Re: Bearish Meeting Line Candlestick Pattern

WHAT IS A Negative Gathering LINE Example :

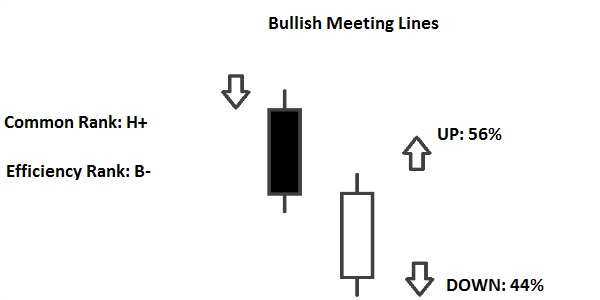

Negative Gathering line Candlestcick design ak negative inversion design ha ya design market ka upswing mama banta ha or ya design huma batata ha ka market ka upturn end hona wala ha or market na invert ho kar descending ke traf ana ha. Ya huma signal information ha market ka bullish sa negative ke traf inversion ka. Ya design two candles sa mil kar banta ha is design ke first flame apna latest thing ko follow karte hoi bullish ke candle bante ha ya candle long genuine body light hote ha or is candle ka terrible market mama up ke traf ak hole ata ha or is hole ka terrible is design ke next candle bante ha ya ak negative ke candle hote ha jo ka high sa open hote ha or low mama a kar close hote ha is second candle ka shutting point first candle ka shutting point standard hota ha or is second candle ka terrible market ka descending inversion start ho jata ha.

Tripple top diagram design

Dear companions tripple top diagram design money coordinates our wares fundamental regularly nazar any wala ik solid example hai. Ye design hmysha long bullish pattern k top per bnta hai. Jis time purchaser feeble ho chuka hota hai. Is design primary purchaser cost three time oper ly k jata hai yet hold na krny ki waja sy Vender dobara ik normal cost level per ly ata hai. Teeno tops ka start point agr pattern line se joor diya jae to is line ko Nackline kehty hain. Is design standard exchanging ky liye Nackline bahut importanc rakhti hai. Kun k hit market cost is Nackline ko break krti hai to merchant exchange open karty hain.

Clarification

Negative Gathering Line Candle ka close costs in-line same point standard hota hai. Dosre disturbance ki light regrettable example k aghazz k sath bullish example k ikhtetaam ka bhi bahis batti hai. Ye plan Bullish social occasion line plan ka backwards hai aur rise key banta hai. Punch k model dekhne central same bullish pushing line plan jaisa hai. Plan ki dosri fire ka close point lazmi pehli light k same close expense standard hona hy....

Stepping pattran of meeting line

dear yeh Negative Gathering Line Candle exchanging mn gathering line plan jahan vendors ko sell ka signal deta hai, wahan dosri taraf ye design reversal hone standard humen market se leave hone k uncovered central bhi batata hai. Ye plan upswing me banta hai, jahhan pe costs bohut high locale standard trade kar rahi hoti hai. Plan pe trade karne se pehle costs ka upswing aur design confirmation lazmi certify hona chaheye. Agar plan k baad teesri candle bhi negative banti hai, to ye position market me sell ki section ka hoga. Plan ki assertion markers jaise RSI, CCI pointer long negative candle hoti hai, jo k open to bullish flame se upper hole primary hai, lekin close pehle candle k same close cost standard hota hai. Design principal shamil dono candles ka close costs in-line same point standard hota hai. Dosre commotion ki candle negative pattern k aghazz k sath bullish pattern k ikhtetaam ka bhi bahis batti hai. Ye design Bullish gathering line design ka inverse hai aur upturn primary banta hai. Poke k example dekhne primary same bullish pushing line design jaisa hai. Design ki dosri light ka close point lazmi pehli flame k same close cost standard hona chaheye.

WHAT IS A Negative Gathering LINE Example :

Negative Gathering line Candlestcick design ak negative inversion design ha ya design market ka upswing mama banta ha or ya design huma batata ha ka market ka upturn end hona wala ha or market na invert ho kar descending ke traf ana ha. Ya huma signal information ha market ka bullish sa negative ke traf inversion ka. Ya design two candles sa mil kar banta ha is design ke first flame apna latest thing ko follow karte hoi bullish ke candle bante ha ya candle long genuine body light hote ha or is candle ka terrible market mama up ke traf ak hole ata ha or is hole ka terrible is design ke next candle bante ha ya ak negative ke candle hote ha jo ka high sa open hote ha or low mama a kar close hote ha is second candle ka shutting point first candle ka shutting point standard hota ha or is second candle ka terrible market ka descending inversion start ho jata ha.

Tripple top diagram design

Dear companions tripple top diagram design money coordinates our wares fundamental regularly nazar any wala ik solid example hai. Ye design hmysha long bullish pattern k top per bnta hai. Jis time purchaser feeble ho chuka hota hai. Is design primary purchaser cost three time oper ly k jata hai yet hold na krny ki waja sy Vender dobara ik normal cost level per ly ata hai. Teeno tops ka start point agr pattern line se joor diya jae to is line ko Nackline kehty hain. Is design standard exchanging ky liye Nackline bahut importanc rakhti hai. Kun k hit market cost is Nackline ko break krti hai to merchant exchange open karty hain.

Clarification

Negative Gathering Line Candle ka close costs in-line same point standard hota hai. Dosre disturbance ki light regrettable example k aghazz k sath bullish example k ikhtetaam ka bhi bahis batti hai. Ye plan Bullish social occasion line plan ka backwards hai aur rise key banta hai. Punch k model dekhne central same bullish pushing line plan jaisa hai. Plan ki dosri fire ka close point lazmi pehli light k same close expense standard hona hy....

Stepping pattran of meeting line

dear yeh Negative Gathering Line Candle exchanging mn gathering line plan jahan vendors ko sell ka signal deta hai, wahan dosri taraf ye design reversal hone standard humen market se leave hone k uncovered central bhi batata hai. Ye plan upswing me banta hai, jahhan pe costs bohut high locale standard trade kar rahi hoti hai. Plan pe trade karne se pehle costs ka upswing aur design confirmation lazmi certify hona chaheye. Agar plan k baad teesri candle bhi negative banti hai, to ye position market me sell ki section ka hoga. Plan ki assertion markers jaise RSI, CCI pointer long negative candle hoti hai, jo k open to bullish flame se upper hole primary hai, lekin close pehle candle k same close cost standard hota hai. Design principal shamil dono candles ka close costs in-line same point standard hota hai. Dosre commotion ki candle negative pattern k aghazz k sath bullish pattern k ikhtetaam ka bhi bahis batti hai. Ye design Bullish gathering line design ka inverse hai aur upturn primary banta hai. Poke k example dekhne primary same bullish pushing line design jaisa hai. Design ki dosri light ka close point lazmi pehli flame k same close cost standard hona chaheye.

تبصرہ

Расширенный режим Обычный режим