bullish taraf muqarrar kar sakta hai, jis mein 1.3000 ke psychological level ko challenge karne ka imkaan hai. Karobarion ko in technical indicators ko mazid tawajo se dekhna chahiye takay market sentiment aur trading opportunities ka andaza lagaya ja sake.

Market Mood Ka Technical analysis: Bullish Sentiment

Daily chart ka tafseeli jaeza wave technique ke zariye GBP/USD ke liye aik bullish outlooq zahir karta hai. Dono moving averages, MA100 aur MA18, mustaqil bullish signals faraham karte hain, jahan MA100 das degree ke aik trend angle par aur MA18 tees degree ke zyada upward trend par hai. Yeh darust bullish sentiment ka saboot hai jo market mein mojood hai. Mazeed iske sath, Ichimoku Cloud hamare mukhtarar karne wale moving average ke ooper maujood hai, jo ke aik mazid bullish bias ke liye support faraham karta hai. Mazeed iske sath, candles local Cloud ke ooper maujood hain, jo ke bullish sentiment ko mustaqil karte hain. Natije mein, price mein kisi bhi giravat ko aik overall bullish trend ke andar correction ke tor par samjha jana chahiye, jahan mukhya focus mazeed mazeed chadhne ke opportunities par hota hai.

Short-Term Strategy: Selling Opportunities Ka Istifada

Chhotay arse mein, traders ko selling opportunities ka faiyda uthana chahiye jo ke indicators jese HamaSystem aur RSI Trend H1 timeframe par bearish mood faraham karte hain. Dono indicators laal rang mein hain, jo ke market mein selleron ki numaya taaqat ko ishara karte hain. Yeh aik mufeed mahol faraham karta hai sell transactions ke liye. Traders magnetic levels indicator ka istemal karke positions ko band kar sakte hain, jahan maujood ideal level kaam karne ke liye 1.26772 hai. Mazeed, traders ko price ke harkaat ko nazdeek se monitor karna chahiye aur dekhna chahiye ke positions ko jari rakhne ya faida hasil karne ka faisla kaise kiya jaye. Ziada munafa hasil karne ke liye, traders ko ek Trailing Stop order bhi lagana chahiye, jise unhone pehle se zyadah hissa band kar diya hai aur baqi hissa ko breakeven par rakha hai.

Market Outlook: GBP/USD Bearish Trend

Technical indicators ishara karte hain ke GBP/USD ke liye qareebi dor mein neeche ki taraf ka rukh mumkin hai. Relative Strength Index (RSI) darmiyani rekha ke neeche hai aur shayad pichle October se iske kam level par girne wala hai, jo ke Pound ko oversold darust karta hai aur iske liye ek correction ka waqt aya hai. Agar GBP/USD pair ne giravat jari rakhi, toh yeh qareebi dor mein 1.2486-1.2553 range ko test kar sakta hai. Yeh zone October 26, 2023 ke trend line aur 100 aur 200 dinon ke moving averages ke zariye wazeh hota hai, jo is potential support level ko mazeed ahmiyat faraham karta hai. Agar Pound is level ke neeche gir jata hai, toh phir yeh 1.2287-1.2393 zone ki taraf gir sakta hai, jo January 3, 2019 ke low aur June 1, 2021 se September 26, 2022 tak ke downtrend ka 50% Fib retracement level daryaft karta hai. Aam tor par, GBP/USD pair ke liye outlooq abhi bearish hai, jabke US dollar mazid mustaqbil hai aur UK ki maeeshat kamzoriyat ka izhar kar rahi hai. Traders ko ahtiyaat aur aham support aur resistance levels ko nazdeek se dekh kar forex market mein potential trading opportunities ko samajhne ke liye mashqiyat ka tajziya karna chahiye.

Navigating Market Uncertainty

Jaise ke traders ko 1.2794 ka darwaza kehtara hai jo ke market ka palatnay ka imkaan darust karta hai, aik strategy mein trading operations ka a temporary cessation trading activities ke sath-sath ahtiyat ke sath karna chahiye takay market ke anjam ko wazehi ke sath dekha ja sake. Lachari aur badlne ke liye tayar rehna financial markets mein kaam karne ke liye lazmi hai, jo ke emerging opportunities ya incoming risks se apni positions ko bachane ke liye rukhsat hai. Ghairat aur adaptability ke sath trading karne se traders apni ships ko turbulant paniyon mein bharakna seekhte hain, jante hain ke unke paas mukhtalif maqamein aur agle kadam ke liye sahi tayyari hai.

Market Dynamics

Geopolitical developments aur changing market conditions forex market ke dynamics par bada asar dal sakte hain. Agar achhe trends mojood hain, toh fluctuations aur corrections laazmi hai, jo trading strategies ke mutadil nazriye ko zaroori banata hai. Effective risk management strategies, jese ke diversification aur stop-loss orders, potential nuksan ko kam karne aur trading portfolios ko mehfooz rakhne ke liye lazmi hain. Iske alawa, macroeconomic trends aur geopolitical developments ke baray mein maloomat hasil karne se potential market shifts ke baray mein aham insights mil sakte hain, jo ke traders ko apni strategies ko mutabiq tayyar karne aur emerging opportunities ka faida uthane mein madad faraham karta hai.

Potential Growth

GBP/USD pair mein potential growth ke mukhtalif scenarios mein se ek ahem role key resistance levels ke toorna shamil hai, jese ke 1.2890 aur 1.2900, jo ke mazid mazid mazid karanay aur upward momentum ki taraf muqarrar kar sakta hai. Maazi ke movement ke mutabiq, agar pair 1.2707 ke darmiyan giravat ka samna karta hai, toh mazeed chadhne ki sambhavna hai. Traders ko price ke harkaat aur key levels, jese ke 1.2895, ko ghaur se monitor karna chahiye taake mazeed chadhne ya ulte pulta hone ke signals ko pehchan sakein. Lekin, USD ke rukh aur market participants ke reactions ke bare mein uncertainties is manzar ko mazeed tawazo aur adaptability se samajhna zaroori banate hain, taa ke market ke potential scenarios ko effectivly navigate kiya ja sake.

تبصرہ

Расширенный режим Обычный режим