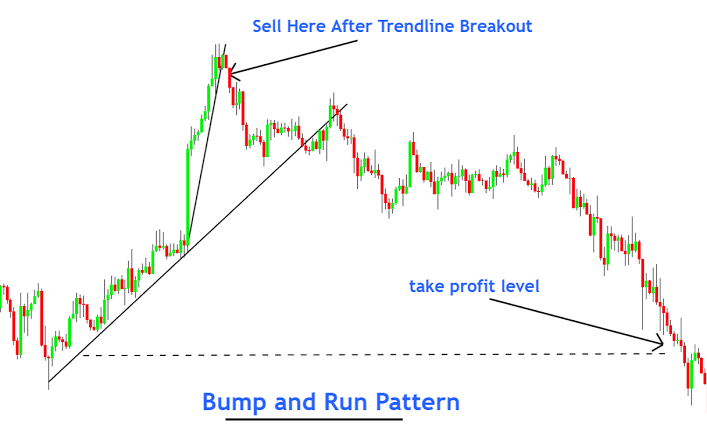

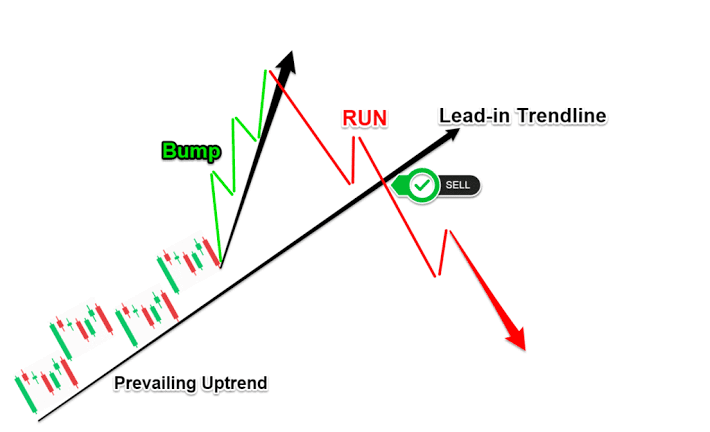

market ke fee ko tabdel karnay 2 step par moshtamel hta hey or trader esay stock index or foreign exchange buying and selling mein estamal kartay heinthums bulkos nay yeh pattern invite kea or os nay market kay structure ka jaiza lea or rate movement ka estamal kartay hvay marketplace mein yeh sample banya khordah trader es sample ka estamal long length fashion ka evaluation karnay kay ley estamal kartay heinBump and Run thomasbulko waski na (Technical evaluation of stock commodities) ki ebook ma bataya ha inka mutbik kisi bi chart sample ka banana ma 3 zaruri steps hota hain lead-in,*bump, run .Bump and run do tarah ka hota ha bullish reversal*bump*and run , bearish reversal*bump*and run. Bullish reversal*bump*and run downtrend ko khatam kar ka uptrend ki direction deta ha .Or bearish reversal*bump*and uptrend ko khatam kar ka downtrend ka signal deta ha .  Bump and Run Trading ki Explaination Bump and run reversal pattern Ek famous Pattern hai jo aapko change ke end aur ek new starting ki identify karne mein help Karega pump and run ki Tijarat approach Ek bahut hi Ek bahut hi aggressive market ki strategy hai jo bahut Tezi se chalne wali marketplace se fayda uthana chahti hai deep studies mein Hamen Pata Chalta Hai Ki ke sample ke Kuchh stages hain jo bump and run ke pattern Se jurte Hain sample ka pahla part ek lead in section hai Jo one month ya OS Se zyada Arsa Tak Chal sakta hai aur is foundation ko tashkil deta hai Agar yah bahut zyada steep hai to phir Aane Wala bump Kafi Aham hone ka Imkan Nahin Hai chat sample marketplace ki situation ko acchi Tarah Se pahchanne ka ek tool hai lekin high-quality Forex sign ke bagair mustakil profit Hasil karna Mushkil ho sakta hai potential help se turned resistance stage ko bump ke andar reaction ki low se bhi pehchana Ja sakta ha

Bump and Run Trading ki Explaination Bump and run reversal pattern Ek famous Pattern hai jo aapko change ke end aur ek new starting ki identify karne mein help Karega pump and run ki Tijarat approach Ek bahut hi Ek bahut hi aggressive market ki strategy hai jo bahut Tezi se chalne wali marketplace se fayda uthana chahti hai deep studies mein Hamen Pata Chalta Hai Ki ke sample ke Kuchh stages hain jo bump and run ke pattern Se jurte Hain sample ka pahla part ek lead in section hai Jo one month ya OS Se zyada Arsa Tak Chal sakta hai aur is foundation ko tashkil deta hai Agar yah bahut zyada steep hai to phir Aane Wala bump Kafi Aham hone ka Imkan Nahin Hai chat sample marketplace ki situation ko acchi Tarah Se pahchanne ka ek tool hai lekin high-quality Forex sign ke bagair mustakil profit Hasil karna Mushkil ho sakta hai potential help se turned resistance stage ko bump ke andar reaction ki low se bhi pehchana Ja sakta ha

Bump and Run Trading ki Explaination

Bump and run reversal pattern Ek famous Pattern hai jo aapko trade ke end aur ek new beginning ki identify karne mein help Karega pump and run ki Tijarat strategy Ek bahut hi Ek bahut hi aggressive market ki strategy hai jo bahut Tezi se chalne wali market se fayda uthana chahti hai deep research mein Hamen Pata Chalta Hai Ki ke pattern ke Kuchh phases hain jo bump and run ke pattern Se jurte Hain pattern ka pahla part ek lead in phase hai Jo one month ya OS Se zyada Arsa Tak Chal sakta hai aur is basis ko tashkil deta hai Agar yah bahut zyada steep hai to phir Aane Wala bump Kafi Aham hone ka Imkan Nahin Hai chat pattern market ki condition ko acchi Tarah Se pahchanne ka ek tool hai lekin best Forex signal ke bagair mustakil profit Hasil karna Mushkil ho sakta hai potential support se turned resistance level ko bump ke andar reaction ki low se bhi pehchana Ja sakta ha Bump and Run trading strategy ki Identification

Bump aur run aik market patteren hai jo qeemat ke rujhan ko tabdeel karne ke do marahil par mushtamil hai. yeh aik nadir chart patteren hai, aur tajir usay stock, index aur forex trading mein istemaal karte hain. Thomas bulkowski ne bump and run ka namona ijaad kya. is ne market ke dhanchay ka jaiza liya aur qeemat ki karwai ka istemaal karte hue aik chart patteren banaya. khorda tajir barray pemanay par is ka istemaal market ke taweel mudti rujhan ke tajziye ki paish goi karne ke liye karte hain. is mazmoon ke aakhir mein, mein is chart patteren ko muaser tareeqay se tijarat karne ke liye aik saada tijarti hikmat e amli ki wazahat karoon ga .

تبصرہ

Расширенный режим Обычный режим