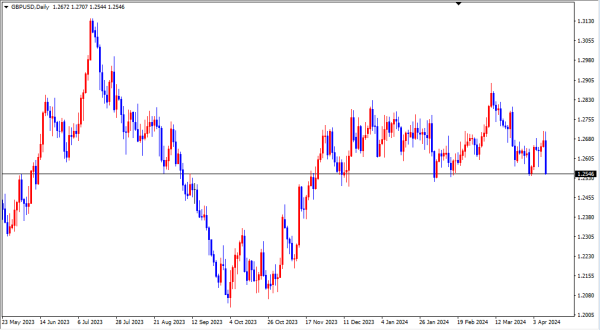

GBP/USD

GBP/USD jodi par ghanton (H1) ka waqt samah chart dekhte hue, numaya hota hai ke pond ka aik ahem taqseem bandon ke darmiyan wasat shetra ki taraf wapas le jane ka keemti waqt guzra hai. Halhi mein keemat ka yeh hilne-phirne khaas taur par tawajjo ko jata hai, khas tor par jab bandon ka pardah andar ki taraf muda hota hai. Aisa ek phenomenon keema hai ke keemat ke rawaiyya ke dynamics mein tabdeeli ka nazara hai. GBP/USD jodi, jo ke forex market mein aam tor par dekhi jane wali jodi hai, halhi mein hone wale trading session mein ek qabil-e-zikar taqseem mein takmeel ho gayi hai. Yeh taqseem khas taur par note ki ja sakti hai jab pond ki harkat ko Bollinger Bands ke H1 waqt samah chart mein daba hua markazi shetra ke sath mawafiq dekha jaye. Bollinger Bands, John Bollinger ne tayar ki gayi aik mashhoor takneeki tajziya ka sadah mooving ausaf (SMA) se ghera hua hota hai jo ke maratabat ke satah ko darust karta hai.

Is tajziya ke ird gird chakrane wale bandon ka dekha jata hai, jo ke is tajziya mein rukh ki taraf ishaarat karta hai. Takneeki tajziya mein, Bollinger Bands ke shakal aur harkat aane wale maarkat dynamics mein tabdeelion ke baray mein qeemati idaron faraham kar sakti hain. Jab bandon ko ikhtasari karke ya andar ki taraf muda diya jata hai, to yeh aksar kam tawazun waqt aur keemat ke amal mein aik marataba kam khalisat aur aik mumkin toar mein mashroot fasla ki alamat hai. Bandon ka yeh tanazur ishara deta hai ke maarkat shayad aik numaya harkat ke liye tayar ho, kyunke kam tawazun waqt ke maratabat aam tor par ziada tawazun waqt ke maratabat ke baad ati hain. Traders aur analysts Bollinger Bands ka rawaiyya nigha banate hain future keemat ke harkat ke baray mein isharon ke liye. Is mamlay mein, bandon ke andar ki taraf muda hua mawafiq yeh ishara deta hai ke GBP/USD jodi mein aik toor ya tazi harkat ka intezar ho sakta hai. Magar, aane wali harkat ka rukh ghair-yakeeni hai aur mazeed tajziya ki zaroorat hai.

GBP/USD jodi par ghanton (H1) ka waqt samah chart dekhte hue, numaya hota hai ke pond ka aik ahem taqseem bandon ke darmiyan wasat shetra ki taraf wapas le jane ka keemti waqt guzra hai. Halhi mein keemat ka yeh hilne-phirne khaas taur par tawajjo ko jata hai, khas tor par jab bandon ka pardah andar ki taraf muda hota hai. Aisa ek phenomenon keema hai ke keemat ke rawaiyya ke dynamics mein tabdeeli ka nazara hai. GBP/USD jodi, jo ke forex market mein aam tor par dekhi jane wali jodi hai, halhi mein hone wale trading session mein ek qabil-e-zikar taqseem mein takmeel ho gayi hai. Yeh taqseem khas taur par note ki ja sakti hai jab pond ki harkat ko Bollinger Bands ke H1 waqt samah chart mein daba hua markazi shetra ke sath mawafiq dekha jaye. Bollinger Bands, John Bollinger ne tayar ki gayi aik mashhoor takneeki tajziya ka sadah mooving ausaf (SMA) se ghera hua hota hai jo ke maratabat ke satah ko darust karta hai.

Is tajziya ke ird gird chakrane wale bandon ka dekha jata hai, jo ke is tajziya mein rukh ki taraf ishaarat karta hai. Takneeki tajziya mein, Bollinger Bands ke shakal aur harkat aane wale maarkat dynamics mein tabdeelion ke baray mein qeemati idaron faraham kar sakti hain. Jab bandon ko ikhtasari karke ya andar ki taraf muda diya jata hai, to yeh aksar kam tawazun waqt aur keemat ke amal mein aik marataba kam khalisat aur aik mumkin toar mein mashroot fasla ki alamat hai. Bandon ka yeh tanazur ishara deta hai ke maarkat shayad aik numaya harkat ke liye tayar ho, kyunke kam tawazun waqt ke maratabat aam tor par ziada tawazun waqt ke maratabat ke baad ati hain. Traders aur analysts Bollinger Bands ka rawaiyya nigha banate hain future keemat ke harkat ke baray mein isharon ke liye. Is mamlay mein, bandon ke andar ki taraf muda hua mawafiq yeh ishara deta hai ke GBP/USD jodi mein aik toor ya tazi harkat ka intezar ho sakta hai. Magar, aane wali harkat ka rukh ghair-yakeeni hai aur mazeed tajziya ki zaroorat hai.

تبصرہ

Расширенный режим Обычный режим