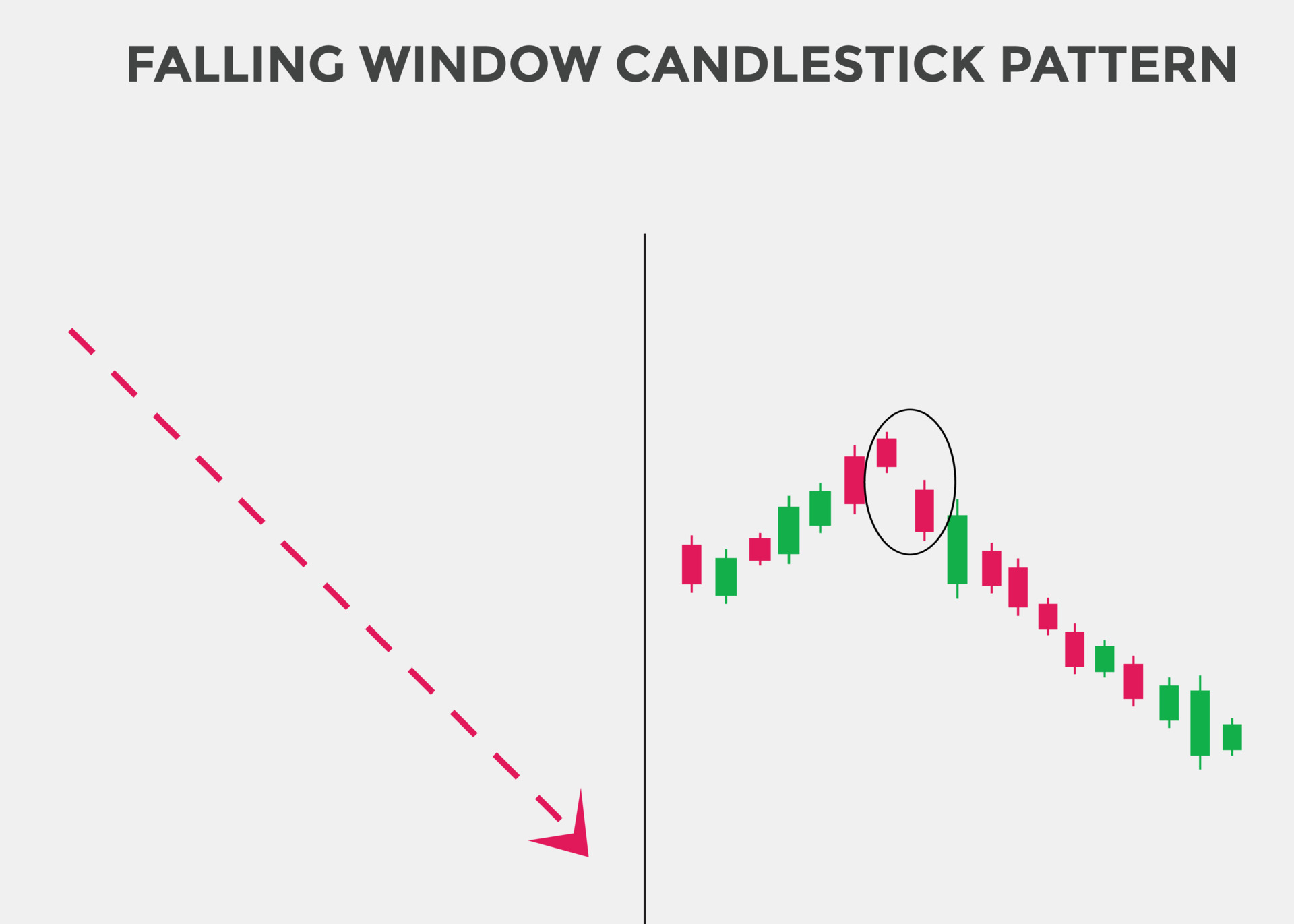

Falling Window Candlestick Chart Pattern

Candlestick charts financial markets mein prices ki movement ko dekhnay ka aik popular tareeqa hai. Chart aik khaas muddat ke douran kisi asset ki qeemat ki karwai ki numindagi karte hain, aur traders ko market ke trend aur simt ke baray mein qeemti maloomat faraham kar satke hain. Candlestick ke sab se popular patterns mein se aik" Falling window" Ka namona hai. Is pattern ki khasusiyat mandi ki qeemat mein farq hai jo lagataar do trading sishnz ke darmiyan hota hai. Pattern ko aksar market mein weakness ki alamat ke tor par dekha jata hai, kyunkay yeh batata hai ke farokht ka dabao barh raha hai aur khredar apna control kho rahay hain. Hum falling window pattern par geherai se nazar dalain ge, bashmole is ki tareef, usay kaisay pehchana jaye, aur is ki tijarat kaisay ki jaye. Hum kuch ahem awamil ka bhi jaiza len ge jo pattern ki taseer ko mutasir kar satke hain, bashmole hajam, time frame, aur deegar takneeki isharay.

Definition of the Falling Window Pattern

Falling window pattern, jisay "Downward gape" Ke naam se bhi jana jata hai, aik bearish candlestick pattern hai jo is waqt hota hai jab lagataar do trading sishnz ke darmiyan qeemat ka farq khilta hai. Farq is waqt hota hai jab dosray session ka kam hissa pehlay session ke aala se ziyada hota hai. Pattern ko aam tor par market mein weakness ki alamat ke tor par dekha jata hai, kyunkay yeh batata hai ke baichnay walay control haasil kar rahay hain aur khredar dilchaspi kho rahay hain. Khalaa jitna bara hoga, pattern ko itna hi ahem samjha jaye ga. Aik chhota sa farq mamooli ho sakta hai aur bazaar ke aam utaar charhao ki wajah se ho sakta hai, jab ke aik bara farq trend ke ulat jane ka ziyada imkaan rakhta hai. Falling window pattern ko kisi bhi financial market mein dekha ja sakta hai, bashmole stock, bandz, commodities, aur currency. Yeh stock markets mein khaas tor par aam hai, jahan usay aksar mandi ke trend ki alamat ke tor par dekha jata hai.

Identifying the Falling Window Pattern

Falling window pattern ki indication karne ke liye, traders ko lagataar do trading sessions ke darmiyan waqfa talaash karna chahiye. Farq ko dosray session mein pehlay session ke aala ke muqablay mein kam nichli satah se numaya kya jana chahiye. Dosray session mein is farq ke sath bearish candle sticks hona chahiye, jo is baat ki indication karta hai ke farokht ka dabao barh raha hai. Traders ko farq ke douran hajam par bhi tawajah deeni chahiye. Farq ke douran ziyada hajam ko aksar pattern ki tasdeeq ke tor par dekha jata hai, kyunkay yeh batata hai ke traders ki aik barri tadaad asset farokht kar rahi hai. Traders ko pattern ki shanakht karte waqt is ke sayaq o sabaq par bhi ghhor karna chahiye. Falling window ka pattern is waqt ziyada ahem hota hai jab yeh taizi ki sargarmi ki muddat ke baad hota hai. Agar pattern tanhai mein hota hai, to yeh kam ahem ho sakta hai aur ho sakta hai ke trend ke ulat jane ki indication nah kere.

Trading the Falling Window Pattern

Traders trading ke faislay karne ke liye falling window pattern ka istemaal kar satke hain. Pattern ko aksar mandi ke trend ki alamat ke tor par dekha jata hai, aur tajir usay mukhtasir position kholnay ya lambi positionsse bahar niklny ke liye istemaal kar satke hain. Falling window pattern ki tijarat karte waqt, traders ko darj zail awamil par ghhor karna chahiye :

Time frame: Falling window pattern long time frame par ziyada ahem ho sakta hai, jaisay rozana ya hafta waar charts. Traders ko chahiye ke woh jis time frame par trade kar rahay hain is par ghhor karen aur is ke mutabiq apni strategy ko adjust karen.

Stop loss: Traders ko window ke falling pattern ki tijarat karte waqt –apne khatray ko mehdood karne ke liye hamesha stap las orders istemaal karne chahiye. Stap las ko pehlay session ki oonchai se oopar rakhna chahiye, taakay mumkina trend ke ulat jane se bachaya ja sakay.

Confirmation: Traders ko tijarat mein daakhil honay se pehlay pattern ki tasdeeq ka intzaar karna chahiye. Tasdeeq bearish candlestick ya aglay trading session mein nichli satah ki soorat mein aa sakti hai.

Volume: Traders ko farq ke douran hajam par tawajah deeni chahiye, kyunkay ziyada hajam pattern ki tasdeeq faraham kar sakta hai.

Candlestick charts financial markets mein prices ki movement ko dekhnay ka aik popular tareeqa hai. Chart aik khaas muddat ke douran kisi asset ki qeemat ki karwai ki numindagi karte hain, aur traders ko market ke trend aur simt ke baray mein qeemti maloomat faraham kar satke hain. Candlestick ke sab se popular patterns mein se aik" Falling window" Ka namona hai. Is pattern ki khasusiyat mandi ki qeemat mein farq hai jo lagataar do trading sishnz ke darmiyan hota hai. Pattern ko aksar market mein weakness ki alamat ke tor par dekha jata hai, kyunkay yeh batata hai ke farokht ka dabao barh raha hai aur khredar apna control kho rahay hain. Hum falling window pattern par geherai se nazar dalain ge, bashmole is ki tareef, usay kaisay pehchana jaye, aur is ki tijarat kaisay ki jaye. Hum kuch ahem awamil ka bhi jaiza len ge jo pattern ki taseer ko mutasir kar satke hain, bashmole hajam, time frame, aur deegar takneeki isharay.

Definition of the Falling Window Pattern

Falling window pattern, jisay "Downward gape" Ke naam se bhi jana jata hai, aik bearish candlestick pattern hai jo is waqt hota hai jab lagataar do trading sishnz ke darmiyan qeemat ka farq khilta hai. Farq is waqt hota hai jab dosray session ka kam hissa pehlay session ke aala se ziyada hota hai. Pattern ko aam tor par market mein weakness ki alamat ke tor par dekha jata hai, kyunkay yeh batata hai ke baichnay walay control haasil kar rahay hain aur khredar dilchaspi kho rahay hain. Khalaa jitna bara hoga, pattern ko itna hi ahem samjha jaye ga. Aik chhota sa farq mamooli ho sakta hai aur bazaar ke aam utaar charhao ki wajah se ho sakta hai, jab ke aik bara farq trend ke ulat jane ka ziyada imkaan rakhta hai. Falling window pattern ko kisi bhi financial market mein dekha ja sakta hai, bashmole stock, bandz, commodities, aur currency. Yeh stock markets mein khaas tor par aam hai, jahan usay aksar mandi ke trend ki alamat ke tor par dekha jata hai.

Identifying the Falling Window Pattern

Falling window pattern ki indication karne ke liye, traders ko lagataar do trading sessions ke darmiyan waqfa talaash karna chahiye. Farq ko dosray session mein pehlay session ke aala ke muqablay mein kam nichli satah se numaya kya jana chahiye. Dosray session mein is farq ke sath bearish candle sticks hona chahiye, jo is baat ki indication karta hai ke farokht ka dabao barh raha hai. Traders ko farq ke douran hajam par bhi tawajah deeni chahiye. Farq ke douran ziyada hajam ko aksar pattern ki tasdeeq ke tor par dekha jata hai, kyunkay yeh batata hai ke traders ki aik barri tadaad asset farokht kar rahi hai. Traders ko pattern ki shanakht karte waqt is ke sayaq o sabaq par bhi ghhor karna chahiye. Falling window ka pattern is waqt ziyada ahem hota hai jab yeh taizi ki sargarmi ki muddat ke baad hota hai. Agar pattern tanhai mein hota hai, to yeh kam ahem ho sakta hai aur ho sakta hai ke trend ke ulat jane ki indication nah kere.

Trading the Falling Window Pattern

Traders trading ke faislay karne ke liye falling window pattern ka istemaal kar satke hain. Pattern ko aksar mandi ke trend ki alamat ke tor par dekha jata hai, aur tajir usay mukhtasir position kholnay ya lambi positionsse bahar niklny ke liye istemaal kar satke hain. Falling window pattern ki tijarat karte waqt, traders ko darj zail awamil par ghhor karna chahiye :

Time frame: Falling window pattern long time frame par ziyada ahem ho sakta hai, jaisay rozana ya hafta waar charts. Traders ko chahiye ke woh jis time frame par trade kar rahay hain is par ghhor karen aur is ke mutabiq apni strategy ko adjust karen.

Stop loss: Traders ko window ke falling pattern ki tijarat karte waqt –apne khatray ko mehdood karne ke liye hamesha stap las orders istemaal karne chahiye. Stap las ko pehlay session ki oonchai se oopar rakhna chahiye, taakay mumkina trend ke ulat jane se bachaya ja sakay.

Confirmation: Traders ko tijarat mein daakhil honay se pehlay pattern ki tasdeeq ka intzaar karna chahiye. Tasdeeq bearish candlestick ya aglay trading session mein nichli satah ki soorat mein aa sakti hai.

Volume: Traders ko farq ke douran hajam par tawajah deeni chahiye, kyunkay ziyada hajam pattern ki tasdeeq faraham kar sakta hai.

تبصرہ

Расширенный режим Обычный режим