Scalping ek trading strategy hai jo market mein chhotay daam harkaat ko giraftar karne par tawajjo deta hai. Yeh tareeqa aam tor par un traders ke darmiyan pasandida hai jo daam mein short-term taqseem mein fa'ayda uthane ki talash mein hain. Din bhar mein mukhtalif trading karke, scalpers is chhotay daam ki tabdeeliyon se fa'ayda hasil karne ki koshish karte hain. Mumkin scalp trades ka pehchan lagane ke liye, traders aksar stochastic oscillator aur moving averages jese technical indicators ka istemal karte hain. Ye indicators traders ko dakhil aur nikalne ke points ko taezgi ke sath pin-point karne mein madad karte hain.

Stochastic oscillator, maslan, aik momentum indicator hai jo daam ke harkaat ki taqat ko napta hai. Yeh market mein overbought aur oversold conditions ko pehchanti hai, jo traders ko mumkin reversals ka andaza lagane mein madad karta hai. Jab dusre technical tools jaise moving averages ke saath mila diya jata hai, traders ek mazboot scalping strategy tayar kar sakte hain jo khatra ko kam aur fa'ayda ko zyada karta hai.

Scalping mein, traders aam tor par chand minutes ya phir seconds ke andar dakhil aur nikalne ke positions mein dakhil ho jate hain. Trading ki tezi ke bina par, scalpers ke liye tight stop-loss orders set karna zaroori hai taake achanak market ke fluctuations se bacha ja sake. Ye stop-loss orders nuqsanat ko kam karne aur peson ko hifazat karne mein madad karte hain, jo successful scalping ke liye zaroori hai.

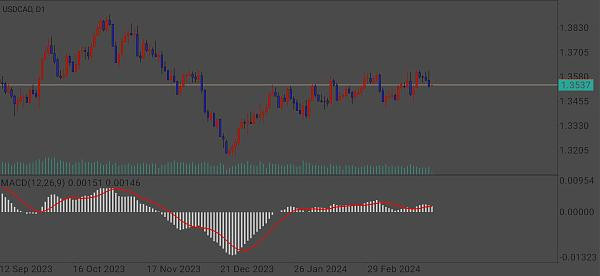

Aage dekhtay hain, USD/CAD market ke buyers ke liye anay wale ghanton mein nihayat pasandida rahega. Yeh ummed mukhtalif factors se hoti hai, jinmein technical indicators aur market ki jazbat shamil hain. Traders is pasandida market shartein ka faida utha kar scalping trades execute kar sakte hain aur short-term daam ki harkaaton ka fa'ayda utha sakte hain.

Scalping ke ilawa, traders USD/CAD market mein apni munafa ko barhane ke liye doosre trading techniques ka mutala kar sakte hain. Aik aisi technique swing trading hai, jo positions ko chand dinon ya hafton tak rakhne ko shamil karti hai taake medium-term daam ki harkaaton ka fa'ayda uthaya ja sake. Scalping ke mukhafal, jo short-term fa'ayda par tawajjo deta hai, swing trading traders ko baray market trends aur tabdeeliyon ka fa'ayda uthane ki izazat deta hai.

Swing trading strategy sabar aur disipline ki zaroorat hai, kyunke traders ko technical analysis aur market conditions ke mutabiq fa'ayda hasil karne ke liye munasib dakhil aur nikalne ke points ka intezaar karna padta hai. Daam ke charts ko gehri nigrani se dekhte hue aur kargar risk management techniques ka istemal karke, traders USD/CAD market mein swing trades ko kamiyabi se execute kar sakte hain aur mustaqil munafa hasil kar sakte hain.

Aam tor par, chahe scalping ya swing trading strategies istemal ki ja rahi hon, traders ko market ki changing conditions ke mutabiq mawafiqat aur apni tajziyat mein chaugun rahna chahiye. Maloomat ke mutabiq rehkar, mufeed trading strategies ka istemal karte hue aur risk ko kargar taur par manage karte hue, traders dynamic USD/CAD market mein itminan aur apne maali maqasid ko hasil kar sakte hain.

Stochastic oscillator, maslan, aik momentum indicator hai jo daam ke harkaat ki taqat ko napta hai. Yeh market mein overbought aur oversold conditions ko pehchanti hai, jo traders ko mumkin reversals ka andaza lagane mein madad karta hai. Jab dusre technical tools jaise moving averages ke saath mila diya jata hai, traders ek mazboot scalping strategy tayar kar sakte hain jo khatra ko kam aur fa'ayda ko zyada karta hai.

Scalping mein, traders aam tor par chand minutes ya phir seconds ke andar dakhil aur nikalne ke positions mein dakhil ho jate hain. Trading ki tezi ke bina par, scalpers ke liye tight stop-loss orders set karna zaroori hai taake achanak market ke fluctuations se bacha ja sake. Ye stop-loss orders nuqsanat ko kam karne aur peson ko hifazat karne mein madad karte hain, jo successful scalping ke liye zaroori hai.

Aage dekhtay hain, USD/CAD market ke buyers ke liye anay wale ghanton mein nihayat pasandida rahega. Yeh ummed mukhtalif factors se hoti hai, jinmein technical indicators aur market ki jazbat shamil hain. Traders is pasandida market shartein ka faida utha kar scalping trades execute kar sakte hain aur short-term daam ki harkaaton ka fa'ayda utha sakte hain.

Scalping ke ilawa, traders USD/CAD market mein apni munafa ko barhane ke liye doosre trading techniques ka mutala kar sakte hain. Aik aisi technique swing trading hai, jo positions ko chand dinon ya hafton tak rakhne ko shamil karti hai taake medium-term daam ki harkaaton ka fa'ayda uthaya ja sake. Scalping ke mukhafal, jo short-term fa'ayda par tawajjo deta hai, swing trading traders ko baray market trends aur tabdeeliyon ka fa'ayda uthane ki izazat deta hai.

Swing trading strategy sabar aur disipline ki zaroorat hai, kyunke traders ko technical analysis aur market conditions ke mutabiq fa'ayda hasil karne ke liye munasib dakhil aur nikalne ke points ka intezaar karna padta hai. Daam ke charts ko gehri nigrani se dekhte hue aur kargar risk management techniques ka istemal karke, traders USD/CAD market mein swing trades ko kamiyabi se execute kar sakte hain aur mustaqil munafa hasil kar sakte hain.

Aam tor par, chahe scalping ya swing trading strategies istemal ki ja rahi hon, traders ko market ki changing conditions ke mutabiq mawafiqat aur apni tajziyat mein chaugun rahna chahiye. Maloomat ke mutabiq rehkar, mufeed trading strategies ka istemal karte hue aur risk ko kargar taur par manage karte hue, traders dynamic USD/CAD market mein itminan aur apne maali maqasid ko hasil kar sakte hain.

تبصرہ

Расширенный режим Обычный режим