USD CHF Qeemat : haliya paish Raft:

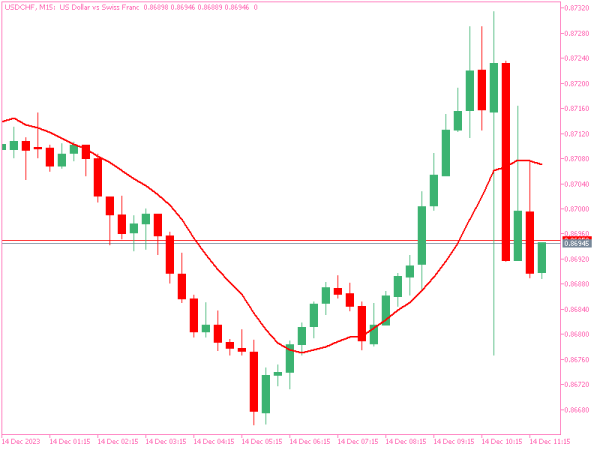

hum usd / chf currency jore ki qeematon ke ravayye ke tajzia par tabadlah khayaal karen ge. m15 chart mein lakhiri mutab channel oopar ki taraf hai, yeh zahir karta hai ke khredar mutharrak hain. mein kharidne par ghhor kar raha hon lekin market ki islaah ka sabr se intzaar karoon ga. mein khareedna chahta hon jab market 0. 87817 ki satah par nichale channel ki sarhad par pahonch jaye. channel ke barhatay hue rujhan ke khilaaf farokht karna ghair danish mandana hai, aur mumkina nuqsanaat ko kam karne ke liye nichale channel ki sarhad se islaah ki bunyaad par daakhil hona ziyada samajhdaari hai. mera maqsad 0. 88391 ki satah par balai had tak pohanchna hai lekin muntakhib channel ki utaar charhao ko adjust karne ke liye usay kam karne par ghhor kar raha hon. aaj ki market kam utaar charhao ka shikaar hai, is liye bhaari tijarat ki tawaqqa nahi hai .

charhtay hue channel mein, usdchf jora apni oopar ki harkat ko dobarah shuru karta hai. mutharrak ost ke mutabiq, qaleel mudti rujhan oopar ki taraf hai. nateejay ke tor par, yeh haqeeqat ke usdchf ki qeematein signal linon ke darmiyan ki satah ki jaanch kar rahi hain is baat ki nishandahi karti hai ke khredar ab market par dabao daal rahay hain. yeh aal kuch din pehlay 0. 8839 par trade kar raha tha jabkay is ki Sabiqa satha par trading kar raha tha. agar 0. 88450 ki support level ko islaah ke hadaf ke tor par jancha jata hai, to test ke baad 0. 8815 ya is se bhi ziyada ka izafah mumkin ho sakta hai. rozana chart zahir karta hai ke qeemat ab bhi taizi ke rujhan ki lakeer se oopar hai. 0. 8930 par muzahmati satah ke oopar band kar ke taizi ka rujhan jari rakhnay ko yakeeni banayen, jo agla hadaf 0. 8831 - 0. 8983 ke hafta waar supply area ke qareeb rakhta hai, jo ke taizi ke tr ke tasalsul ka ishara day ga .

usdchf ke chaar charts ke mutabiq, mein dekh sakta hon ke aik achi radd karne wali mom batii ban gayi hai, aur qeemat ko 0. 8810 qeemat ki satah se mustard kar diya gaya hai. tareekh ki sthon ka jaiza lainay ke baad, mein dekh sakta hon ke qeemat ko chore diya gaya hai kyunkay yeh 0. 8810 aur 0. 8840 ke darmiyan aik aala hajam walay zone se ghira sun-hwa hai. is satah par, qeemat ki karwai teen fojion ki tashkeel karti hai. haftay ke douran, is satah ne bhi mazboot himayat faraham ki, aur kharidaron ne is satah par qeemat ko buland rakha. fi al haal, yeh 0. 8835 par trade kar raha hai. tawaqqa hai ke is haftay bhi dollar ki mazbooti barqarar rahay gi. mein ne –apne chart par dekha hai ke relativ tadaat index 4 indicator trained line taizi ke rujhan ko zahir karti hai, jo market ki taizi ki haalat ko zahir karti hai. har soyng up iqdaam ke sath, soys currency ke muqablay mein dollar ki taaqat mein izafah hota hai, is liye hum sirf kharidari ke mawaqay talaash karen ge .

hum usd / chf currency jore ki qeematon ke ravayye ke tajzia par tabadlah khayaal karen ge. m15 chart mein lakhiri mutab channel oopar ki taraf hai, yeh zahir karta hai ke khredar mutharrak hain. mein kharidne par ghhor kar raha hon lekin market ki islaah ka sabr se intzaar karoon ga. mein khareedna chahta hon jab market 0. 87817 ki satah par nichale channel ki sarhad par pahonch jaye. channel ke barhatay hue rujhan ke khilaaf farokht karna ghair danish mandana hai, aur mumkina nuqsanaat ko kam karne ke liye nichale channel ki sarhad se islaah ki bunyaad par daakhil hona ziyada samajhdaari hai. mera maqsad 0. 88391 ki satah par balai had tak pohanchna hai lekin muntakhib channel ki utaar charhao ko adjust karne ke liye usay kam karne par ghhor kar raha hon. aaj ki market kam utaar charhao ka shikaar hai, is liye bhaari tijarat ki tawaqqa nahi hai .

charhtay hue channel mein, usdchf jora apni oopar ki harkat ko dobarah shuru karta hai. mutharrak ost ke mutabiq, qaleel mudti rujhan oopar ki taraf hai. nateejay ke tor par, yeh haqeeqat ke usdchf ki qeematein signal linon ke darmiyan ki satah ki jaanch kar rahi hain is baat ki nishandahi karti hai ke khredar ab market par dabao daal rahay hain. yeh aal kuch din pehlay 0. 8839 par trade kar raha tha jabkay is ki Sabiqa satha par trading kar raha tha. agar 0. 88450 ki support level ko islaah ke hadaf ke tor par jancha jata hai, to test ke baad 0. 8815 ya is se bhi ziyada ka izafah mumkin ho sakta hai. rozana chart zahir karta hai ke qeemat ab bhi taizi ke rujhan ki lakeer se oopar hai. 0. 8930 par muzahmati satah ke oopar band kar ke taizi ka rujhan jari rakhnay ko yakeeni banayen, jo agla hadaf 0. 8831 - 0. 8983 ke hafta waar supply area ke qareeb rakhta hai, jo ke taizi ke tr ke tasalsul ka ishara day ga .

usdchf ke chaar charts ke mutabiq, mein dekh sakta hon ke aik achi radd karne wali mom batii ban gayi hai, aur qeemat ko 0. 8810 qeemat ki satah se mustard kar diya gaya hai. tareekh ki sthon ka jaiza lainay ke baad, mein dekh sakta hon ke qeemat ko chore diya gaya hai kyunkay yeh 0. 8810 aur 0. 8840 ke darmiyan aik aala hajam walay zone se ghira sun-hwa hai. is satah par, qeemat ki karwai teen fojion ki tashkeel karti hai. haftay ke douran, is satah ne bhi mazboot himayat faraham ki, aur kharidaron ne is satah par qeemat ko buland rakha. fi al haal, yeh 0. 8835 par trade kar raha hai. tawaqqa hai ke is haftay bhi dollar ki mazbooti barqarar rahay gi. mein ne –apne chart par dekha hai ke relativ tadaat index 4 indicator trained line taizi ke rujhan ko zahir karti hai, jo market ki taizi ki haalat ko zahir karti hai. har soyng up iqdaam ke sath, soys currency ke muqablay mein dollar ki taaqat mein izafah hota hai, is liye hum sirf kharidari ke mawaqay talaash karen ge .

تبصرہ

Расширенный режим Обычный режим