USD/CHF

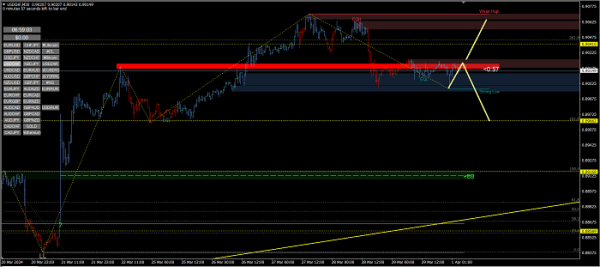

Assalam Alaikum! Trading chart ke mutabiq, dollar/franc joda muzahmati satah ke qarib sideways me karobar jari rakhe hue hai. Ab sawal yah hai keh yah jodi aage kahan jayegi. Jode ki mustaqbil ki naqal o harkat ke liye do mumkena scenario hain. Bears ke mamle me, joda apne nuqsanat ko badha sakta hai, jo maujudah muzahmati satah se 0.89662 ki support satah tak fisal jayega. Tezi ki surat me, jode ke ooper ki taraf palatne aur apne bulandi ki taraf badhne ki ummid hai.

Assalam Alaikum! Trading chart ke mutabiq, dollar/franc joda muzahmati satah ke qarib sideways me karobar jari rakhe hue hai. Ab sawal yah hai keh yah jodi aage kahan jayegi. Jode ki mustaqbil ki naqal o harkat ke liye do mumkena scenario hain. Bears ke mamle me, joda apne nuqsanat ko badha sakta hai, jo maujudah muzahmati satah se 0.89662 ki support satah tak fisal jayega. Tezi ki surat me, jode ke ooper ki taraf palatne aur apne bulandi ki taraf badhne ki ummid hai.

تبصرہ

Расширенный режим Обычный режим