TECHNICAL ANALYSIS: AUD/USD

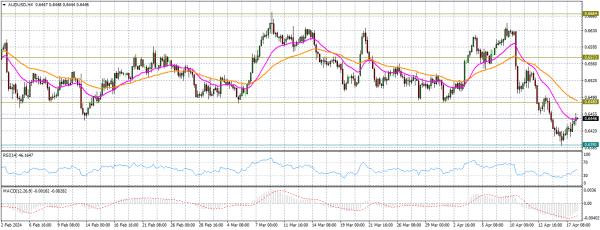

Salam. Aaj main AUD/USD chart ka tajziya kar raha hoon aur is jodi ke liye abhi tak koi dilchasp cheez nahi hai. Ab chaliye baat karte hain aaj ke chart ke baare mein jo is waqt tayyar kiya gaya hai. Waqt likhne ke daur mein AUD/USD 0.6446 par trade ho raha hai. Ab is chart par, kami abhi tak market par havi hai. Isliye candlestick ka zahir hona aane wale mauqe ke liye aik frokht signal faraham karta hai. Ye chart AUD/USD ke price action ko dikhata hai. Is chart par, Relative Strength Index (RSI) indicator oversold ki nishani nahi dikhata. Usi waqt, lagta hai ke Moving Average Convergence Divergence (MACD) indicator abhi bhi neeche ki taraf ishara kar raha hai. Isliye, main ye umeed karta hoon ke AUD/USD neeche ki taraf tajwez karega. Agar hum is par 20 marabut exponential moving average aur 50 marabut exponential moving average ke mawafiq tajziya karen, to iska hotmail phir bhi bearish ko wapas janib le jane ki rujhan hai. Sath hi, chart mein mojood support aur resistance ke sath, market structure ko samajhna aasan hai. Price 0.6391 ke oopar hai aur 0.6480 par resistance ko test kar rahi hai jo pehla resistance level hai. Agar ye koshish kamyab hai, to price agle resistance par 0.6573 tak chalay jayega jo doosra resistance level hai. 0.6573 ke resistance ke oopar aik tor par kiraya price ko 0.6664 ke resistance ke taraf le jayega jo teesra resistance level hai. Dosri taraf, neeche ki taraf chalne ka reference point local support level hoga, jo 0.6391 par maujood hai. Market price ne aane wale dino mein naya support level bana sakta hai. Agar aisa hota hai, to market price ka agla target 0.5921 hoga. Iske baad, main aur junub ki taraf chalne ka intezar karunga, takreban support level tak, jo 0.5432 par maujood hai jo teesra support level hai. Kharidaron aur farokht karne wale ne is hafte AUD/USD Time Frame par aik bohat hi moassar hafte guzari hai.

Chart mein istemal hone wale indicators: MACD indicator, RSI indicator period 14, 50-day exponential moving average rang Orange, 20-day exponential moving average rang Magenta.

: TECHNICAL ANALYSIS: AUD/USD

Salam. Aaj main AUD/USD chart ka tajziya kar raha hoon aur is jodi ke liye abhi tak koi dilchasp cheez nahi hai. Ab chaliye baat karte hain aaj ke chart ke baare mein jo is waqt tayyar kiya gaya hai. Waqt likhne ke daur mein AUD/USD 0.6446 par trade ho raha hai. Ab is chart par, kami abhi tak market par havi hai. Isliye candlestick ka zahir hona aane wale mauqe ke liye aik frokht signal faraham karta hai. Ye chart AUD/USD ke price action ko dikhata hai. Is chart par, Relative Strength Index (RSI) indicator oversold ki nishani nahi dikhata. Usi waqt, lagta hai ke Moving Average Convergence Divergence (MACD) indicator abhi bhi neeche ki taraf ishara kar raha hai. Isliye, main ye umeed karta hoon ke AUD/USD neeche ki taraf tajwez karega. Agar hum is par 20 marabut exponential moving average aur 50 marabut exponential moving average ke mawafiq tajziya karen, to iska hotmail phir bhi bearish ko wapas janib le jane ki rujhan hai. Sath hi, chart mein mojood support aur resistance ke sath, market structure ko samajhna aasan hai. Price 0.6391 ke oopar hai aur 0.6480 par resistance ko test kar rahi hai jo pehla resistance level hai. Agar ye koshish kamyab hai, to price agle resistance par 0.6573 tak chalay jayega jo doosra resistance level hai. 0.6573 ke resistance ke oopar aik tor par kiraya price ko 0.6664 ke resistance ke taraf le jayega jo teesra resistance level hai. Dosri taraf, neeche ki taraf chalne ka reference point local support level hoga, jo 0.6391 par maujood hai. Market price ne aane wale dino mein naya support level bana sakta hai. Agar aisa hota hai, to market price ka agla target 0.5921 hoga. Iske baad, main aur junub ki taraf chalne ka intezar karunga, takreban support level tak, jo 0.5432 par maujood hai jo teesra support level hai. Kharidaron aur farokht karne wale ne is hafte AUD/USD Time Frame par aik bohat hi moassar hafte guzari hai.

Chart mein istemal hone wale indicators: MACD indicator, RSI indicator period 14, 50-day exponential moving average rang Orange, 20-day exponential moving average rang Magenta.

: TECHNICAL ANALYSIS: AUD/USD

تبصرہ

Расширенный режим Обычный режим