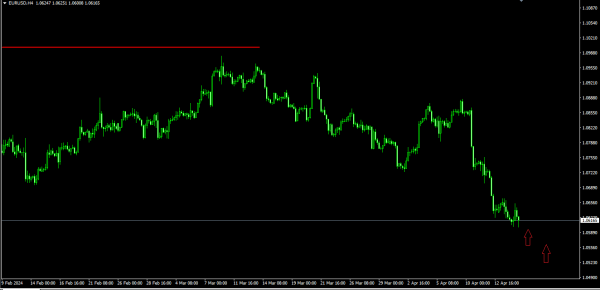

EURUSD pair abhi tak ek barqarar downtrend dikhata hai, jari rah kar naye local lows set karta hai. Ye neeche ki taraf ja raha hai, lekin abhi tak 1.06 level ko cross nahi kar paya. Market ki overall volatility kaafi kam hai, lekin koi bhi pullback ya reversal ke signs abhi tak nahi dikh rahe hain. Ye downtrend US dollar ki taqat par barhne ki wajah se hai, jo euro ke muqable mein hosla afzai kar raha hai.

Current market halat mein, meri trading strategy wahi rehti hai, aur main abhi bhi sidelines par hoon. Is halat mein bechne ki himmat nahi kar raha hoon. Lekin, main closely monitor kar raha hoon ki kya 1.06 level ke neeche break ho sakta hai ya nahi. Agar aisa hota hai aur false breakout saabit hota hai, to main long position enter karne ka sochunga.

Market mein safar karte hue, currency pair ke future direction ko decide karne wale ahem levels par dhyan dena zaroori hai. Nazdiki muddaton mein dekhne wale ahem levels 1.06 neeche aur 1.07 ooper hain. 1.06 ke neeche break hone ki surat mein, aur mazeed giravat ki taraf jaane ka raasta saaf ho sakta hai. Saath hi, 1.07 ke upar breakout bhi ek dum saaf signal ho sakta hai ki matli hai ke reversal ka intezaar hai.

Haloned trading mahol mein, sabar kaafi ahem hai, aur trading ke faisle lene se pehle waziha aur mazboot signals ka intezar karna zaroori hai. Upcoming economic releases aur geopolitical events ke baare mein maaloomat rakhte rehna bhi zaroori hai, jo EURUSD pair ke movement ko influence kar sakti hain. Mehnati risk management practices, jaise ke stop-loss orders set karna aur ek achhi trading plan ka paalan karna, forex market ke be-tab hawale kshitij mein asani se aage badhne mein madadgar sabit ho sakti hain.

Akhri mein, jab EURUSD pair neeche ki taraf jari raha hai, to ehtiyaat aur bina samajhdaari ke trading faislon se bachne ke liye zaroori hai. Sabar, hosla aur maaloomat ka istemal kar ke, traders behtareen mauqe ko hasil karne ke liye tayyar ho sakte hain aur forex market ke din dhalne wale manzar mein risks ka bhi behtar samna kar sakte hain.

(Note: The text above has been translated into Roman Urdu script.)

Current market halat mein, meri trading strategy wahi rehti hai, aur main abhi bhi sidelines par hoon. Is halat mein bechne ki himmat nahi kar raha hoon. Lekin, main closely monitor kar raha hoon ki kya 1.06 level ke neeche break ho sakta hai ya nahi. Agar aisa hota hai aur false breakout saabit hota hai, to main long position enter karne ka sochunga.

Market mein safar karte hue, currency pair ke future direction ko decide karne wale ahem levels par dhyan dena zaroori hai. Nazdiki muddaton mein dekhne wale ahem levels 1.06 neeche aur 1.07 ooper hain. 1.06 ke neeche break hone ki surat mein, aur mazeed giravat ki taraf jaane ka raasta saaf ho sakta hai. Saath hi, 1.07 ke upar breakout bhi ek dum saaf signal ho sakta hai ki matli hai ke reversal ka intezaar hai.

Haloned trading mahol mein, sabar kaafi ahem hai, aur trading ke faisle lene se pehle waziha aur mazboot signals ka intezar karna zaroori hai. Upcoming economic releases aur geopolitical events ke baare mein maaloomat rakhte rehna bhi zaroori hai, jo EURUSD pair ke movement ko influence kar sakti hain. Mehnati risk management practices, jaise ke stop-loss orders set karna aur ek achhi trading plan ka paalan karna, forex market ke be-tab hawale kshitij mein asani se aage badhne mein madadgar sabit ho sakti hain.

Akhri mein, jab EURUSD pair neeche ki taraf jari raha hai, to ehtiyaat aur bina samajhdaari ke trading faislon se bachne ke liye zaroori hai. Sabar, hosla aur maaloomat ka istemal kar ke, traders behtareen mauqe ko hasil karne ke liye tayyar ho sakte hain aur forex market ke din dhalne wale manzar mein risks ka bhi behtar samna kar sakte hain.

(Note: The text above has been translated into Roman Urdu script.)

تبصرہ

Расширенный режим Обычный режим