Assalamualaikum Kise ho ap sab log me bilkul thek or khariyat se ho or umeed karta ho ke ap sab log bhi bilkul thek or khariyat se ho ge aj is thread me apkoMe Pakistan forex trading ke ak bhot he important topic island Reversal Candlestick pattern ki importance ke bare me btao ga or me umeed karta ho ke jo

Information me apse share karo ga wo apke knowledge or experience me zaror izafa kare ge or agar ap mere is thread pe amal karte he to ak kamyab trader

Ban sakte he ak or bat jo me apko btana chahta hun ke agar ham Pakistan forex forum pe apni pori mhenat or himmat se Kam karte he or apna ziyada se ziyada

Time bhi Pakistan forex forum pe guzarte he to ham ak kamyab trader ban sakte he.

What is Island Reversal Candlestick?

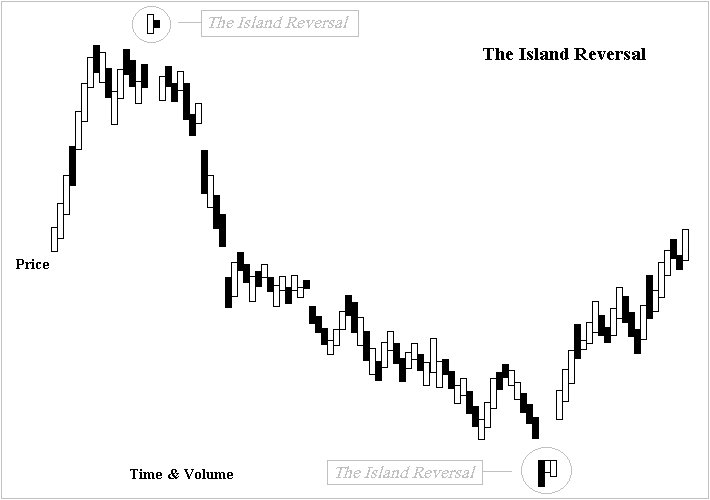

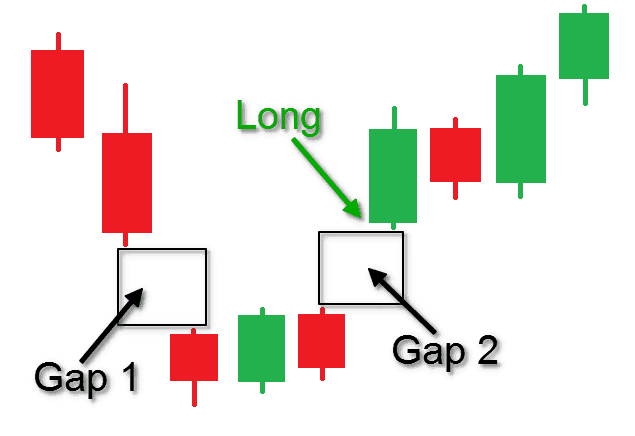

jazeeray ka ulat palat baar charts ya candle stick charts par qeemat ka aik namona hai jo rozana chart par, qeemat ke amal mein farq ke zareya dono taraf se allag honay walay dinon ki aik group bandi ko numaya karta hai. qeematon ka yeh namona batata hai ke qeematein is waqt kisi bhi rujhan ko tabdeel kar sakti hain jis ki woh numayesh kar rahay hain, chahay oopar se neechay ki taraf ya neechay se oopar ki taraf .

Key Takeaway;.

qeemat ka yeh namona is waqt hota hai jab do mukhtalif farq tijarti dinon ke aik cluster ko allag kar dete hain. patteren ka matlab aam tor par ulat jana hai aur yeh taizi ya mandi ki tabdeeli par laago ho sakta hai. oopar ki taraf rujhan wali qeematon ( taizi ) se neechay ki taraf rujhan wali qeematon ( mandi ) mein jazeeray ka ulat jana is ke bar aks se kahin ziyada baar baar hota hai .

Understanding;.

jazeeray ki tabdeelian aik makhsoos shanakht kanandah hain kyunkay un ki tareef tijarti adwaar ( aam tor par dinon ) ke dono taraf qeemat ke farq se hoti hai. agarchay bohat se tajzia karon aur taajiron ka yeh aqeedah hai ke khalaa aakhir kaar pur ho jaye ga ( matlab yeh hai ke qeematein pehlay se mojood kisi bhi khalaa par wapas aa jayen gi ), jazeera ki tabdeeli is khayaal par mabni hai ke tashkeel mein do khalaa aksar pur nahi hon ge. kam az kam thori der ke liye nahi .

Information me apse share karo ga wo apke knowledge or experience me zaror izafa kare ge or agar ap mere is thread pe amal karte he to ak kamyab trader

Ban sakte he ak or bat jo me apko btana chahta hun ke agar ham Pakistan forex forum pe apni pori mhenat or himmat se Kam karte he or apna ziyada se ziyada

Time bhi Pakistan forex forum pe guzarte he to ham ak kamyab trader ban sakte he.

What is Island Reversal Candlestick?

jazeeray ka ulat palat baar charts ya candle stick charts par qeemat ka aik namona hai jo rozana chart par, qeemat ke amal mein farq ke zareya dono taraf se allag honay walay dinon ki aik group bandi ko numaya karta hai. qeematon ka yeh namona batata hai ke qeematein is waqt kisi bhi rujhan ko tabdeel kar sakti hain jis ki woh numayesh kar rahay hain, chahay oopar se neechay ki taraf ya neechay se oopar ki taraf .

Key Takeaway;.

qeemat ka yeh namona is waqt hota hai jab do mukhtalif farq tijarti dinon ke aik cluster ko allag kar dete hain. patteren ka matlab aam tor par ulat jana hai aur yeh taizi ya mandi ki tabdeeli par laago ho sakta hai. oopar ki taraf rujhan wali qeematon ( taizi ) se neechay ki taraf rujhan wali qeematon ( mandi ) mein jazeeray ka ulat jana is ke bar aks se kahin ziyada baar baar hota hai .

Understanding;.

jazeeray ki tabdeelian aik makhsoos shanakht kanandah hain kyunkay un ki tareef tijarti adwaar ( aam tor par dinon ) ke dono taraf qeemat ke farq se hoti hai. agarchay bohat se tajzia karon aur taajiron ka yeh aqeedah hai ke khalaa aakhir kaar pur ho jaye ga ( matlab yeh hai ke qeematein pehlay se mojood kisi bhi khalaa par wapas aa jayen gi ), jazeera ki tabdeeli is khayaal par mabni hai ke tashkeel mein do khalaa aksar pur nahi hon ge. kam az kam thori der ke liye nahi .

تبصرہ

Расширенный режим Обычный режим