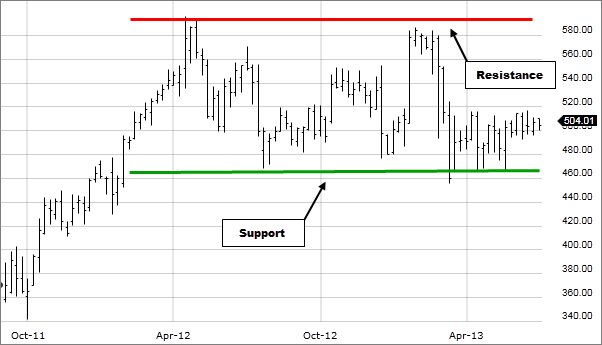

Market resistance level ek technical analysis concept hai, jo stock market ya anya financial markets mein price movement ko describe karne mein istemal hota hai. Resistance level ek aisa price level hota hai jahan par ek security ka price historically upar nahi gaya hai ya jahan se price mein girawat (downtrend) aa sakti hai.Resistance level ko samajhne ke liye yeh points mahatvapurna hote hain: 1. Historical Data: Resistance level ko tay karne ke liye traders aur analysts historical price data ka istemal karte hain. Jab security ka price ek specific level tak pahunchta hai aur phir wahan se reverse ho jata hai, to woh level resistance level ban jata hai. Ismein usually ek horizontal line draw ki jati hai. 2. Psychological Factor: Resistance levels mein ek psychological factor bhi hota hai. Jab price ek level par pahunchta hai jahan par pichli baar selling pressure aayi thi, to traders wahan se fir se selling pressure expect karte hain. Isse woh level ek resistance ban jata hai. 3. Supply and Demand: Resistance level ka main concept supply aur demand se juda hota hai. Jab price ek resistance level tak pahunchta hai, to traders aur investors selling karte hain, jisse supply badh jati hai. Agar us level par buyers kam hote hain, to price gir sakta hai. 4. Role Reversal: Resistance level ka opposite hota hai support level, jahan par price girne ke baad reverses hota hai. Kabhi-kabhi, jab price ek resistance level ko upar break kar leta hai, to woh level support ban sakta hai. 5. Technical Indicators: Traders aur analysts technical indicators jaise ki moving averages, RSI (Relative Strength Index), aur Fibonacci retracements ka bhi istemal karte hain resistance levels tay karne ke liye.Resistance level ko samajhna traders ke liye mahatvapurna hota hai kyunki ye unhe price movement aur trading strategies ke liye guidance provide karta hai. Jab price ek resistance level ko upar break karta hai, to yeh ek bullish signal ho sakta hai, jabki agar price resistance level se reverse hota hai, to yeh ek bearish signal ho sakta hai.Traders often use stop-loss orders near resistance levels to manage risk, and they may also use resistance levels to identify potential entry and exit points for their trades.

`

X

new posts

-

#16 Collapse

-

<a href="https://www.instaforex.org/ru/?x=ruforum">InstaForex</a> -

#17 Collapse

Market Resistance level:Introduction of market resistence level; Assalamoalaikum dear forex members kaisa hy ap sb log Allah pak ap sb logo ko kamyabi atta frmaye or hamesha khush rha ALLAH PAK apka walaiden ka saya hamesha kaim rakha aj hm bat karain ga market main resistence level kia hota hy resistence leve aik aisa level hy jha pr market main onch nech hoty rehty hy hai iska kam bhi kar Mein kam karne ke liye do chijen bahut jaruri hai information aur experience kar Sakoge aaj primary aapke liye ek naya point Lekar Aaunga ke liye using time productively bahut jaruri hai kitna time Ham market Mein Doge utna hello there aap benefit Hasil kar Sakoge aaiae Apne subject ki taraf Chalte HainMARKET support resistence LEVEL:Dear forex people market ka deterrent level aik asa cost level hota hai. Jb bht sary specialists is cost pr apni sell ki trade dynamic krna chahty hain . Us time Market pr bht pressure hota hai. Is specific examination k lye mumble aik level ko sort out kr laty hain. Then again is trha mumble apni trade ko b powerful bna lety hain.MARKET Backing LEVEL:Dear forex people market mom support level aik asy point or sponsorship level ko kaha jata hai jis mother trade ki cost us time frame sy underneath nahi jati hai. Agr mumble specific examination kr k point out kr k mumble market ka least advantage maloom kr sakty hain.Center POINT of market:Dear forex people forex trading point mother center point k turn point ko b kaha ja sakta hai. Center point kisi b unequivocal time period mom market ka center point hota hai. Specific assessment ko improve krny k lye market k center point ka data or experience hona bht huge hai. Isko seekh kr mumble apny examination ko behtr bna sakty hain.MARKET Pattern LINE:Dear forex people design line market ki bearing ko show krti hai. Design line confuse mom move krti hai. Ye aik bht huge line hoti hai.Is sy market k example ka pta chlta hai. Market jb design line ko cross krti hai. To is bt ka signl deti ha k market ka design change hony wala hai.CHANEL OR WEDGES OF Market:Dear forex people wedges aik asy cost outline ko kaha jata hai. Jo market k worth outline or example pr trading krta hai. Jis sy market ki high akyy hai. then again minimal expense show hoti hai. Ye b aik bht critical model hota hai. Of course mumble apni trading ko advantageous or compelling bna sakyy hain.MARKET ANALYSIS;

Dear forex people market plan mom different fire bn rahi hoti hain. IS main sb sa ahm cheze hoty hy ka insan ka pass experience hona chahea or market ka knowledge bhi ahm hy trading or analysysis ka lea

Believe in your self and your abilities you will get success

Believe in your self and your abilities you will get success

-

<a href="https://www.instaforex.org/ru/?x=ruforum">InstaForex</a> -

#18 CollapseInstaSpot: کسی بھی EPS اور بینک سے منافع واپس لیں، اور EPS اور cryptocurrencies کے تبادلے پر 7% تک کمائیں۔

RESISTANCE LEVEL: Asslamoalaikum I hope aap sab khariyat sy hoon gy Forex tradings Marketing main MARKET resistance level ek price level hota hai jahan pe market mein selling pressure dominate karti hai aur price ko upar jane se rok deti hai. Resistance level traders ke liye important hota hai, kyunki waha se price ka bounce back ya reversal ho sakta hai.Resistance level market mein supply zone ke roop mein consider kiya jata hai, jahan pe sellers active hote hain aur apne positions ko sell karne ke liye ready hote hain. Jab price resistance level tak pahunchta hai, to waha se selling pressure increase hoti hai aur price ko upar jane se rok deti hai. Iska result hota hai price ka reversal, pullback, ya hamary liye comfortable hota Hai. FOCUS OF POINT: Piary dosto eis topic ko madnzar rakhty howy forex trading marketing Mei Resistance level traders ko entry aur exit points determination mein madad karta hai. Jab price resistance level ko test karta hai, to waha se bounce back ya reversal hone ka possibility hota hai. Traders is information ka istemaal karke apne trades ko enter ya exit kar sakte hain.Resistance level traders ko stop loss placement mein madad karta hai. Jab price resistance level ko break karke upar move karta hai, tab traders apne stop loss levels ko resistance level ke above set kar sakte hain, jisse trade protection ho sakta hai.Dear members forex exchanging Market Mei yeh ziyada zarori hota ye Pattren ky resistance level ko break karke upar move karta hai, to ye trend reversal ka indication ho sakta hai. Traders ko ye signal milta hai ki uptrend ka continuation possible hai.Hamesha yaad rakhiye ki resistance level bhi single indicator ke saath perfect accuracy nahi deta hai. Iska sahi tareeke se istemaal karne ke liye practice, experience aur additional analysis ki zaroorat hoti hai. Traders ko apni analysis aur trading decisions ko validate karne ke liye multiple tools aur indicators ka istemaal karna zaroori samjha jata Hei our Traders hazraat trade ko samjhna bhot ahmyiat ky Hamil hoty hen.

اب آن لائن

ہم مواصلات کے پلیٹ فارم کے طور پر فاریکس فورم فاریکس پاکستان کے آپ کے انتخاب کی تعریف کرتے ہیں۔

موجودہ وقت 08:54 AM (GMT+5)۔

Working...

X

تبصرہ

Расширенный режим Обычный режим