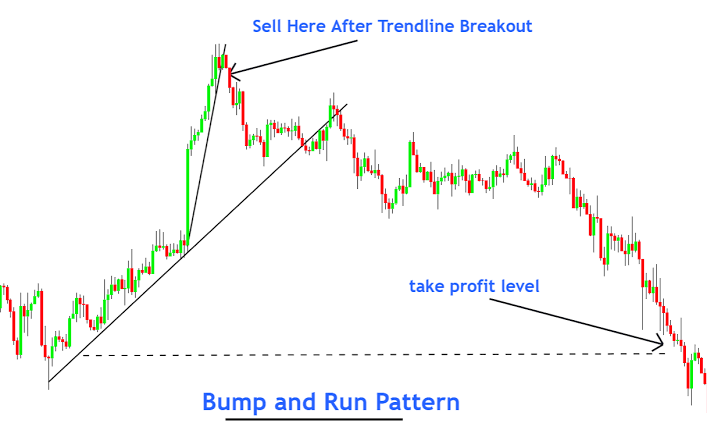

What is Bump and run pattern:? INTRODUCTION&EXPLNATION: sir,, Aslamoalekum members. Mujhy umeed hay ap sab kheryt say hon gay. Apka trading session acha ja raha hoga. Aj ka hamara discussion bum and run pattern k bary hay. Dekhty hain k yeh kia hay r kesy information deta hay Bump and run pattern Thomas halkoshki k zariye daryaft karda bump and run phase reversal pattern is waqt banta hay jab zrort say zeada kayas arayo or hujam main izafay ki waja say ksi asasy ki kermat main tezi say izafa ya kami hoi hoti hay tashkeel k doran teen marahil hoty hain lead in, takrana or run. Is pattern k pichy yeh kahyal yeh hay k simat ka tayun jsy b ho lkein faida ya nuqsan k hawalay say sb sy pehky isy dekha jata hay taky market jab b oper nchy ho tajir is bat ka rujhan dekhty hain k izafa r kami ks.had tak mutawaqa hay. Is bump and run bulish r bairish pattern sirr,, Han run r bum bottm patter. K tezi ka ishara deta hay kiu k yeh zabardst kami k baf ak mazbot relu ki taraf lay jata hay jab keemat single line sey mazahmat krti hay r tor jati hay r acha khass nuqsan ka nsamna karna pata hay to esy main tajir ak anya runhan ktn laty hai. Bat kabl e tawaja hay k id tarz. Ki 2 mukhtalif halaten hai. Ak oprr ka rujhan r dsra nichay ka rujha.[/INDENT][/COLOR]

basis of bump and run Qayas arai pr mubni sargarmi.asi hay jesy abhi faida r abhi nuqsan. R jasy he market ka trend badalta hay bs tajir ka rujahan whe pr esy e badala jata hay fir wh faida nuqsan dekhy bager koi market ki sargarmi.ko nazar andaz kr dety hai.akhri marhala us waqt shrur hota hay jab keemat hamayat ya mazahmat ki keleedi satho pr hoto hay r up down ho k nafa ya nuqsan deti hay

BEST OF LUCK DEAR......,,,,,,,,,,,,,,,

تبصرہ

Расширенный режим Обычный режим