Candlestick Pattern:-

Aslam u alaikum,

Dear forex member umeed karta hun aap sab khairiyat se honge dear members Candlesticks ka aghaz japan me 1600 sadi me hona shoro howa tha. Japanese chawalo (rice) ki pedawar aur mustaqil me achey result k leye is ki madad lete the. 1870 me Japanese stock market shoro hone k baad candlestick ka istemal financial markets me hone laga. Jab se candlestick ka istemal all over the hone laga hai, to is se traders ko financial market me apne karobar ko profitable banane me bari madad meli hai.

Aslam u alaikum,

Dear forex member umeed karta hun aap sab khairiyat se honge dear members Candlesticks ka aghaz japan me 1600 sadi me hona shoro howa tha. Japanese chawalo (rice) ki pedawar aur mustaqil me achey result k leye is ki madad lete the. 1870 me Japanese stock market shoro hone k baad candlestick ka istemal financial markets me hone laga. Jab se candlestick ka istemal all over the hone laga hai, to is se traders ko financial market me apne karobar ko profitable banane me bari madad meli hai.

Candlesticks charts ko candle chart bhi kaha jata hai. Is ko abtedaye tawar par reversal signal ko talash karne me madad karne k leye tayar kia gaya hai, aur jab is ko sahi tareeqay se istemal kia jata hai, to na sirf ye traders k sarmaye ko mehfoz banata hai, bulkeh us me izafa karne me madad faraham karta hai. Candlestick chart pattern dosre chart pattern (bar chart aur line chart) k muqabele me market ka tafseeli aur ziada darust naqsha dekhata hai, aur is ki waja ye hai k candle charts analysis ki naye rahen (vanues) khulte hen aur dosre charts k muqabele me ziada fawayed pesh karte hen:

- Candle k chart bulls aur bears k darmeyan jang kon jeet raha hai, dekha kar supply aur demand ki soratehal ko mukamal tawar par zahir karte hen.

- Baar chart ki tarah, candle charts bhi market k trend ko zahir karta hai, lekin candles is aqdam k peche taqatwar asbab (ya kamzor asbab) ko bhi zahir kar k analyst ki ziada madad karte hen.

- Baar charts techniques ko reversal signals muntaqil karne me aksar hafte lagte hen. Taham, candle chart aksar aik se teen sessions me bohut jald reversal jane k indication faraham karta hai.

- Chonkeh candles chart same wahi data istemal karte hen jo baar chart karta hai (yani open, close, high and low), is waja se baar chart par istemal hone wale dosre tamam technical signals asani se candles pe lago keye ja sakte hen. Chonkeh baar charts ki nisbat candles charts k fawayed ziada hen, is waja se humen candles charts ka hi istemal karna chaheye, aur is pe hum dosre sare indicators aur singal bhi asani se lago kar sakte hen.

Candlestick Timeframe

Aik candlestick ka timeframe 1 minute se lekar aik month tak ka ho sakta hai. Jo rules aur regulations one minute ki candlestick k leye hoti hai, wahi same one month ki timeframe wali candle ki leye bhi hoti hai. One minute se lekar one hour tak ki candlestick short-term analysis k leye istemal kia jata hai, q k inka duration kam hota hai. Lekin 4 hour se le kar one month tak ki candlestick ling time duration ka hone ki waja se is ka istemal long-term ki analysis me hota hai. Aik candlestick ki duration jitni ziada hogi, utni hi us ka data ziada accurate hoga. Aik candle one minute (M1),five minutes (M5), fifteen minutes (M15), thirty minutes (M30), one hours (H1), four hour (H4), one week (W1) aur one month (MN) ki duration par mushtamil hota hai.

Key terms of a candlestick

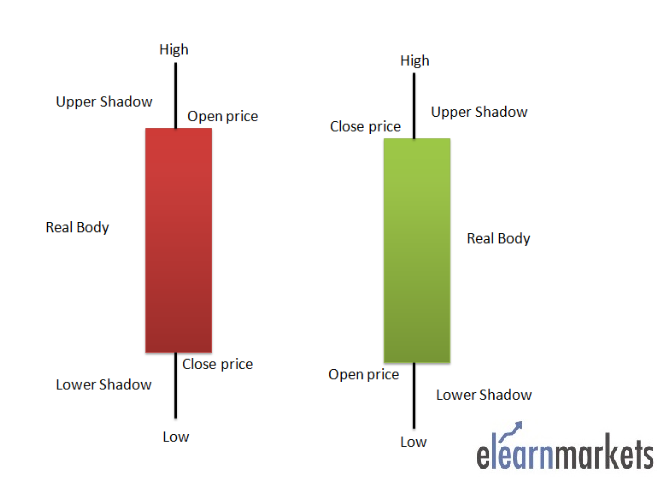

Aik candlestick mandarja-zel chaar hiso par mushtamil hoti hai. Financial market ki technical analysis k leye aik candlestick ki in hiso ka samjhna bohut zarori hai.

- White real body (bullish candle k leye)

- Black real body (bearish candle k leye)

- Upper shadow (wick)

- Lower shadow (wick)

White Real Body (Bullish):

Candle ki white body ka matlab hai, k maojooda session ziada ya high qeemat me band howa hai. White real body candle open se lekar close hone tak mutateel hisa hota hai, jo k nechay se uper ki taraf hota hai. Is candle me qeematon ka positive movement karne ki waja se, is candle ko bullish candle bhi kaha jata hai.

Black Real Body (Bearish):

Black real body wali candle ka matlab hota hai k maojooda session kam qeemat me band ho gaya hai. Black real body me open position high aur close position downward hota hai. Yani is me qeematen uper se shoro hoyi haiaur nechay ki janib jati hai. Candle ki real body same mustateel shakal me hoti hai, jis ko bearish candle bhi kaha jata hai.

Uper Shadow (Wick ):

Candles me aksar uper nechay aik line si bani hoti hai jis ko candle ka shodow kaha jata hai. Agar candle ki uper side pe koi line banti hai to is ko uper shadow ya wick kaha jata hai. Uper shadow candle ki sab se highest qeemat hoti hai, jahan ko ye qamaten touch kar chuki hoti hen. Uper shadow humen buying pressure k bare me information deti hai.

Lower Shadow (Wick):

Agar kisi candle ki down side pe koi saya ya line nazar ati hai to ye us candle ki lower shodow kehlati hai. Lower shadow candle ki kam qeematen hoti hai, jis ko is candle ne touch kia hota hai. Lower shadows traders ko selling pressure k bare me batati hai.

Candlestick ki Main Aqsaam

Aam tawar par to candlestick ki kafi sari qesmen hen, lekin in me teen main aqsaam hen (yani baqi sari candles in teen aqsaam me shumar hoti hen).

- Bullish Candle

- Bearish Candle

- Doji Candle

Bullish Candle:

Bullish candle ko white candle bhi kaha jata hai, jis se murad wo candle hoti hai, jis me aik session k duran closing price hamesha opening price se ziada hoti hai. Bullish candle jitni ziada bari hogi utni hi market me qeematen upside pe ziada move karti hai.

Bearish Candle:

Bearish candles bullish candles ki opposite hoti hen aur color me black hoti hai. Bearish candle me aik session closing price hamesha opening price se kam hoti hai. Jitna ziada market me selling pressure hoga, to us hisab se bearish candle bhi bari hogi.

Doji Candle:

Doji candle aik colour less candle hoti hen, jo simple do lines pe mushtamil hoti hai. In candle me open, close qeematen same hoti hen, lekin high aur low price mukhtalif ho sakti hai. Doji candle na to positive hoti hai aur na hi negative, is waja se is ko neutral candle bhi kaha jata hai.

تبصرہ

Расширенный режим Обычный режим