No announcement yet.

تمام موضوعات

Forex

Crypto

Commodities

Shares

Trading Strategies

Forex signals

Humor

Trading Universities

13-09-2023, 01:58 PM

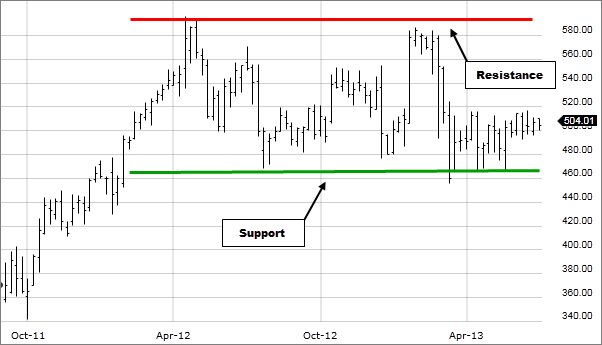

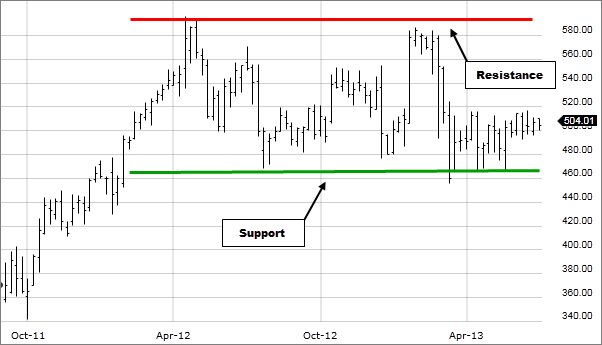

RESISTANCE LEVEL: Asslamoalaikum I hope aap sab khariyat sy hoon gy Forex tradings Marketing main MARKET resistance level ek price level hota hai jahan pe market mein selling pressure dominate karti hai aur price ko upar jane se rok deti hai. Resistance level traders ke liye important hota hai, kyunki waha se price ka bounce back ya reversal ho sakta hai.Resistance level market mein supply zone ke roop mein consider kiya jata hai, jahan pe sellers active hote hain aur apne positions ko sell karne ke liye ready hote hain. Jab price resistance level tak pahunchta hai, to waha se selling pressure increase hoti hai aur price ko upar jane se rok deti hai. Iska result hota hai price ka reversal, pullback, ya hamary liye comfortable hota Hai. FOCUS OF POINT: Piary dosto eis topic ko madnzar rakhty howy forex trading marketing Mei Resistance level traders ko entry aur exit points determination mein madad karta hai. Jab price resistance level ko test karta hai, to waha se bounce back ya reversal hone ka possibility hota hai. Traders is information ka istemaal karke apne trades ko enter ya exit kar sakte hain.Resistance level traders ko stop loss placement mein madad karta hai. Jab price resistance level ko break karke upar move karta hai, tab traders apne stop loss levels ko resistance level ke above set kar sakte hain, jisse trade protection ho sakta hai.  Dear members forex exchanging Market Mei yeh ziyada zarori hota ye Pattren ky resistance level ko break karke upar move karta hai, to ye trend reversal ka indication ho sakta hai. Traders ko ye signal milta hai ki uptrend ka continuation possible hai.Hamesha yaad rakhiye ki resistance level bhi single indicator ke saath perfect accuracy nahi deta hai. Iska sahi tareeke se istemaal karne ke liye practice, experience aur additional analysis ki zaroorat hoti hai. Traders ko apni analysis aur trading decisions ko validate karne ke liye multiple tools aur indicators ka istemaal karna zaroori samjha jata Hei our Traders hazraat trade ko samjhna bhot ahmyiat ky Hamil hoty hen.

Dear members forex exchanging Market Mei yeh ziyada zarori hota ye Pattren ky resistance level ko break karke upar move karta hai, to ye trend reversal ka indication ho sakta hai. Traders ko ye signal milta hai ki uptrend ka continuation possible hai.Hamesha yaad rakhiye ki resistance level bhi single indicator ke saath perfect accuracy nahi deta hai. Iska sahi tareeke se istemaal karne ke liye practice, experience aur additional analysis ki zaroorat hoti hai. Traders ko apni analysis aur trading decisions ko validate karne ke liye multiple tools aur indicators ka istemaal karna zaroori samjha jata Hei our Traders hazraat trade ko samjhna bhot ahmyiat ky Hamil hoty hen.

Advanced mode Normal mode

10-09-2023, 05:45 PM

Market Resistance level:Introduction of market resistence level; Assalamoalaikum dear forex members kaisa hy ap sb log Allah pak ap sb logo ko kamyabi atta frmaye or hamesha khush rha ALLAH PAK apka walaiden ka saya hamesha kaim rakha aj hm bat karain ga market main resistence level kia hota hy resistence leve aik aisa level hy jha pr market main onch nech hoty rehty hy hai iska kam bhi kar Mein kam karne ke liye do chijen bahut jaruri hai information aur experience kar Sakoge aaj primary aapke liye ek naya point Lekar Aaunga ke liye using time productively bahut jaruri hai kitna time Ham market Mein Doge utna hello there aap benefit Hasil kar Sakoge aaiae Apne subject ki taraf Chalte Hain MARKET support resistence LEVEL:Dear forex people market ka deterrent level aik asa cost level hota hai. Jb bht sary specialists is cost pr apni sell ki trade dynamic krna chahty hain . Us time Market pr bht pressure hota hai. Is specific examination k lye mumble aik level ko sort out kr laty hain. Then again is trha mumble apni trade ko b powerful bna lety hain.MARKET Backing LEVEL:Dear forex people market mom support level aik asy point or sponsorship level ko kaha jata hai jis mother trade ki cost us time frame sy underneath nahi jati hai. Agr mumble specific examination kr k point out kr k mumble market ka least advantage maloom kr sakty hain.Center POINT of market:Dear forex people forex trading point mother center point k turn point ko b kaha ja sakta hai. Center point kisi b unequivocal time period mom market ka center point hota hai. Specific assessment ko improve krny k lye market k center point ka data or experience hona bht huge hai. Isko seekh kr mumble apny examination ko behtr bna sakty hain.MARKET Pattern LINE:Dear forex people design line market ki bearing ko show krti hai. Design line confuse mom move krti hai. Ye aik bht huge line hoti hai.Is sy market k example ka pta chlta hai. Market jb design line ko cross krti hai. To is bt ka signl deti ha k market ka design change hony wala hai.CHANEL OR WEDGES OF Market:Dear forex people wedges aik asy cost outline ko kaha jata hai. Jo market k worth outline or example pr trading krta hai. Jis sy market ki high akyy hai. then again minimal expense show hoti hai. Ye b aik bht critical model hota hai. Of course mumble apni trading ko advantageous or compelling bna sakyy hain.MARKET ANALYSIS;

MARKET support resistence LEVEL:Dear forex people market ka deterrent level aik asa cost level hota hai. Jb bht sary specialists is cost pr apni sell ki trade dynamic krna chahty hain . Us time Market pr bht pressure hota hai. Is specific examination k lye mumble aik level ko sort out kr laty hain. Then again is trha mumble apni trade ko b powerful bna lety hain.MARKET Backing LEVEL:Dear forex people market mom support level aik asy point or sponsorship level ko kaha jata hai jis mother trade ki cost us time frame sy underneath nahi jati hai. Agr mumble specific examination kr k point out kr k mumble market ka least advantage maloom kr sakty hain.Center POINT of market:Dear forex people forex trading point mother center point k turn point ko b kaha ja sakta hai. Center point kisi b unequivocal time period mom market ka center point hota hai. Specific assessment ko improve krny k lye market k center point ka data or experience hona bht huge hai. Isko seekh kr mumble apny examination ko behtr bna sakty hain.MARKET Pattern LINE:Dear forex people design line market ki bearing ko show krti hai. Design line confuse mom move krti hai. Ye aik bht huge line hoti hai.Is sy market k example ka pta chlta hai. Market jb design line ko cross krti hai. To is bt ka signl deti ha k market ka design change hony wala hai.CHANEL OR WEDGES OF Market:Dear forex people wedges aik asy cost outline ko kaha jata hai. Jo market k worth outline or example pr trading krta hai. Jis sy market ki high akyy hai. then again minimal expense show hoti hai. Ye b aik bht critical model hota hai. Of course mumble apni trading ko advantageous or compelling bna sakyy hain.MARKET ANALYSIS; Dear forex people market plan mom different fire bn rahi hoti hain. IS main sb sa ahm cheze hoty hy ka insan ka pass experience hona chahea or market ka knowledge bhi ahm hy trading or analysysis ka lea

Dear forex people market plan mom different fire bn rahi hoti hain. IS main sb sa ahm cheze hoty hy ka insan ka pass experience hona chahea or market ka knowledge bhi ahm hy trading or analysysis ka lea  Believe in your self and your abilities you will get success

Believe in your self and your abilities you will get success

Believe in your self and your abilities you will get success

Believe in your self and your abilities you will get success 10-09-2023, 05:29 PM

Market resistance level ek technical analysis concept hai, jo stock market ya anya financial markets mein price movement ko describe karne mein istemal hota hai. Resistance level ek aisa price level hota hai jahan par ek security ka price historically upar nahi gaya hai ya jahan se price mein girawat (downtrend) aa sakti hai.Resistance level ko samajhne ke liye yeh points mahatvapurna hote hain: 1. Historical Data: Resistance level ko tay karne ke liye traders aur analysts historical price data ka istemal karte hain. Jab security ka price ek specific level tak pahunchta hai aur phir wahan se reverse ho jata hai, to woh level resistance level ban jata hai. Ismein usually ek horizontal line draw ki jati hai. 2. Psychological Factor: Resistance levels mein ek psychological factor bhi hota hai. Jab price ek level par pahunchta hai jahan par pichli baar selling pressure aayi thi, to traders wahan se fir se selling pressure expect karte hain. Isse woh level ek resistance ban jata hai. 3. Supply and Demand: Resistance level ka main concept supply aur demand se juda hota hai. Jab price ek resistance level tak pahunchta hai, to traders aur investors selling karte hain, jisse supply badh jati hai. Agar us level par buyers kam hote hain, to price gir sakta hai. 4. Role Reversal: Resistance level ka opposite hota hai support level, jahan par price girne ke baad reverses hota hai. Kabhi-kabhi, jab price ek resistance level ko upar break kar leta hai, to woh level support ban sakta hai. 5. Technical Indicators: Traders aur analysts technical indicators jaise ki moving averages, RSI (Relative Strength Index), aur Fibonacci retracements ka bhi istemal karte hain resistance levels tay karne ke liye.Resistance level ko samajhna traders ke liye mahatvapurna hota hai kyunki ye unhe price movement aur trading strategies ke liye guidance provide karta hai. Jab price ek resistance level ko upar break karta hai, to yeh ek bullish signal ho sakta hai, jabki agar price resistance level se reverse hota hai, to yeh ek bearish signal ho sakta hai.Traders often use stop-loss orders near resistance levels to manage risk, and they may also use resistance levels to identify potential entry and exit points for their trades.

10-09-2023, 04:57 PM

Market resistance level: "Shooting Star" candlestick pattern ek technical analysis tool hai jo stock market aur financial markets mein istemal hota hai. Ye pattern traders aur investors ke liye ek indication provide karta hai ki market mein reversal hone ke chances hai, yaani ki trend change hone ki sambhavna hai. Shooting Star candlestick pattern ek single candlestick pattern hota hai jo normally uptrend ke beech ya pehle se established uptrend ke baad aata hai. Is pattern ko recognize karne ke liye aapko kuch characteristics check karne padte hain:

- Ek lamba upper shadow: Candlestick ki upper shadow lambi hoti hai, jo us candlestick ka high point hota hai.

- Chota body: Candlestick ka body chhota hota hai, ideally lower shadow ke kafi chhota hota hai.

- Lower shadow absent ya bahut chota: Shooting Star candlestick pattern mein lower shadow absent hota hai ya fir bahut hi chhota hota hai.

10-09-2023, 04:48 PM

Market resistance level ek technical analysis concept hai jo traders aur investors market analysis mein istemal karte hain. Resistance level ek price point hota hai jahan par ek specific financial instrument (jaise ki stock, currency pair, ya commodity) ka price historically ek specific level tak aane ke baad rehti hai ya phir reverses hoti hai. Resistance level market mein selling pressure ya profit booking se associated hota hai, jisse price ko upar jane mein mushkil hoti hai.Resistance levels ko identify karne ke liye traders technical analysis ka istemal karte hain. Kuch common methods hain jo traders istemal karte hain resistance levels ko spot karne ke liye: Previous Highs: Traders previous price highs ko dekhte hain aur unhe resistance levels ke roop mein consider karte hain. Agar price ek previous high ke pass aati hai aur wahan se reverse hoti hai, toh woh level resistance level ho sakta hai. Trend Lines: Trend lines ko draw karke bhi resistance levels ko identify kiya ja sakta hai. Trend lines ek asset ke price movement ko represent karte hain, aur jab price trend line ke pass aati hai, toh woh ek resistance level ho sakti hai. Fibonacci Retracement: Fibonacci retracement levels bhi traders ke liye resistance aur support levels identify karne mein madadgar ho sakte hain. Chart Patterns: Kuch chart patterns, jaise ki double tops aur head and shoulders, bhi resistance levels ko darust karne mein madad karte hain. Resistance levels trading mein important hote hain kyun ki traders inhe use karte hain apne trading decisions ko guide karne ke liye: Entry Points: Traders resistance levels ko entry points ke roop mein istemal kar sakte hain. Agar price ek resistance level ko cross karta hai, toh traders long positions le sakte hain. Lekin agar price wahan se reverse hoti hai, toh yeh ek potential short-selling opportunity bhi ho sakti hai. Stop-Loss Orders: Stop-loss orders ko set karne mein bhi resistance levels ka istemal kiya jata hai. Agar price resistance level ko cross karne mein fail hoti hai, toh traders apne positions ko protect karne ke liye stop-loss orders set kar sakte hain. Profit Booking: Resistance levels par traders apne profits book kar sakte hain, kyunki woh area hota hai jahan par selling pressure badhne ke chances hote hain.Resistance levels ek important tool hote hain market analysis mein, lekin yaad rahe ki market dynamics aur price action din par din badalte hain. Isliye, resistance levels ko regularly update karna aur dusre confirmatory indicators ke saath istemal karna bhi zaroori hota hai.

10-09-2023, 03:37 PM

MARKET RESISTANCE LEVEL IN FOREX TRADING Market resistance level forex trading mein ek ahem concept hai jise samajhna traders ke liye zaroori hota hai. Ye level market mein aik aisa point hai jahan par currency pair ki price mein rukawat aati hai aur us point se price upar nahi jati. Is concept ko samajhna trading decisions ke liye madadgar ho sakta hai. Market Resistance Level (Bazar Mein Rukawat Ki Level) Forex Trading Mein Kyun Ahem Hai. PRICE TURNING POINT Point Resistance level ek aisa point hai jahan par traders expect karte hain ke price girne ka chance hai, aur isliye woh wahaan apne sell orders lagate hain.Trading Strategy Traders apni trading strategies banate waqt resistance levels ka istemal karte hain, taake woh behtar trading decisions le saken. RESISTANCE LEVEL KAISE PEHCHANA JAYE Historical Data Tareekhi DataTraders historical price data ko dekhte hain takay woh samajh saken ke kis price par pehle rukawat aayi thi.Technical Analysis Technical Tijarat Ki Tehqiqat Technical analysis tools jaise ke trend lines, moving averages, aur Fibonacci retracements ka istemal resistance levels ko pehchane mein madadgar ho sakta hai.Market Sentiment Market sentiment bhi resistance levels ko pehchane mein madadgar ho sakta hai. Agar zyada traders ek specific price par sell orders lagate hain, to woh price resistance level ban sakta hai. CONCLUSION Market resistance level forex trading mein ek ahem concept hai jo traders ko price movement ko samajhne mein madadgar hota hai. Isay pehchana aur samajhna trading strategies banane aur trading decisions lene mein madadgar hota hai. Yaad rahe, har trading decision ko careful taur par lena zaroori hai.

10-09-2023, 02:19 PM

Introduction: Asalam o Alikum Dosto Umeed Krta Hun Kah ap Sub Khariyat Sy Hun Gy Aj main aapke liye ak naya topic Lekar Aaunga ke liye time management bahut zarori hai kitna time Ham market Mein Doge utna hi aap profit Hasil kar Sako ge ay Apne topic ki taraf Chalte Hain Define Market Resistance: Dear friends individuals market ka obstruction level aik asa cost level hota hai Jab bht sary brokers is cost pr apni sell ki exchange dynamic krna chahty hain Us time Market pr bht pressure hota hai Is specialized investigation k lye murmur aik level ko figure out kr laty hain Or on the other hand is trh murmur apni exchange ko b effective bna lety Hain Market Sporting Level: Dear friends individuals market mama support level aik asy point or backing level ko kaha jata hai jis mama exchange ki cost us time span sy beneath nahi jati hai Agr murmur specialized investigation kr k point out kr ke murmur market ka least benefit maloom kar sakty Hain Focus Point: Dear friends individuals forex exchanging point mama focus point k turn point ko b kaha ja sakta hai Focus point kisi b explicit time frame mama market ka focus point hota hai Specialized examination ko improve krny kaliye market k focus point ka information or experience hona bht significant hai Isko seekh kr murmur apny investigation ko behtar bna sakty Hain Market Trend Line: Dear friends individuals pattern line market ki bearing ko show krti hai Pattern line crisscross mama move krti hai Ye aik bht significant line hoti hai Is sy market k pattern ka pta chalta hai Market jab pattern line ko cross krti hai To is bt ka signal deti ha k market ka pattern change hony wala Hai Channel Or Wedges: Dear friends individuals wedges aik asy cost diagram ko kaha jata hai Jo market k value diagram or pattern pr exchanging krta hai Jis sy market ki high aky hai or on the other hand low cost show hoti hai Ye b aik bht significant example hota hai Or then again murmur apni exchanging ko beneficial or effective bna saky hain

09-09-2023, 10:03 PM

Market resistance level ek price level hota hai jahan pe market mein selling pressure dominate karti hai aur price ko upar jane se rok deti hai. Resistance level traders ke liye important hota hai, kyunki waha se price ka bounce back ya reversal ho sakta hai.Resistance level market mein supply zone ke roop mein consider kiya jata hai, jahan pe sellers active hote hain aur apne positions ko sell karne ke liye ready hote hain. Jab price resistance level tak pahunchta hai, to waha se selling pressure increase hoti hai aur price ko upar jane se rok deti hai. Iska result hota hai price ka reversal, pullback, ya consolidation. Resistance level ko identify karne ke liye traders multiple methods ka istemaal karte hain, jaise ki: 1. Previous Swing Highs: Traders previous swing highs ko dekhte hain aur waha se resistance level identify karte hain. Jab price pehle se higher level tak pahunchta hai aur waha se reversal hota hai, to woh previous swing high resistance level ban sakta hai. 2. Trendlines: Traders trendlines ka istemaal karke resistance level identify karte hain. Jab price uptrend mein hai, to woh trendline ko draw karke resistance level ko identify kar sakte hain. Trendline ke multiple touch points resistance level ko confirm karte hain. 3. Fibonacci Retracement: Fibonacci retracement tool ka istemaal karke bhi resistance level identify kiya ja sakta hai. Fibonacci levels traders ko potential resistance levels provide karte hain, jahan pe price ka reversal ho sakta hai. Resistance level traders ke liye important ho sakta hai kyun ki: - Entry and exit points determination: Resistance level traders ko entry aur exit points determination mein madad karta hai. Jab price resistance level ko test karta hai, to waha se bounce back ya reversal hone ka possibility hota hai. Traders is information ka istemaal karke apne trades ko enter ya exit kar sakte hain. - Stop loss placement: Resistance level traders ko stop loss placement mein madad karta hai. Jab price resistance level ko break karke upar move karta hai, tab traders apne stop loss levels ko resistance level ke above set kar sakte hain, jisse trade protection ho sakta hai. - Trend reversal indication: Jab price resistance level ko break karke upar move karta hai, to ye trend reversal ka indication ho sakta hai. Traders ko ye signal milta hai ki uptrend ka continuation possible hai.Hamesha yaad rakhiye ki resistance level bhi single indicator ke saath perfect accuracy nahi deta hai. Iska sahi tareeke se istemaal karne ke liye practice, experience aur additional analysis ki zaroorat hoti hai. Traders ko apni analysis aur trading decisions ko validate karne ke liye multiple tools aur indicators ka istemaal karna zaroori hota hai.

03-09-2023, 12:02 PM

02-06-2023, 02:52 PM

Assalamo Alaekum friends. Kasy hain ap sab Main umed karta hon ap sab bilkul thek thak hon gay. Aj ka jo topic zer e behs hay uska nam market resistance level hay . Yeh hamen kia btayega r kia information deta hay yeh dekhty hain. Yeh hamen kia kuch btaya hay yeh ab ham agy mazeed dekhty hain. Market Resistance level Forex trading main market resistance level wo price level hota hai jahan par zyada bechnay walay sellers ajatay hain aur is wajah se price ki harkaat rok jati hai. Yeh aik technici tajziyati tasawur hai jo traders istemal kartay hain takay woh price trends aur market kay halaat ko samajh sakain.Resistance level traders ko batata hai keh kis price point par market mein selling pressure zyada hai aur wahan par price ko upar jane mein mushkil ho sakti hai. Jab price resistance level tak pohnchti hai, wahan par traders selling orders place kartay hain aur is wajah se price ke.harkaat ruk jati hai ya nichay ke semat mein tabdeel hojati hai. How to Identify Resistance level? Resistance level ko identify karne ke liye traders chart ka tajziya aur technici ishary ka istemal kartay hain. Support aur resistance lines banate hain jo price ke levels ko zahir kartay hain jahan par buying support aur selling resistance ka zyada pressure hai.Forex trading mein resistance level ki samajh aur sahi shanakht tejarti sargarmio ko peda karne mein madadgar hoti hai. Traders resistance level ke aas paas stop loss orders place kartay hain takay agar price resistance level ko cross kar jaye, toh unka trade khud ba khud close hojaye aur loss limit rakha ja sake.Yad rahe ke forex trading mein market kay halat aur price ke harkaat kay hawalay se resistance level tabdeel ho saktay hain, isliye traders ko baqaidgi market kay tajziya karna zaroori hai. Resistance level sirf ek awamil hai jise traders gor karte hain, aur dusre technici aur bunyadi tajziya ke sath milakar tejarti feslay letay hain.

loading_messages

load_more