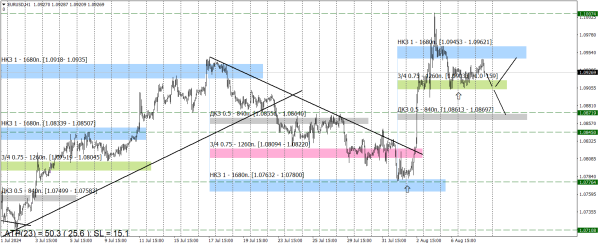

Kharidaaron ke paas itni taqat nahi thi ke wo upar ki taraf push kar sakain. Unhone sirf 1.0945-1.0962 ke full margin zone ke niche ke boundary ko touch kiya, aur bechne walon ne Euro ko aage barhne se roknay mein kamyabi hasil ki. Subah yeh zahir ho gaya tha ke aaj buyers aur sellers ke darmiyan ka jang is hi zone mein hoga. Chart ko dekh kar, yeh nazar aata hai ke sellers ne phir se full margin zone ko defend karne mein kamyabi hasil ki aur EURUSD pair ko phir se neeche push kar diya.

Is waqt, market ka future action 3/4 support zone 1.0903-1.0915 ke aas-paas honay wale battle par depend karega. Agar buyers is zone ko phir se defend karne mein successful rahe, to market mein upar ki taraf bounce dekhne ko mil sakta hai, aur EURUSD pair phir se full margin zone 1.0945-1.0962 ki taraf barh sakta hai. Yeh situation buyers ke liye favorable hogi, aur unhe strength milegi ke wo apne positions ko maintain kar saken.

Lekin, agar 3/4 support zone 1.0903-1.0915 neeche ki taraf break ho jata hai, to sellers ko is cheez ka faida ho sakta hai aur wo EURUSD ko aur neeche le ja sakte hain. Aise mein, market correction ki taraf ja sakti hai aur pehle breach kiya gaya half zone 1.0861-1.0869 tak pahunchne ka raasta ban sakta hai. Sellers ko yeh opportunity mil sakti hai ke wo market ko niche ki taraf push karain aur profit hasil karain.

Mera tajwez hai ke is waqt market ke haalatiyat aur price action ka tajziya karna zaroori hai. Buyers aur sellers ke darmiyan ka balance aur support-resistance levels ko analyze karte hue, hum yeh samajh sakte hain ke market ka trend kis taraf ja sakta hai. Agar buyers apne support zones ko protect kar lete hain aur market ko upar ki taraf le jaate hain, to hum upward movement dekh sakte hain. Lekin agar sellers ne support levels ko break kar diya, to market ka trend downward ho sakta hai aur correction ki process shuru ho sakti hai. Is liye, investors ko careful observation aur timely decision-making ki zaroorat hai.

Is waqt, market ka future action 3/4 support zone 1.0903-1.0915 ke aas-paas honay wale battle par depend karega. Agar buyers is zone ko phir se defend karne mein successful rahe, to market mein upar ki taraf bounce dekhne ko mil sakta hai, aur EURUSD pair phir se full margin zone 1.0945-1.0962 ki taraf barh sakta hai. Yeh situation buyers ke liye favorable hogi, aur unhe strength milegi ke wo apne positions ko maintain kar saken.

Lekin, agar 3/4 support zone 1.0903-1.0915 neeche ki taraf break ho jata hai, to sellers ko is cheez ka faida ho sakta hai aur wo EURUSD ko aur neeche le ja sakte hain. Aise mein, market correction ki taraf ja sakti hai aur pehle breach kiya gaya half zone 1.0861-1.0869 tak pahunchne ka raasta ban sakta hai. Sellers ko yeh opportunity mil sakti hai ke wo market ko niche ki taraf push karain aur profit hasil karain.

Mera tajwez hai ke is waqt market ke haalatiyat aur price action ka tajziya karna zaroori hai. Buyers aur sellers ke darmiyan ka balance aur support-resistance levels ko analyze karte hue, hum yeh samajh sakte hain ke market ka trend kis taraf ja sakta hai. Agar buyers apne support zones ko protect kar lete hain aur market ko upar ki taraf le jaate hain, to hum upward movement dekh sakte hain. Lekin agar sellers ne support levels ko break kar diya, to market ka trend downward ho sakta hai aur correction ki process shuru ho sakti hai. Is liye, investors ko careful observation aur timely decision-making ki zaroorat hai.

تبصرہ

Расширенный режим Обычный режим