Understanding Dark Cloud Cover

Introduction:

Dark Cloud Cover ek candlestick pattern hai jo traders ko market trends aur possible reversals ke liye signals provide karta hai. Ye bearish reversal pattern hota hai aur investors ko indicate karta hai ke uptrend ke baad market mein potential downward movement hone wala hai. Is post mein, hum dekheinge ke Dark Cloud Cover pattern ko samajhne ke liye kya guidelines hain.

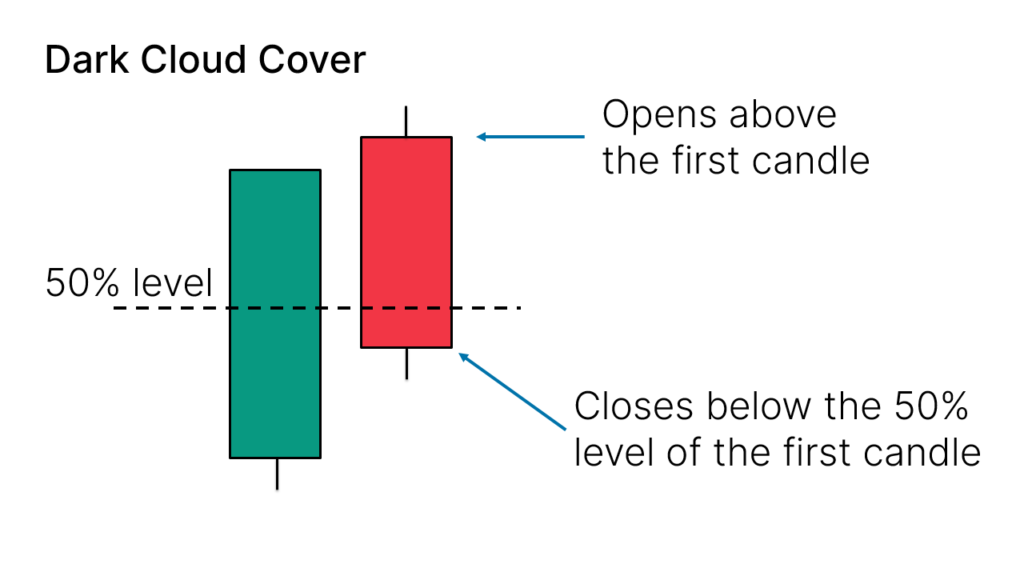

Dark Cloud Cover Pattern:

Dark Cloud Cover ek do-candlestick pattern hai jo uptrend ke baad aata hai. Pehla candle green (bullish) hota hai, jo indicate karta hai ke market mein strong buying pressure hai. Dusra candle red (bearish) hota hai aur iska opening price pehle candle ke closing price ke near hota hai. Lekin iska closing price pehle candle ke half se neeche hota hai. Ye situation bearish reversal ko indicate karti hai.

Guidelines for Understanding Dark Cloud Cover

Pehla Candle (Bullish):

Dark Cloud Cover pattern ki shuruaat ek uptrend ke saath hoti hai, jisme pehla candle green hota hai.

Is candle ki length aur body ka size indicate karte hain ke buyers control mein hain aur strong buying pressure hai.

Dusra Candle (Bearish):

Dusra candle red hota hai, jo pehle candle ke closing price ke near open hota hai.

Dusra candle ki length aur body ka size pehle candle ke half se neeche hona chahiye.

Closing Price Comparison:

Dark Cloud Cover pattern mein critical point closing prices ka comparison hai.

Dusra candle ka closing price pehle candle ke half se neeche hona bearish reversal ko confirm karta hai.

Volume Analysis:

Volume bhi ek important factor hai Dark Cloud Cover pattern ko confirm karne ke liye.

Agar second candle ke sath increased selling volume hai, to ye bearish reversal signal ko strengthen karta hai.

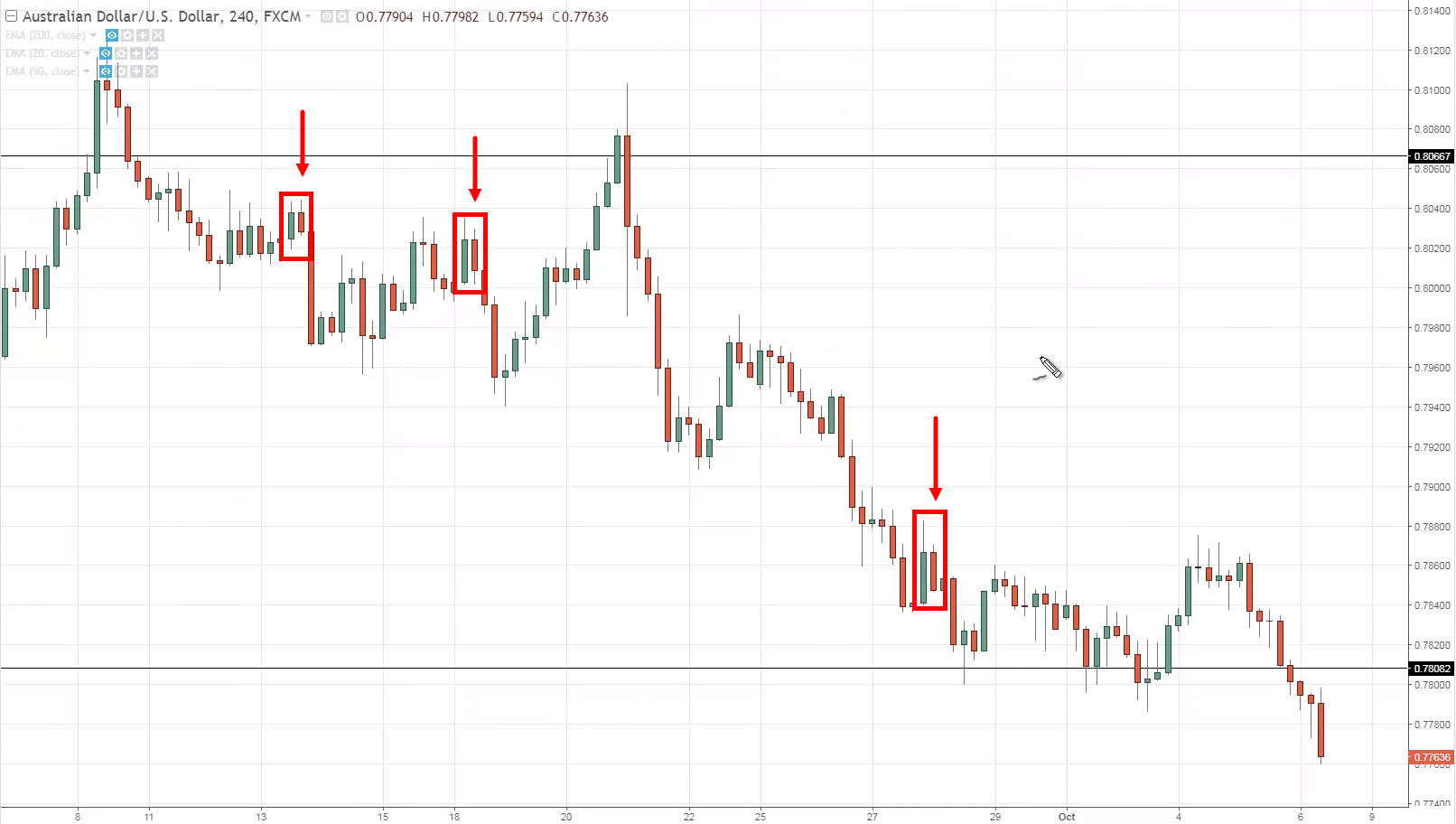

Dark Cloud Cover Pattern Ka Istemal

Reversal Signal:

Dark Cloud Cover bearish reversal signal deta hai, indicating ke uptrend ke baad market mein potential downtrend shuru hone wala hai.

Traders ise trend reversal ka initial indication samajh kar apne trading strategies ko adjust kar sakte hain.

Entry and Exit Points:

Traders Dark Cloud Cover pattern ka istemal karke apne entry aur exit points tay kar sakte hain.

Is pattern ke occurrence ke baad, investors apne long positions ko close karke short positions le sakte hain.

Risk Management:

Dark Cloud Cover ko samajh kar traders apne risk management strategies ko improve kar sakte hain.

Stop-loss orders ko strategically place karke losses se bacha ja sakta hai.

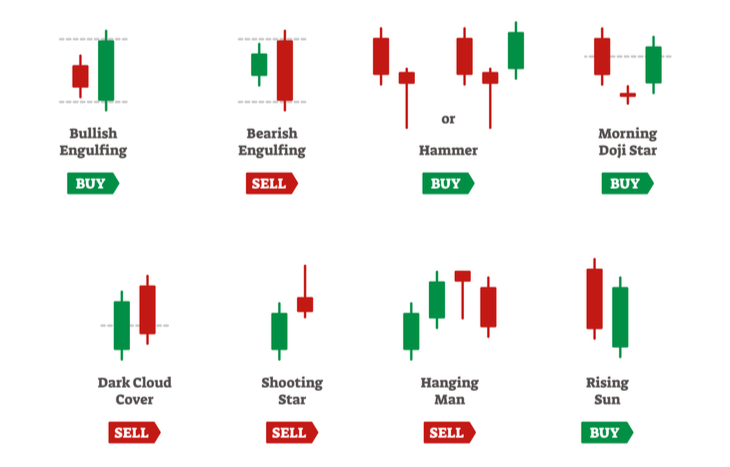

Confirmation with Other Indicators:

Dark Cloud Cover pattern ko aur bhi strong banane ke liye, traders ise dusre technical indicators ke saath combine kar sakte hain.

Moving averages, RSI, ya MACD ke saath Dark Cloud Cover ka istemal karke more accurate trading decisions liye ja sakte hain.

Conclusion:

Dark Cloud Cover pattern trading mein ek important tool hai jo market trends ko samajhne aur potential reversals ko identify karne mein madad karta hai. Is pattern ko sahi taur par samajh kar aur dusre indicators ke saath combine karke traders apne trading strategies ko refine kar sakte hain. Dark Cloud Cover ka istemal karke, investors apne risk ko minimize karke aur market movements ko predict karke apne trading experience ko enhance kar sakte hain.

تبصرہ

Расширенный режим Обычный режим