Amreki dollar ya Canadian dollar ki quwwat mein tabdiliyan. Kamzor Amreki dollar ya zyada mazboot Canadian dollar joray ki upri harkat ko rukawat bana sakti hai, jabke Canada ki oil exports par bharosa karte hue oil ke daamon mein tabdiliyan bhi Canadian dollar ki quwwat par asar dal sakti hain. In factors ke roshni mein, traders aur investors ko hoshiyari se kaam karna chahiye aur apne strategies ko mutabiq banaye rakhna chahiye. Maazi ka manzar yeh darust karta hai ke USD/CAD joray mein mazeed upri harkat ki sambhavna hai. Magar, traders ko market mein ahem levels aur taraqqiyan ko kareeb se nigrani mein rakhna zaroori hai. Maaloomat hasil rakhne aur narmi se kaam karne se, traders forex market ke dinamik manzar mein taezai se chhote kar sakte hain aur ubharne wale moqaat ka faida utha sakte hain. USD/CAD joray mein kamyabi ke aik ahem pehlu ki currency qeemat mein tabdiliyon par kaano band rakhna hai. Maali indicators, markazi bank policies, aur saiyasi waqiyat, sab Amreki dollar aur Canadian dollar ki quwwat par asar dal sakte hain. In taraqqiyat ke mutabiq amli tor par dekhtehue, traders ko market ki junubi jazbaton mein tabdiliyan ane ki sambhavnaon ko pehle hi dekh leni chahiye aur apni positions ko mutabiq bana lena chahiye. Is ke ilawa, Canadian dollar ki quwwat ko shakal denay mein oil ke daamon mein tabdiliyan aham kirdaar ada karti hain. Duniya ke baray oil exporters mein se aik hone ke natayej mein, Canada ka currency oil ke daamon ke sath qareebi taluq rakhta hai. Is liye, traders ko USD/CAD joray ko trade karte waqt oil market dynamics aur unke Canadian dollar par ke asar ko dekhna chahiye. Funooni factors ko nigrani mein rakhne ke ilawa, technical analysis bhi mukhtasir price movements mein shamil hoti hai. Ahem support aur resistance levels ko pehchan'na, sath hi price action mein patterns aur trends ko pehchan'na, traders ko entry aur exit points ke bare mein mutakammil faislay karne mein madadgar sabit hota hai. Khatarnak management bhi kamyabi ke liye aik ahem pehlu hai USD/CAD joray mein. Risk ko bardasht ke mutabiq stop-loss orders laga kar aur position ke sizes ko manage karna nuqsaan ki sambhavnaon ko kam karne ke liye zaroori amal hai. Mazboot risk management principles ko amal mein lanay se, traders apna maal bacha sakte hain aur lambe arse tak munafa

X

Collapse

new posts

-

#2506 Collapse

-

<a href="https://www.instaforex.org/ru/?x=ruforum">InstaForex</a> -

#2507 Collapse

Maujooda qeemat 1.3537 ki support area par tair rahi hai jo ke ahem hai ke baad mein farokht karne wale waapas le sakte hain. Aaj ke USD/CAD market mein farokht dabao mein izafa wazeh hai, jo ke dikhata hai ke farokht karne wale support zone ki taraf mael ho rahe hain. Ye taraqqi qeemat ko mazeed farokht karne ke liye buland imkaanat ko kafi barha deti hai. Is mutaharrik mauqa ka faida uthana zaroori hai. Is ke ilawa, apni tareeqe mein khabron par trading ki strategies shamil karke, hum mazeed munafa ko mukhtasar waqt mein barha sakte hain. Aakhir mein, USD/CAD ki qeemat aaj takneeki tahlil ko meneay mein layegi.

Aam tor par, USD/CAD market ab farokht karne walon ke faavour mein nazar aata hai. Magar, market trends ke khilaf na jayen. Isi tarah, USD/CAD news trading ka tajurba markazi khabron ke events ko istemal karke qeemat ki urdu mein tanzim karta hai aur fori kamaai paida karta hai. Baharhaal, maloomat mein reh kar aur ahem khabron ke tajurbaat par fori jawab de kar, traders un fursat ke mauqe ko pakad sakte hain jo achanak market ke tabdil hone se paida hote hain. USD/CAD market ke case mein, bechnay ki taraf trades shuru karne ka tawajo dena munafa haasil karne ke lehaz se faida mand hai. Ye tahsini kadam mojooda farokht dabao ke saath milti hai aur support zone ke qareeb hone ke saath, mazeed munafa ke lehaz se faydah mand nataij tak pohanch sakti hai. Magar, saqafati halaat ke asaani se samne aane par hoshyar aur mutanazzi rehna zaroori hai. USD/CAD ke trading ke doran, yaad rakhen ke geopolitical tajurbaat, aur doosre ahem khabron ke updates market ki jazbat ko dolat sakti hain. Takneeki tahlil ko haqeeqat mein khabron ki tashreeh ke saath mila kar, traders apne trading faislon ko behtar bana sakte hain aur khatron ko mukhtasir kar sakte hain. Umeed hai, USD/CAD ki qeemat jald hi 1.3517 ke darjat ko choo ya to todegi.

-

#2508 CollapseInstaSpot: کسی بھی EPS اور بینک سے منافع واپس لیں، اور EPS اور cryptocurrencies کے تبادلے پر 7% تک کمائیں۔

Halqay ka dam 1.3537 ka saath behar hai, jo ke mukhtalif hawalat mein farokht karne wale log baad mein apni kheer chukayein ge. Aaj ke USD/CAD market mein farokht ki dabao mein izafah dar hai, jo ke yeh darust karta hai ke farokht karne wale log sahara ilaqay ki taraf ja rahe hain. Yeh taraqqi aik bare farokht ke imkanat ko nihayat barha deta hai. Is naye mauqay ka faida uthana zaroori hai. Is ke ilawa, khabron ke trading strategies ko apne tareeqay mein shamil kar ke, hum mukhtalif maamlat mein munafa ko mazeed barha sakte hain aik chand muddat ke andar. Aakhir mein, USD/CAD ke qeemat aaj takniqi tajziya ke peechay chalay gi.

image_4992321.png

Aam tor par, USD/CAD market farokht karne walo ke liye faida mand nazar aa rahi hai. Lekin, market ke trend ke khilaf na jaen. USD/CAD khabron ke trading ka tanaza mukhtalif market mein taraqqi pazeeri ko istemaal kar ke qeemat ka volatiliti aur tezi se wapas hasil karne ke liye hai. Agar aap khabron ke asar ko raftar se maloom aur jaldi jawab de kar, to munafa maloom karne ke liye achi mauqay ko istemal kar sakte hain jo ke foranee market ki harkaton se hoti hain. USD/CAD market mein trading ke dauran, behtareen faida haasil karne ke liye farokht ki taraf mablaagh mukhtalif karte hue ghor karna zaroori hai. Lekin, anwaar khabron ke asar se samundar mein tarha maloom honge. Trading ke dauran, geopolitical hawalat aur dosray ahem khabar jo market ka jazbaat badal sakti hain, ko yaad rakhen. Taknik tajziya ke saath real-time khabar ka intezaar, trading ke faislon ko behtareen tareeqay se karne aur khatray ko effectively kam karne mein madadgar hota hai. Umeed hai ke USD/CAD ki keemat ya to 1.3517 ke darjay ko chooegi ya to toor degi.

Kamyab trading ka din guzariye!

-

#2509 Collapse

USD/CAD: Kamiyabi ke liye Trading ka Raasta

Chaliye ab USD/CAD currency pair ki mojooda keemat par ghor karte hain aur isay real-time mein tajziya karte hain. Shuruaat mein, hum USD/CAD jodi ko M15 time frame par jaanchenge, jahan hum no aur bees ke periods ke simple moving averages ka istemaal karenge. Intersection point 1.35985 par hai, jo ek farokht ka moqa darust karta hai. Main kam az kam ek se teen tak munafa nisbat ka shorakh muqarar karta hoon aur apni strategy ko raftaar leti hui market conditions ke mutabiq adjust karta hoon. Main apne stops ko taqreeban 20 points ke aas paas rakhta hoon, jo maine imtehaan aur ghalati ke zariye tay kiya hai, jhooti harkaton se bachne ke liye. Agay chalte hain, H1 time frame par, parabolic curve ek mumkin trend tabdeeli ka ishaara deta hai, jahan halaat ko bechne ka moqa hai. Mazeed, Moving Average yeh tasdeeq karta hai ke yeh farokht ka signal ke saath milta hai. Main apni position ko paraybolic nishan ka peechha karta hoon.

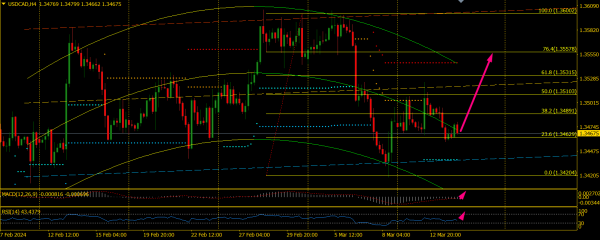

Ab, chaliye us mazkoor shoda jodi ki chaar ghante ki chart par nazar daalain. Uptrend ke doran, qeemat ne 1.3641 par resistance ko test kiya, jise baad mein ek rebound mehsoos hua. Technical indicators bullish fehmi dikhate hain: qeemat Kijun-sen aur ablaagh ke upar trade kar rahi hai, Chikou-span line qeemat chart ke upar hai aur aik "golden cross" faa'al hai. RSI 50 ke ooper hai, MACD ek islaah ko dikhata hai, aur trend filter oscillator hara hai. Kharidarun ka faida hai, 1.3641 ke upar ek breakout aur muwazan ke baad mazeed izafa ke imkanat hain, jo 1.3702 ko nishana banata hai. Tariq raheta hai kharidun ke saath jab tak qeemat Kijun-sen ke upar rahe. Magar, agar qeemat badal jaye aur ablaagh ke darjaat ke neeche trade ho, toh tayyari karen intezaar ki aur kharidun ki strategy ko mutabiq karna.

-

#2510 Collapse

USD/CAD currency pair ne Thursday ke Asian trading mein izafa kiya, jab ke mazbooti se tawaqo ki gayi US inflation data ne March ke liye. Ye US dollar ko 105.30 par saal ka naya unchi pohnchaya. Investors aaj ke din aane wale US producer price index (PPI) release se mazeed ishaaron ka intezaar kar rahe hain. Umeed hai ke headline aur core PPI figures mein barhawat 2.2% aur 2.3% year-over-year ke mutabiq hogi. Intehai, Bank of Canada (BoC) ne apni key interest rate ko July se 5% par chhatey meeting tak barqarar rakha. Bank of Canada Governor, Stephen Macklem, ne announcement ke baad ek press conference mein inflation ke samne musbat taraqqi ko tasleem kiya. Lekin, unho ne rate cut ka tajurba karne se pehle mustaqil inflation kam hoti ki mazeed concrete saboot ki zaroorat ko zyada ahmiyat di. Macklem ne June mein rate reduction ki mumkinat ka ishara diya, lekin is khabar ne market ki tawaqo ko Tuesday ko 53% se bas 21% tak girane ka asar kiya, CME FedWatch tool ke mutabiq. March ke US inflation report ne inflation ko kam karne ke challenges ko ahem tor par numaya kiya, jo ke looser monetary policy ki taraf ek harkat ko taal sakti hai. Is nateejay mein, US Dollar Index (DXY) ko saalana naye unchiyon par pahunchne mein madad mili, USD/CAD pair ko saath dene mein madad mili.

Technical tor par, USD/CAD pair ne aik halki izafa dikhaya, jab usne apne Simple Moving Average (SMA) par support paaya aur short-term uptrend channel ke andar reh gaya. Jab ke Moving Average Convergence Divergence (MACD) indicator abhi apne trigger line ke nazdeek zero par hai aur uski momentum kamzor hoti ja rahi hai, to Relative Strength Index (RSI) thora upar neutral level 50 ke qareeb hai. Agar market apni upar ki rah ko jaari rakhta hai, toh potential upside 1.3610 se 1.3655 ke range ke andar 1.3655 resistance zone se rok sakti hai. Baraks, agar yeh area ko paar karta hai, toh bullish sentiment ko mazbooti milti hai aur pair ko 1.3770 resistance ki taraf le ja sakti hai, jo ke pichle saal November 16 ko nahi dekha gaya. Neeche ki taraf, agar speculative trading hold par hoti hai aur pair 200-day moving average ko paar karta hai, toh ek temporary decline ki rukawat 1.3455 ke aas paas ho sakti hai, jahan tak aur neeche ki taraf 1.3410 tak ka target ho sakta hai. 1.3175 ke paanch mahine ka low ko tasleem karne se pehle aik decisive break bearish bias ki taraf ishara ho sakta hai.

-

#2511 CollapseInstaSpot: کسی بھی EPS اور بینک سے منافع واپس لیں، اور EPS اور cryptocurrencies کے تبادلے پر 7% تک کمائیں۔

USD/CAD ka takniki tajziya:

USD/CAD currency pair jo H4 chart par dekha gaya hai, ab ek southern correction ka shikaar hai, jo 1.38147 par hai. Instaforex ke indicators ko dekhne par, forex market mein ek mashhoor company, pehla hissa ek buyer faayda mandi ka 60.41% ko zahir karta hai. Magar, doosra hissa ishaare karta hai aaj ke market observation mein ek southern trend ki, jo kehaan gaya hai. Aaj ke bazaar ke tajziye ko khaas taur par ahem maana jata hai Canada se koi bhi ahem khabrein na hone ke bawajood, halankeh USA se shuruati applicationon ki tadad ke mutaliq ahem data ka intezar hai. Is kam information background ke darmiyan, hamara tajziya zyada tar takniki bunnayadon par mustehkam hota hai, fundamental factors ke bajaaye.

Pehle toh takniki pehlu ke zaviye se chart mein ek southern correction ka sujhaav diya gaya hai. 1.38147 ke price level par kharidari ka dominion maloom hota hai, haalaanki Instaforex ke indicator ke mutabiq thoda sa southern trend ka ishaara bhi hai. Magar bazaar ka mahaul bilkul giraaysh nahin hai, maujooda buyer faayda ke zaviye se mumkinah qeemat ke harkaat ki manzil hai, hum ek chhoti muddat tak ka southern correction ka tawaqqu kar rahe hain, shayad 1.3780 ke support level ki taraf. Yeh correction Instaforex ke indicator ke zahir kiye gaye southern trend ke saath milti hai. Magar ihtiyaat baratna zaroori hai kyun ke sudharaat temporary ho sakti hain aur palatvaar ka ishaara kar sakti hain. Agar aage dekha jaaye toh, ek ahem resistance level 1.3870 par hai, jo ek mumkinah uttarward palatvaar ke liye maqsad ban sakta hai. Agar keemat is resistance level ko toorna ka kaam karegi, toh yeh ek market ka mahaul kehne ka taabeer karega ek bullish outlook ki taraf.

Fundamental tajziya ki taraf jaate hue, jab Canada se koi bhi ahem developments na hone ke bawajood, attention USA ke shuruati applicationon ki tadad ke mutaliq hai. Is data mein koi bhi ghair mutawaqqa harkaatain ho sakti hain, jo ke potentially market ke mahaul aur raah ko asar daal sakti hain. Ikhtitam mein, USD/CAD currency pair aaj traders ke liye dilchaspi ka markaz hai. Takniki indicators ek southern correction ko sujha rahe hain magar thoda sa buyer faayda ke saath, jaise hi US ki bayrozgaar ke mutaliq tajziyat ke mutaliq intezar hai, traders hoshiyaar rehna chahiye. Hamara tajziya ek chhoti muddat tak ka southern correction ki taraf lean karta hai, phir ek mumkinah uttar ki taraf palatvaar ki taraf nishaanay 1.3870 ke darajay par. Magar bazaar ki dynamics tabdeel hone ke mauqay par hain aur zaroori hai ke halat ke mutabiq badalne wale shara'it ke mutabiq adap karain.

i -

#2512 Collapse

USD/CAD darin mein 1.31159 par support level ka ek mazboot istiqamat darusti ki taraf ishara karta hai. Yeh level ek saabit qadam saathi ki tarah kaam karta hai, jo ke market mein trading karne wale logon ko asani se samajhne aur uska faida uthane mein madad karta hai. Support level ka matlab hota hai ke jab bazaar mein keemat is level tak pohanchti hai, toh wahan se market ki taqat hoti hai ke keemat ko upar ya neeche nahi jane deti. Yani, jab keemat 1.31159 ke qareeb hoti hai, toh woh support level ki taraf ishaara karta hai. Jab bazaar is level par pohanchta hai, toh traders ko ek mazboot base milta hai apne trading ke faislon ko banane ke liye. Ek mukhtasir tajziya ke doran, agar market 1.31159 ke neeche jaati hai, toh yeh ho sakta hai ke wahan se selling pressure barh jaaye aur market neeche ki taraf chali jaye. Lekin agar market is level ko toorna nahi paati aur wapas upar ki taraf mudti hai, toh yeh ek strong indication hai ke support level kaam kar raha hai aur market ke bullish trend mein stability hai. Support level ko samajhne ke liye, traders market ke historical data ko bhi dekhte hain. Agar pehle bhi yeh level support ke tor par kaam kiya hai, toh yeh uski mazbooti aur ehmiyat ko aur bhi zyada barha deta hai. Is tarah ke historical analysis ke zariye traders support level ki strength aur uski importance ko samajhte hain. Is level par trading karte waqt, traders apni positions ko risk management ke saath manage karte hain. Woh stop loss orders lagate hain takay agar market support level ko toorna chahti hai, toh unka nuksan kam ho. Isi tarah, woh profit targets bhi set karte hain takay agar market support level ko support karti hai, toh unka faida maximise ho. Overall, 1.31159 par support level ki mazbooti aur uski importance market mein trading karne wale logon ke liye ahem hai. Yeh level ek saabit qadam saathi ki tarah kaam karta hai aur traders ko market ke movements ko samajhne mein madad deta hai

-

#2513 Collapse

Technical analysis mein ghumte hue, ye indicator buyers ke notable advantage ko reveal karta hai, jisme mojooda market range mein 60.05% ka dominance hai. Ye market participants ke darmiyan prevailing bullish sentiment ko suggest karta hai, jo ke trading decisions ko influence kar sakta hai.

Iske alawa, indicator short-term uttar ki taraf trend ko point karta hai, jo temporary uptick in price movement ko indicate karta hai. Traders jo USDCAD pair ko nazdeek se monitor kar rahe hain, unhe ye opportunity samajhne ko milti hai ke short-term bullish momentum par capitalize kiya ja sake, apni trading strategies ko uske mutabiq adjust karte hue.

Lekin, jabki fundamental data market sentiment ko shape karne mein crucial role play karta hai, aaj ka economic calendar limited insights provide karta hai. Khas tor par, Canada se koi bhi significant ya impactful news expected nahi hai, jo ke spotlight ko United States par chhod deta hai. Monitor karne ke liye ye key release hai ke labor market par open vacancies ke number, jo ke US economy ke health ke valuable insights provide kar sakta hai aur potentially US dollar ke performance ko impact kar sakta hai.

Fundamental data ki scarcity ke sath, traders apni trading decisions ko guide karne ke liye technical analysis par zyada emphasis dal rahe hain. Jab USDCAD pair mein uttar ki taraf ka correction observe kiya gaya hai aur buyers ka significant advantage hai, traders potential entry aur exit points par focus karne ke liye technical indicators aur chart patterns par dhyan denge.

Major economic events ki absence mein, market participants price movements aur key technical levels ko closely monitor karenge takay trading opportunities ko identify kiya ja sake. USDCAD pair mein observe kiya gaya uttar ka correction, Instaforex indicator dwara darshaya gaya bullish sentiment ke sath, short term mein potential long positions ke liye stage set karta hai.

-

#2514 CollapseInstaSpot: کسی بھی EPS اور بینک سے منافع واپس لیں، اور EPS اور cryptocurrencies کے تبادلے پر 7% تک کمائیں۔

USD/CAD, jo kayi traders ke liye "Loonie" ke roop mein mashhoor hai, forex market ka ek ahem currency pair hai jo United States dollar aur Canadian dollar ke darmiyan tabadla karta hai. Haal hi mein, yeh pair ek southern correction ka saamna kar raha hai aur ab darja 1.38143 par sthit hai. Is correction ka saamna karne se pehle, is trend ki wajahon ko samajhna zaroori hai. Pehli wajah, economic indicators aur monetary policies hain. Canada aur United States ke economic indicators, jaise GDP growth, employment rates, aur inflation, USD/CAD pair ke qeemat par asar daal sakte hain. Is ke ilawa, Federal Reserve aur Bank of Canada ki monetary policies bhi is pair par asar daal sakti hain. Agar kisi mulk ki central bank apni interest rates ko badal deti hai ya phir kisi aur monetary policy measure ko implement karti hai, to iska asar USD/CAD pair par hota hai. Doosri wajah, commodities ka asar hai. Canada ek major commodities exporter hai, jismein oil, natural gas, aur metals shamil hain. Agar commodities ki qeemat mein tabdiliyan aati hain, to yeh USD/CAD pair par asar daal sakti hain. Jaise ke oil prices mein girawat, Canadian dollar ko kamzor kar sakti hai aur USD/CAD pair ko badha sakti hai. Teesri wajah, geopolitical tensions aur global events hain. Kisi bhi tarah ke geopolitical tensions, jaise ke trade disputes ya phir international conflicts, USD/CAD pair par asar daal sakte hain. Is ke ilawa, global events, jaise ke natural disasters ya phir pandemics, bhi currency pairs par asar daal sakte hain. Southern correction ka saamna karne ke baad, traders ko apni strategies ko tarmeem karne ki zaroorat hoti hai. Scalpers aur day traders, jinhein chhotay time frames par trade karna pasand hai, ko is correction ka faida uthane ka mauqa milta hai. Unka maqsad chand pips hasil karna hota hai, jo ke is tarah ke short term movements mein mumkin hota hai. Mudallal aur long term traders, jo ke adhiktam maamooli taur par fundamentals aur technical analysis par amal karte hain, bhi is trend se faida utha rahe hain. Unka maqsad zyada lambi muddat ke liye currency pairs mein invest karna hota hai, jo ke is tarah ke trends par mabni hota hai. Lekin, har trading situation ki tarah, is southern correction ke bhi apne challenges hain. Ek ahem sawal yeh hai ke yeh correction kitna lamba chalega aur kya future mein koi aur trend iski jagah lega. Is liye, traders ko hamesha sambhal kar chalna chahiye aur market ki taaza updates par amal karna chahiye. Is southern correction ke sath, USD/CAD pair ki trading opportunities mein izafa hua hai. Tajwezat, traders aur investors ko faida uthane ke liye mukhtalif strategies aur approaches ka istemal karna chahiye. Is ke ilawa, risk management aur market analysis ki ahmiyat bhi barh gayi hai. Jis tarah se market ki conditions tabdeel ho rahe hain, traders ko bhi apni strategies ko adjust karte hue taraqqi karna chahiye.

-

#2515 Collapse

USD/CAD taqat hasil karta raha aur resistance line ko support banane mein kamiyab ho gaya, jo 2023 ke uchay darjat se aage nikal gaya tha, aur kal 1.3500 ilaqa mein phir se oopar chala gaya. Bank of Canada ke monetary policy meeting ke agle din hone wale barhte hue chal se tawajjo ko 1.3500 aur 1.3660 ilaqa ki taraf shift kar diya gaya hai, jabke technical indicators mazeed barhne ki sambhavna ko darust karte hain. RSI 50 ke upar se bullish sentiment ko dobara shuru kiya, aur MACD laal signal line ke upar uthne laga hai. Mutasir tor par, stochastic 80 ke qareeb overbought level ke qareeb rehta hai, jo dikhata hai ke khareedne walay jodne ki gatividhi ko barhane mein nakam hain taake pair ko oopar le ja sakein. Iske ilawa, keemat abhi tak 1.3450 par triangle continuation pattern resistance line ke oopar mazboot nahi hui hai, isliye ek waapas chakkar mumkin hai. Yahan neeche chart diya gaya hai.

Agar jodi 1.3660 ke neeche tezi se barhti hai, to khareedne walay 2022 ke unchaai par 1.3676 ka nishana banayenge. Ek bearish surat mein, agar jodi waapas aati hai, to pehle 1.3370 aur 1.3385 ilaqa mein support pa sakegi, jo 2023 ki had line aur 20-dinon ka simple moving average shamil hai. Is ilaqa ke neeche band ho jaane se mazeed girawat ke mumkin hone ka tassur ho sakta hai 50-dinon ke EMA ki taraf, jabke tajziyat se girawat july se chhoti dora uptrend line ko 1.3535 aur 200-dinon ke EMA tak challenge kar sakti hai. Toh, aakhri mein, USD/CAD jodi ka maamla aage barhne ka maqam rakhta hai, lekin agar neutral triangle pattern ko kamyaabi se guzarna na mumkin ho to khareedne walay kuch mushkilat ka samna kar sakte hain. Yahan neeche chart diya gaya hai.

-

#2516 Collapse

USD/CAD

USD/CAD apni shumali rukh ko barqarar rakhta hai, halankeh hum haftay ke APR se guzar chuke hain (sabz bara). Is haftay ooncha kharidna khatarnak hai, lekin main samajhta hoon ke jab aise mazboot flat channel se bahar nikalte hain to woh ooncha ja sakte hain. Phir aap ko wapis ka intezar karna hoga. Abhi bhi mujhe yeh flat growing cone pasand nahi aata; woh aise formation se oopar ja sakte hain. Magar zyada tar woh neeche jaate hain. Shumali taraf ke liye, behtar hai ke flat mein rehna aur naye haftay mein cone se oopar ki taraf se bahar aana. Agar aaj hum cone se neeche nikalte hain, to shumali buraabri aaj zaroor tootega, phir yeh roll back zones ke reaction par munhasir hoga. Daily pivot ke upar 1.3690 abhi bhi shumali hai. Neche hum ek roll back shuru karenge margi DVC ke liye kharidne ke liye, aur mojooda bulandiyon se yeh 1.3680-76 aur 1.3634-25 ke darmiyan hai.

USDCAD pair ke liye kal kharidne wale keemat par dabao daalne ke liye kharidar jari rakhte hain aur is ki bharakne se hum ne sirf maqami rukh ki darjaat tak pohanchne ka intezaam kiya, balkay isay toor bhi diya, halankeh is darjaat ke upar mazbooti se jam ho jaane ke baad, lekin volumes bohot buland the aur dheere dheere barhte rahe, jo ke mukhtalif giravat aur 1.3712 ke darjaat ka ulta toorna ke muqablay mein kuch taqat ka kamzori lagta hai, aur baad mein bhaari giravat aur is ke baraks giravat ke baad, jo ke mazid izafa ke baad ghatiyon ki bahaali ka ek sahoolat se mauqif lagta hai.

-

#2517 CollapseInstaSpot: کسی بھی EPS اور بینک سے منافع واپس لیں، اور EPS اور cryptocurrencies کے تبادلے پر 7% تک کمائیں۔

USD/CAD H4 time frame:

Forex trading ke daire mein, USD/CAD currency pair investors ki tawajjo ko hasb-e-haal mein le gaya hai, khaaskar us waqt jab qeemat ko tehqeeqi tor par dekha jata hai jahan qeemat ko durust karne mein shakist nahi hai, jise mazbooti se 1.37 level ke ird gird ghoom raha hai. Yeh mushahida trading scenarios aur strategic considerations ke mustaqbil ko dekhne par majboor karta hai.

Jab qeemat apni ziddeyana tor par qeemat ko durust karne mein mustaqil rahti hai, aur mukarar 1.37 level ke ird gird apni position ko barqarar rakhti hai, to kisi wazeh neechay ki harkat ki ghair maujoodgi traders ke liye ehtiyaat se amal ki zaroorat hai. Is tarah ke halat mein, sabr se kaam lena aur ek chaukanna mansooba apna karne ki zaroorat hai, jo trading system ka naazuk eqilibrium ko disturb kar sakta hai.

Magar, ek junbish na hone ke baawajood, musbat trading mauqa ka imkaan nahi ko inkaar karta hai. Agar qeemat apni mojooda satah se wapas hoti hai, aur 1.36 ke darwaze ke qareeb paunchti hai, to traders ke liye long positions ka tajziya karna aamadah hota hai. Ye strategic kadam umeed karta hai ke mukarar 1.37 level ke oopar ek break out ke imkaan ko samne laayega, aur mazeed urooj ke raste ko kholega.

Muhim hai ke ek mazboot neechay ki durusti ke baghair, ek shumara raste mein chalna apne aap mein mushkil hota hai. Isliye, traders ko chaowkidaari banaye rakhna zaroori hai, bazar ke dynamics aur qeemat ke tabdeelion ko qareeb se dekhte hue, jo momentem mein aane wale kisi tabdeeli ke ishaaron ko nishan de sakta hai.

Is ke ilawa, ek mukammal analysis sirf qeemat ke harkat se age nahi badhti, balki usmein jama'ati maaishiyati alamat aur jughrafiayi taraqqiyat bhi shamil hoti hain jo USD/CAD currency pair par numaind asar daal sakti hain. Ahem karkardagi farq, sauda siyasat aur jughrafiayi tanazurat tamaam bazaar ka jazba e amal aur currency harkat ka rukh tehreer kar sakti hain.

-

#2518 Collapse

USDCAD pair ne ek qabil-e-zikar uptrend dekha hai, jahan buyers ne mazeed buland rawana movement ke liye momkinah mojooda kiya hai. Ab, tajziya bullish manzar par hota hai, jo traders ke liye itna faida mand banata hai ke wo niche ke rawana movements ki bajaye oopar ki umeed karain. Aaj, raasta shumal ki taraf muntaqil hone ka imkan lagta hai, jahan ek khaas level tak pohanchne ki tawaqo hai.

Yeh bullish jazba kai factors ki taraf se munsalik kiya ja sakta hai jo currency pair ko mutasir karte hain, jaise ke maeeshati indicators, siyasi oorjaat aur bazaar ki jazba. Maeeshati indicators market ke harkaton ko shakl dene mein ahem kirdar ada karte hain, aur traders aksar data releases ko dekhte hain taake mulkoon ke ma'ashi halat ka andaza laga sakein. USDCAD ke mamle mein, United States aur Canada ke dono maeeshati indicators, jaise ke GDP growth, rozgar ki shumariyan, mehngaai darain aur interest rate faislay, pair ke raaste par asar andaaz hote hain. Ek mulk se doosre ke muqable mein maeeshati maaloomaat ke mustaqbil mein farq peda kar sakta hai, jis se currency ke qeemat asar andaz hoti hai.

Siyasi oorjaat bhi currency pairs par asar andaaz ho sakte hain, khaas tor par woh jo United States aur Canada ko shamil karte hain. Tijarati musaahibat, siyasi tanazur, aur siyasi oorjaat forex market mein volatality ko dakhil kar sakte hain, investor ki jazba aur currency ke harkaat par asar andaaz kar sakte hain. Traders siyasi oorjaat ke jawab mein apni positions ko adjust karte hain, jo USDCAD pair mein tabdeeliyan peda kar sakti hain.

Bazaar ki jazba, jo kisi khaas currency pair ke khilaf traders ki overall attitude ko refect karta hai, price ke harkaat par bhi asar daal sakti hai. Bullish jazba umeed aur khareedne ki raagbat ko dikhata hai, jabke bearish jazba naumeedi aur bechne ki rujoo ko dikhata hai. Khatra se bhari zindagi, investor ka itmenan, aur bazaar ki tawaqo jaise factors sab jazba mein tabdeeliyan la sakte hain, jo USDCAD pair ke supply aur demand ke dynamics par asar andaz karte hain.

Technical analysis bhi ek tool hai jo traders istemal karte hain taake qabalbardar qeemat ke hawale se mumkinah harkaat ka andaza laga sakein, tareekhi price data aur chart patterns ke base par. Key technical indicators, jaise ke moving averages, support aur resistance levels, aur oscillators, trends, reversals, aur entry/exit points ko pehchane mein madad karte hain. Traders apni trading decisions ko tasdeeq karne aur khatra ko efektivly manage karne ke liye technical analysis ka istemal kar sakte hain.

In factors ke ilawa, central banks ki monetry policy decisions bhi currency harkaat ko shape karne mein ek ahem kirdar ada karte hain. United States mein Federal Reserve aur Canada mein Bank of Canada maeeshati halaat ko nazar andaaz karte hain aur apni monetry policy ko mazid wazeh karte hain taake apne maqasid, jin mein qeemat ki mustawafadgi, poora rozgar aur maeeshat ki baqa shaamil hain, ko pa sakein. Interest rate decisions, forward guidance aur quantitative easing measures sab exchange rates par asar andaz hote hain, jo USDCAD pair ke raaste par asar andaz karte hain.

Maujooda bullish momentum ke hawale se, traders ko oopar ki harkaaton ka faida uthane ke liye mauqa dhoondne ka sochna chahiye. Lambi positions ko munaasib khatra nigrani strategies ke sath shuru kiya ja sakta hai taake potential reversals ya unfavorable bazaar ki shuruwat ko rokne ke liye. Stop-loss orders ko nuqsanain mehdood karne ke liye istemal kiya ja sakta hai, jabke munafa maqasid ko key resistance levels ya technical indicators ke base par set kiya ja sakta hai.

Magar, zaroori hai ke forex market mein hamesha muttayyan aur tayyar rehna, kyun ke shara'it mukhtalif factors ki wajah se tezi se tabdeel ho sakti hain. Maeeshati releases, siyasi oorjaat, central bank ke taqreerain, aur bazaar ki jazba ko nigrani karna traders ke liye maloomati insight faraham kar sakta hai taake woh sahi trading decisions le sakein. Iske ilawa, trading strategies ko mukhtalif karna aur mazeed analysis ke sources ko shamil karna khatron ko kam karne aur forex market mein kamiyabi hasil karne ke liye madadgar ho sakta hai.

Ikhtisaar mein, USDCAD pair ab bullish momentum ko dikhata hai, jahan buyers qeemat ko buland kar rahe hain. Traders ko bullish bias ko apnane aur currency pair ko mutasir karne wale bunyadi aur technical factors ko madde nazar rakhte hue long positions mein dakhil hone ki tawaqo hai. Magar, zaroori hai ke disiplin banaye rakhein, khatra ko efektivly manage karein, aur bazaar ke tajurbaat ke bare mein agah rahen taake forex market ko kamiyabi se samajh sakein.

-

#2519 Collapse

USD/CAD H4

H4 time frame par USD/CAD ka mahatva, is trend ka bazaar ke jawabat par kese asar hua hai, samajhne ke liye ahem hai. USD/CAD ke daur-e-qeemat ko waqt ke sath tajziye se munfarid insights mil sakte hain jo is ke fluctuations ko mutasir karne wale moolyakar karanon ki roshni mein dikhate hain. US aur Canadian dollars ke darmiyan taluqat ko sahi dhang se tasveer mein laane wala USD/CAD pair, forex market mein sab se faa'al currency pairs mein se ek hai. Is ki keemat ki harkat H4 time period mein baraie ek nazar buniyadi iqtisadi aur siyasi dynamics ko zahir karta hai. Jab USD/CAD ka tareekhi data dekha jata hai, toh ek plex tapestry ka jhalakta hai, har ek ki moolyakar factors ka aik ta'alluq-e-tayyar, iqtisadi indicators aur siyasi waqiat shamil hain.

Tehqiq 80% darust lag rahi hai jab ke price action 1.3518 aur 1.3510 ke darmiyan support zone ko test kar raha hai. Rehnumai ki qeemat, khaaskar short-term traders ke liye, qadre bhi ja rahi hai, jab ke main Canadian dollar ki kamzori ka khof bhi tasleem karta hoon. 1.3480 support level ke neeche ek sell position shuru karne ki salahiyat, 1.3470 par aik pending order rakhne ka sujhav, aur 1.3570 se thora oopar ek stop loss qaim karna haqeeqat mein danishmandana hai. Is liye, agar bear early on control mein qabiz na ho, toh yeh pair 1.3615 ke mukammal resistance level ki taraf barh sakta hai. Is level ka aik waqtan mein tor phor sirf peechle waqt mein tay kiya ja sakega. Is liye, main ek USD/CAD hedge strategy ko amal mein laane ki taraf rujoo karta hoon. Phir bhi, sarasar intizam asoolain wahi rehte hain, 1.3600 ke resistance ke upar ek breakout ki tawaqo hai.

-

<a href="https://www.instaforex.org/ru/?x=ruforum">InstaForex</a> -

#2520 CollapseInstaSpot: کسی بھی EPS اور بینک سے منافع واپس لیں، اور EPS اور cryptocurrencies کے تبادلے پر 7% تک کمائیں۔

USDCAD pair ne aik qabil-e-zikar uptrend dekha hai, jahan buyers nay mazeed urooj ke liye momentum qaaim kiya hai. Halqa aaj ki surat haal ko bullish manzar mein dikhata hai, jo ke traders ke liye uthalta rukh umeedwar bana deta hai, neeche ke rukh ki bajaye. Aaj, rukh muttaham hai ke uttar ki taraf ja raha hai, ek mukhtasir level ko pohanchne ka matlooba nishana hai.

Yeh bullish jazba kuch factors par moshtamil ho sakta hai jo currency pair ko mutasir kar rahe hain, jaise maeeshati indicators, siyasi oorjaat, aur market jazba. Maeeshati indicators market movements ko shape karne mein aham kirdar ada karte hain, aur traders aksar data releases ko nigrani mein rakhte hain taake shamil maeeshati economies ki sehat ka andaza lagaya ja sake. USDCAD ke case mein, economic indicators United States aur Canada dono se, jaise ke GDP growth, employment figures, inflation rates, aur interest rate decisions, pair ke rukh ko mutasir kar sakte hain. Ek mulk relative doosre ke muqable mein musbat maeeshati data currency valuations mein farq peda kar sakta hai, exchange rates ko mutasir karte hue.

Siyasi oorjaat bhi currency pairs ko mutasir karne ka potential rakhte hain, khaaskar jab woh United States aur Canada ko shamil karte hain. Trade agreements, siyasi tensions, aur siyasi oorjaat forex market mein uljhan peda kar sakte hain, investor sentiment ko mutasir karke aur currency movements ko tehreek dene ke liye. Traders siyasi khabron ke jawab mein apni positions ko adjust kar sakte hain, jo USDCAD pair mein fluctuations ko paida karta hai.

Market sentiment, jo ke traders ka khas attitude ek khaas currency pair ke liye dikhata hai, bhi qeemat harkaton ko mutasir kar sakta hai. Bullish sentiment umeedwar aur kharidari ki pasandgi ko dikhata hai, jabke bearish sentiment mayoosi aur bechnay ki raay deta hai. Khatraat ka shoq, investor confidence, aur market speculation sab sentiment mein tabdiliyon mein hissa dal sakte hain, USDCAD pair ki farahmi aur talab ki dynamics ko mutasir karte hue.

Technical analysis bhi ek tool hai jo traders istemal karte hain taake potential price movements ko assess kiya ja sake, base karte hue historical price data aur chart patterns. Ahem technical indicators, jaise ke moving averages, support aur resistance levels, aur oscillators, trends, reversals, aur entry/exit points ko pehchanne mein madad kar sakte hain. Traders technical analysis ko apne trading decisions ko tasdiq karne aur risk ko effectively manage karne ke liye istemal karte hain.

In factors ke ilawa, central banks ki monetry policy decisions bhi currency movements ko shape karne mein ahem kirdar ada karte hain. United States mein Federal Reserve aur Canada mein Bank of Canada maeeshati shorat ko qareeb se monitor karte hain aur monetry policy ko unki mukhtalif mandates ko hasil karne ke liye adjust karte hain, jo ke price stability, full employment, aur economic growth shamil hote hain. Interest rate decisions, forward guidance, aur quantitative easing measures sab exchange rates ko mutasir kar sakte hain, USDCAD pair ke rukh ko tehreek dene ke liye.

Mojudah bullish momentum ke douran USDCAD pair mein, traders ko upar ki harkaton ka faida uthane ke liye opportunities dhoondhne ke liye dekhna chahiye. Long positions ko darust risk management strategies ke sath shuru kiya ja sakta hai taake potential reversals ya adverse market conditions ke khilaf bachav kiya ja sake. Stop-loss orders ko nuksan ko mehdood karne ke liye istemal kiya ja sakta hai, jabke munafa targets ko key resistance levels ya technical indicators ke base par set kiya ja sakta hai.

Magar, forex market mein chaukasi aur adaptable rehna zaroori hai, kyunke conditions mukhtalif factors ki wajah se tezi se tabdeel ho sakti hain. Maeeshati releases, siyasi oorjaat, central bank speeches, aur market sentiment ko nigrani mein rakhna traders ke liye maaloomati faidaymandiyon faraham kar sakta hai taake inform kiye hue trading decisions banaye ja sakein. Iske ilawa, trading strategies ko diversify karna aur mukhtalif sources of analysis ko shamil karna risks ko kam karne aur amm tor par performance ko behtar banane mein madadgar ho sakta hai, jo ke dynamic aur hamesha badalne wale forex market mein kamiyabi ke liye zaroori hai.

Ikhtisar mein, USDCAD pair halqa bullish momentum ko dikhata hai, jahan buyers qeemat ko ooper le jate hain. Traders ko bullish bias ko ikhtiyar karne aur currency pair ko mutasir karne wale fundamental aur technical factors ko madahon ke taur par dekhte hue long positions mein dakhil hone ka sochna chahiye. Magar, zaroori hai ke disipline qaim rakha jaye, risk ko effective taur par manage kiya jaye, aur market ki developments ke bare mein maloomati rahein taake forex market ko kamiyabi se guzar sakein.

اب آن لائن

ہم مواصلات کے پلیٹ فارم کے طور پر فاریکس فورم فاریکس پاکستان کے آپ کے انتخاب کی تعریف کرتے ہیں۔

موجودہ وقت 01:50 PM (GMT+5)۔

Working...

X

تبصرہ

Расширенный режим Обычный режим