USD/CHF

Main USD/CHF currency pair ki daily time frame par technical analysis karta hoon. Meri analysis ke natije mein, lagta hai ke bullish pressure bohot strong hai, jo is currency pair ki 0.88755 key resistance level ko tor kar guzar gayi hai. Ye breakout is ongoing bullish trend ka mazboot tasdeeq hai. Mazeed, 50 EMA aur 100 EMA ke darmiyan crossover bhi hai, jo is bullish trend ki kamyabi mein mujh par itminan barha deta hai. Magar, halat mein peechle highest level 0.908785 se ek neeche ki correction bhi nazar aa rahi hai. Halan ke ye correction peechle significant price increase ka natural jawab ho sakta hai, main temporary trend mein tabdeeli ke ihtemal par mutawajjah hoon. Magar, mujhe ye bhi maaloom hai ke ek downward correction hamesha bullish trend ka khatam hone ka ishara nahi hota. Aksar, aise corrections price ka main trend dobara apni raah par chalne se pehle temporary consolidation ka hissa hote hain.

Agla kadam ke samne hone ke liye, mera iraada hai ke H1 chart jaise chhote time frames ko check karoon. Chhote time frames par analysis karna price patterns ke zyada tafseel se mutaliq madad karta hai aur mujhe potential acche entry ya exit points ka pata lagane mein madad karta hai.

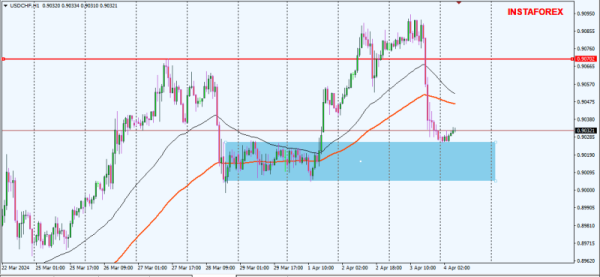

USD/CHF ANALYSIS H1

Kal USD/CHF currency pair ki movement ne 0.90904 tak se ek significant decline ka samna kiya. Ye decline market mein strong selling pressure ko darust karti hai. Magar agar hum overall trend dekhein, toh ye dikhayi deta hai ke ye currency pair ab bhi ek bullish trend mein hai. Yeh khaaskar wazeh hai 0.90049 se lekar 0.90257 tak ke price range mein mojood ek ahem demand area se, jahan par sellers tightness mehsoos kar rahe hain, jo darust karta hai ke mazeed price girne ke liye kafi tight buying interest mojood hai. Halan ke price ne 50 EMA aur 100 EMA ko tor diya hai, jo aam tor par ek bullish signal samjha jata hai, magar abhi tak dono moving averages ke darmiyan crossover nahi hua hai. 50 EMA aur 100 EMA ke darmiyan crossover aksar trend mein tabdeeli ka strong ishara samjha jata hai, aur jab tak crossover nahi hota, toh bullish trend ka jari rehna mumkin hai.

In shara'ait ko madde nazar rakhte hue, mera trading plan bullish signals ke liye dekhnay ka hai. Main kisi bhi mazboot bullish candle ka nazar rakhoonga jo yeh dikhata hai ke buying interest dobara wapas aayi hai. Yeh khaaskar maqbool hai kyunki abhi price woh demand area mein hai jahan se dobara uthne ke signs nazar aa rahe hain.

Main USD/CHF currency pair ki daily time frame par technical analysis karta hoon. Meri analysis ke natije mein, lagta hai ke bullish pressure bohot strong hai, jo is currency pair ki 0.88755 key resistance level ko tor kar guzar gayi hai. Ye breakout is ongoing bullish trend ka mazboot tasdeeq hai. Mazeed, 50 EMA aur 100 EMA ke darmiyan crossover bhi hai, jo is bullish trend ki kamyabi mein mujh par itminan barha deta hai. Magar, halat mein peechle highest level 0.908785 se ek neeche ki correction bhi nazar aa rahi hai. Halan ke ye correction peechle significant price increase ka natural jawab ho sakta hai, main temporary trend mein tabdeeli ke ihtemal par mutawajjah hoon. Magar, mujhe ye bhi maaloom hai ke ek downward correction hamesha bullish trend ka khatam hone ka ishara nahi hota. Aksar, aise corrections price ka main trend dobara apni raah par chalne se pehle temporary consolidation ka hissa hote hain.

Agla kadam ke samne hone ke liye, mera iraada hai ke H1 chart jaise chhote time frames ko check karoon. Chhote time frames par analysis karna price patterns ke zyada tafseel se mutaliq madad karta hai aur mujhe potential acche entry ya exit points ka pata lagane mein madad karta hai.

USD/CHF ANALYSIS H1

Kal USD/CHF currency pair ki movement ne 0.90904 tak se ek significant decline ka samna kiya. Ye decline market mein strong selling pressure ko darust karti hai. Magar agar hum overall trend dekhein, toh ye dikhayi deta hai ke ye currency pair ab bhi ek bullish trend mein hai. Yeh khaaskar wazeh hai 0.90049 se lekar 0.90257 tak ke price range mein mojood ek ahem demand area se, jahan par sellers tightness mehsoos kar rahe hain, jo darust karta hai ke mazeed price girne ke liye kafi tight buying interest mojood hai. Halan ke price ne 50 EMA aur 100 EMA ko tor diya hai, jo aam tor par ek bullish signal samjha jata hai, magar abhi tak dono moving averages ke darmiyan crossover nahi hua hai. 50 EMA aur 100 EMA ke darmiyan crossover aksar trend mein tabdeeli ka strong ishara samjha jata hai, aur jab tak crossover nahi hota, toh bullish trend ka jari rehna mumkin hai.

In shara'ait ko madde nazar rakhte hue, mera trading plan bullish signals ke liye dekhnay ka hai. Main kisi bhi mazboot bullish candle ka nazar rakhoonga jo yeh dikhata hai ke buying interest dobara wapas aayi hai. Yeh khaaskar maqbool hai kyunki abhi price woh demand area mein hai jahan se dobara uthne ke signs nazar aa rahe hain.

تبصرہ

Расширенный режим Обычный режим