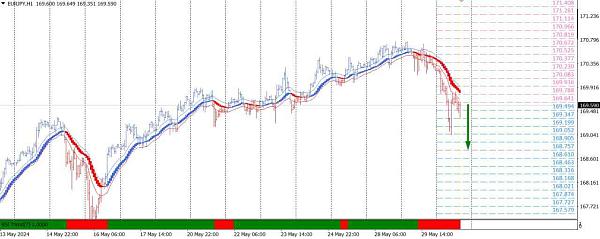

EURJPY

EURJPY currency pair/instrument ka current chart H1 timeframe par dekhte hue, trading ke liye ek favorable market situation observe ki ja sakti hai. Achhi profit hasil karne ke liye trade open karne ke liye suitable position chunne ke liye, kuch important preliminary conditions poori honi chahiye. Sab se pehle, yeh zaroori hai ke higher timeframe H4 par current trend ko sahi tarah se identify kiya jaye taa ke market sentiment forecasting mein galti se financial losses na ho. Toh, aayein apne instrument ka chart H4 timeframe ke saath dekhte hain aur main condition check karte hain - H1 aur H4 time periods par trend movements ka milna zaroori hai. Is tarah, pehle rule ke poora hone ko verify karne ke baad, humein nazar aata hai ke aaj market humein ek zabardast moqa de raha hai short trade enter karne ka. Aage ke analysis mein, hum teen working indicators - HamaSystem, RSI Trend, aur Magnetic_Levels_Color ke signals par rely karenge.

Hum intezar karte hain jab Hama aur RSI indicators ka rang red ho jaye, jo yeh main confirmation hoga ke sellers is waqt market mein dominate kar rahe hain. Jaise hi yeh hota hai, hum market mein enter karte hain aur ek sell trade open karte hain. Hum position se exit point ko magnetic levels indicator ke hisaab se chunenge. Aaj, signal execution ke liye sab se probable levels yeh hain - 168.757. Uske baad, hum chart par price ka behavior carefully monitor karenge jab yeh selected magnetic level ke qareeb aayega, aur decide karenge ke kaise aage barhna hai - ya to position ko market mein agle magnetic level tak rehne diya jaye ya phir already achieved profit ko lock kar liya jaye. Potential earnings ko mazid barhane ke liye, trailing stop ko activate kiya ja sakta hai.

EURJPY currency pair/instrument ka current chart H1 timeframe par dekhte hue, trading ke liye ek favorable market situation observe ki ja sakti hai. Achhi profit hasil karne ke liye trade open karne ke liye suitable position chunne ke liye, kuch important preliminary conditions poori honi chahiye. Sab se pehle, yeh zaroori hai ke higher timeframe H4 par current trend ko sahi tarah se identify kiya jaye taa ke market sentiment forecasting mein galti se financial losses na ho. Toh, aayein apne instrument ka chart H4 timeframe ke saath dekhte hain aur main condition check karte hain - H1 aur H4 time periods par trend movements ka milna zaroori hai. Is tarah, pehle rule ke poora hone ko verify karne ke baad, humein nazar aata hai ke aaj market humein ek zabardast moqa de raha hai short trade enter karne ka. Aage ke analysis mein, hum teen working indicators - HamaSystem, RSI Trend, aur Magnetic_Levels_Color ke signals par rely karenge.

Hum intezar karte hain jab Hama aur RSI indicators ka rang red ho jaye, jo yeh main confirmation hoga ke sellers is waqt market mein dominate kar rahe hain. Jaise hi yeh hota hai, hum market mein enter karte hain aur ek sell trade open karte hain. Hum position se exit point ko magnetic levels indicator ke hisaab se chunenge. Aaj, signal execution ke liye sab se probable levels yeh hain - 168.757. Uske baad, hum chart par price ka behavior carefully monitor karenge jab yeh selected magnetic level ke qareeb aayega, aur decide karenge ke kaise aage barhna hai - ya to position ko market mein agle magnetic level tak rehne diya jaye ya phir already achieved profit ko lock kar liya jaye. Potential earnings ko mazid barhane ke liye, trailing stop ko activate kiya ja sakta hai.

تبصرہ

Расширенный режим Обычный режим