مارچ 26 2024 کو یورو/امریکی ڈالرکی پیشن گوئی

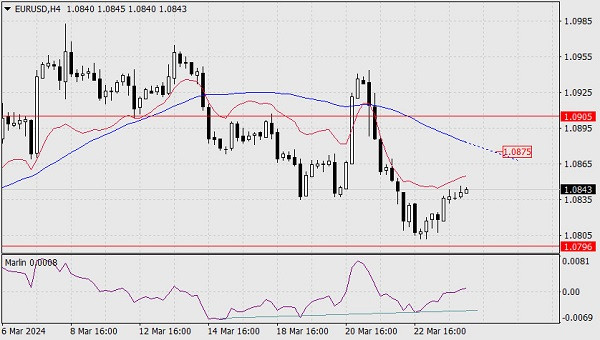

تصحیح کے ایک حصے کے طور پر، پیر کے روز یورو میں 28 پِپس کا اضافہ ہوا۔ جوڑی آج صبح بڑھتی رہتی ہے، کیونکہ یہ توازن اشارے لائن (ریڈ موونگ لائن) سے اوپر رہتی ہے۔ ایسا لگتا ہے کہ یورو اوپر کی طرف حرکت شروع کرنے کی کوشش کر رہا ہے، کیونکہ اس کا مقصد ایم. اے. سی. ڈی. لائن سے اوپر چڑھنا ہے اور 1.0905 پر مزاحمت ہے، یعنی 1.0796-1.0905 کی حد کو مخالف سمت سے گزرنے کی کوشش کر رہا ہے۔ لیکن موجودہ صورتحال ایسی ہے کہ قیمت ایم. اے. سی. ڈی. لائن کے نیچے اور گرتے ہوئے مارلن آسیلیٹر پر بڑھ رہی ہے، اس لیے اس بات کا زیادہ امکان ہے کہ قیمت اصلاحی اقدام کو مکمل کرنے کی کوشش کر رہی ہے اور اس کے بعد یہ 1.0795 پر سپورٹ کے نیچے چلی جائے گی۔ سادہ موونگ ایوریج MA144، کیونکہ یہ قریب ترین ہدف 1.0724 پر کھل جائے گا۔

آج، امریکا فروری کے لیے امریکہ میں پائیدار اشیا کے آرڈرز کے بارے میں ایک رپورٹ جاری کرے گا، جس میں 1.2% کی پیشن گوئی کی گئی ہے، اور مارچ کے لیے کنزیومر کنفیڈنس انڈیکس، جس کے پچھلے 106.7 سے بڑھ کر 106.9 ہونے کی توقع ہے۔ اس کے علاوہ، جنوری کے لیے ایس. اینڈ. پی. ہوم پرائس انڈیکس کے 6.1% y/y سے بڑھ کر 6.6% y/y تک متوقع ہے۔ بنیادی ذاتی کھپت کے اخراجات (پی. سی. ای.) انڈیکس کی متوقع اعلی پڑھنے کے ساتھ 2.9% سال بہ سال، اس سے پہلے 2.8% y/y کے مقابلے میں، یہ توقعات میں بنیادی تبدیلی کا باعث بن سکتا ہے تین کے بجائے فیڈرل ریزرو۔ میڈیا رپورٹس کے مطابق فیڈ چیف جیروم پاول کی سان فرانسسکو میں جمعہ کی تقریر ان تازہ ترین اعداد و شمار سے متعلق ہوگی۔ میکرو اکنامک توقعات یورو کی نمو میں حصہ نہیں ڈالتی ہیں۔

٤- گھنٹے کے چارٹ پر، مارلن آسیلیٹر کے ساتھ قیمت کا دوہرا کنورجنس اب بھی موثر ہے، اور آسکیلیٹر کی سگنل لائن پہلے ہی مثبت علاقے میں منتقل ہو چکی ہے۔ متذکرہ بالا وجوہات کی بنا پر، اصلاحی اضافے کی حد ایم. اے. سی. ڈی. لائن 1.0875 کی سطح پر ظاہر کرتی ہے۔ 1.0796 کی سطح کو توڑنا بالآخر یورو کے بڑھنے کی خواہش کو ختم کر دے گا۔

.تعینات کیا مراد ہے مارکیٹ کے تجزیات یہاں ارسال کیے جاتے ہیں جس کا مقصد آپ کی بیداری بڑھانا ہے، لیکن تجارت کرنے کے لئے ہدایات دینا نہیں*

تصحیح کے ایک حصے کے طور پر، پیر کے روز یورو میں 28 پِپس کا اضافہ ہوا۔ جوڑی آج صبح بڑھتی رہتی ہے، کیونکہ یہ توازن اشارے لائن (ریڈ موونگ لائن) سے اوپر رہتی ہے۔ ایسا لگتا ہے کہ یورو اوپر کی طرف حرکت شروع کرنے کی کوشش کر رہا ہے، کیونکہ اس کا مقصد ایم. اے. سی. ڈی. لائن سے اوپر چڑھنا ہے اور 1.0905 پر مزاحمت ہے، یعنی 1.0796-1.0905 کی حد کو مخالف سمت سے گزرنے کی کوشش کر رہا ہے۔ لیکن موجودہ صورتحال ایسی ہے کہ قیمت ایم. اے. سی. ڈی. لائن کے نیچے اور گرتے ہوئے مارلن آسیلیٹر پر بڑھ رہی ہے، اس لیے اس بات کا زیادہ امکان ہے کہ قیمت اصلاحی اقدام کو مکمل کرنے کی کوشش کر رہی ہے اور اس کے بعد یہ 1.0795 پر سپورٹ کے نیچے چلی جائے گی۔ سادہ موونگ ایوریج MA144، کیونکہ یہ قریب ترین ہدف 1.0724 پر کھل جائے گا۔

آج، امریکا فروری کے لیے امریکہ میں پائیدار اشیا کے آرڈرز کے بارے میں ایک رپورٹ جاری کرے گا، جس میں 1.2% کی پیشن گوئی کی گئی ہے، اور مارچ کے لیے کنزیومر کنفیڈنس انڈیکس، جس کے پچھلے 106.7 سے بڑھ کر 106.9 ہونے کی توقع ہے۔ اس کے علاوہ، جنوری کے لیے ایس. اینڈ. پی. ہوم پرائس انڈیکس کے 6.1% y/y سے بڑھ کر 6.6% y/y تک متوقع ہے۔ بنیادی ذاتی کھپت کے اخراجات (پی. سی. ای.) انڈیکس کی متوقع اعلی پڑھنے کے ساتھ 2.9% سال بہ سال، اس سے پہلے 2.8% y/y کے مقابلے میں، یہ توقعات میں بنیادی تبدیلی کا باعث بن سکتا ہے تین کے بجائے فیڈرل ریزرو۔ میڈیا رپورٹس کے مطابق فیڈ چیف جیروم پاول کی سان فرانسسکو میں جمعہ کی تقریر ان تازہ ترین اعداد و شمار سے متعلق ہوگی۔ میکرو اکنامک توقعات یورو کی نمو میں حصہ نہیں ڈالتی ہیں۔

٤- گھنٹے کے چارٹ پر، مارلن آسیلیٹر کے ساتھ قیمت کا دوہرا کنورجنس اب بھی موثر ہے، اور آسکیلیٹر کی سگنل لائن پہلے ہی مثبت علاقے میں منتقل ہو چکی ہے۔ متذکرہ بالا وجوہات کی بنا پر، اصلاحی اضافے کی حد ایم. اے. سی. ڈی. لائن 1.0875 کی سطح پر ظاہر کرتی ہے۔ 1.0796 کی سطح کو توڑنا بالآخر یورو کے بڑھنے کی خواہش کو ختم کر دے گا۔

.تعینات کیا مراد ہے مارکیٹ کے تجزیات یہاں ارسال کیے جاتے ہیں جس کا مقصد آپ کی بیداری بڑھانا ہے، لیکن تجارت کرنے کے لئے ہدایات دینا نہیں*

تبصرہ

Расширенный режим Обычный режим