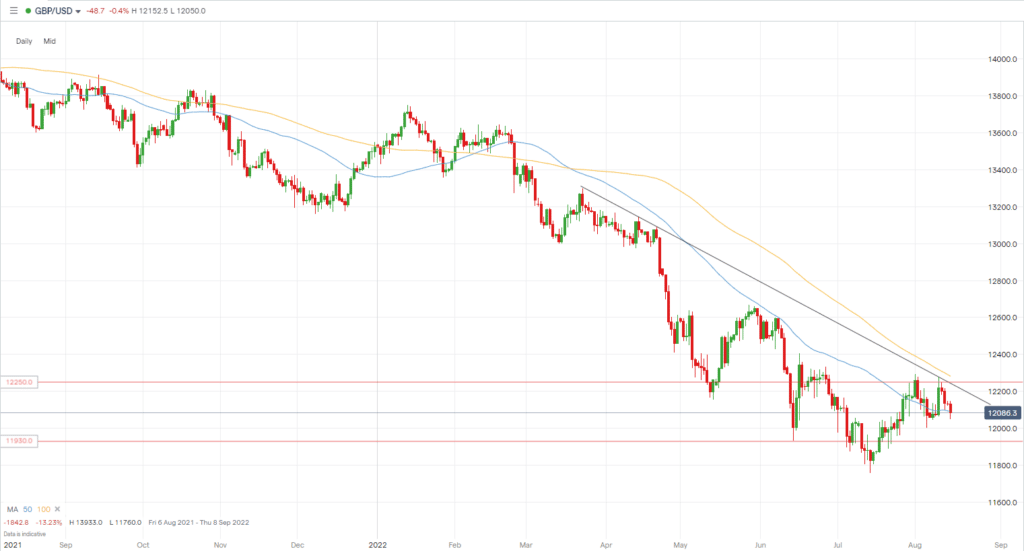

GBP USD H4 TIME FRAME KA ANALYSIS

neechay ki taraf kharabi jis ke baad jama hona aur is ke nateejay mein oopar ki taraf rad-e-amal, jab ke nichli range line ki oopri had se numaya tor par agay nahi barhta, mazbooti se murawaja taaqat aur farokht knndgan ke neechay ki simt ki taraf bunyadi jhukao ki nishandahi karta hai. jaisa ke tehreek asal simt mein neechay ki taraf lautade hai, mere aaj ke tajzia ke liye yahi kaafi hai. jaisa ke pehlay zikar kiya gaya hai, kami ki soorat mein, badnaam zamana" friday ayfikt" par amal karte hue, adaad o shumaar ke 25 se neechay girnay ka imkaan hai, jahan aik baar simt ka intikhab kya jata hai, khaas tor par bunyadi simt mein, usay mazbooti se neechay dhakel diya jata hai. . yeh rozana chart par aik dilchasp manzar nama banata hai. agar aaj tehreek ka muqaabla nahi kya jata hai to, mojooda halaat ke paish e nazar aik mumkina manzar naame ke mutabiq, rozana chart par mumkina neechay ki taraf tosee mein bohat kam rukawat hai. kam se kam hai, 1. 25-1. 2440 ke support zone ke andar, aik jaisi chouti banata hai. zimma daari kharidaron par hai ke woh is zone ko mazbooti se pakren. aisa karne mein nakami musalsal neechay ki taraf rujhan ka aaghaz kar sakti hai .

GBP USD D1 TIME FRAME KA ANALYSIS

gbp / usd jora farokht karne ke mawaqay barqarar rehtay hain, kyunkay yeh aam tor par –apne aap ko nichale siray par paata hai, jo neechay ki taraf dhakelnay ke liye tayyar hota hai. fi al haal 1. 2554 par trading kar rahay hain, ahem faisla is ke gird ghoomta hai ke aaya is haftay ki raftaar 1. 2438 ki taraf jaye gi ya mehez 1. 2505 tak. 1. 2542 se neechay ka nuzool 1. 2505 par support ko khatam kar day ga, jis se surkh manzar naame mein 1. 2438 ki taraf kami ki raah hamwar ho gi. is ke bar aks, agar oopar ki taraf rujhan zahir hota hai, to 1. 2785 tak pounchanay se mumkina tor par 1. 2505 tak nuzool ke sath jori 1. 2626 tak pahonch jaye gi. yeh earzi mansoobay hain, aur mera jhukao surkh manzar naame ki taraf hai, gbp / usd jori mein 1. 2438 tak girnay ki tawaqqa hai .

neechay ki taraf kharabi jis ke baad jama hona aur is ke nateejay mein oopar ki taraf rad-e-amal, jab ke nichli range line ki oopri had se numaya tor par agay nahi barhta, mazbooti se murawaja taaqat aur farokht knndgan ke neechay ki simt ki taraf bunyadi jhukao ki nishandahi karta hai. jaisa ke tehreek asal simt mein neechay ki taraf lautade hai, mere aaj ke tajzia ke liye yahi kaafi hai. jaisa ke pehlay zikar kiya gaya hai, kami ki soorat mein, badnaam zamana" friday ayfikt" par amal karte hue, adaad o shumaar ke 25 se neechay girnay ka imkaan hai, jahan aik baar simt ka intikhab kya jata hai, khaas tor par bunyadi simt mein, usay mazbooti se neechay dhakel diya jata hai. . yeh rozana chart par aik dilchasp manzar nama banata hai. agar aaj tehreek ka muqaabla nahi kya jata hai to, mojooda halaat ke paish e nazar aik mumkina manzar naame ke mutabiq, rozana chart par mumkina neechay ki taraf tosee mein bohat kam rukawat hai. kam se kam hai, 1. 25-1. 2440 ke support zone ke andar, aik jaisi chouti banata hai. zimma daari kharidaron par hai ke woh is zone ko mazbooti se pakren. aisa karne mein nakami musalsal neechay ki taraf rujhan ka aaghaz kar sakti hai .

GBP USD D1 TIME FRAME KA ANALYSIS

gbp / usd jora farokht karne ke mawaqay barqarar rehtay hain, kyunkay yeh aam tor par –apne aap ko nichale siray par paata hai, jo neechay ki taraf dhakelnay ke liye tayyar hota hai. fi al haal 1. 2554 par trading kar rahay hain, ahem faisla is ke gird ghoomta hai ke aaya is haftay ki raftaar 1. 2438 ki taraf jaye gi ya mehez 1. 2505 tak. 1. 2542 se neechay ka nuzool 1. 2505 par support ko khatam kar day ga, jis se surkh manzar naame mein 1. 2438 ki taraf kami ki raah hamwar ho gi. is ke bar aks, agar oopar ki taraf rujhan zahir hota hai, to 1. 2785 tak pounchanay se mumkina tor par 1. 2505 tak nuzool ke sath jori 1. 2626 tak pahonch jaye gi. yeh earzi mansoobay hain, aur mera jhukao surkh manzar naame ki taraf hai, gbp / usd jori mein 1. 2438 tak girnay ki tawaqqa hai .

تبصرہ

Расширенный режим Обычный режим